Manual payout processes in remittance require significant time and human intervention, often leading to delays and higher operational costs. Automated payout systems streamline transactions by enabling instant fund disbursement with minimal errors, enhancing customer satisfaction. Leveraging automation in remittance payouts increases efficiency, reduces risks of fraud, and supports scalability for growing transaction volumes.

Table of Comparison

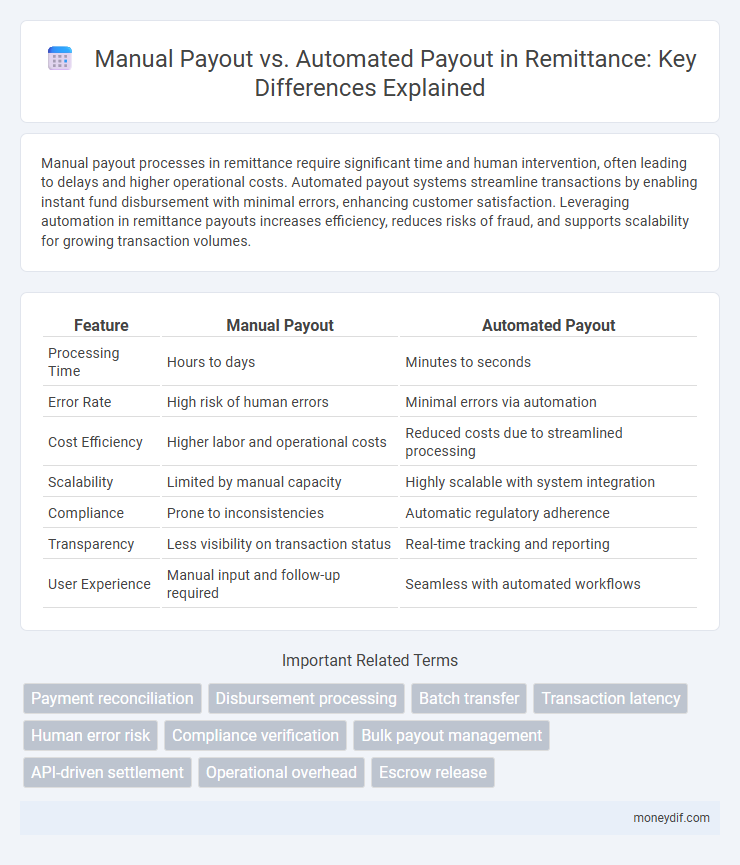

| Feature | Manual Payout | Automated Payout |

|---|---|---|

| Processing Time | Hours to days | Minutes to seconds |

| Error Rate | High risk of human errors | Minimal errors via automation |

| Cost Efficiency | Higher labor and operational costs | Reduced costs due to streamlined processing |

| Scalability | Limited by manual capacity | Highly scalable with system integration |

| Compliance | Prone to inconsistencies | Automatic regulatory adherence |

| Transparency | Less visibility on transaction status | Real-time tracking and reporting |

| User Experience | Manual input and follow-up required | Seamless with automated workflows |

Understanding Manual vs Automated Payouts in Remittance

Manual payouts in remittance involve human intervention to process transactions, which can lead to slower processing times and increased risk of errors. Automated payouts leverage technology to execute transactions swiftly and accurately, enhancing efficiency and reducing operational costs. Choosing between manual and automated payouts depends on factors like transaction volume, accuracy requirements, and the need for real-time processing.

Key Differences Between Manual and Automated Remittance Payouts

Manual remittance payouts involve human intervention to process transactions, often leading to longer processing times and increased chances of errors, while automated remittance payouts leverage software systems to execute transactions quickly and accurately. Automated systems enhance efficiency through real-time transaction tracking, reduced operational costs, and improved compliance with regulatory standards. The key differences lie in scalability, speed of execution, and the ability to minimize manual errors, making automated payouts more suitable for high-volume remittance operations.

Pros and Cons of Manual Payouts

Manual payout in remittance offers precise control over each transaction, reducing errors from automation glitches and allowing for personalized customer service. However, it is time-consuming and prone to human error, which can delay payment processing and increase operational costs. This method lacks scalability compared to automated payouts, limiting efficiency in handling high transaction volumes.

Advantages and Challenges of Automated Payout Systems

Automated payout systems streamline remittance processes by enabling faster transaction settlements, reducing human error, and lowering operational costs through real-time payment tracking and batch processing capabilities. They challenge traditional manual payout methods by requiring sophisticated cybersecurity measures and robust system integration to handle diverse payment corridors and comply with regulatory standards. Scalability and enhanced transparency in automated systems provide significant advantages for financial institutions aiming to improve customer experience and operational efficiency.

Impact on Transaction Speed: Manual vs Automated Remittance

Automated payout systems significantly increase transaction speed by processing remittances instantly or within minutes, compared to manual payouts that often require hours or days due to human verification and administrative delays. Automated platforms utilize real-time data processing and integration with financial institutions, minimizing the risk of errors and accelerating fund transfers. Faster transaction speeds in automated remittances enhance customer satisfaction and enable businesses to maintain a competitive edge in the global finance market.

Security Considerations for Manual and Automated Payouts

Manual payouts in remittance often carry higher risks of human error and fraud due to manual data entry and authorization processes. Automated payouts leverage advanced encryption, multi-factor authentication, and real-time fraud detection algorithms to enhance security and reduce vulnerabilities. Implementing automated systems with strict compliance protocols significantly minimizes potential security breaches compared to manual payout methods.

Cost Comparison: Manual vs Automated Remittance Payout Processes

Manual remittance payout processes typically incur higher operational costs due to labor-intensive tasks, increased error rates, and longer transaction times. Automated payout systems reduce expenses by streamlining workflows, minimizing human intervention, and accelerating fund transfers, leading to significant cost savings for financial institutions. Data from industry reports show automated remittance solutions can lower processing costs by up to 40% compared to manual methods.

Compliance and Regulatory Aspects in Payout Methods

Manual payout processes often face challenges in maintaining strict compliance with evolving regulatory requirements, increasing the risk of errors and delays in documentation. Automated payout systems enhance regulatory adherence by integrating real-time monitoring, audit trails, and fraud detection, ensuring accurate fulfillment of anti-money laundering (AML) and know-your-customer (KYC) regulations. Financial institutions leveraging automated payouts achieve higher efficiency and reduced compliance costs while minimizing the risk of penalties associated with regulatory breaches.

Choosing the Right Payout Method for Your Remittance Business

Manual payouts offer personalized control and flexibility, ideal for smaller remittance businesses or unique payment scenarios, but they can be time-consuming and prone to errors. Automated payouts enhance efficiency, scalability, and accuracy by streamlining transactions through software integration, making them suitable for large-volume remittance operations. Selecting the right payout method depends on transaction volume, operational scale, and the need for speed versus control in payout processes.

Future Trends: Automation in the Remittance Industry

Automated payouts in the remittance industry significantly reduce processing time and minimize human errors compared to manual payouts, leading to enhanced operational efficiency. The integration of AI and blockchain technologies is expected to drive future trends, enabling real-time settlements and increased transparency in cross-border transactions. As automation advances, financial institutions and remittance service providers are poised to offer faster, more secure, and user-friendly payout solutions globally.

Important Terms

Payment reconciliation

Payment reconciliation ensures accurate matching of transactions between manual payouts and automated payouts to prevent discrepancies and financial errors. Automated payouts streamline the reconciliation process by reducing human error and enhancing transaction traceability compared to time-consuming manual payout methods.

Disbursement processing

Automated payout streamlines disbursement processing by reducing errors and accelerating transaction times compared to manual payout methods.

Batch transfer

Batch transfer enables simultaneous processing of multiple payments, significantly reducing manual workload and minimizing errors compared to manual payout methods. Automated payout systems streamline batch transfers by integrating with financial platforms, ensuring faster, accurate, and scalable disbursement of funds.

Transaction latency

Automated payouts reduce transaction latency by processing payments instantly through systems, whereas manual payouts experience delays due to human verification and manual intervention.

Human error risk

Automated payout systems reduce human error risk by minimizing manual data entry and process inconsistencies, resulting in faster, accurate, and more secure financial transactions.

Compliance verification

Compliance verification ensures manual payouts undergo thorough audits to prevent fraud and errors, while automated payouts leverage real-time data validation and rule-based checks for consistent regulatory adherence. Automated payout systems reduce human error and processing time, enhancing accuracy and traceability in financial transactions.

Bulk payout management

Automated bulk payout management significantly reduces processing time and errors compared to manual payout methods, enhancing operational efficiency and accuracy.

API-driven settlement

API-driven settlement enhances efficiency by automating payouts, reducing errors and processing time compared to manual payout methods.

Operational overhead

Automated payout systems reduce operational overhead by minimizing manual intervention, decreasing errors, and accelerating transaction processing.

Escrow release

Automated payout in escrow release minimizes delays and errors compared to manual payout, ensuring faster and more secure funds disbursement.

manual payout vs automated payout Infographic

moneydif.com

moneydif.com