OPEX remittance involves regular, operational payments essential for day-to-day business functions, such as salaries and utilities, ensuring smooth cash flow management. CAPEX remittance refers to expenditures on acquiring or upgrading physical assets like equipment or property, aiming for long-term business growth and asset value enhancement. Differentiating these remittance types helps optimize budgeting and financial planning strategies.

Table of Comparison

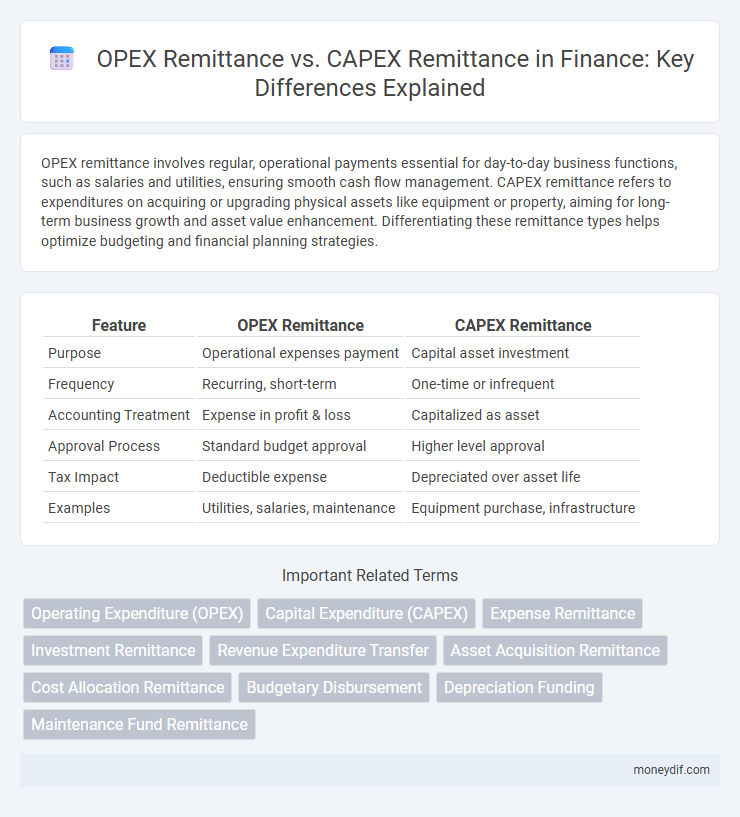

| Feature | OPEX Remittance | CAPEX Remittance |

|---|---|---|

| Purpose | Operational expenses payment | Capital asset investment |

| Frequency | Recurring, short-term | One-time or infrequent |

| Accounting Treatment | Expense in profit & loss | Capitalized as asset |

| Approval Process | Standard budget approval | Higher level approval |

| Tax Impact | Deductible expense | Depreciated over asset life |

| Examples | Utilities, salaries, maintenance | Equipment purchase, infrastructure |

Understanding OPEX and CAPEX in Remittance

OPEX remittance refers to operational expenses associated with the day-to-day costs of managing remittance services, including transaction processing fees, customer service, and compliance costs. CAPEX remittance involves capital expenditures related to long-term investments such as technology infrastructure, software development, and security systems that enhance remittance platforms. Understanding the distinction helps financial institutions allocate resources efficiently, optimize cash flow management, and improve the scalability of remittance operations.

Key Differences Between OPEX Remittance and CAPEX Remittance

OPEX remittance involves operational expenses related to day-to-day business functions, such as rent, utilities, and salaries, typically recurring and expensed within the accounting period. CAPEX remittance pertains to capital expenditures for acquiring or upgrading physical assets like equipment, buildings, or technology, recorded as long-term investments and depreciated over time. Key differences include their impact on financial statements, with OPEX affecting operational cash flow immediately while CAPEX influences balance sheets and future asset value.

Benefits of OPEX Remittance for Businesses

OPEX remittance offers businesses enhanced financial flexibility by converting remittance expenses into operational expenditures, which can be fully deducted from taxable income in the same fiscal year. This approach improves cash flow management by avoiding large upfront capital outlays associated with CAPEX remittance, allowing businesses to allocate resources more efficiently. Furthermore, OPEX remittance supports scalability and adaptability, enabling companies to adjust payment volumes based on operational needs without compromising financial stability.

Advantages of CAPEX Remittance in Financial Planning

CAPEX remittance offers significant advantages in financial planning by enabling long-term asset acquisition and infrastructure development, which enhances operational capacity and market competitiveness. It facilitates tax benefits and depreciation deductions, improving cash flow management and financial stability over time. Compared to OPEX remittance, CAPEX investments provide strategic growth opportunities and stronger balance sheet positioning for sustained business expansion.

Cost Implications: OPEX vs. CAPEX Remittance

OPEX remittance involves ongoing operational expenses that are fully deductible in the same fiscal year, providing immediate tax benefits and enhancing cash flow management. In contrast, CAPEX remittance pertains to capital expenditures that are capitalized and depreciated over time, leading to deferred tax advantages but requiring higher initial cash outlays. Evaluating the cost implications between OPEX and CAPEX remittance is crucial for optimizing financial strategy and ensuring efficient allocation of resources within remittance operations.

Tax Treatment: OPEX Remittance vs. CAPEX Remittance

OPEX remittance typically involves deductible expenses that reduce taxable income immediately, allowing businesses to lower their tax burden within the current fiscal year. In contrast, CAPEX remittance relates to capital expenditures that are capitalized and depreciated or amortized over the asset's useful life, spreading the tax benefits across multiple years. Understanding the distinction in tax treatment between OPEX and CAPEX remittances is crucial for effective tax planning and compliance in financial reporting.

Cash Flow Impact of OPEX and CAPEX Remittance

OPEX remittance refers to operational expenses paid regularly, directly affecting cash flow by reducing available working capital through recurring outflows, while CAPEX remittance involves capital expenditures that impact cash flow by allocating funds toward long-term assets, often causing significant one-time cash outflows. OPEX impacts short-term liquidity and operational efficiency due to its continuous nature, whereas CAPEX remittance influences long-term financial planning and depreciation schedules. Efficient management of both OPEX and CAPEX remittances is crucial to maintaining a balanced cash flow and ensuring sustainable business growth.

Use Case Scenarios: When to Choose OPEX or CAPEX Remittance

OPEX remittance suits businesses aiming for operational flexibility, covering routine expenses such as salaries, subscriptions, and utilities, allowing for manageable cash flow and tax benefits through immediate deductions. CAPEX remittance applies to substantial investment payments on fixed assets like machinery or infrastructure, typically resulting in depreciation over time, ideal for long-term strategic growth. Organizations should select OPEX remittance for recurring costs and CAPEX remittance when financing capital-intensive projects to optimize financial reporting and tax planning.

Regulatory and Compliance Considerations

OPEX remittance involves recurring operational expenses subject to regulatory scrutiny regarding AML, KYC, and transaction reporting to ensure ongoing compliance with financial authorities. CAPEX remittance, typically related to capital investments, requires adherence to cross-border transfer regulations and tax compliance frameworks dictated by jurisdictional capital control laws. Both remittance types mandate robust audit trails and transparency to satisfy compliance standards enforced by bodies such as the Financial Action Task Force (FATF) and local financial regulatory agencies.

Strategic Decision-Making: Selecting the Right Remittance Model

OPEX remittance involves operational expenditure, enabling flexible, short-term budget allocation for routine remittance processes, while CAPEX remittance requires capital investment in infrastructure or technology solutions that support long-term remittance capabilities. Strategic decision-making hinges on evaluating cash flow, scalability, and return on investment, with OPEX models favoring adaptability and reduced upfront costs, and CAPEX models driving potential cost savings and asset ownership over time. Selecting the right remittance model optimizes financial planning, risk management, and alignment with organizational remittance volume and growth objectives.

Important Terms

Operating Expenditure (OPEX)

Operating Expenditure (OPEX) involves the ongoing costs for running a business, such as salaries, utilities, and maintenance, directly impacting cash flow and profitability. OPEX remittance refers to the timely payment of these operational expenses, whereas CAPEX remittance pertains to funding long-term investments in assets like equipment or infrastructure, with distinct accounting treatments and tax implications for each.

Capital Expenditure (CAPEX)

Capital Expenditure (CAPEX) involves long-term investments in physical assets or infrastructure, significantly impacting a company's balance sheet and financial strategy. Comparing OPEX remittance, which covers operational expenses and recurring costs, CAPEX remittance focuses on funds allocated for acquiring or upgrading fixed assets, influencing depreciation and capital budgeting decisions.

Expense Remittance

Expense remittance in OPEX refers to the reimbursement of operational expenditures such as rent, utilities, and salaries, which are necessary for day-to-day business functions. In contrast, CAPEX remittance involves payments for capital expenditures, including the acquisition of fixed assets like machinery, buildings, or technology improvements that provide long-term value and depreciation benefits.

Investment Remittance

Investment remittance in OPEX involves funds allocated for day-to-day operational expenses such as salaries, rent, and utilities, directly impacting the company's short-term liquidity and financial efficiency. In contrast, CAPEX remittance refers to capital expenditures directed towards acquiring or upgrading physical assets like machinery, buildings, or technology, essential for long-term growth and asset base enhancement.

Revenue Expenditure Transfer

Revenue Expenditure Transfer involves reallocating operational expenses (OPEX remittance) to cover day-to-day business functions, while Capital Expenditure Transfer pertains to CAPEX remittance focused on long-term asset investments. Distinguishing between OPEX and CAPEX remittance is crucial for accurate financial reporting, tax treatment, and budgeting within organizational accounting frameworks.

Asset Acquisition Remittance

Asset Acquisition Remittance involves the transfer of funds specifically for purchasing or upgrading fixed assets, classified under CAPEX Remittance, which affects long-term capital investment and depreciation schedules. In contrast, OPEX Remittance covers operational expenses such as maintenance and utilities, impacting short-term financial statements and cash flow management.

Cost Allocation Remittance

Cost allocation remittance distinguishes OPEX remittance, which covers operational expenses like rent, utilities, and salaries, from CAPEX remittance that involves capital expenditures for long-term asset investments such as equipment or infrastructure. Efficient management of OPEX and CAPEX remittances ensures accurate financial reporting and optimized budget control within organizations.

Budgetary Disbursement

Budgetary disbursement differentiates between OPEX remittance, which covers operational expenses like salaries and utilities, and CAPEX remittance, allocated for capital expenditures such as infrastructure and asset acquisition. Effective management of both OPEX and CAPEX disbursements ensures optimized cash flow, compliance with financial policies, and strategic investment in organizational growth.

Depreciation Funding

Depreciation funding involves allocating expenses over an asset's useful life, impacting OPEX remittance by gradually recognizing costs rather than upfront CAPEX remittance, which records the full asset cost immediately. This approach improves cash flow management and financial reporting transparency by spreading out expenditure recognition aligned with asset utilization.

Maintenance Fund Remittance

Maintenance Fund Remittance primarily falls under OPEX Remittance as it covers routine expenses for upkeep, repairs, and operational sustainability of assets, ensuring continuous service performance. CAPEX Remittance, by contrast, involves capital expenditures aimed at acquiring or upgrading physical assets, reflecting investments in long-term value rather than recurring maintenance costs.

OPEX Remittance vs CAPEX Remittance Infographic

moneydif.com

moneydif.com