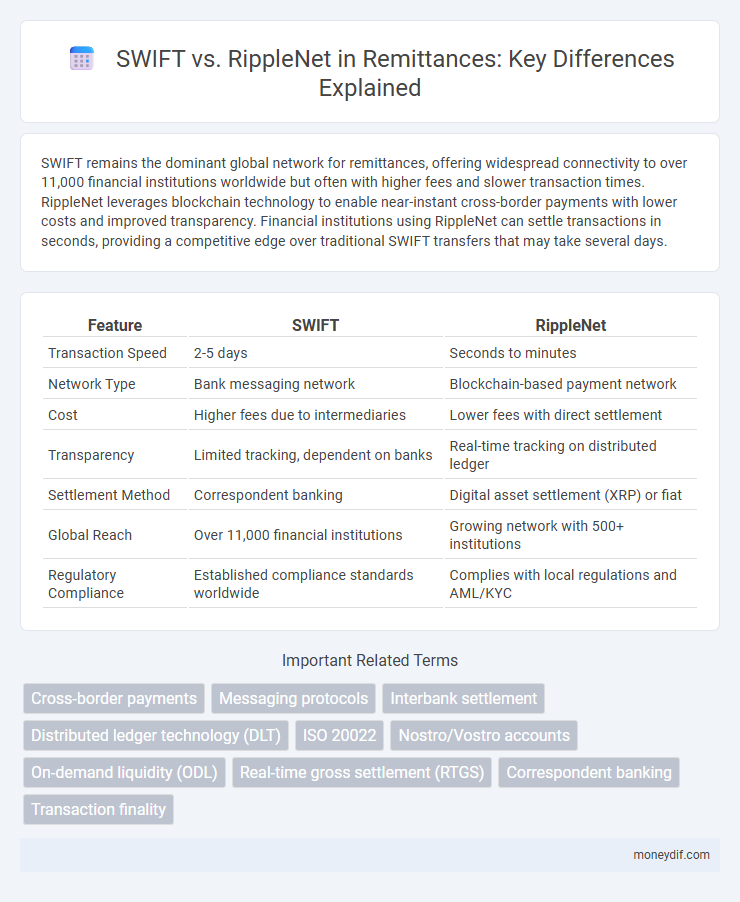

SWIFT remains the dominant global network for remittances, offering widespread connectivity to over 11,000 financial institutions worldwide but often with higher fees and slower transaction times. RippleNet leverages blockchain technology to enable near-instant cross-border payments with lower costs and improved transparency. Financial institutions using RippleNet can settle transactions in seconds, providing a competitive edge over traditional SWIFT transfers that may take several days.

Table of Comparison

| Feature | SWIFT | RippleNet |

|---|---|---|

| Transaction Speed | 2-5 days | Seconds to minutes |

| Network Type | Bank messaging network | Blockchain-based payment network |

| Cost | Higher fees due to intermediaries | Lower fees with direct settlement |

| Transparency | Limited tracking, dependent on banks | Real-time tracking on distributed ledger |

| Settlement Method | Correspondent banking | Digital asset settlement (XRP) or fiat |

| Global Reach | Over 11,000 financial institutions | Growing network with 500+ institutions |

| Regulatory Compliance | Established compliance standards worldwide | Complies with local regulations and AML/KYC |

Introduction: Understanding Remittance in the Digital Age

SWIFT facilitates cross-border remittances through a global network connecting over 11,000 financial institutions, relying on traditional messaging protocols that can result in delays and higher fees. RippleNet leverages blockchain technology to enable real-time, low-cost international payments by directly linking banks and payment providers with a secure, decentralized ledger. The shift from SWIFT to RippleNet represents a significant evolution in digital remittance, emphasizing speed, transparency, and cost-efficiency.

What is SWIFT? A Legacy System Explained

SWIFT is a global messaging network established in 1973 that enables financial institutions to securely exchange information about international money transfers. As a legacy system, SWIFT relies on a standardized protocol and correspondent banking relationships to facilitate cross-border payments, often resulting in slower transaction times and higher fees. Its widespread adoption contrasts with newer blockchain-based networks like RippleNet, which aim to increase speed and transparency in remittance processing.

RippleNet: The Modern Alternative

RippleNet offers a modern alternative to SWIFT by leveraging blockchain technology to enable faster and more cost-effective cross-border remittances. Its decentralized network facilitates near-instant settlement and transparent tracking, significantly reducing transaction fees and eliminating the multi-day delays common with SWIFT systems. Financial institutions using RippleNet benefit from enhanced liquidity management and increased operational efficiency in global payments.

Transaction Speed: SWIFT vs RippleNet Comparison

RippleNet processes cross-border payments in seconds by utilizing blockchain technology, significantly outperforming SWIFT's traditional system which can take 1 to 5 business days to settle transactions. RippleNet's near-instant settlement reduces liquidity costs and enhances transparency, providing a seamless remittance experience. SWIFT, while widely adopted, relies on correspondent banking networks causing delays and higher fees compared to RippleNet's efficient digital ledger.

Cost Efficiency: Breaking Down Fees

SWIFT remittance fees often include fixed charges, correspondent bank fees, and currency conversion costs, resulting in higher overall expenses for cross-border transactions. RippleNet leverages blockchain technology to reduce intermediaries, significantly lowering transaction fees and enabling near-instant settlements. Businesses and individuals benefit from RippleNet's transparent, lower-cost fee structure compared to SWIFT's traditional banking network charges.

Global Coverage and Network Reach

SWIFT operates with a vast network of over 11,000 financial institutions in more than 200 countries, enabling extensive global coverage for cross-border remittances. RippleNet, while smaller, connects over 500 financial institutions worldwide and leverages blockchain technology to provide faster transaction speeds and real-time settlement. The expansive reach of SWIFT ensures broad accessibility, whereas RippleNet focuses on optimizing speed and cost efficiency within its rapidly growing network.

Security and Compliance Measures

SWIFT employs a global messaging network with strict security protocols and encryption standards to ensure secure cross-border remittance transactions, adhering to international regulatory compliance such as AML and KYC requirements. RippleNet leverages blockchain technology with end-to-end encryption and real-time transaction monitoring, providing enhanced security through decentralized validation and smart contract compliance capabilities. Both platforms prioritize regulatory adherence, but RippleNet offers faster settlement times and transparent transaction tracking that strengthen fraud detection and compliance reporting.

Transparency and Traceability of Payments

SWIFT offers a globally established network for cross-border payments but often lacks real-time transparency and detailed traceability of transactions, leading to delays in payment status updates. RippleNet leverages blockchain technology to provide end-to-end visibility, allowing both senders and receivers to track payments in real time with immutable records. This enhanced transparency and traceability reduce payment errors and reconciliation times, improving overall efficiency in remittance processes.

Adoption Rates: Banks and Financial Institutions

Banks and financial institutions show varied adoption rates between SWIFT and RippleNet, with SWIFT boasting over 11,000 member institutions worldwide, making it the dominant network for cross-border payments. RippleNet, leveraging blockchain technology, is rapidly gaining traction among over 500 financial institutions seeking faster, more cost-effective remittance solutions. The growing preference for RippleNet stems from its ability to process transactions in seconds, contrasting with SWIFT's traditional multi-day settlement times.

Future Prospects: The Evolution of Cross-Border Remittance

SWIFT's extensive network and decades of trust anchor its dominance in cross-border remittance, but RippleNet's blockchain technology offers faster settlement times and lower transaction costs. RippleNet leverages real-time payment capabilities and liquidity solutions, positioning itself as a key player in the evolving digital remittance landscape. Future prospects indicate a gradual integration of blockchain-based platforms like RippleNet alongside traditional systems to enhance efficiency and transparency in global money transfers.

Important Terms

Cross-border payments

Cross-border payments leveraging SWIFT rely on a decentralized network of intermediaries, often resulting in longer settlement times and higher transaction fees, whereas RippleNet utilizes blockchain technology to enable faster, low-cost, and transparent international money transfers. Financial institutions adopting RippleNet benefit from near real-time settlement and enhanced liquidity management compared to the traditional SWIFT system.

Messaging protocols

SWIFT operates on a standardized messaging protocol primarily using ISO 20022 for secure financial communication between banks worldwide, ensuring global interoperability and compliance. RippleNet utilizes the Interledger Protocol (ILP) combined with its own messaging format to enable real-time cross-border payments with enhanced speed and transparency.

Interbank settlement

Interbank settlement involves the transfer of funds between banks to complete financial transactions, where SWIFT facilitates communication and messaging for secure cross-border payments, while RippleNet offers a blockchain-based network that enables real-time, low-cost international money transfers. RippleNet's use of digital assets and distributed ledger technology reduces settlement times from days to seconds, contrasting with SWIFT's reliance on traditional correspondent banking systems.

Distributed ledger technology (DLT)

Distributed ledger technology (DLT) underpins RippleNet by enabling real-time cross-border payments with enhanced transparency and reduced settlement times compared to SWIFT's traditional messaging system, which relies on correspondent banking networks and can incur delays and higher costs. RippleNet leverages DLT for direct transfer of digital assets between parties, improving efficiency and lowering transaction friction relative to SWIFT's indirect intermediary process.

ISO 20022

ISO 20022 is a universal financial messaging standard that enhances interoperability and data richness for cross-border payments by enabling standardized, structured data exchange within SWIFT's network and RippleNet's blockchain-based platform. While SWIFT leverages ISO 20022 to modernize traditional correspondent banking with improved messaging efficiency, RippleNet integrates the standard to facilitate real-time, transparent, and cost-effective settlement of digital assets and fiat currencies.

Nostro/Vostro accounts

Nostro/Vostro accounts function as correspondent bank accounts where Nostro refers to "our account with you," and Vostro means "your account with us," traditionally used in cross-border payments through SWIFT's messaging network. RippleNet utilizes blockchain technology to offer real-time settlement and reduced need for Nostro/Vostro accounts by enabling direct transactions between financial institutions, enhancing liquidity and decreasing operational costs.

On-demand liquidity (ODL)

On-demand liquidity (ODL) leverages RippleNet's blockchain technology to enable real-time, cross-border payments by utilizing digital assets like XRP as a bridge currency, significantly reducing transaction costs and settlement times compared to traditional systems. In contrast, SWIFT relies on a correspondent banking network that typically involves multiple intermediaries, resulting in slower processing and higher fees for international transfers.

Real-time gross settlement (RTGS)

Real-time gross settlement (RTGS) systems process high-value interbank payments instantly and irrevocably, with SWIFT leveraging its extensive global messaging network for secure transaction instructions, while RippleNet employs blockchain technology to enable faster, lower-cost cross-border settlements by minimizing intermediaries. RippleNet's protocol enhances liquidity management and real-time tracking compared to traditional SWIFT RTGS environments, optimizing settlement speed and reducing transaction fees.

Correspondent banking

Correspondent banking relies on intermediary banks to facilitate cross-border payments, typically using the SWIFT network, which processes nearly 11,000 financial institutions globally but often involves higher fees and slower settlement times. RippleNet offers a blockchain-based alternative that provides faster transaction settlements, enhanced transparency, and lower costs by enabling direct connections between banks, with over 500 financial institutions adopting the platform as of 2024.

Transaction finality

Transaction finality in SWIFT relies on correspondent banking networks, often resulting in longer settlement times and increased counterparty risk due to multiple intermediaries. RippleNet utilizes blockchain technology to enable near-instantaneous, irrevocable transaction finality, reducing settlement risk and enhancing cross-border payment efficiency.

SWIFT vs RippleNet Infographic

moneydif.com

moneydif.com