AML (Anti-Money Laundering) focuses on detecting and preventing the illicit concealment of illegally obtained funds, while CTF (Counter-Terrorism Financing) targets the disruption of financial support to terrorist activities. Both frameworks share common techniques such as customer due diligence and transaction monitoring but apply distinct risk assessments tailored to money laundering and terrorism financing threats. Effective remittance services integrate AML and CTF measures to ensure compliance and safeguard against financial crimes.

Table of Comparison

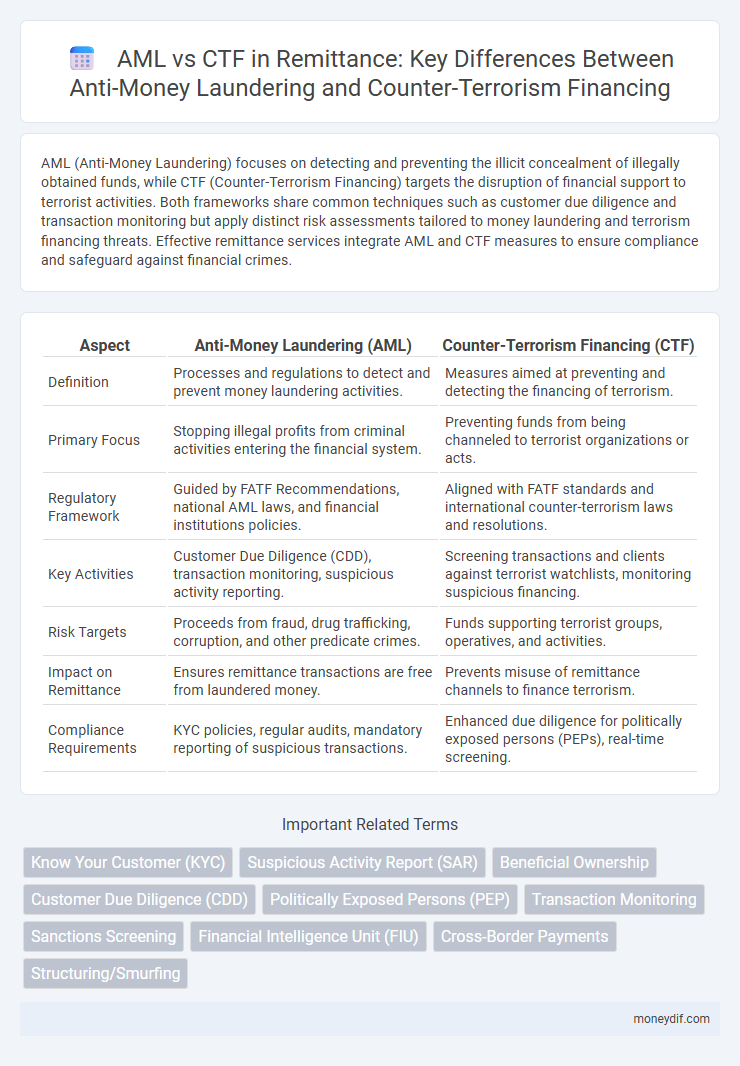

| Aspect | Anti-Money Laundering (AML) | Counter-Terrorism Financing (CTF) |

|---|---|---|

| Definition | Processes and regulations to detect and prevent money laundering activities. | Measures aimed at preventing and detecting the financing of terrorism. |

| Primary Focus | Stopping illegal profits from criminal activities entering the financial system. | Preventing funds from being channeled to terrorist organizations or acts. |

| Regulatory Framework | Guided by FATF Recommendations, national AML laws, and financial institutions policies. | Aligned with FATF standards and international counter-terrorism laws and resolutions. |

| Key Activities | Customer Due Diligence (CDD), transaction monitoring, suspicious activity reporting. | Screening transactions and clients against terrorist watchlists, monitoring suspicious financing. |

| Risk Targets | Proceeds from fraud, drug trafficking, corruption, and other predicate crimes. | Funds supporting terrorist groups, operatives, and activities. |

| Impact on Remittance | Ensures remittance transactions are free from laundered money. | Prevents misuse of remittance channels to finance terrorism. |

| Compliance Requirements | KYC policies, regular audits, mandatory reporting of suspicious transactions. | Enhanced due diligence for politically exposed persons (PEPs), real-time screening. |

Understanding AML and CTF in the Remittance Sector

AML (Anti-Money Laundering) and CTF (Counter-Terrorism Financing) are critical compliance frameworks in the remittance sector aimed at preventing illicit financial activities. AML focuses on detecting and reporting suspicious transactions that may involve the proceeds of crime, while CTF targets the disruption of financial networks used to support terrorist organizations. Effective implementation of AML and CTF measures ensures the integrity of remittances by monitoring transactions, verifying customer identities, and reporting suspicious activities to regulatory authorities.

Key Differences Between AML and CTF Regulations

AML regulations primarily target the detection and prevention of money laundering activities by monitoring suspicious financial transactions and enforcing customer due diligence. CTF regulations focus specifically on identifying and disrupting the financing of terrorism through enhanced scrutiny of funds and entities linked to terrorist activities. Both frameworks share compliance measures but differ in their core objectives, with AML addressing broader illicit fund flows and CTF concentrating on terrorism-related financial crimes.

Why Remittance Providers Need Robust AML Policies

Remittance providers must implement robust AML policies to detect and prevent illicit financial flows that can obscure the origins of criminal proceeds. Strong AML frameworks ensure compliance with international regulations, reducing risks of legal penalties and reputational damage. Integrating real-time transaction monitoring enhances the ability to identify suspicious activity linked to money laundering and terrorist financing.

The Role of CTF in Global Remittance Transactions

Counter-Terrorism Financing (CTF) plays a critical role in securing global remittance transactions by identifying and preventing the flow of funds to terrorist organizations. Robust CTF measures ensure that remittance channels are monitored for suspicious activities without disrupting legitimate transfers, thereby maintaining trust and regulatory compliance in cross-border payments. Enhanced due diligence, transaction screening, and real-time intelligence sharing are key strategies employed to effectively mitigate risks associated with terrorism financing in the remittance sector.

Regulatory Frameworks: AML vs CTF Compliance

AML (Anti-Money Laundering) and CTF (Counter-Terrorism Financing) regulatory frameworks collectively enforce rigorous compliance standards to prevent illicit financial activities. AML focuses on detecting and reporting suspicious transactions linked to money laundering, while CTF targets the prevention of funds being used to finance terrorism. Financial institutions must implement comprehensive customer due diligence, continuous monitoring, and reporting mechanisms in adherence to both AML and CTF regulations to mitigate risks and ensure compliance with global standards such as FATF recommendations.

Risk Assessment for AML and CTF in Remittance Services

Risk assessment in remittance services is critical for both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, focusing on identifying and mitigating vulnerabilities exploited by illicit financial activities. Effective risk assessment involves analyzing customer profiles, transaction patterns, and geographic risk factors to detect suspicious activities indicative of money laundering or terrorism financing. Compliance with regulatory requirements ensures robust screening processes, enhancing the integrity and security of cross-border remittance operations.

Technological Solutions for AML and CTF in Remittances

Technological solutions for AML and CTF in remittances leverage artificial intelligence, machine learning, and blockchain to detect suspicious transactions and enhance compliance with regulatory frameworks. Real-time transaction monitoring systems and biometric verification tools significantly reduce fraud and financing of terrorism by identifying unusual patterns and authenticating users securely. Integration of these technologies enables financial institutions to streamline due diligence processes while maintaining transparency and security in cross-border money transfers.

Challenges in Implementing AML and CTF Controls

Implementing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) controls faces challenges such as the evolving complexity of financial crime methods and the need for real-time transaction monitoring. Compliance requires significant investment in technology and skilled personnel to identify suspicious activities while minimizing false positives. Regulatory inconsistencies across jurisdictions further complicate risk management and hinder seamless enforcement of AML and CTF measures in remittance services.

Case Studies: AML and CTF Failures in Remittance

AML and CTF failures in remittance have exposed vulnerabilities that criminal networks exploit to launder illicit funds and finance terrorism. Notable case studies include the 2012 HSBC scandal, where inadequate AML controls allowed drug cartels to move billions through remittance channels, and the 2017 FinCEN advisory highlighting terrorist organizations exploiting informal value transfer systems. These failures underscore the critical need for robust transaction monitoring, customer due diligence, and enhanced collaboration between regulatory bodies to mitigate money laundering and terrorist financing risks in remittance services.

Future Trends in AML and CTF for Remittance Industry

Future trends in AML and CTF for the remittance industry emphasize enhanced AI-driven transaction monitoring and predictive analytics to detect suspicious activities with greater accuracy. Regulatory frameworks are evolving to incorporate blockchain technology for improved transparency and real-time compliance reporting. Collaboration between financial institutions and law enforcement agencies is increasing to strengthen information sharing and combat sophisticated money laundering and terrorism financing schemes.

Important Terms

Know Your Customer (KYC)

Know Your Customer (KYC) processes are fundamental in Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, enabling financial institutions to verify customer identities and assess risks associated with money laundering and terrorist financing activities. Effective KYC procedures enhance compliance with AML regulations by detecting suspicious transactions and supporting CTF efforts to prevent the financing of terrorism through thorough customer due diligence and ongoing monitoring.

Suspicious Activity Report (SAR)

Suspicious Activity Reports (SARs) are critical tools in both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, designed to document and flag unusual financial transactions that may indicate illegal activities such as money laundering or terrorist financing. Regulatory agencies rely on SARs to identify patterns, enable investigations, and strengthen compliance with AML and CTF laws aimed at disrupting illicit finance networks.

Beneficial Ownership

Beneficial ownership transparency is a critical component in both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, enabling authorities to identify individuals who ultimately control or benefit from legal entities used to conceal illicit funds or finance terrorism. Enhanced due diligence and robust beneficial ownership registries help prevent the misuse of corporate structures, thereby strengthening the effectiveness of AML and CTF measures globally.

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) is a critical process in both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, designed to verify the identity of clients and assess risks associated with illicit financial activities. Effective CDD helps financial institutions detect suspicious transactions, prevent money laundering channels, and disrupt terrorist financing networks by ensuring compliance with regulatory standards.

Politically Exposed Persons (PEP)

Politically Exposed Persons (PEPs) present heightened risks in Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks due to their potential involvement in corruption and misuse of power. AML and CTF measures require enhanced due diligence and continuous monitoring of PEPs to detect and prevent illicit financial activities and terrorism funding.

Transaction Monitoring

Transaction monitoring systems are essential for detecting suspicious activities that may indicate money laundering or terrorism financing, employing advanced algorithms to analyze transaction patterns and flag anomalies in real-time. These systems differentiate AML efforts, which focus on preventing illicit money integration into the financial system, from CTF initiatives aimed specifically at identifying and disrupting funding sources for terrorist organizations.

Sanctions Screening

Sanctions screening is a critical process in both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) frameworks, helping financial institutions detect and block transactions involving sanctioned individuals, entities, or countries. Effective sanctions screening leverages updated global watchlists and robust risk-based methodologies to prevent illicit fund flows linked to money laundering and terrorist financing activities.

Financial Intelligence Unit (FIU)

The Financial Intelligence Unit (FIU) plays a crucial role in both Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) by collecting, analyzing, and disseminating financial information to detect and prevent illicit financial activities. Through its strategic collaboration with law enforcement agencies and financial institutions, the FIU enhances national and international efforts to combat money laundering and the financing of terrorism effectively.

Cross-Border Payments

Cross-border payments require rigorous AML and CTF measures to detect and prevent illicit activities such as money laundering and terrorist financing, leveraging advanced transaction monitoring systems and enhanced due diligence protocols. Financial institutions must comply with international regulatory frameworks like FATF recommendations to ensure transparency, traceability, and risk mitigation in cross-border fund transfers.

Structuring/Smurfing

Structuring, also known as smurfing, is a common money laundering technique involving breaking large financial transactions into smaller, less suspicious amounts to evade AML detection systems. This method challenges both AML and CTF frameworks by masking illicit funds and complicating the identification of terrorist financing within financial networks.

AML vs CTF (Anti-Money Laundering vs Counter-Terrorism Financing) Infographic

moneydif.com

moneydif.com