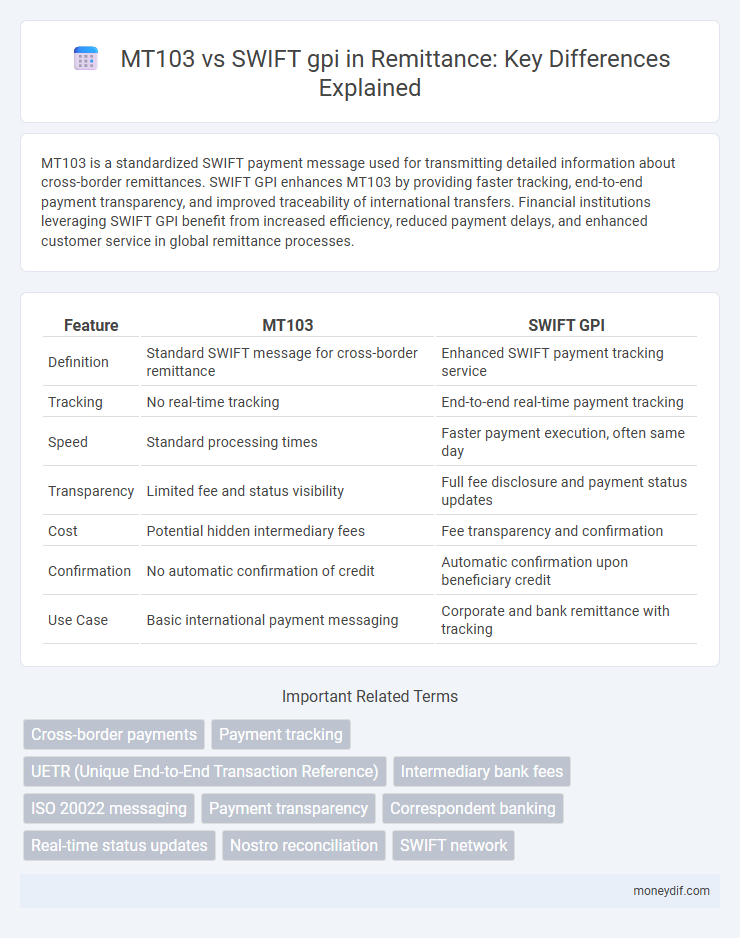

MT103 is a standardized SWIFT payment message used for transmitting detailed information about cross-border remittances. SWIFT GPI enhances MT103 by providing faster tracking, end-to-end payment transparency, and improved traceability of international transfers. Financial institutions leveraging SWIFT GPI benefit from increased efficiency, reduced payment delays, and enhanced customer service in global remittance processes.

Table of Comparison

| Feature | MT103 | SWIFT GPI |

|---|---|---|

| Definition | Standard SWIFT message for cross-border remittance | Enhanced SWIFT payment tracking service |

| Tracking | No real-time tracking | End-to-end real-time payment tracking |

| Speed | Standard processing times | Faster payment execution, often same day |

| Transparency | Limited fee and status visibility | Full fee disclosure and payment status updates |

| Cost | Potential hidden intermediary fees | Fee transparency and confirmation |

| Confirmation | No automatic confirmation of credit | Automatic confirmation upon beneficiary credit |

| Use Case | Basic international payment messaging | Corporate and bank remittance with tracking |

Understanding MT103 in International Remittance

MT103 is a standardized SWIFT payment message used for initiating international wire transfers, containing detailed transaction information to ensure transparency and traceability. SWIFT GPI enhances MT103 by enabling real-time tracking of cross-border payments, significantly reducing processing times and improving reconciliation for banks and beneficiaries. Understanding MT103 is essential for accurate remittance processing, as it provides the foundational data structure that SWIFT GPI builds upon to optimize the efficiency of global payments.

Introduction to SWIFT GPI: The Next Evolution

SWIFT GPI (Global Payments Innovation) revolutionizes traditional MT103 remittance messaging by enabling faster, transparent, and traceable cross-border payments with end-to-end tracking. Unlike the static MT103, SWIFT GPI provides real-time payment status updates, improving visibility for banks and beneficiaries. This innovation significantly enhances payment speed and compliance, supporting seamless international transactions in the global banking ecosystem.

Key Differences Between MT103 and SWIFT GPI

MT103 is a standardized SWIFT message format used for cross-border payment instructions, providing detailed transaction information but lacking real-time tracking capabilities. SWIFT GPI (Global Payments Innovation) enhances MT103 by enabling near-instant tracking, transparency, and faster settlement through end-to-end payment visibility across correspondent banks. Unlike MT103, SWIFT GPI offers value-added features such as same-day use of funds, fee transparency, and enriched payment status updates.

Speed and Transparency: GPI vs MT103

SWIFT GPI revolutionizes remittance speed by enabling same-day or next-day cross-border payments, whereas traditional MT103 transactions often require several days for settlement. Transparency is enhanced with GPI as it provides end-to-end tracking and real-time payment status updates, contrasting with MT103's limited visibility that leaves beneficiaries uncertain about payment progress. This combination of rapid execution and increased transparency makes GPI the preferred choice for corporates seeking efficient and reliable international funds transfers.

Tracking Capabilities in MT103 vs SWIFT GPI

MT103 is a traditional SWIFT payment message format that provides basic transaction details but lacks real-time tracking capabilities, making it difficult to monitor the payment status across correspondent banks. SWIFT GPI enhances remittance processes by enabling end-to-end tracking with unique end-to-end transaction references, allowing banks and customers to trace payments instantly and verify fees and delivery times. This tracking capability significantly improves transparency and efficiency in cross-border payments compared to the limited visibility offered by MT103.

Security Features: MT103 Compared to SWIFT GPI

MT103 transactions provide a standardized format for international wire transfers with basic security protocols such as SWIFT network encryption and compliance checks. SWIFT GPI enhances security by incorporating real-time tracking, end-to-end payment encryption, and transparent confirmation of payment status, reducing fraud risk and unauthorized delays. The advanced audit trails and confirmation processes in SWIFT GPI significantly improve transaction integrity compared to traditional MT103 transfers.

Remittance Cost Efficiency: Which is Better?

MT103, a standardized SWIFT message for cross-border payments, often incurs higher remittance costs due to intermediary bank fees and slower processing times. SWIFT GPI enhances cost efficiency by enabling faster tracking, transparency on fees, and reduced intermediary charges, resulting in more predictable and lower expenses. Banks adopting SWIFT GPI report up to a 40% decrease in remittance costs compared to traditional MT103 transfers.

Compliance and Regulatory Considerations

MT103 messages serve as the standardized format for international wire transfers, ensuring transparency and traceability, which is critical for compliance with anti-money laundering (AML) regulations and Know Your Customer (KYC) protocols. SWIFT gpi enhances these compliance measures by providing real-time tracking, faster transaction processing, and improved visibility into payment chains, which helps financial institutions meet stringent regulatory requirements more effectively. Both MT103 and SWIFT gpi support adherence to global regulatory frameworks by facilitating audit trails and enabling efficient monitoring of cross-border remittances.

Benefits for Banks and End Users

MT103 enables detailed tracking of international wire transfers, providing banks with clear transaction transparency and compliance monitoring, while offering end users reliable proof of payment. SWIFT GPI enhances remittance speed and end-to-end payment tracking through a real-time tracking mechanism, reducing delays and improving beneficiary satisfaction. Both MT103 and SWIFT GPI improve operational efficiency, but SWIFT GPI's faster settlement and comprehensive tracking optimize the remittance experience for banks and their customers.

Future of Cross-Border Payments: MT103 or SWIFT GPI?

MT103, a traditional SWIFT message format, ensures standardized cross-border payment instruction but lacks real-time tracking and transparency features. SWIFT GPI revolutionizes remittances by enabling end-to-end tracking, faster settlement times, and enhanced transparency, making it the preferred choice for future cross-border payments. Financial institutions increasingly adopt SWIFT GPI to meet growing demands for speed, security, and traceability in global money transfers.

Important Terms

Cross-border payments

MT103 is a standardized SWIFT message format used for transmitting detailed information about cross-border payments, ensuring transparency and traceability. SWIFT GPI enhances cross-border payments by providing end-to-end tracking, faster settlement times, and improved payment status updates compared to traditional MT103 transactions.

Payment tracking

Payment tracking using MT103 enables basic transaction transparency by providing detailed payment instructions and status updates, while SWIFT GPI enhances this process with real-time tracking, end-to-end visibility, and faster reconciliation across global banks. The SWIFT GPI system leverages enriched MT103 data fields to deliver improved tracking accuracy, beneficiary confirmation, and reduced payment processing times, thereby increasing overall transaction efficiency.

UETR (Unique End-to-End Transaction Reference)

UETR (Unique End-to-End Transaction Reference) is a 36-character identifier embedded in MT103 payments within the SWIFT GPI framework to enhance end-to-end tracking and transparency across cross-border transactions.

Intermediary bank fees

Intermediary bank fees for MT103 payments can be higher due to multiple correspondent banks charging separate fees, while SWIFT gpi streamlines payment tracking and reduces costs by enhancing transparency and minimizing intermediaries. The SWIFT gpi network provides real-time fee and status updates, allowing businesses to better predict and control intermediary bank charges compared to traditional MT103 transfers.

ISO 20022 messaging

ISO 20022 messaging enhances MT103 payment instructions by enabling richer, standardized data exchange that improves interoperability and transparency within the SWIFT GPI framework.

Payment transparency

MT103 provides detailed, standardized payment instructions for cross-border transactions, while SWIFT GPI enhances payment transparency by enabling real-time tracking and confirmation of payment status across participating banks.

Correspondent banking

Correspondent banking relies heavily on MT103 messages for standardized, transparent, and traceable cross-border payment instructions ensuring compliance and accuracy. SWIFT GPI enhances these transactions by providing real-time payment tracking, confirmation of credit, and faster settlement, significantly improving the efficiency and transparency of correspondent banking payments.

Real-time status updates

MT103 messages provide standardized payment instructions, while SWIFT gpi enhances real-time status updates by offering end-to-end tracking and transparency for cross-border transactions.

Nostro reconciliation

Nostro reconciliation improves accuracy and transparency by matching MT103 transaction details with SWIFT GPI tracking data for efficient cross-border payment verification.

SWIFT network

SWIFT GPI enhances the traditional MT103 transfer by providing real-time tracking, faster settlement, and improved transparency for cross-border payments within the SWIFT network.

MT103 vs SWIFT GPI Infographic

moneydif.com

moneydif.com