The value date in remittance refers to the actual date when funds are credited to the beneficiary's account, impacting the availability of the money. The booking date is the transaction date recorded by the sending bank, marking when the remittance was initiated. Understanding the difference between value date and booking date is crucial for accurate financial planning and cash flow management in cross-border payments.

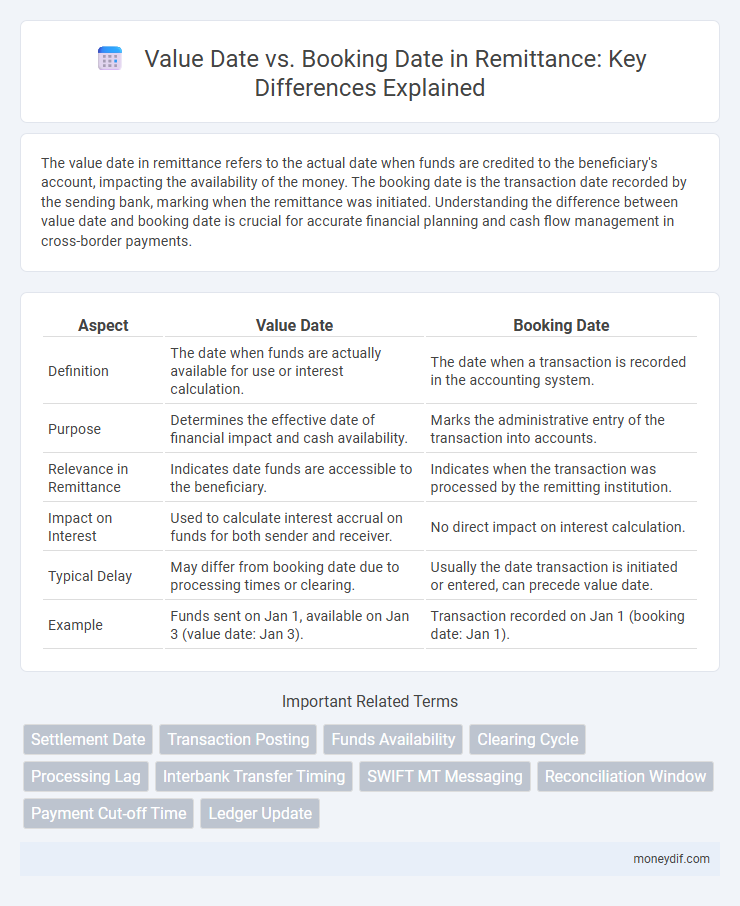

Table of Comparison

| Aspect | Value Date | Booking Date |

|---|---|---|

| Definition | The date when funds are actually available for use or interest calculation. | The date when a transaction is recorded in the accounting system. |

| Purpose | Determines the effective date of financial impact and cash availability. | Marks the administrative entry of the transaction into accounts. |

| Relevance in Remittance | Indicates date funds are accessible to the beneficiary. | Indicates when the transaction was processed by the remitting institution. |

| Impact on Interest | Used to calculate interest accrual on funds for both sender and receiver. | No direct impact on interest calculation. |

| Typical Delay | May differ from booking date due to processing times or clearing. | Usually the date transaction is initiated or entered, can precede value date. |

| Example | Funds sent on Jan 1, available on Jan 3 (value date: Jan 3). | Transaction recorded on Jan 1 (booking date: Jan 1). |

Understanding Value Date in Remittance

In remittance transactions, the value date represents the exact day when funds become available for use by the beneficiary, reflecting the maturity of the payment and interest calculations. This differs from the booking date, which is the date the transaction is recorded by the financial institution, often occurring earlier than the value date. Understanding the value date is crucial for cash flow management and accurate financial planning in international money transfers.

What is Booking Date in Financial Transactions?

Booking Date in financial transactions refers to the specific date when a transaction is officially recorded in the accounting system or bank ledger, reflecting the moment the financial entry is booked. It differs from the Value Date, which indicates the date when the funds are actually available for use or settlement occurs. Accurate identification of the Booking Date is crucial for compliance, audit trails, and financial reporting within remittance operations.

Key Differences Between Value Date and Booking Date

Value date refers to the actual date on which funds are available for use or interest calculation in a remittance transaction, while booking date is the date the transaction is recorded by the financial institution. The value date impacts currency conversion rates and interest accrual, whereas the booking date primarily affects transaction processing and record-keeping. Understanding these differences is crucial for accurate financial planning and compliance in international transfers.

Importance of Value Date for Remittance Recipients

The value date determines the exact day funds are credited and available to the remittance recipient, affecting financial planning and cash flow management. Unlike the booking date, which records when the transaction is initiated, the value date reflects the settlement date essential for accurate account balance updates. Ensuring a precise value date minimizes delays and helps recipients avoid potential liquidity issues or missed payment obligations.

How Booking Date Impacts Account Statements

Booking date determines the exact day a transaction is recorded in the account, directly impacting the balance shown in account statements. Unlike the value date, which reflects when funds are available or interest calculations begin, the booking date influences the timing of debit or credit entries visible to account holders. Accurate booking dates ensure transparency and help avoid discrepancies in statement reconciliations and financial reporting.

Common Mistakes: Value Date vs Booking Date

Common mistakes in remittance processes often arise from confusing the value date with the booking date; the value date indicates when the funds are actually available or settle, while the booking date records when the transaction was entered into the system. Misinterpreting these dates can lead to errors in cash flow forecasting and reconciliation in banking operations. Accurate differentiation between value date and booking date is crucial to avoid delays and discrepancies in international money transfers.

Impact on Exchange Rates: Value Date vs Booking Date

Value Date determines the exact day funds are exchanged and settled, directly influencing the applicable exchange rate based on real-time market fluctuations. Booking Date refers to when the transaction is recorded, often preceding the Value Date, and may reflect outdated exchange rates if market conditions shift between these dates. Exchange rate volatility between the Booking Date and Value Date can significantly impact the final amount received in remittance transactions.

Ensuring Timely Remittance with the Right Dates

Ensuring timely remittance requires accurate understanding of the value date and booking date, as the value date determines when funds are effectively available to the recipient, while the booking date marks the transaction's initiation. Misalignment between these dates can lead to delays or discrepancies in fund availability, impacting cash flow and financial planning. Optimizing remittance processes involves synchronizing booking and value dates to guarantee prompt crediting and compliance with banking and regulatory standards.

Regulatory Implications of Value and Booking Dates

Regulatory frameworks mandate precise use of value dates and booking dates to ensure accurate financial reporting and compliance in remittance transactions. The value date determines the actual date funds are credited or debited, impacting interest calculations and anti-money laundering (AML) monitoring, while the booking date marks when the transaction is recorded in the institution's ledger. Discrepancies between these dates can lead to regulatory scrutiny, potential penalties, and affect the timing of compliance checks such as transaction monitoring and reporting obligations under Know Your Customer (KYC) and AML regulations.

Best Practices for Tracking Remittance Dates

Accurately distinguishing between the value date and booking date in remittance tracking enhances financial reconciliation and cash flow management. Implement systems that log the booking date for transaction initiation and the value date for fund availability to ensure precise accounting and audit trails. Consistently updating these dates in real-time banking platforms supports compliance with regulatory standards and optimizes liquidity forecasting.

Important Terms

Settlement Date

Settlement Date refers to the day when a financial transaction is finalized and the ownership of assets or funds is officially transferred. It often differs from the Value Date, which indicates when the funds are available for use or interest calculation, and the Booking Date, when the transaction is recorded in the accounting system.

Transaction Posting

Transaction posting distinguishes between the value date, indicating when funds begin to accrue interest or affect account balances, and the booking date, which marks the actual date the transaction is recorded in the financial system. Accurate alignment of value dates and booking dates is crucial to ensure precise interest calculations, compliance reporting, and financial statement integrity.

Funds Availability

Funds availability depends on the value date, which determines when the funds are accessible for use, while the booking date indicates when the transaction is recorded in the financial institution's system. Understanding the distinction between value date and booking date is crucial for accurate cash flow management and reconciliation in banking operations.

Clearing Cycle

The clearing cycle in banking determines when transactions are finalized, influencing the distinction between value date and booking date; the value date marks when funds become available for use, while the booking date records the transaction entry. Understanding this difference is crucial for accurate financial reporting and liquidity management.

Processing Lag

Processing lag in financial transactions occurs when the booking date, the date a transaction is recorded, differs from the value date, the date funds are actually transferred or become effective. This lag can impact cash flow management, foreign exchange rates, and interest calculations, highlighting the importance of synchronizing value dates with booking dates to minimize settlement risk and ensure accurate financial reporting.

Interbank Transfer Timing

Interbank transfer timing depends heavily on the distinction between the booking date, when the transaction is recorded by the sending bank, and the value date, when the funds become available to the receiving party. Differences in time zones, banking hours, and cut-off times influence the value date, often causing a delay from the initial booking date, which impacts cash flow management and liquidity planning for businesses.

SWIFT MT Messaging

SWIFT MT messaging distinguishes the Value Date as the date when funds are made available or finalized in a transaction, whereas the Booking Date refers to the actual date the transaction is recorded in the bank's system. Accurate differentiation between Value Date and Booking Date ensures precise settlement timing and liquidity management in cross-border payments.

Reconciliation Window

The Reconciliation Window represents the time frame during which transactions are matched and verified based on their Value Date and Booking Date, ensuring accurate financial reporting and cash flow management. Discrepancies between the Value Date, which indicates the actual economic event date, and the Booking Date, reflecting when the transaction is recorded, are resolved within this window to maintain consistency in accounting records.

Payment Cut-off Time

Payment cut-off time determines the latest moment a transaction can be processed on the same business day, directly impacting the booking date, which marks when the payment is recorded by the bank. The value date, on the other hand, signifies the effective date funds become available or start accruing interest, potentially differing from the booking date due to processing delays or banking policies.

Ledger Update

Ledger updates reflect financial transactions by recording the booking date, which captures the exact day the transaction is entered into the accounting system, while the value date indicates when the transaction amount actually affects the account balance or value. Accurate distinction between value date and booking date is essential for precise cash flow management, reconciliation, and compliance with accounting standards.

Value Date vs Booking Date Infographic

moneydif.com

moneydif.com