Closed-loop remittance systems restrict transactions to a specific network, ensuring higher security and lower fraud risk by controlling both sending and receiving points. Open-loop systems allow funds to be sent and received across various networks and financial institutions worldwide, offering greater flexibility and accessibility. Choosing between these systems depends on the desired balance between security, reach, and cost efficiency in international money transfers.

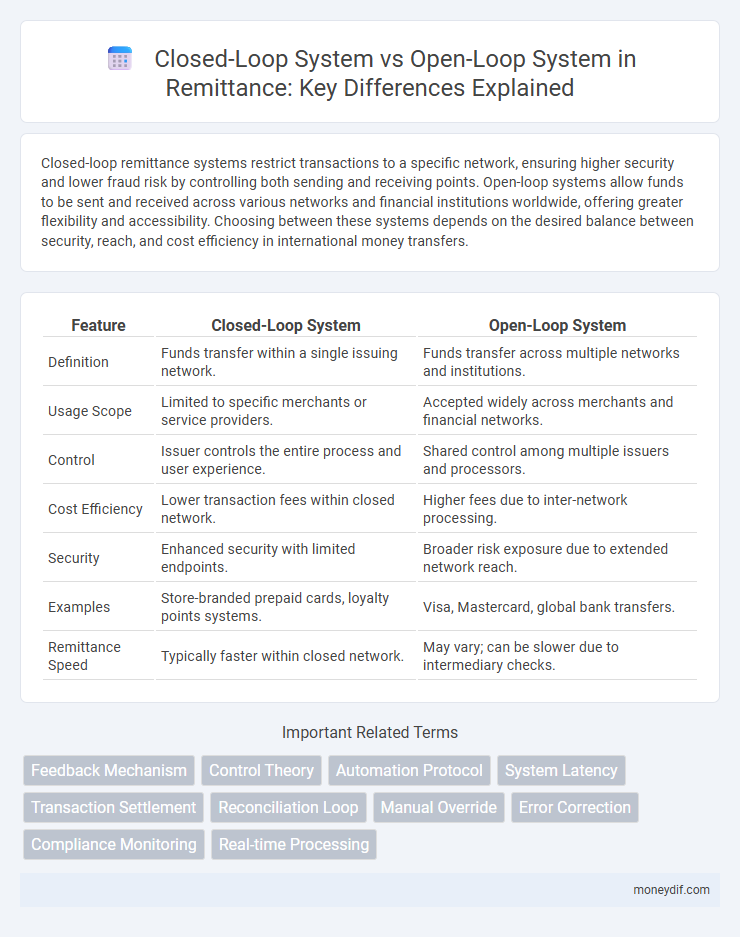

Table of Comparison

| Feature | Closed-Loop System | Open-Loop System |

|---|---|---|

| Definition | Funds transfer within a single issuing network. | Funds transfer across multiple networks and institutions. |

| Usage Scope | Limited to specific merchants or service providers. | Accepted widely across merchants and financial networks. |

| Control | Issuer controls the entire process and user experience. | Shared control among multiple issuers and processors. |

| Cost Efficiency | Lower transaction fees within closed network. | Higher fees due to inter-network processing. |

| Security | Enhanced security with limited endpoints. | Broader risk exposure due to extended network reach. |

| Examples | Store-branded prepaid cards, loyalty points systems. | Visa, Mastercard, global bank transfers. |

| Remittance Speed | Typically faster within closed network. | May vary; can be slower due to intermediary checks. |

Overview of Closed-Loop and Open-Loop Remittance Systems

Closed-loop remittance systems operate within a restricted network where funds can only be sent and received between registered users, enhancing control and reducing fraud risks. Open-loop systems allow transfers across multiple financial institutions and networks, providing broader accessibility and flexibility for cross-border payments. Both systems impact transaction speed, cost, and user convenience differently, with closed-loop focusing on security and open-loop emphasizing wide reach.

Key Differences Between Closed-Loop and Open-Loop Remittance

Closed-loop remittance systems operate within a restricted network, allowing funds to be sent and received only among registered users or predefined locations, which enhances security and reduces transaction costs. Open-loop systems enable transfers between any sender and receiver across different financial institutions and networks, offering greater interoperability and flexibility. The key differences lie in accessibility, network scope, and regulatory compliance, with closed-loop systems favoring control and efficiency, while open-loop systems prioritize broad reach and user convenience.

Benefits of Closed-Loop Remittance Systems

Closed-loop remittance systems enhance transaction security by restricting transfers within a predefined network of users and partners, reducing the risk of fraud and errors. These systems enable faster settlement times and lower operational costs due to streamlined processes and fewer intermediaries. Furthermore, closed-loop systems improve customer experience through tailored services and greater control over fund flow within connected financial ecosystems.

Advantages of Open-Loop Remittance Solutions

Open-loop remittance systems offer extensive flexibility by allowing users to send and receive funds across multiple financial networks without restrictions to specific merchants or services. These systems enhance global accessibility and convenience, supporting interoperability with a wide range of payment methods, including bank accounts, mobile wallets, and prepaid cards. Open-loop solutions significantly reduce transaction friction and broaden user choice, making them ideal for cross-border money transfers.

Security Considerations: Closed vs Open-Loop Systems

Closed-loop remittance systems enhance security by restricting transactions within a controlled network, minimizing fraud and unauthorized access risks. Open-loop systems, while offering broader acceptance and convenience, face increased vulnerabilities due to multiple intermediaries and regulatory complexities. Employing tokenization, encryption, and real-time monitoring strengthens security across both systems but remains more straightforward in closed-loop environments.

Costs and Fees in Closed and Open-Loop Remittance

Closed-loop remittance systems typically incur lower transaction costs due to direct control over the payment network, reducing intermediary fees and enabling more competitive rates for users. In contrast, open-loop systems involve multiple third-party partners and banking networks, leading to higher fees and longer processing times because of added layers in the payment chain. Cost efficiency in closed-loop systems benefits frequent remitters and businesses seeking predictable expenses, while open-loop systems offer broader accessibility at the expense of increased service charges.

User Experience and Accessibility in Both Systems

Closed-loop remittance systems offer enhanced user experience through faster transaction times and reduced fees by limiting transactions within a specific network or region. Open-loop systems provide greater accessibility by enabling users to send and receive funds across multiple networks, countries, and financial institutions, supporting a wider range of currencies and payment methods. Both systems impact user convenience differently, with closed-loop prioritizing efficiency within a controlled environment and open-loop enhancing global reach and interoperability.

Regulatory and Compliance Challenges

Closed-loop remittance systems operate within a limited network, enabling easier regulatory compliance by maintaining tighter control over transactions and customer verification. Open-loop systems, by processing payments across multiple financial institutions and jurisdictions, face increased regulatory scrutiny and complexity to comply with anti-money laundering (AML) and know-your-customer (KYC) requirements. Navigating cross-border compliance challenges requires robust monitoring frameworks and alignment with evolving international regulations in open-loop networks.

Use Cases: When to Choose Closed or Open-Loop Remittance

Closed-loop remittance systems are best suited for use cases where funds are transferred within a specific network, such as remittances between company accounts or family members using the same digital wallet platform, ensuring faster processing and lower fees. Open-loop remittance systems support cross-network transfers, ideal for international money transfers to recipients without common wallet access, offering wider reach and flexibility. Businesses and individuals should choose closed-loop systems for restricted ecosystems with frequent transactions, while open-loop systems are preferable for broad access and interoperability across different financial institutions and regions.

Future Trends in Remittance System Architecture

Future trends in remittance system architecture emphasize the integration of closed-loop systems for enhanced security and reduced fraud, leveraging blockchain technology to ensure transaction transparency and immutability. Open-loop systems continue to evolve by incorporating API-driven interoperability, enabling seamless cross-border transfers through partnerships with global financial institutions and digital wallets. Emerging hybrid models combine the benefits of both systems, optimizing cost efficiency and user accessibility while supporting real-time settlement and compliance with evolving regulatory standards.

Important Terms

Feedback Mechanism

A feedback mechanism in a closed-loop system continuously monitors output signals to adjust inputs, enhancing accuracy and system stability, whereas an open-loop system operates without such feedback, often leading to less precise control. Closed-loop systems rely on sensors and controllers to automatically correct deviations, making them ideal for applications requiring consistent performance and adaptability.

Control Theory

Control theory focuses on the behavior of dynamical systems with feedback, where closed-loop systems use feedback to automatically adjust and maintain desired output, enhancing stability and accuracy. In contrast, open-loop systems operate without feedback, relying solely on predetermined inputs, which can lead to less precise control and increased sensitivity to disturbances.

Automation Protocol

Automation protocols in closed-loop systems utilize feedback to continuously adjust processes, enhancing precision and reducing errors compared to open-loop systems that operate without feedback control, often leading to less accuracy and higher variability. Closed-loop automation protocols, such as PID control, optimize system performance by dynamically responding to sensor data, whereas open-loop protocols rely solely on predefined instructions without real-time adjustments.

System Latency

System latency in closed-loop systems critically impacts feedback response time, often causing delays that can degrade control accuracy and stability. Open-loop systems exhibit fixed latency unaffected by feedback processing, resulting in generally faster but less adaptive control performance.

Transaction Settlement

Transaction settlement in a closed-loop system occurs within a single network where the issuer and acquirer are the same entity, enabling faster processing and lower fees. Open-loop systems involve multiple financial institutions and networks, requiring more complex settlement procedures that enhance interoperability but may increase transaction times and costs.

Reconciliation Loop

The Reconciliation Loop in a closed-loop system continuously monitors and adjusts outputs based on real-time feedback to minimize errors, enhancing accuracy and system stability compared to an open-loop system, which operates without feedback and cannot self-correct. This feedback-driven process in closed-loop systems optimizes performance in applications like control systems, robotics, and manufacturing automation, where precision and adaptability are critical.

Manual Override

Manual override in a closed-loop system allows direct human intervention to alter system behavior by bypassing automatic feedback control, enhancing safety and flexibility. In contrast, open-loop systems lack feedback mechanisms, making manual override essential for correcting errors as the system cannot self-adjust.

Error Correction

Error correction in closed-loop systems involves continuous feedback that adjusts system outputs to minimize deviations from the desired setpoint, enhancing accuracy and stability. In contrast, open-loop systems lack feedback mechanisms, making them unable to automatically correct errors caused by disturbances or system variations, leading to reduced precision and reliability.

Compliance Monitoring

Compliance monitoring in a closed-loop system continuously collects and analyzes real-time data to automatically adjust processes, ensuring adherence to regulatory standards. In contrast, an open-loop system monitors compliance passively without feedback mechanisms, often requiring manual intervention to correct deviations.

Real-time Processing

Real-time processing in closed-loop systems involves continuous monitoring and instantaneous feedback to adjust system performance based on sensor data, enhancing control accuracy and responsiveness. In contrast, open-loop systems rely on pre-set instructions without feedback, making them less adaptive to dynamic changes and typically less precise in real-time applications.

closed-loop system vs open-loop system Infographic

moneydif.com

moneydif.com