Amortization involves gradually paying off a loan through regular, fixed payments that cover both principal and interest, resulting in full repayment by the end of the term. Balloon payment loans require smaller periodic payments with a large lump sum due at the loan's maturity, often used to reduce monthly costs initially. Understanding the difference between amortization schedules and balloon payment structures is crucial for managing cash flow and long-term financial planning.

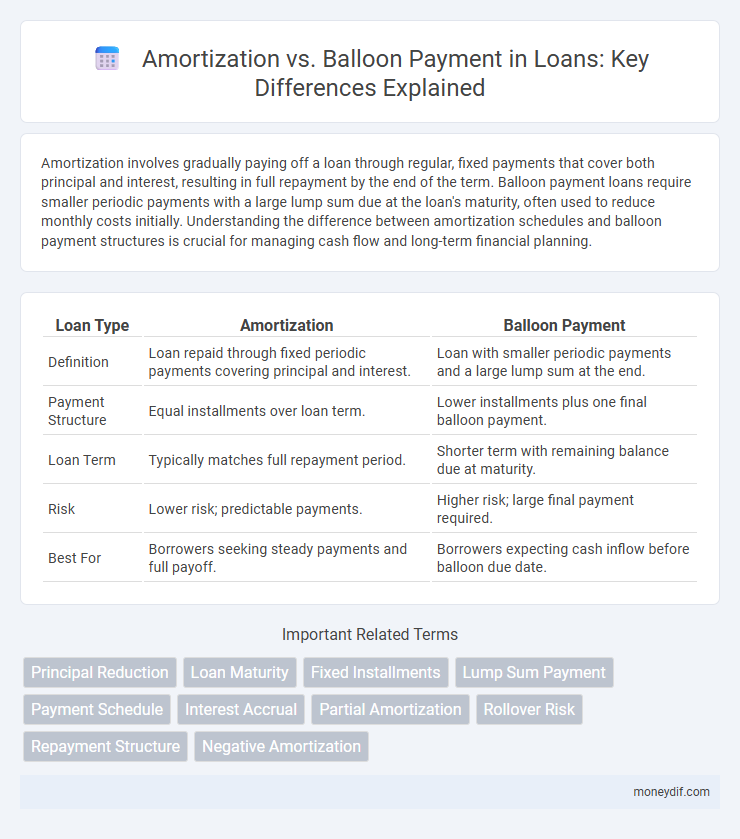

Table of Comparison

| Loan Type | Amortization | Balloon Payment |

|---|---|---|

| Definition | Loan repaid through fixed periodic payments covering principal and interest. | Loan with smaller periodic payments and a large lump sum at the end. |

| Payment Structure | Equal installments over loan term. | Lower installments plus one final balloon payment. |

| Loan Term | Typically matches full repayment period. | Shorter term with remaining balance due at maturity. |

| Risk | Lower risk; predictable payments. | Higher risk; large final payment required. |

| Best For | Borrowers seeking steady payments and full payoff. | Borrowers expecting cash inflow before balloon due date. |

Understanding Amortization in Loans

Amortization in loans refers to the process of gradually paying off a debt through regular, fixed payments that cover both principal and interest over a specified term. Each payment reduces the loan balance, ensuring the loan is fully repaid by the end of the amortization schedule. Understanding amortization helps borrowers plan their finances by providing predictable monthly payments and clear timelines for loan payoff.

What Is a Balloon Payment?

A balloon payment is a large, lump-sum payment due at the end of a loan term after a series of smaller regular payments, often used in loans with amortization schedules that do not fully pay off the principal. Unlike fully amortized loans, balloon loans have lower monthly payments but require the borrower to pay off the remaining balance in one substantial final payment. Balloon payments are common in mortgage loans and commercial financing where borrowers anticipate refinancing or selling the asset before the balloon payment comes due.

Key Differences: Amortization vs Balloon Payment

Amortization involves spreading loan payments evenly over the loan term, combining principal and interest into consistent monthly installments, ensuring full repayment by the end of the term. Balloon payment loans feature lower monthly payments during the term, followed by a large lump-sum payment of the remaining balance at maturity. The key difference lies in payment structure: amortized loans provide steady, predictable payments, while balloon loans require significant end-term payment, impacting borrower cash flow and refinancing needs.

Pros and Cons of Amortized Loans

Amortized loans feature consistent monthly payments that cover both principal and interest, ensuring the loan is fully paid off by the end of the term, which aids in budgeting and reduces long-term interest costs. The main drawback is higher monthly payments compared to balloon loans, requiring more immediate financial commitment. Borrowers benefit from gaining equity steadily, but may face challenges if cash flow fluctuates.

Advantages and Risks of Balloon Payment Loans

Balloon payment loans offer lower monthly payments during the loan term, improving short-term cash flow management for borrowers. However, the lump-sum payment due at the end carries significant repayment risk, potentially leading to refinancing challenges or default if funds are insufficient. This loan structure benefits those expecting increased future income or asset sales but requires careful financial planning to mitigate the balloon payment burden.

Ideal Borrowers for Amortized Loans

Ideal borrowers for amortized loans are individuals or businesses seeking predictable monthly payments that gradually reduce the principal balance over the loan term, such as homeowners financing a primary residence or small business owners investing in equipment. These borrowers prioritize long-term financial stability and prefer the convenience of consistent payment schedules without a large lump sum due at the end. Amortized loans suit those with steady income streams who aim to build equity and avoid refinancing risks associated with balloon payments.

When Is a Balloon Payment Loan Suitable?

A balloon payment loan is suitable for borrowers who anticipate higher income or refinancing opportunities before the large payment is due, often used in real estate or business financing. It allows lower monthly payments compared to fully amortizing loans, making it ideal for short-term financing or when cash flow management is critical. Borrowers should have a clear repayment strategy to avoid default risk associated with the lump-sum balloon payment at the loan term's end.

Impact on Monthly Payments: Amortization vs Balloon

Amortization spreads loan principal and interest evenly across monthly payments, resulting in consistent and predictable payment amounts. Balloon payments require smaller monthly payments during the loan term but demand a large lump-sum payment at the end, increasing financial risk. Borrowers choosing amortization favor steady cash flow management, while balloon payment loans offer lower initial payments at the expense of future repayment pressure.

Long-Term Costs and Financial Planning

Amortization spreads loan payments evenly over the loan term, reducing long-term costs through predictable, gradual principal and interest reduction, which simplifies financial planning. Balloon payments, however, require a large lump sum at the end of the term, potentially increasing overall expenses due to accrued interest and necessitating careful future cash flow management. Borrowers should assess their long-term financial stability and risk tolerance to choose between consistent amortized payments or the higher short-term burden of a balloon payment.

Choosing the Right Loan Structure for You

Amortization loans provide consistent monthly payments that cover both principal and interest, allowing borrowers to fully repay the loan by the end of the term. Balloon payments require smaller periodic payments with a large lump sum due at the loan's maturity, often appealing to those expecting increased cash flow or refinancing options. Selecting the right loan structure depends on your financial stability, repayment capacity, and future income projections.

Important Terms

Principal Reduction

Principal reduction decreases loan balance faster through amortization by spreading payments evenly, whereas balloon payments require a large lump sum at loan end to reduce principal.

Loan Maturity

Loan maturity defines the final due date for full repayment, determined by amortization schedules spreading principal and interest evenly, unlike balloon payments that require a large lump sum at maturity.

Fixed Installments

Fixed installments provide consistent monthly payments by evenly amortizing the loan principal and interest, unlike balloon payments that require a large lump sum at the end of the term.

Lump Sum Payment

Lump sum payments reduce the principal balance more quickly in amortization schedules but differ from balloon payments, which defer a large payment until the end of the loan term.

Payment Schedule

The payment schedule for amortization involves equal periodic payments reducing principal and interest over time, whereas a balloon payment schedule requires smaller installments with a large lump-sum payment at the end.

Interest Accrual

Interest accrual impacts amortization by gradually spreading interest costs over loan payments, whereas balloon payments require a large lump sum interest payment at the end of the loan term.

Partial Amortization

Partial amortization combines regular amortization payments with a final balloon payment, reducing monthly installments but requiring a large lump sum payment at loan maturity.

Rollover Risk

Rollover risk increases with balloon payments due to large lump-sum refinancing needs, while amortization reduces this risk by spreading principal repayments over time.

Repayment Structure

Amortization ensures full loan repayment through fixed periodic payments, while a balloon payment involves smaller regular installments followed by a large lump sum at the end.

Negative Amortization

Negative amortization occurs when loan payments are insufficient to cover interest, causing the loan balance to increase, unlike standard amortization that reduces principal over time or a balloon payment that requires a large lump-sum at the end.

Amortization vs Balloon Payment Infographic

moneydif.com

moneydif.com