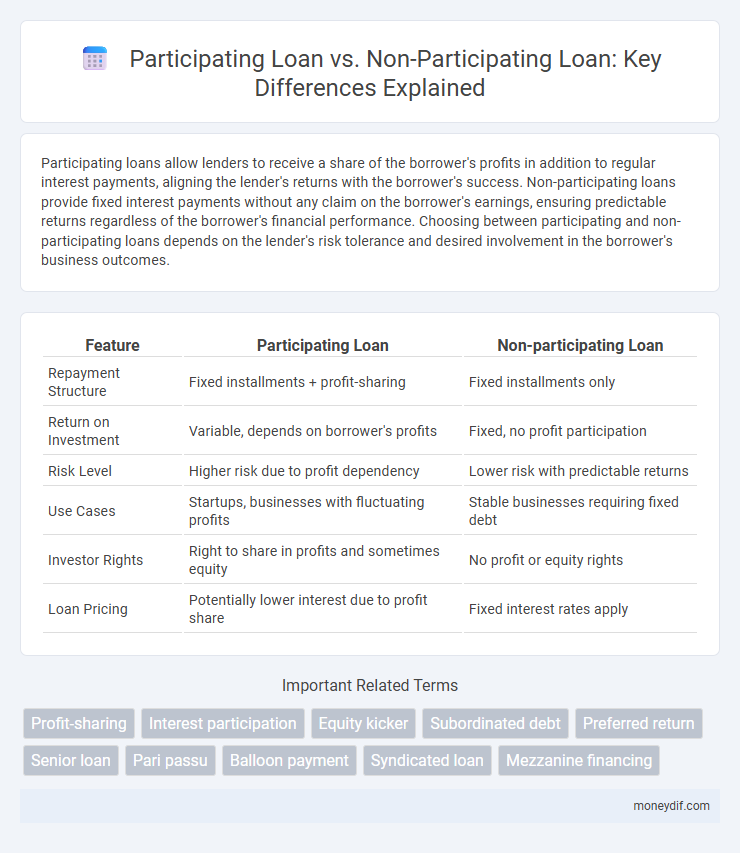

Participating loans allow lenders to receive a share of the borrower's profits in addition to regular interest payments, aligning the lender's returns with the borrower's success. Non-participating loans provide fixed interest payments without any claim on the borrower's earnings, ensuring predictable returns regardless of the borrower's financial performance. Choosing between participating and non-participating loans depends on the lender's risk tolerance and desired involvement in the borrower's business outcomes.

Table of Comparison

| Feature | Participating Loan | Non-participating Loan |

|---|---|---|

| Repayment Structure | Fixed installments + profit-sharing | Fixed installments only |

| Return on Investment | Variable, depends on borrower's profits | Fixed, no profit participation |

| Risk Level | Higher risk due to profit dependency | Lower risk with predictable returns |

| Use Cases | Startups, businesses with fluctuating profits | Stable businesses requiring fixed debt |

| Investor Rights | Right to share in profits and sometimes equity | No profit or equity rights |

| Loan Pricing | Potentially lower interest due to profit share | Fixed interest rates apply |

Introduction to Participating vs Non-participating Loans

Participating loans allow lenders to receive interest payments plus a share of the borrower's profits or equity appreciation, providing potential upside beyond fixed interest returns. Non-participating loans offer only predetermined interest payments without any claim to the borrower's future earnings or asset value increases. Understanding the distinction between these loan types is crucial for both lenders and borrowers to align risk, return, and control expectations in financing arrangements.

Definition of Participating Loans

Participating loans are a type of financing where the lender receives interest payments along with a share of the borrower's profits or equity appreciation. These loans offer lenders potential upside beyond fixed interest, linking repayment to the borrower's financial success. Participating loans are commonly used in real estate and business financing to align incentives between borrowers and lenders.

Definition of Non-participating Loans

Non-participating loans refer to debt agreements where the lender receives fixed interest payments without any share in the borrower's profits or equity gains. These loans prioritize regular interest income and principal repayment, with no additional returns linked to the borrower's business performance. Typically favored in traditional lending scenarios, non-participating loans provide predictable cash flow without exposure to company profit fluctuations.

Key Differences Between Participating and Non-participating Loans

Participating loans allow lenders to receive a portion of the borrower's profits or equity appreciation in addition to fixed interest payments, while non-participating loans provide only predetermined interest without profit sharing. The risk profile differs significantly; participating loans expose lenders to variable returns tied to the borrower's financial success, whereas non-participating loans offer predictable income regardless of business outcomes. Equity participation and profit-sharing clauses define participating loans, making them common in venture capital financing, unlike non-participating loans favored for traditional debt financing with fixed repayment schedules.

How Participating Loans Work

Participating loans allow lenders to receive a fixed interest rate plus a share of the borrower's profits, aligning lender returns with the borrower's financial success. These loans typically involve an initial principal repayment structure combined with performance-based returns, making them attractive in equity-like financing. The participation feature incentivizes lenders by providing upside potential beyond standard interest payments.

How Non-participating Loans Function

Non-participating loans function by providing borrowers with a fixed repayment schedule that does not fluctuate based on the borrower's profits or business performance. Lenders receive only the agreed-upon interest and principal payments, without having any claim to future earnings or equity in the borrower's enterprise. This structure limits the lender's risk exposure but also removes potential upside benefits tied to the borrower's financial success.

Benefits of Participating Loans

Participating loans offer borrowers the benefit of sharing in the lender's profits or equity appreciation, which can lead to lower interest rates or reduced repayment amounts compared to non-participating loans. These loans provide flexible repayment options tied to the financial performance of the borrower, aligning lender and borrower interests. Participating loans are especially advantageous for businesses seeking growth capital, as they reduce fixed financial burdens during periods of fluctuating income.

Advantages of Non-participating Loans

Non-participating loans offer borrowers fixed interest rates and predictable repayment schedules, reducing financial uncertainty and simplifying budgeting. These loans typically feature lower interest costs compared to participating loans, as lenders do not share profits or gains from the underlying asset. Non-participating loans also provide clear terms without revenue-sharing complexities, enhancing transparency and ease of administration for both borrowers and lenders.

Risks and Considerations for Each Loan Type

Participating loans expose lenders to higher risk due to profit-sharing arrangements, which can fluctuate with the borrower's financial performance, potentially yielding variable returns. Non-participating loans offer fixed repayments, reducing income variability but increasing credit risk if the borrower defaults, as lenders cannot benefit from additional profits. Careful evaluation of the borrower's financial stability and market conditions is essential to mitigate risks associated with both loan types.

Choosing the Right Loan: Participating or Non-participating

Choosing the right loan depends on your long-term financial goals and risk tolerance. Participating loans offer a share in the borrower's profits, aligning lender returns with business success, while non-participating loans provide fixed returns regardless of performance. Evaluating cash flow stability and growth potential helps determine whether a flexible profit-linked loan or a predictable fixed-payment structure suits your investment strategy.

Important Terms

Profit-sharing

Profit-sharing in participating loans allows lenders to receive a portion of the borrower's profits in addition to interest, whereas non-participating loans provide lenders only fixed interest payments without profit participation.

Interest participation

Participating loans offer interest participation based on borrower profits or performance, while non-participating loans provide fixed interest payments regardless of financial outcomes.

Equity kicker

An equity kicker enhances returns in participating loans by granting lenders a share of equity upside, unlike non-participating loans where lenders receive fixed interest without equity participation.

Subordinated debt

Subordinated debt in participating loans offers investors potential profit-sharing beyond fixed interest, unlike non-participating loans that provide only predetermined interest without equity participation.

Preferred return

Preferred return ensures investors receive a fixed return before lenders in participating loans share profits, whereas non-participating loans offer only fixed interest without profit participation.

Senior loan

A senior participating loan offers lenders the right to share in the borrower's profits beyond fixed interest payments, unlike a non-participating loan which provides only guaranteed principal and interest without profit participation.

Pari passu

Pari passu ensures equal ranking of Participating Loans and Non-participating Loans in repayment priority, with Participating Loans entitling lenders to additional profits beyond principal repayment unlike Non-participating Loans.

Balloon payment

Balloon payments in participating loans allow lenders to share borrowers' equity gains before the final lump sum is due, unlike non-participating loans where the balloon payment is fixed and unrelated to property performance.

Syndicated loan

A syndicated loan involves multiple lenders sharing risk and funds, where participating loans allow lenders to share in the borrower's profits or equity upside, while non-participating loans limit lenders to fixed interest payments without profit participation.

Mezzanine financing

Mezzanine financing typically involves participating loans that allow lenders to share in a company's upside through equity participation, unlike non-participating loans which provide fixed returns without equity involvement.

Participating Loan vs Non-participating Loan Infographic

moneydif.com

moneydif.com