Bullet repayment involves paying the entire principal amount in a single lump sum at the end of the loan term, minimizing periodic payments but requiring a large final payout. Step-up repayment starts with lower monthly installments that gradually increase over time, aligning payments with anticipated income growth. Both methods impact cash flow management and interest costs differently, making the choice dependent on the borrower's financial strategy and income stability.

Table of Comparison

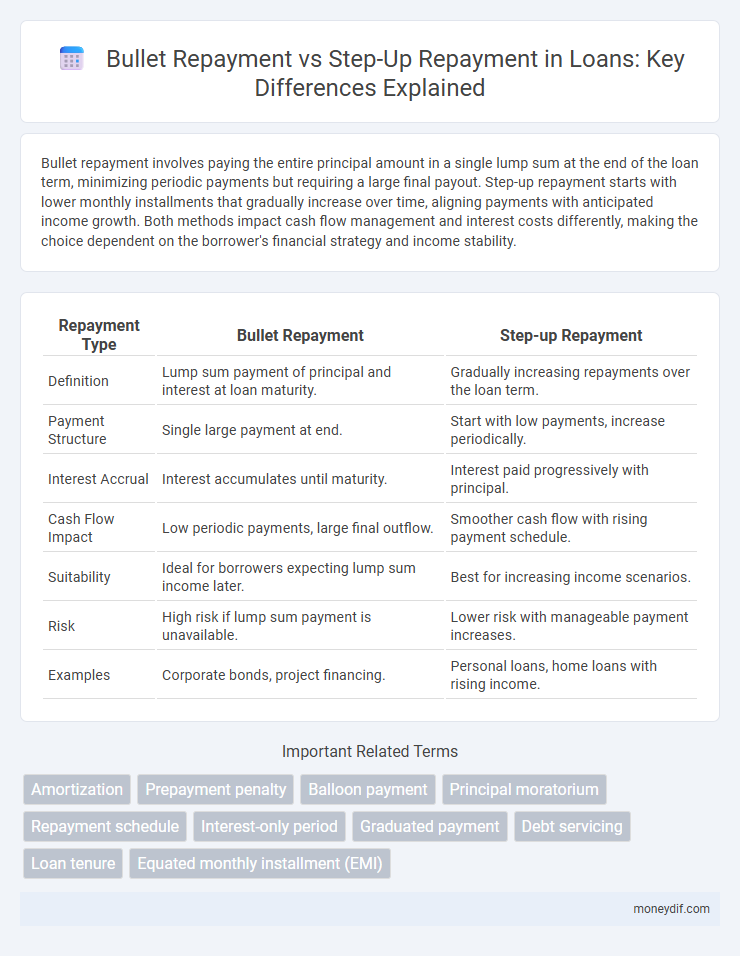

| Repayment Type | Bullet Repayment | Step-up Repayment |

|---|---|---|

| Definition | Lump sum payment of principal and interest at loan maturity. | Gradually increasing repayments over the loan term. |

| Payment Structure | Single large payment at end. | Start with low payments, increase periodically. |

| Interest Accrual | Interest accumulates until maturity. | Interest paid progressively with principal. |

| Cash Flow Impact | Low periodic payments, large final outflow. | Smoother cash flow with rising payment schedule. |

| Suitability | Ideal for borrowers expecting lump sum income later. | Best for increasing income scenarios. |

| Risk | High risk if lump sum payment is unavailable. | Lower risk with manageable payment increases. |

| Examples | Corporate bonds, project financing. | Personal loans, home loans with rising income. |

Understanding Bullet Repayment

Bullet repayment involves paying the entire loan principal in one lump sum at the end of the loan term, while interest is usually paid periodically during the tenure. This method is beneficial for borrowers expecting a large cash inflow at maturity, such as from investments or asset sales. Understanding bullet repayment is crucial for managing cash flow effectively and avoiding default risks associated with large end-term payments.

What Is Step-Up Repayment?

Step-up repayment is a loan repayment method where the borrower makes smaller initial payments that gradually increase over time, matching expected growth in income. This structure helps manage cash flow by starting with lower monthly installments, which rise at predetermined intervals until the loan is fully repaid. Compared to bullet repayment, which requires a large lump sum at the end, step-up repayment spreads out the financial burden more evenly while accommodating future earning capacity.

Key Differences Between Bullet and Step-Up Repayment

Bullet repayment requires paying the entire principal amount at the end of the loan term, while interest is usually paid periodically. Step-up repayment involves gradually increasing the repayment amounts over time, starting lower and rising according to a predetermined schedule. Bullet loans benefit borrowers seeking low initial payments, whereas step-up loans suit those expecting rising income to cover higher future payments.

Pros and Cons of Bullet Repayment

Bullet repayment offers the advantage of paying interest only during the loan tenure with a single lump sum principal payment at maturity, reducing initial cash flow burdens. This method suits borrowers expecting higher future income or lump sum inflows but carries the risk of a large final payment that may strain finances if not properly planned. The main drawback lies in the potential accumulation of interest costs over time, making the total repayment amount higher than regular amortization loans.

Advantages and Disadvantages of Step-Up Repayment

Step-up repayment loans offer the advantage of initially lower EMIs, easing financial strain in the early stages, which benefits borrowers with rising income trajectories. The structured increase in repayments helps in gradually adjusting cash flow without compromising loan tenure, reducing the risk of default during initial periods. However, higher future EMIs can become challenging if income growth does not meet expectations, potentially leading to financial stress and the need for refinancing.

Suitable Scenarios for Bullet Repayment Loans

Bullet repayment loans are ideal for borrowers expecting a large cash inflow at a specific future date, such as from a business sale or maturity of an investment. This structure suits startups and project financing where initial cash flow is limited but profitability or revenue generation is anticipated later. It enables borrowers to minimize periodic payments and manage short-term liquidity effectively while preparing for a lump-sum payment at loan maturity.

When to Choose Step-Up Repayment Plans

Step-up repayment plans are ideal for borrowers expecting their income to increase steadily over time, such as young professionals or those in fast-growing careers. This method starts with lower initial payments and gradually increases, aligning with future financial capacity while reducing early financial strain. Choosing step-up plans helps manage cash flow effectively during the early loan tenure while ensuring faster amortization as earnings grow.

Impact on Total Interest Paid

Bullet repayment loans require a lump sum payment of principal at maturity, resulting in higher total interest paid over the loan term due to interest accruing on the full principal amount. Step-up repayment structures feature increasing installment amounts, gradually reducing the principal and thereby decreasing total interest paid compared to bullet repayment. Borrowers choosing step-up repayments benefit from lower interest costs as the outstanding loan balance decreases progressively throughout the repayment period.

Comparison of Repayment Flexibility

Bullet repayment offers simplicity with a single lump-sum payment at loan maturity, reducing monthly financial pressure but requiring substantial funds at the end. Step-up repayment provides increased cash flow flexibility by allowing smaller initial payments that gradually rise, aligning with expected income growth over time. Comparing these, bullet repayment suits borrowers with irregular income but strong future cash availability, while step-up repayment benefits those anticipating steady income increases who prefer manageable early payments.

Choosing the Right Repayment Method for Your Needs

Bullet repayment involves repaying the entire principal at the end of the loan term, making it suitable for borrowers expecting lump-sum income or refinancing options. Step-up repayment structures start with lower payments that gradually increase, aligning with anticipated income growth over time. Selecting the right repayment method depends on cash flow stability, future income projections, and financial goals to ensure manageable debt servicing and minimize default risk.

Important Terms

Amortization

Amortization schedules determine how loan principal and interest are repaid over time, significantly impacting cash flow under Bullet repayment, where the principal is paid in full at maturity, versus Step-up repayment, which involves increasing periodic payments that gradually reduce principal and interest. Bullet repayment benefits borrowers seeking lower initial payments and deferred principal, while Step-up repayment aligns with improving cash flow and reduces total interest expense through incremental amortization.

Prepayment penalty

Prepayment penalties often apply to bullet repayment loans to compensate lenders for the risk of early full repayment, while step-up repayment structures typically reduce this risk by gradually increasing payments, potentially minimizing or eliminating penalties. Understanding the differences in prepayment terms between bullet and step-up repayment schedules is crucial for borrowers seeking flexibility and cost savings.

Balloon payment

Balloon payment involves a large final payment at loan maturity, similar to bullet repayment which also requires a lump sum at the end, whereas step-up repayment features gradually increasing installment amounts over the loan term. Balloon and bullet repayments concentrate repayment risk at maturity, while step-up repayment spreads cash flow more evenly, aiding borrowers with expected income growth.

Principal moratorium

Principal moratorium allows borrowers to defer principal repayments temporarily, impacting cash flow management during loan tenure. Bullet repayment requires a lump sum principal payment at maturity, whereas step-up repayment schedules gradually increase principal payments over time, both offering distinct strategies for handling deferred principal under moratorium.

Repayment schedule

The repayment schedule for bullet repayment involves a lump-sum payment of the principal at maturity, minimizing monthly obligations but increasing end-term risk. Step-up repayment structures gradually increase payment amounts over time, easing initial cash flow pressure and aligning repayment capacity with expected income growth.

Interest-only period

During the interest-only period, bullet repayment involves paying only the accrued interest with the principal repaid entirely at the end of the loan term, enabling lower initial payments but resulting in a large lump-sum payment. Step-up repayment alternates by starting with interest-only payments that gradually increase in amount over time, allowing for manageable payment growth and better cash flow alignment with anticipated income increases.

Graduated payment

Graduated payment plans involve increasing payment amounts over time, offering a middle ground between Bullet repayment, which requires a single lump sum at maturity, and Step-up repayment, where payments rise at predetermined intervals. This structure helps borrowers manage cash flow by starting with lower payments that escalate gradually, optimizing financial planning compared to the immediate full repayment demand of Bullet loans and the rigid schedule of Step-up repayments.

Debt servicing

Debt servicing refers to the cash required to cover the repayment of interest and principal on a debt over a given period. Bullet repayment involves a lump-sum payment of the principal at the end of the loan term, while step-up repayment consists of gradually increasing payment amounts over time to match the borrower's improving cash flow.

Loan tenure

Loan tenure significantly affects the choice between bullet repayment and step-up repayment methods, as shorter tenures often align with bullet repayments where the principal is paid at maturity, while longer tenures favor step-up repayments that gradually increase installment amounts over time. Step-up repayment structures optimize cash flow management during extended loan periods, enhancing borrower affordability and reducing default risk compared to bullet repayment schedules.

Equated monthly installment (EMI)

Equated Monthly Installment (EMI) structure varies significantly between Bullet repayment and Step-up repayment loans, with Bullet repayment requiring a lump-sum principal payment at maturity while interest may be paid periodically, resulting in lower EMI amounts initially. Step-up repayment involves gradually increasing EMI payments, aligning with projected income growth, thus easing financial burden early in the loan tenure and reducing overall interest liability compared to Bullet repayment.

Bullet repayment vs Step-up repayment Infographic

moneydif.com

moneydif.com