A swingline facility offers short-term, flexible credit within a larger revolving credit agreement, allowing borrowers to quickly access funds up to a specified limit without extensive approval processes. In contrast, an overdraft facility permits account holders to withdraw more money than their available balance, typically up to an agreed limit, to manage temporary cash flow shortfalls. While both options provide immediate liquidity, swingline facilities are often structured as formal loan components, whereas overdrafts function as extensions of bank accounts with variable interest rates.

Table of Comparison

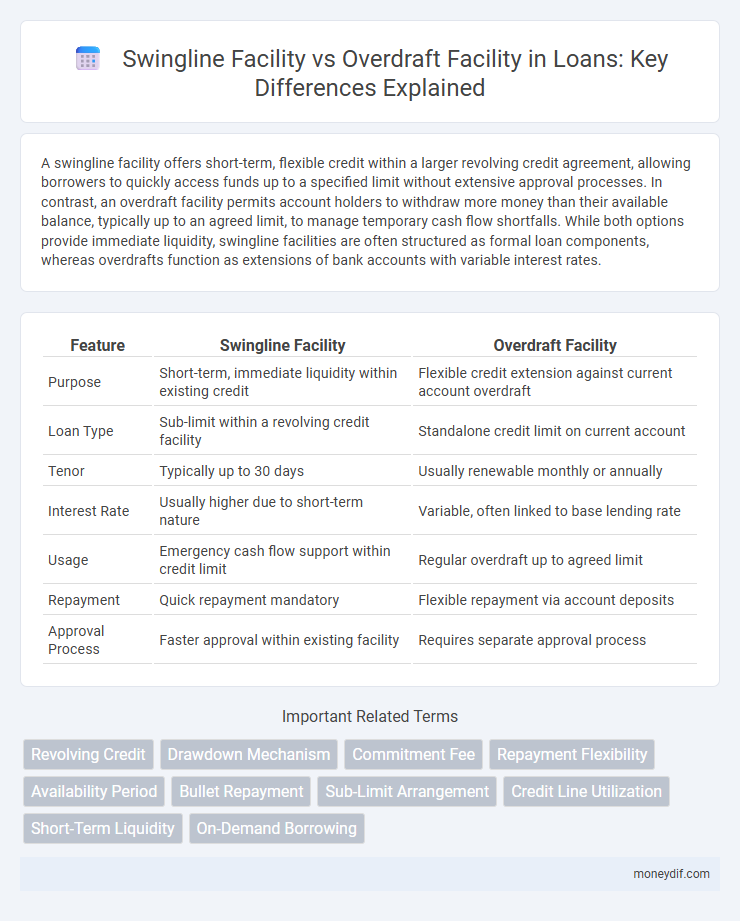

| Feature | Swingline Facility | Overdraft Facility |

|---|---|---|

| Purpose | Short-term, immediate liquidity within existing credit | Flexible credit extension against current account overdraft |

| Loan Type | Sub-limit within a revolving credit facility | Standalone credit limit on current account |

| Tenor | Typically up to 30 days | Usually renewable monthly or annually |

| Interest Rate | Usually higher due to short-term nature | Variable, often linked to base lending rate |

| Usage | Emergency cash flow support within credit limit | Regular overdraft up to agreed limit |

| Repayment | Quick repayment mandatory | Flexible repayment via account deposits |

| Approval Process | Faster approval within existing facility | Requires separate approval process |

Introduction to Swingline and Overdraft Facilities

Swingline facilities are short-term, high-speed credit lines allowing borrowers quick access to funds within a predetermined limit, typically used for bridging cash flow gaps. Overdraft facilities enable account holders to withdraw more than their available balance up to an approved limit, providing flexible liquidity management for everyday business needs. Both facilities support working capital requirements but differ in structure, usage terms, and cost implications.

Definition of Swingline Facility

A swingline facility is a short-term, revolving credit feature within a larger loan agreement, typically used for quick access to funds up to a pre-set limit. It differs from an overdraft facility, which allows borrowers to withdraw beyond their account balance up to an agreed limit, often with variable interest rates. Swingline facilities provide immediate liquidity, usually with lower fees and faster processing, making them ideal for managing short-term cash flow needs.

Definition of Overdraft Facility

An overdraft facility allows account holders to withdraw funds beyond their available balance up to an agreed limit, providing short-term liquidity and flexibility for managing cash flow gaps. Unlike a swingline facility, which is a specific type of short-term credit often used within a larger loan arrangement, overdrafts are typically linked directly to a checking account and can fluctuate daily based on the account holder's transactions. Overdraft interest is usually charged only on the amount overdrawn, making it a convenient option for businesses or individuals needing occasional access to extra funds.

Key Differences Between Swingline and Overdraft Facilities

Swingline facilities offer short-term, high-value loans typically integrated within a revolving credit facility, enabling quick access to funds with predefined drawdown limits. Overdraft facilities provide flexible credit extensions on current accounts, allowing the borrower to withdraw beyond their balance up to an approved limit, usually incurring interest only on the utilized amount. Key differences include the structured repayment terms and higher fees associated with swingline facilities versus the more flexible, usage-based costs and renewable nature of overdraft facilities.

Eligibility Criteria for Swingline vs Overdraft

Eligibility criteria for swingline facilities typically require borrowers to have an existing primary credit agreement with the lender and often a stronger credit profile due to the short-term, high-flexibility nature of the facility. In contrast, overdraft facilities may have more lenient eligibility requirements focused on the borrower's current account activity and cash flow history without necessarily demanding a formal credit arrangement. Lenders assess creditworthiness, business history, and financial stability differently for swinglines, which are structured as part of larger credit lines, whereas overdrafts are often granted based on transactional behavior and bank relationship.

Application Process Comparison

The application process for a swingline facility typically involves a detailed review of the borrower's creditworthiness and existing revolving credit agreements, requiring formal documentation and approval from the lender. In contrast, an overdraft facility often has a simpler and faster application process, with pre-approved limits based on the account holder's banking history, allowing immediate access to funds. Swingline facilities are structured within larger loan agreements, necessitating more rigorous underwriting, whereas overdraft facilities offer more flexible and accessible short-term credit solutions.

Interest Rates and Fees: Swingline vs Overdraft

Swingline facilities typically offer lower interest rates compared to overdraft facilities due to their short-term, revolving credit nature designed for quick liquidity. Overdraft facilities often involve higher fees and variable interest rates that can escalate based on usage and bank policies. Borrowers should closely evaluate the cost structures of both options to choose the most cost-effective financing solution for their cash flow needs.

Use Cases: When to Choose Swingline Over Overdraft

Swingline facilities provide short-term, high-speed access to funds ideal for bridging immediate working capital gaps during periods of fluctuating cash flows. They suit businesses requiring quick, reliable liquidity for operational needs without the irregularities or fees commonly associated with overdraft facilities. Companies facing anticipated cash shortfalls or needing to cover temporary spikes in expenses often choose swingline over overdraft to maintain financial stability and flexible borrowing limits.

Risks and Limitations of Each Facility

Swingline facilities carry risks such as higher interest rates and shorter repayment terms, which can strain cash flow if not managed properly. Overdraft facilities may lead to unpredictable fees and potential overdraft limit reductions, increasing financial uncertainty for businesses. Both facilities require careful monitoring to avoid liquidity issues and maintain creditworthiness.

Conclusion: Selecting the Right Facility for Your Needs

Choosing between a swingline facility and an overdraft facility depends on the specific cash flow requirements and borrowing frequency of a business. Swingline facilities offer short-term, high-speed access to capital ideal for bridging temporary liquidity gaps, while overdraft facilities provide flexible borrowing up to a limit for ongoing working capital needs. Evaluating transaction frequency, repayment terms, and cost structure is essential to align the facility with operational cash management strategies.

Important Terms

Revolving Credit

A revolving credit facility provides flexible borrowing up to a set limit, enabling borrowers to draw, repay, and redraw funds as needed, while a swingline facility offers short-term, rapid-access credit within a larger revolving credit agreement, typically used for urgent liquidity needs. An overdraft facility allows account holders to withdraw beyond their balance with bank approval, often incurring interest immediately, contrasting with the structured repayment terms and borrowing limits inherent in revolving credit and swingline facilities.

Drawdown Mechanism

The Drawdown Mechanism in a Swingline Facility allows borrowers to access short-term funding quickly through a dedicated sub-limit within a revolving credit agreement, enabling immediate liquidity for operational needs. In contrast, an Overdraft Facility provides flexible, on-demand borrowing against a current account up to a preset limit, often with variable interest rates and fewer formal drawdown procedures, making it suitable for interest optimization and managing daily cash flow fluctuations.

Commitment Fee

The commitment fee on a swingline facility typically compensates the lender for the reserved short-term credit availability often integrated within a larger revolving credit agreement, whereas an overdraft facility's commitment fee charges for the unused portion of the credit line that allows temporary negative balances. Swingline facilities generally feature higher commitment fees due to their immediate access and flexibility for short-term liquidity needs compared to overdraft facilities primarily used for managing daily cash flow fluctuations.

Repayment Flexibility

Repayment flexibility in a swingline facility typically allows for short-term, quick access to funds with the option to repay on demand or within a very short period, making it ideal for managing immediate liquidity needs. Overdraft facilities offer more extended repayment terms with higher credit limits, enabling businesses to withdraw funds beyond their account balance while repaying over a longer cycle, thus providing greater flexibility in managing cash flow fluctuations.

Availability Period

The Availability Period for a swingline facility typically allows short-term borrowing within a specified short duration, often up to 30 days, providing quick access to funds for urgent liquidity needs. In contrast, an overdraft facility usually offers a continuous and more flexible borrowing period tied to a current account, enabling ongoing access to funds without a fixed expiration, subject to agreed limits.

Bullet Repayment

Bullet repayment requires the entire principal to be paid at maturity, contrasting with overdraft facilities that allow revolving credit with flexible repayment. Swingline facilities provide short-term, high-limit borrowing within a revolving credit agreement, enabling quick access to funds but still necessitating full repayment by the agreed date, unlike the continuous borrowing capacity of overdrafts.

Sub-Limit Arrangement

A Sub-Limit Arrangement restricts the maximum amount available within a primary credit facility, such as a swingline facility designed for short-term, immediate liquidity needs typically with high-speed approval. In contrast, an overdraft facility offers flexible, revolving credit linked to a current account, allowing borrowers to withdraw funds up to a set limit without needing prior approval for each transaction.

Credit Line Utilization

Credit line utilization measures the proportion of available credit drawn from facilities like swingline and overdraft, with swingline facilities typically offering short-term, high-speed access compared to overdraft facilities that provide flexible, revolving credit tied directly to a bank account. Effective management of swingline facility utilization ensures liquidity for immediate operational needs, while overdraft facility utilization impacts ongoing cash flow and credit costs due to varying interest rates and fee structures.

Short-Term Liquidity

Short-term liquidity management often involves utilizing a swingline facility, which provides rapid, short-duration credit typically up to 30 days, designed for immediate cash flow needs and operating expenses. In contrast, an overdraft facility offers a flexible, revolving credit line attached to a bank account, allowing persistent short-term borrowing with ongoing access subject to pre-agreed limits and fees.

On-Demand Borrowing

On-demand borrowing through a swingline facility provides borrowers with immediate, short-term liquidity under an existing credit agreement, typically featuring lower collateral requirements and faster access compared to an overdraft facility. Overdraft facilities allow account holders to exceed their credit balance up to a preset limit, often with higher interest rates and fewer structured terms than swingline borrowings, making swingline preferable for urgent, substantial funding within syndicated loans.

swingline facility vs overdraft facility Infographic

moneydif.com

moneydif.com