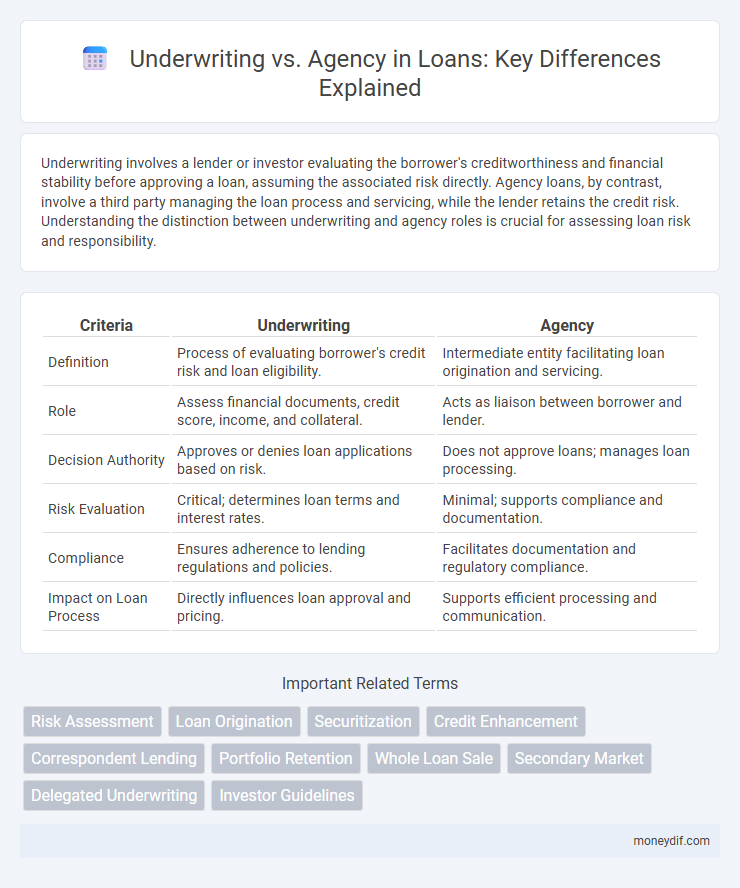

Underwriting involves a lender or investor evaluating the borrower's creditworthiness and financial stability before approving a loan, assuming the associated risk directly. Agency loans, by contrast, involve a third party managing the loan process and servicing, while the lender retains the credit risk. Understanding the distinction between underwriting and agency roles is crucial for assessing loan risk and responsibility.

Table of Comparison

| Criteria | Underwriting | Agency |

|---|---|---|

| Definition | Process of evaluating borrower's credit risk and loan eligibility. | Intermediate entity facilitating loan origination and servicing. |

| Role | Assess financial documents, credit score, income, and collateral. | Acts as liaison between borrower and lender. |

| Decision Authority | Approves or denies loan applications based on risk. | Does not approve loans; manages loan processing. |

| Risk Evaluation | Critical; determines loan terms and interest rates. | Minimal; supports compliance and documentation. |

| Compliance | Ensures adherence to lending regulations and policies. | Facilitates documentation and regulatory compliance. |

| Impact on Loan Process | Directly influences loan approval and pricing. | Supports efficient processing and communication. |

Understanding Loan Underwriting

Loan underwriting assesses a borrower's creditworthiness by analyzing financial documents, income, and debt-to-income ratios to determine the risk level. Agency underwriting follows specific guidelines set by entities like Fannie Mae or Freddie Mac, ensuring loans meet standardized criteria for purchase or guarantee. Understanding these distinctions is crucial for evaluating loan approval processes and risk management in mortgage lending.

What is Agency Lending?

Agency lending involves a lender providing loans that are subsequently sold to investors through a third-party agency, such as Fannie Mae or Freddie Mac. This process allows lenders to transfer risk while maintaining liquidity by adhering to standardized underwriting guidelines set by these agencies. Agency lending enhances market stability by promoting transparency and consistent credit quality across loan portfolios.

Key Differences: Underwriting vs Agency

Underwriting involves the lender assuming full credit risk and liability for the loan, whereas agency servicing merely manages loan administration without taking on credit risk. Underwritten loans typically allow lenders to retain the loan in their portfolio or sell it to investors with recourse, while agency loans follow standardized guidelines set by government-sponsored enterprises like Fannie Mae or Freddie Mac. The key difference lies in risk exposure--underwriting shifts risk to the lender, while agency servicing shifts risk to investors.

Risk Assessment in Underwriting and Agency

Risk assessment in loan underwriting involves a detailed evaluation of a borrower's creditworthiness, financial history, and repayment capacity to minimize default risk. Loan agencies typically assess risk by applying standardized criteria and relying on automated systems to ensure consistency and efficiency. Underwriting provides a more customized risk profile, while agencies streamline decision-making to manage loan portfolios at scale.

Loan Approval Processes Compared

Underwriting in loan approval involves a detailed evaluation of a borrower's creditworthiness, income, debt-to-income ratio, and collateral, enabling lenders to assess risk thoroughly. Agency loan approvals, often governed by Fannie Mae or Freddie Mac guidelines, rely on standardized criteria and automated systems to expedite decision-making. Understanding the differences in documentation requirements, risk assessment, and approval timelines between underwriting and agency processes is crucial for efficient loan processing.

Roles of Underwriters vs Agencies

Underwriters assess loan applications by evaluating credit risk, verifying borrower information, and determining loan eligibility based on financial criteria and lending guidelines. Agencies primarily act as intermediaries, facilitating communication between borrowers and lenders while ensuring compliance with regulatory standards and managing documentation processes. The underwriter's role centers on risk analysis and decision-making, whereas agencies focus on client service and administrative support within the loan process.

Benefits of Underwriting for Lenders

Underwriting enables lenders to thoroughly assess borrower risk, leading to better-informed lending decisions and reduced default rates. It provides a customized evaluation of creditworthiness, allowing tailored loan terms that align with risk profiles and enhance portfolio quality. This detailed scrutiny helps optimize risk management and improve long-term financial performance for lending institutions.

Advantages of Agency Loans for Borrowers

Agency loans offer borrowers lower interest rates and more flexible qualification requirements compared to traditional underwriting loans. These loans benefit from standardized terms and government-sponsored entity backing, which reduces risk and increases access for a wider range of credit profiles. Borrowers also gain faster approval times and streamlined documentation processes with agency loans.

Impact on Loan Terms and Interest Rates

Underwriting directly influences loan terms and interest rates by assessing borrower risk and creditworthiness, leading to tailored rate adjustments and customized repayment schedules. Agency loans often feature standardized terms and interest rates set by government or umbrella entities, typically resulting in more predictable but less flexible loan conditions. The underwriting process enables lenders to manage risks more precisely, which can result in either more favorable or stringent loan terms compared to agency-backed loans.

Choosing Between Underwriting and Agency Loans

Choosing between underwriting and agency loans depends on risk tolerance and control preferences; underwriting loans involve the lender assuming full credit risk, offering greater control over loan terms and borrower selection. Agency loans transfer credit risk to government-sponsored enterprises like Fannie Mae or Freddie Mac, providing standardized guidelines and potentially lower interest rates. Evaluating factors such as borrower creditworthiness, loan purpose, and market conditions helps determine the optimal loan type for financing needs.

Important Terms

Risk Assessment

Risk assessment in underwriting involves a detailed analysis of applicant data, historical loss trends, and predictive modeling to determine insurance eligibility and pricing accuracy. Agencies rely on underwriting risk assessments to ensure policy suitability and regulatory compliance while maintaining client trust through transparent risk evaluation processes.

Loan Origination

Loan origination involves the process of evaluating and approving borrower applications, where underwriting assesses credit risk and financial qualifications, while agency functions facilitate the loan approval and funding through third-party entities. Effective differentiation between underwriting and agency services ensures accurate risk assessment and efficient loan processing in mortgage and commercial lending sectors.

Securitization

Securitization involves pooling financial assets and issuing securities backed by these assets, where underwriting refers to the process by which underwriters assume risk by purchasing the entire pool before resale, while agency roles act as intermediaries facilitating transactions without holding risk. Underwriting in securitization ensures credit risk assessment and capital commitment upfront, whereas agency structures primarily provide structuring, distribution, and administrative services without direct exposure to asset performance.

Credit Enhancement

Credit enhancement improves the creditworthiness of financial instruments by reducing default risk, often through mechanisms like guarantees or collateral. In underwriting, credit enhancement helps secure investor confidence and favorable pricing, while in agency arrangements, it shifts risk from the issuer to a third party, enhancing the agency's ability to manage and distribute credit risk efficiently.

Correspondent Lending

Correspondent lending involves a lender originating and underwriting loans before selling them to an agency or investor, maintaining initial responsibility for credit risk evaluation and loan quality. Underwriting in correspondent lending typically adheres to strict agency guidelines to ensure loans meet investor standards for seamless delivery and pricing.

Portfolio Retention

Portfolio retention rate measures the percentage of policies an insurer keeps from underwriting compared to those passed through agencies, reflecting underwriting discipline and agency performance. Higher retention indicates strong underwriting confidence and efficient risk selection, while lower retention may signal reliance on agency-distributed policies to diversify risk.

Whole Loan Sale

Whole loan sale transactions require thorough underwriting processes to evaluate loan quality, borrower creditworthiness, and collateral valuation before transferring ownership; this contrasts with agency sales where standardized criteria and risk sharing reduce underwriting complexity. Investors in whole loan sales assume full credit risk, making meticulous underwriting crucial for accurate pricing and portfolio performance.

Secondary Market

The secondary market facilitates the trading of securities after their initial issuance, impacting underwriting by providing liquidity and price discovery that influence issuers' future capital-raising strategies. Agency underwriting involves intermediaries who distribute securities without assuming risk, contrasting with underwriting where firms guarantee purchase, thereby affecting market behavior and investor confidence in the secondary market.

Delegated Underwriting

Delegated underwriting allows insurers to transfer authority to agencies or third parties to assess risks and issue policies, streamlining the underwriting process and enhancing operational efficiency. Unlike traditional underwriting where insurers evaluate risks directly, agencies with delegated authority use set guidelines to make binding decisions, reducing turnaround times and expanding market reach.

Investor Guidelines

Investor guidelines for underwriting emphasize comprehensive risk assessment and capital commitment to support loan origination, while agency guidelines focus on adherence to predefined criteria for loan purchase or securitization without assuming credit risk. Underwriting requires detailed due diligence and borrower evaluation, contrasting with agency standards that prioritize compliance and timely delivery of eligible assets.

underwriting vs agency Infographic

moneydif.com

moneydif.com