A grace period allows borrowers to delay loan repayments for a specified time after disbursement, with interest typically accruing during this phase. A moratorium extends the repayment deferral, often including interest suspension, offering temporary financial relief without immediate payment obligations. Understanding the differences helps borrowers manage cash flow and avoid penalties during financial hardships.

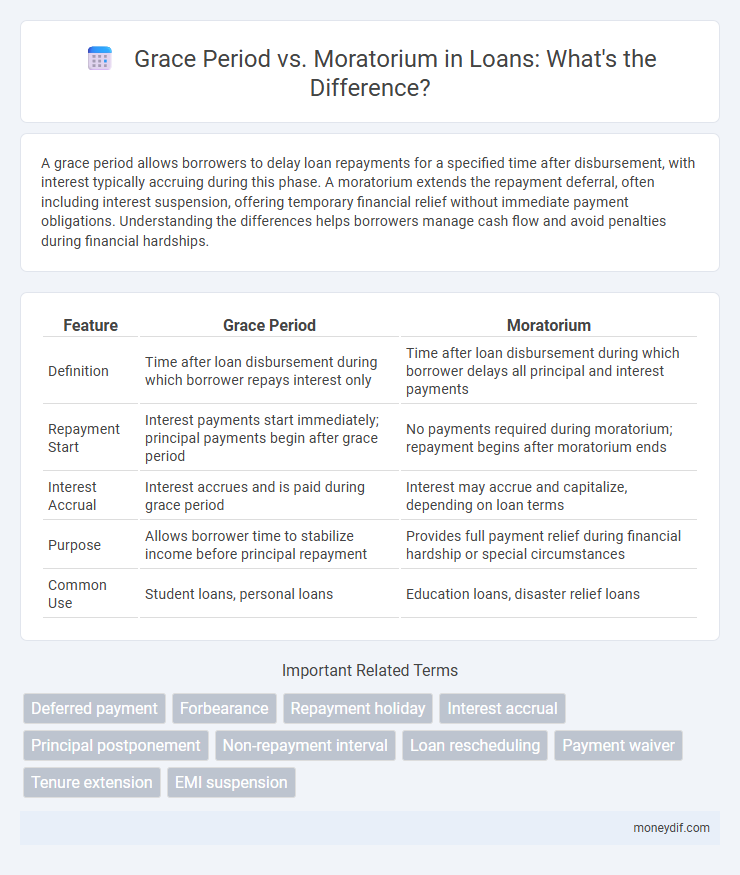

Table of Comparison

| Feature | Grace Period | Moratorium |

|---|---|---|

| Definition | Time after loan disbursement during which borrower repays interest only | Time after loan disbursement during which borrower delays all principal and interest payments |

| Repayment Start | Interest payments start immediately; principal payments begin after grace period | No payments required during moratorium; repayment begins after moratorium ends |

| Interest Accrual | Interest accrues and is paid during grace period | Interest may accrue and capitalize, depending on loan terms |

| Purpose | Allows borrower time to stabilize income before principal repayment | Provides full payment relief during financial hardship or special circumstances |

| Common Use | Student loans, personal loans | Education loans, disaster relief loans |

Understanding Grace Period and Moratorium in Loans

Grace period in loans refers to a specified timeframe after the due date during which borrowers can make payments without penalties or additional interest. Moratorium is a temporary suspension of loan repayments authorized by lenders or governments, often during financial hardships or crises. Understanding the difference helps borrowers manage cash flow and avoid default by knowing when payments can be deferred versus when interest continues to accrue.

Key Differences Between Grace Period and Moratorium

The grace period in a loan refers to the specific time after the loan tenure begins during which the borrower is not required to make principal payments, though interest may still accrue, while the moratorium is an officially approved suspension of both principal and interest payments typically granted during financial hardship or unforeseen events. Grace periods are pre-determined and standard in many loans, offering temporary relief without altering the loan duration, whereas moratoriums extend the loan tenure by deferring payments and interest accumulation for the approved period. Understanding these differences helps borrowers manage repayment schedules effectively and negotiate terms during financial difficulties.

How Grace Periods Benefit Loan Borrowers

Grace periods offer loan borrowers a temporary relief by allowing them to postpone repayments without penalty, which helps manage financial strain during initial loan phases. This period improves cash flow flexibility, enabling borrowers to allocate funds towards essential expenses or emergency needs before full repayment begins. Borrowers benefit from reduced stress and greater financial stability, increasing the likelihood of timely loan completion.

Advantages and Disadvantages of Loan Moratoriums

Loan moratoriums provide borrowers temporary relief by pausing principal and interest repayments, reducing immediate financial stress and preventing defaults during economic hardships. However, moratoriums often lead to accrual of interest on the outstanding loan amount, increasing the total repayment burden and potentially extending the loan tenure. While moratoriums enhance short-term liquidity, they may negatively impact credit scores and future borrowing capacity if not managed properly.

Eligibility Criteria for Grace Period vs Moratorium

The eligibility criteria for a grace period typically require borrowers to have an active loan account in good standing, with the grace period offered immediately after loan disbursement or repayment commencement. In contrast, moratorium eligibility often depends on specific hardship conditions such as unemployment, illness, or natural disasters, and may require formal application and approval from the lender or financial institution. Lenders assess credit history, income stability, and regulatory guidelines to determine eligibility for both grace periods and moratoriums, ensuring borrowers meet the necessary requirements.

Impact on Loan Repayment Schedules

Grace period allows borrowers to delay initial loan repayments without accruing penalties, effectively extending the overall loan term and easing immediate cash flow pressures. Moratorium temporarily suspends all loan repayments, including principal and interest, which can lead to a revised repayment schedule with potentially higher EMI amounts once the moratorium ends. Both options alter loan amortization timelines but differ in terms of payment deferral and interest accrual, impacting the borrower's financial planning and total cost of credit.

Interest Accrual: Grace Period vs Moratorium

During the grace period, interest continues to accrue on the loan principal, increasing the overall repayment amount once the repayment phase begins. In contrast, a moratorium typically pauses both principal and interest payments, with interest accrual either halted or deferred depending on the loan agreement. Understanding the impact of these periods on interest accumulation is crucial for effective loan repayment planning.

When Should You Opt for a Moratorium?

Opt for a moratorium when facing temporary financial hardship that prevents timely loan repayments without incurring penalties or affecting credit scores, typically during emergencies or unforeseen income disruptions. Unlike a grace period, which delays the start of repayments after the loan disbursement, a moratorium suspends both principal and interest payments for a defined duration, providing immediate relief. Borrowers should evaluate the moratorium terms carefully to avoid extended loan tenure or increased interest burden post-suspension.

Legal and Regulatory Perspectives

Grace period in loans refers to the legally defined timeframe during which borrowers are not required to make payments, yet interest may continue to accrue, often regulated under specific banking laws to protect consumer rights. Moratorium, by contrast, is a temporary suspension of loan repayments mandated or approved by regulatory authorities during extraordinary circumstances, such as economic crises or natural disasters, providing legal relief without penalty. Regulatory frameworks typically outline distinct definitions, application procedures, and borrower protections for grace periods versus moratoriums to ensure compliance and financial stability.

Frequently Asked Questions: Grace Period vs Moratorium

The grace period in a loan refers to the specific timeframe after the due date during which late payments can be made without penalty, whereas moratorium is a temporary suspension of loan repayments granted by the lender or government, often due to financial hardship or emergencies. Borrowers commonly ask if interest accrues during these periods; interest typically continues to accumulate during a moratorium but may not during a grace period, depending on loan terms. Understanding these differences helps borrowers manage repayment schedules effectively and avoid default.

Important Terms

Deferred payment

Deferred payment schemes often feature a grace period allowing borrowers to postpone principal repayments while continuing to pay interest, unlike moratoriums which suspend both principal and interest payments temporarily. Understanding the differences between grace periods and moratoriums is crucial for managing loan cash flow effectively during financial hardship.

Forbearance

Forbearance allows temporary relief from loan payments by postponing or reducing them, differing from a grace period where payments are deferred immediately after loan disbursement without accruing interest, and from a moratorium which is a legally authorized suspension of payments during financial hardship. Unlike grace periods and moratoriums, forbearance may lead to the accumulation of interest on overdue amounts, affecting the total loan balance over time.

Repayment holiday

A repayment holiday allows borrowers to temporarily pause loan repayments without penalties, differentiating it from a grace period, which delays the start of repayments but often continues interest accrual, while a moratorium typically suspends both repayments and interest accumulation under specific hardship conditions. Understanding these distinctions is crucial for managing loan agreements effectively, especially in personal loans, mortgages, and student loan contexts.

Interest accrual

Interest accrual during a grace period typically pauses, allowing borrowers to delay payments without additional interest, whereas during a moratorium, interest often continues to accrue, increasing the total repayment amount. Understanding the differences impacts loan cost calculations and financial planning for borrowers.

Principal postponement

Principal postponement involves delaying the repayment of the loan's principal amount, which differs from a grace period that allows borrowers to defer payments without penalty, typically during the initial loan phase. A moratorium extends this concept by legally suspending both principal and interest payments for a specified period, providing borrowers temporary relief during financial hardship.

Non-repayment interval

Non-repayment interval refers to the timeframe during which borrowers are not required to make principal payments, often observed in both grace periods and moratoriums. While grace periods typically delay repayment commencement without accruing interest on the principal, moratoriums suspend both principal and interest payments, providing temporary financial relief during hardship.

Loan rescheduling

Loan rescheduling involves modifying the original repayment schedule, often incorporating a grace period that allows borrowers temporary relief from principal repayments while still requiring interest payments. Moratorium, in contrast, provides a complete suspension of both principal and interest payments for a specified period, offering broader financial relief during severe hardship.

Payment waiver

Payment waiver allows borrowers to skip payments without penalty, often granted during financial hardship periods, while a grace period provides a temporary delay in payment due dates without extra interest or fees. A moratorium postpones both principal and interest payments for a fixed term, typically during crises, allowing borrowers to resume normal payments afterward without impacting credit standing.

Tenure extension

Tenure extension in loan repayment allows borrowers to spread out payments over a longer period, reducing monthly installments and improving cash flow during financial strain. Grace periods provide temporary relief by pausing payments without penalty, whereas moratoriums offer a legal suspension of repayment obligations, both integral in managing loan tenure adjustments during economic hardship.

EMI suspension

EMI suspension allows borrowers to temporarily halt loan repayments, often during financial hardships, with the grace period representing the initial phase where interest may continue to accrue but no payments are required; moratorium extends this by providing a legally approved pause on both principal and interest payments without penalties. Understanding the differences between grace periods and moratoriums is crucial for managing loan tenor, interest capitalization, and total repayment obligations effectively.

Grace period vs Moratorium Infographic

moneydif.com

moneydif.com