A covenant in a loan agreement is a promise made by the borrower to do or not do certain actions throughout the life of the loan, ensuring ongoing compliance and risk management. A condition precedent is a specific event or requirement that must be fulfilled before the lender is obligated to disburse funds or the loan agreement becomes effective. Understanding the distinction between covenants and conditions precedent is essential for managing loan execution and maintaining contractual obligations.

Table of Comparison

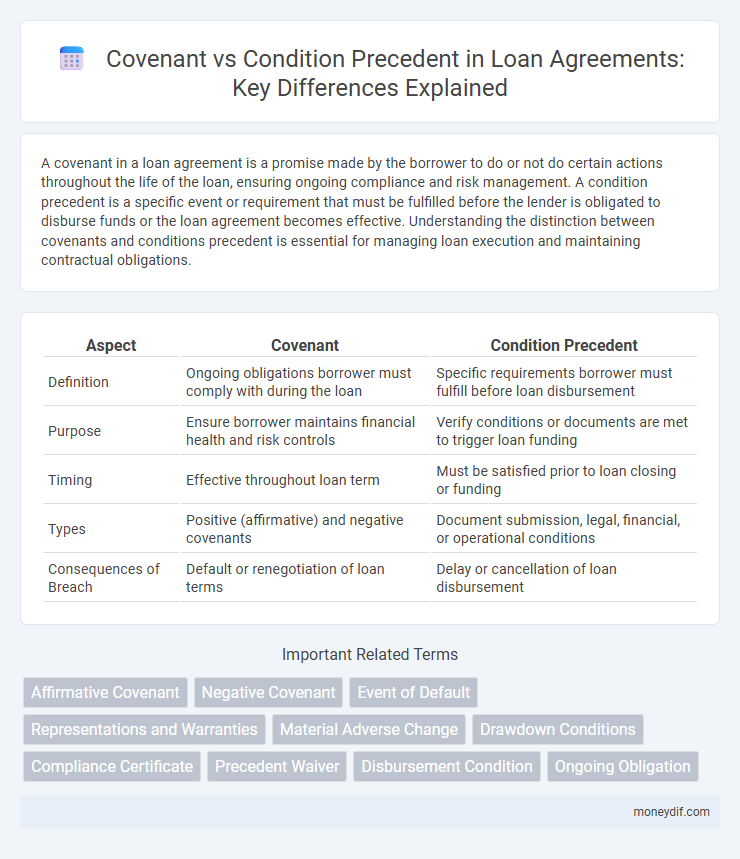

| Aspect | Covenant | Condition Precedent |

|---|---|---|

| Definition | Ongoing obligations borrower must comply with during the loan | Specific requirements borrower must fulfill before loan disbursement |

| Purpose | Ensure borrower maintains financial health and risk controls | Verify conditions or documents are met to trigger loan funding |

| Timing | Effective throughout loan term | Must be satisfied prior to loan closing or funding |

| Types | Positive (affirmative) and negative covenants | Document submission, legal, financial, or operational conditions |

| Consequences of Breach | Default or renegotiation of loan terms | Delay or cancellation of loan disbursement |

Understanding Loan Covenants vs. Conditions Precedent

Loan covenants are ongoing obligations borrowers must adhere to throughout the loan term, such as maintaining financial ratios or restrictions on additional debt, ensuring lender protection against risk. Conditions precedent are specific requirements or documents that must be fulfilled or provided before the loan is disbursed, like proof of insurance or legal opinions, serving as triggers for loan funding. Distinguishing between covenants and conditions precedent is crucial for loan compliance and risk management, as covenants govern borrower behavior during the loan life, while conditions precedent focus on pre-disbursement criteria.

Key Differences Between Covenants and Conditions Precedent

Covenants in loans are ongoing promises or obligations the borrower agrees to maintain throughout the loan term, such as financial ratios or reporting requirements, ensuring compliance and risk management. Conditions precedent are specific requirements that must be fulfilled before the loan agreement becomes effective or funds are disbursed, like providing security documentation or evidence of insurance. The key difference lies in timing and function: conditions precedent are initial triggers for loan activation, while covenants govern borrower behavior during the loan lifecycle.

Importance of Covenants in Loan Agreements

Covenants in loan agreements establish ongoing obligations that protect lenders by ensuring borrowers maintain financial discipline and operational transparency throughout the loan term. Unlike conditions precedent that must be met before loan disbursement, covenants serve as continuous checks, reducing default risk and safeguarding creditor interests. Strongly defined covenants contribute to loan performance monitoring and help maintain the borrower's creditworthiness.

Role of Conditions Precedent in Loan Disbursement

Conditions precedent play a critical role in loan disbursement by ensuring all contractual obligations and regulatory requirements are met before funds are released, mitigating lender risk. These conditions typically include verification of borrower's financial statements, receipt of necessary approvals, and completion of legal documentation. Unlike covenants, conditions precedent act as mandatory checkpoints that must be satisfied to trigger the loan drawdown, safeguarding the lender's interests throughout the financing process.

Common Types of Loan Covenants

Common types of loan covenants include financial covenants such as maintaining specific debt-to-equity ratios, interest coverage ratios, and minimum net worth requirements. Affirmative covenants require borrowers to fulfill certain actions like providing financial statements or maintaining insurance coverage. Negative covenants restrict borrowers from activities like incurring additional debt, making asset sales, or paying dividends without lender approval.

Typical Conditions Precedent in Lending

Typical conditions precedent in lending include verification of borrower's financial statements, proof of insurance, and execution of loan documents, ensuring all requirements are met before funds are disbursed. Covenants, by contrast, are ongoing obligations borrowers must follow during the loan term, such as maintaining financial ratios or restrictions on additional debt. Conditions precedent serve as initial checkpoints, while covenants monitor compliance throughout the loan lifecycle.

Legal Implications: Breach of Covenant vs. Unmet Condition Precedent

A breach of covenant in a loan agreement typically results in a default, triggering remedies such as acceleration of the loan or enforcement actions. Failure to satisfy a condition precedent prevents the loan from becoming effective, meaning the lender is not obligated to disburse funds. Legal implications differ as covenants govern ongoing borrower behavior post-closing, whereas conditions precedent must be fulfilled for the contract's enforceability to commence.

How Lenders Enforce Covenants and Conditions Precedent

Lenders enforce covenants through regular monitoring of borrower compliance, often requiring periodic financial reporting and site inspections to identify any breaches promptly. Conditions precedent are strictly enforced at loan closing, where lenders verify that all stipulated requirements, such as documentation or regulatory approvals, are fulfilled before disbursing funds. Failure to meet covenants or conditions precedent can trigger default provisions, enabling lenders to demand immediate repayment or impose penalties.

Impact on Borrowers: Covenant Breaches vs. Failure to Satisfy Conditions

Covenant breaches in loan agreements often trigger penalties, higher interest rates, or accelerated repayment demands, significantly affecting the borrower's financial stability and creditworthiness. Failure to satisfy conditions precedent typically prevents loan disbursement entirely, delaying access to funds crucial for business operations or growth. Understanding these distinctions helps borrowers manage compliance risks and anticipate potential financial impacts on their liquidity and operational continuity.

Best Practices for Managing Covenants and Conditions Precedent

Effective management of covenants and conditions precedent in loan agreements requires clear documentation and regular monitoring to ensure compliance and mitigate risks. Establishing automated tracking systems and assigning dedicated compliance teams enhances timely identification of potential breaches and fulfillment of conditions before loan disbursement. Regular communication with borrowers and thorough due diligence during loan origination further strengthen adherence to contractual obligations and support risk management strategies.

Important Terms

Affirmative Covenant

An Affirmative Covenant requires a party to undertake specific actions or maintain certain conditions throughout the contract term, differing from a Condition Precedent which must be fulfilled before a contract or obligation becomes effective. In legal agreements, an Affirmative Covenant ensures ongoing compliance, whereas a Condition Precedent serves as a trigger for contractual performance or rights activation.

Negative Covenant

A negative covenant restricts specific actions by a party, contrasting with a condition precedent that requires the fulfillment of a particular event before contractual obligations arise. Unlike conditions precedent, negative covenants continuously bind parties to refrain from certain behaviors throughout the contract duration.

Event of Default

An Event of Default occurs when a borrower breaches a covenant, indicating failure to comply with agreed terms during the loan period, whereas a Condition Precedent is a specific requirement that must be fulfilled before the loan agreement or obligation becomes effective. Covenants are ongoing obligations aimed at preventing default, while Conditions Precedent serve as initial triggers for disbursing funds or activating the contract.

Representations and Warranties

Representations and Warranties establish current facts about a party's status or the subject matter, while a Covenant imposes ongoing obligations to be fulfilled after the agreement's execution. Conditions Precedent require specific events or actions to occur before certain contractual duties become effective, distinguishing timing and performance triggers from factual assertions and continuous promises.

Material Adverse Change

Material Adverse Change (MAC) clauses serve as critical contractual mechanisms allowing parties to renegotiate or terminate agreements upon significant deterioration in a target's financial or operational condition, distinguishing from conditions precedent that are specific obligations or events required before contract effectiveness. Unlike covenants, which are ongoing promises throughout the contract life, MACs specifically address unforeseen negative developments post-signing that materially impact deal value or risk profile.

Drawdown Conditions

Drawdown conditions specify the prerequisites a borrower must satisfy before loan disbursement, often encompassing affirmative covenants that require ongoing compliance throughout the loan term. Unlike conditions precedent, which mandate the fulfillment of specific requirements before contract effectiveness or initial disbursement, drawdown conditions focus on operational benchmarks and documentation verification at each tranche release.

Compliance Certificate

A Compliance Certificate verifies fulfillment of contractual obligations, serving as evidence that specific covenants have been met, unlike a condition precedent which must be satisfied before a contract becomes binding. This certificate ensures ongoing adherence to terms, while conditions precedent act as prerequisites to contract enforceability.

Precedent Waiver

A precedent waiver refers to the intentional relinquishment of a condition precedent, allowing contractual obligations to move forward despite unmet conditions typically required before performance. Unlike covenants, which are ongoing promises within a contract, conditions precedent must be satisfied or waived for the contract to become effective, making precedent waivers critical in modifying the timing or occurrence of contractual duties.

Disbursement Condition

Disbursement condition refers to specific requirements that must be met before funds are released under a loan or financing agreement, often overlapping with conditions precedent that serve as mandatory checkpoints for initial or subsequent transactions. While covenants impose ongoing obligations or restrictions on the borrower to maintain financial health or operational standards, conditions precedent are one-time criteria that must be satisfied to trigger initial disbursement or subsequent drawdowns.

Ongoing Obligation

Ongoing obligation in contract law refers to duties that must be continually fulfilled throughout the term of the agreement, contrasting with conditions precedent which are specific events or actions that must occur before a party's initial performance becomes due. Covenants impose continuous promises, such as maintaining insurance or compliance with regulations, while conditions precedent act as triggers that activate contractual obligations only after their satisfaction.

covenant vs condition precedent Infographic

moneydif.com

moneydif.com