An underwater loan occurs when the outstanding loan balance exceeds the current value of the collateral, increasing the borrower's risk of negative equity. Over-collateralized loans require collateral worth more than the loan amount, providing lenders with extra security and reducing credit risk. Comparing the two, underwater loans expose borrowers to potential financial distress, while over-collateralization enhances loan stability and lender confidence.

Table of Comparison

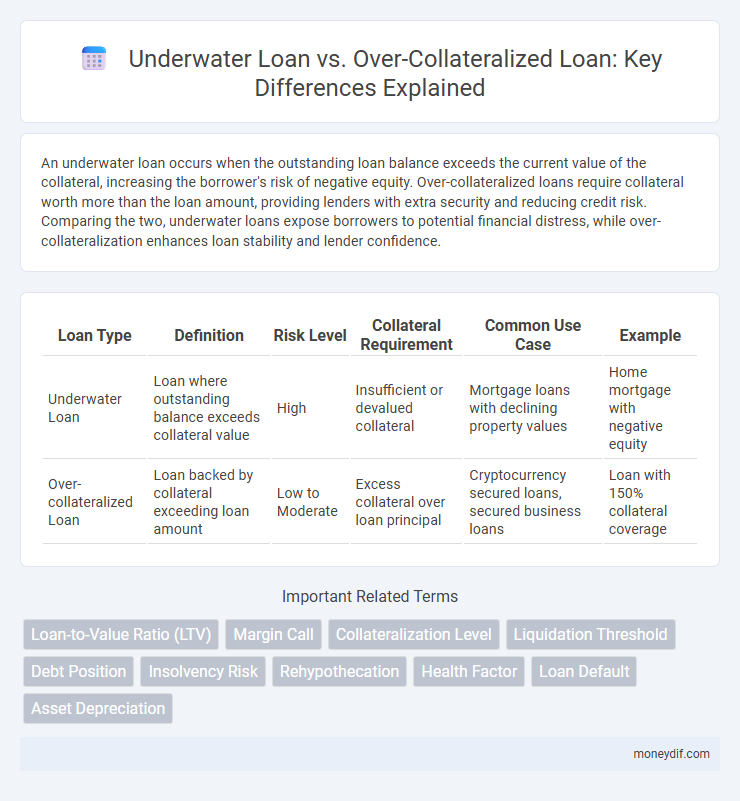

| Loan Type | Definition | Risk Level | Collateral Requirement | Common Use Case | Example |

|---|---|---|---|---|---|

| Underwater Loan | Loan where outstanding balance exceeds collateral value | High | Insufficient or devalued collateral | Mortgage loans with declining property values | Home mortgage with negative equity |

| Over-collateralized Loan | Loan backed by collateral exceeding loan amount | Low to Moderate | Excess collateral over loan principal | Cryptocurrency secured loans, secured business loans | Loan with 150% collateral coverage |

Understanding Underwater Loans: Definition and Implications

Underwater loans occur when the outstanding loan balance exceeds the current market value of the collateral, often seen in mortgage lending during market downturns. This negative equity situation can lead to increased borrower risk, potential default, and challenges in refinancing or selling the asset. Financial institutions must carefully assess underwater loan implications on portfolio risk and loan loss provisioning.

What Is an Over-collateralized Loan? Key Features Explained

An over-collateralized loan involves providing collateral with a value significantly higher than the loan amount, reducing the lender's risk and potentially lowering interest rates. Key features include enhanced borrower credibility, increased loan approval chances, and protection against asset depreciation. This approach is common in secured lending, where assets like real estate or securities back the loan to ensure repayment security.

Core Differences Between Underwater and Over-collateralized Loans

Underwater loans occur when the outstanding loan balance exceeds the current value of the collateral, increasing borrower risk and potential default. Over-collateralized loans have collateral valued higher than the loan amount, providing lenders with greater security and reduced risk of loss. The core difference lies in loan-to-value ratios: underwater loans have a ratio above 100%, while over-collateralized loans maintain a ratio below 100%, directly influencing credit risk and lending terms.

Risk Factors: Underwater vs Over-collateralized Lending

Underwater loans pose higher risk due to the borrower owing more than the collateral's current market value, increasing the likelihood of default and lender losses. Over-collateralized loans reduce risk by requiring collateral exceeding the loan amount, providing lenders a buffer against asset depreciation or borrower default. Effective risk management in lending involves assessing collateral adequacy and market volatility to differentiate underwater loan vulnerabilities from over-collateralized loan protections.

Impact on Borrowers: Underwater Loans Compared to Over-collateralization

Underwater loans significantly increase financial strain on borrowers by requiring repayment amounts that exceed the current asset value, leading to higher default risk and potential negative credit impacts. Over-collateralized loans provide borrowers with enhanced security and potentially lower interest rates, as lenders face reduced risk due to collateral surpassing the loan value. Consequently, underwater loans often limit refinancing and borrowing flexibility, whereas over-collateralization supports better credit terms and improved borrower confidence.

Effects on Lenders: Managing Risks in Different Loan Structures

Underwater loans increase credit risk for lenders due to borrowers owing more than the collateral's current value, necessitating stricter monitoring and potential loss mitigation strategies. Over-collateralized loans reduce lender risk by providing excess collateral, improving loan recovery prospects and enabling more favorable lending terms. Effective risk management in these structures involves assessing collateral volatility and borrower creditworthiness to balance potential losses and returns.

Market Conditions That Lead to Underwater Loans

Underwater loans occur when the outstanding loan balance exceeds the current value of the collateral, often triggered by declining property values or adverse economic conditions such as recessions and housing market downturns. These market conditions reduce asset prices, increasing the likelihood that borrowers owe more than the collateral is worth. In contrast, over-collateralized loans maintain a loan-to-value ratio below 100%, providing a cushion against market volatility and reducing the risk of loan underwater scenarios.

The Benefits of Over-collateralization in Loan Agreements

Over-collateralized loans provide lenders with enhanced security by requiring collateral value to exceed the loan amount, reducing default risk significantly. This approach improves borrowing terms, often resulting in lower interest rates due to decreased credit risk. Borrowers benefit from increased access to capital and potential for higher loan amounts compared to underwater loans, where collateral value falls below the outstanding loan balance.

Recovery Strategies: Addressing Underwater and Over-collateralized Loans

Recovery strategies for underwater loans focus on renegotiation, loan modifications, or short sales to mitigate losses when the loan balance exceeds collateral value. Over-collateralized loans rely on liquidating excess collateral or restructuring terms to recover owed amounts efficiently. Effective loss mitigation requires tailored approaches aligning with the collateral status and borrower's financial capacity.

Choosing the Right Loan Structure: Factors to Consider

Choosing the right loan structure involves evaluating the loan-to-value ratio, as underwater loans occur when the borrowed amount exceeds the asset's current value, increasing default risk. Over-collateralized loans require providing collateral worth more than the loan principal, offering lenders added security and potentially lower interest rates. Key factors include asset volatility, borrower creditworthiness, and the purpose of the loan to balance risk and cost effectively.

Important Terms

Loan-to-Value Ratio (LTV)

Loan-to-Value Ratio (LTV) measures the loan amount relative to the appraised value of the collateral, where an underwater loan occurs when the LTV exceeds 100%, indicating the borrower owes more than the collateral's worth. Over-collateralized loans have an LTV below 100%, providing lenders with a safety margin by securing the loan with collateral valued higher than the outstanding loan balance.

Margin Call

Margin calls occur when the value of an underwater loan, where the collateral's value falls below the loan amount, declines, requiring the borrower to deposit additional funds or assets to restore the required equity. Over-collateralized loans reduce the risk of margin calls by maintaining a collateral value significantly higher than the loan balance, providing a buffer against market volatility.

Collateralization Level

Collateralization level measures the ratio of collateral value to loan amount, crucial for assessing underwater loans where the collateral value falls below the loan balance, increasing lender risk. Over-collateralized loans maintain a collateralization level above 100%, providing a safety buffer that reduces default risk and enhances loan security.

Liquidation Threshold

The Liquidation Threshold represents the collateral value percentage at which an underwater loan faces liquidation risk, typically occurring when the loan balance exceeds the collateral value. Over-collateralized loans maintain a collateral value significantly higher than the loan amount, reducing liquidation risk by keeping the loan well below the Liquidation Threshold.

Debt Position

A debt position with an underwater loan occurs when the outstanding loan balance exceeds the current value of the collateral, increasing default risk for lenders. Conversely, an over-collateralized loan features collateral value surpassing the loan amount, providing a safety margin that reduces lender exposure and enhances creditworthiness.

Insolvency Risk

Insolvency risk significantly increases with underwater loans, where the outstanding loan amount exceeds the collateral value, creating a higher probability of borrower default and asset liquidation shortfalls. Over-collateralized loans reduce insolvency risk by providing lenders with collateral values surpassing the loan balance, enhancing recovery potential during borrower financial distress.

Rehypothecation

Rehypothecation involves repurposing collateral from underwater loans, where the loan value exceeds the collateral, increasing risk exposure for lenders. In contrast, over-collateralized loans, secured by assets exceeding the loan amount, reduce reliance on rehypothecation, enhancing credit stability and mitigating systemic risk.

Health Factor

Health Factor represents the safety ratio of a loan, calculated as the liquidation threshold divided by the loan's current value, indicating the risk of liquidation. Underwater loans occur when the Health Factor drops below 1, signaling insufficient collateral, whereas over-collateralized loans maintain a Health Factor well above 1, ensuring loan security and reducing liquidation risk.

Loan Default

Loan default risk increases significantly with underwater loans, where the outstanding debt exceeds the collateral's current market value, limiting recovery options for lenders. Over-collateralized loans reduce default potential by securing the loan with assets valued above the borrowed amount, offering lenders a buffer against market fluctuations and borrower insolvency.

Asset Depreciation

Asset depreciation impacts underwater loans by increasing the loan-to-value ratio, often causing the loan balance to exceed the asset's market value and risking default. Over-collateralized loans mitigate this risk by maintaining collateral value above the loan amount, providing a buffer against depreciation-induced losses.

Underwater loan vs Over-collateralized loan Infographic

moneydif.com

moneydif.com