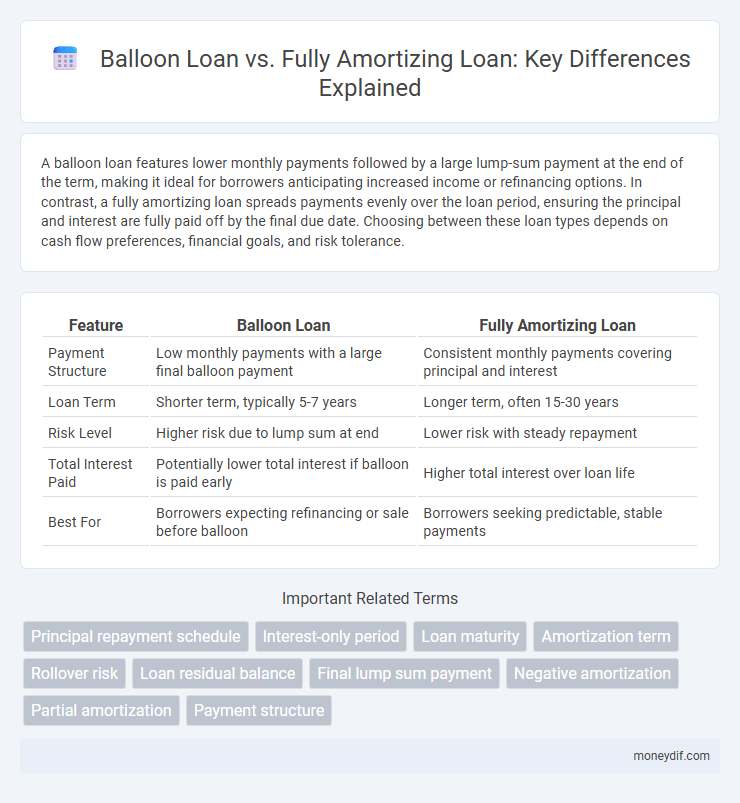

A balloon loan features lower monthly payments followed by a large lump-sum payment at the end of the term, making it ideal for borrowers anticipating increased income or refinancing options. In contrast, a fully amortizing loan spreads payments evenly over the loan period, ensuring the principal and interest are fully paid off by the final due date. Choosing between these loan types depends on cash flow preferences, financial goals, and risk tolerance.

Table of Comparison

| Feature | Balloon Loan | Fully Amortizing Loan |

|---|---|---|

| Payment Structure | Low monthly payments with a large final balloon payment | Consistent monthly payments covering principal and interest |

| Loan Term | Shorter term, typically 5-7 years | Longer term, often 15-30 years |

| Risk Level | Higher risk due to lump sum at end | Lower risk with steady repayment |

| Total Interest Paid | Potentially lower total interest if balloon is paid early | Higher total interest over loan life |

| Best For | Borrowers expecting refinancing or sale before balloon | Borrowers seeking predictable, stable payments |

Introduction to Balloon Loans and Fully Amortizing Loans

Balloon loans require a large lump-sum payment at the end of the loan term after smaller periodic payments, resulting in lower monthly payments but a significant balance due at maturity. Fully amortizing loans spread out payments evenly over the loan term, fully paying off both principal and interest by the end of the schedule with no remaining balance. Borrowers choose balloon loans for short-term financing needs or lower initial payments, while fully amortizing loans are preferred for predictable long-term payment structures.

How Balloon Loans Work

Balloon loans require borrowers to make lower monthly payments based on a longer amortization period, with a large lump sum payment due at the end of the loan term. The final balloon payment is typically much larger than the preceding payments and must be paid in full or refinanced. This structure allows for lower monthly obligations but carries the risk of payment shock if the borrower cannot manage the balloon payment at maturity.

How Fully Amortizing Loans Work

Fully amortizing loans are structured so that each monthly payment covers both principal and interest, ensuring the loan is completely paid off by the end of the term. Borrowers benefit from predictable payments, which include recalculated amounts over time to reduce the principal balance steadily. This type of loan eliminates the need for a large lump-sum payment at maturity, unlike balloon loans.

Key Differences Between Balloon Loans and Fully Amortizing Loans

Balloon loans require a large lump-sum payment at the end of the term, whereas fully amortizing loans have equal monthly payments that cover both principal and interest until the loan is fully paid off. Balloon loans often have lower monthly payments but carry the risk of refinancing or paying off the large final balance. Fully amortizing loans eliminate balloon risk by spreading payments evenly over the loan period, providing predictable budgeting and reducing default risk.

Pros and Cons of Balloon Loans

Balloon loans offer lower initial monthly payments compared to fully amortizing loans, making them attractive for borrowers seeking short-term affordability or expecting increased future income. The primary risk involves a large lump-sum payment due at the end of the term, which may require refinancing or selling the asset if the borrower cannot pay it off outright. Balloon loans provide flexibility but can lead to financial strain if the market conditions or borrower's financial situation change unfavorably before maturity.

Pros and Cons of Fully Amortizing Loans

Fully amortizing loans provide predictable monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the term and reducing the risk of a large final payment. These loans offer financial stability for borrowers who prefer consistent budgeting but may result in higher monthly payments compared to balloon loans. However, fully amortizing loans typically have higher initial rates, making them less favorable for borrowers seeking short-term financing or lower immediate payments.

Suitability: Who Should Consider Each Loan Type?

Borrowers seeking lower initial monthly payments and the ability to make a large lump-sum payment at the end of the term should consider a balloon loan, typically suitable for those expecting increased future income or planning to refinance. Fully amortizing loans are ideal for individuals desiring predictable, consistent payments with complete loan payoff by the end of the term, favored by steady-income borrowers prioritizing long-term financial stability. Small business owners and real estate investors might choose balloon loans for cash flow flexibility, while conventional homebuyers usually prefer fully amortizing loans for budget certainty.

Risks and Challenges of Balloon Loans

Balloon loans pose higher risks due to their large lump-sum payment at the end of the term, which can lead to borrower default if refinancing or repayment funds are unavailable. Unlike fully amortizing loans that gradually reduce principal and interest through fixed payments, balloon loans maintain lower monthly payments until the balloon payment is due, increasing financial uncertainty. The challenges of balloon loans include potential payment shock, refinancing risks, and greater vulnerability during adverse market conditions or changes in borrower creditworthiness.

Long-Term Costs: Balloon vs Fully Amortizing Loans

Balloon loans often have lower initial monthly payments but require a large lump-sum payment at the end of the term, potentially increasing long-term costs due to refinancing risks and interest rate changes. Fully amortizing loans spread both principal and interest evenly across the loan term, resulting in higher monthly payments but no large final payment, often reducing overall interest paid long-term. Borrowers seeking predictability and minimizing total interest charges typically benefit more from fully amortizing loans despite higher monthly payments.

Choosing the Right Loan: Factors to Consider

Choosing the right loan involves evaluating payment structure and long-term affordability; balloon loans offer lower initial payments with a large final payment, suitable for short-term plans or anticipated refinancing. Fully amortizing loans provide consistent payments that cover both principal and interest, ensuring the loan is paid off by maturity, ideal for stable financial situations and predictable budgeting. Key factors include cash flow stability, future income expectations, and risk tolerance for lump-sum payments at loan end.

Important Terms

Principal repayment schedule

A principal repayment schedule for a balloon loan involves minimal or interest-only payments throughout the term, followed by a large lump-sum principal payment at maturity, contrasting with a fully amortizing loan where equal payments gradually reduce both principal and interest to zero by the end of the term. Balloon loans typically offer lower monthly payments but pose refinancing risk, while fully amortizing loans ensure consistent principal reduction and predictable payoff timelines.

Interest-only period

An interest-only period in a balloon loan allows borrowers to pay only interest for a set term, resulting in lower initial payments compared to a fully amortizing loan, where both principal and interest are paid throughout the loan term, steadily reducing the balance. Balloon loans require a large lump-sum payment at maturity, whereas fully amortizing loans fully repay the principal by the end of the term.

Loan maturity

Loan maturity significantly influences repayment structure, with balloon loans featuring a shorter maturity and a large lump-sum payment at the end, while fully amortizing loans spread payments evenly over the entire term, fully paying off principal and interest by maturity. Balloon loans often have lower monthly payments initially but higher risk at maturity, contrasting with the predictable, steadily declining balance of fully amortizing loans.

Amortization term

Amortization in a balloon loan involves smaller periodic payments with a large lump sum due at the end, contrasting fully amortizing loans where equal payments cover both principal and interest, fully paying off the loan by maturity. Balloon loans often have shorter amortization schedules, increasing repayment risk compared to fully amortizing loans that ensure predictable payoff.

Rollover risk

Rollover risk in a balloon loan arises from the borrower's obligation to refinance or pay the outstanding principal at maturity, creating potential exposure to interest rate hikes or credit tightening, whereas a fully amortizing loan minimizes this risk by spreading principal repayments evenly over the loan term, eliminating the need for refinancing at loan maturity. Balloon loans typically carry higher rollover risk, impacting borrower liquidity and increasing default probability compared to fully amortizing loans.

Loan residual balance

Loan residual balance in balloon loans refers to the remaining principal due at the end of the loan term, often requiring a large lump-sum payment, whereas fully amortizing loans have no residual balance because payments cover both principal and interest evenly until the loan is paid off. Balloon loans carry higher risk due to the substantial residual balance, contrasting with the predictable payoff structure of fully amortizing loans.

Final lump sum payment

A final lump sum payment in a balloon loan represents a large, one-time payment due at the end of the loan term, contrasting with a fully amortizing loan where the principal and interest are paid down evenly over the life of the loan, eliminating the need for a final balloon payment. Balloon loans typically have lower monthly payments early on but require substantial refinancing or payoff at maturity, whereas fully amortizing loans provide consistent, predictable payments without a large outstanding balance.

Negative amortization

Negative amortization occurs when loan payments are insufficient to cover the interest due, causing the unpaid interest to be added to the principal balance, commonly affecting balloon loans where a large lump-sum payment is required at maturity, unlike fully amortizing loans which systematically pay down both principal and interest over the loan term to avoid balance increases. Balloon loans often present a risk of negative amortization if payments do not cover accruing interest, whereas fully amortizing loans maintain a consistent repayment schedule that prevents principal growth and reduces default risk.

Partial amortization

Partial amortization involves paying down a loan balance through scheduled payments that cover only a portion of the principal, resulting in a remaining principal balance due at the end of the term, similar to a balloon loan structure. In contrast, a fully amortizing loan requires equal periodic payments that completely pay off both principal and interest by maturity, eliminating any lump-sum balloon payment.

Payment structure

Balloon loans feature a payment structure where borrowers make smaller periodic payments with a large lump-sum balloon payment due at the end of the loan term, reducing initial monthly costs but increasing risk at maturity. Fully amortizing loans require consistent payments covering both principal and interest throughout the loan period, ensuring the loan balance is zero at term-end and providing predictable budgeting for borrowers.

Balloon loan vs Fully amortizing loan Infographic

moneydif.com

moneydif.com