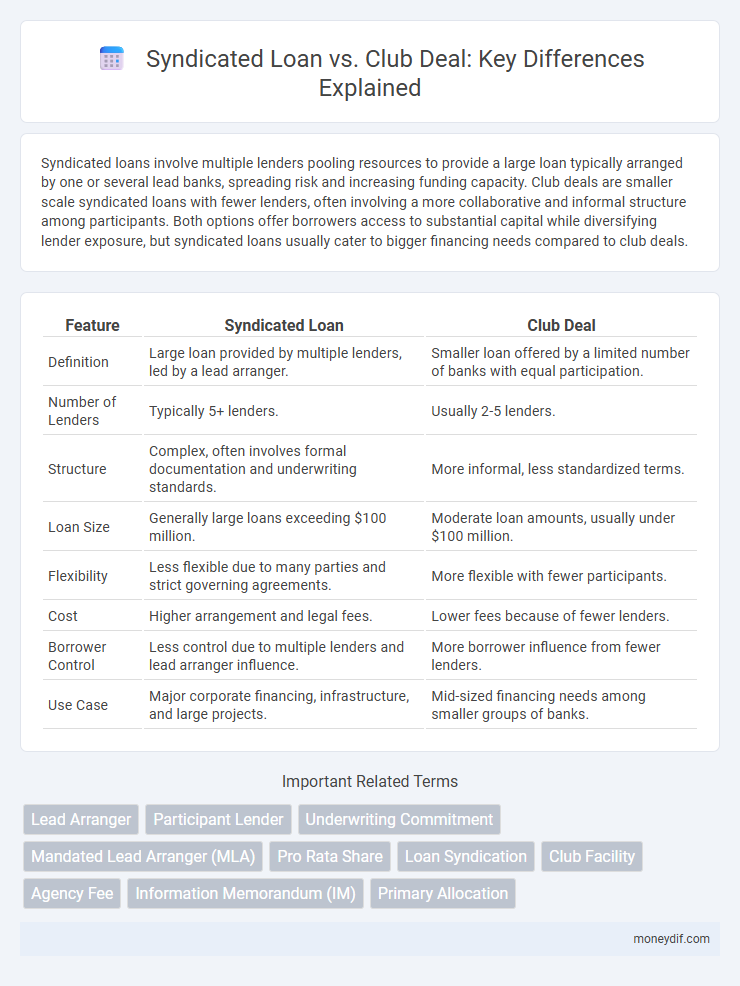

Syndicated loans involve multiple lenders pooling resources to provide a large loan typically arranged by one or several lead banks, spreading risk and increasing funding capacity. Club deals are smaller scale syndicated loans with fewer lenders, often involving a more collaborative and informal structure among participants. Both options offer borrowers access to substantial capital while diversifying lender exposure, but syndicated loans usually cater to bigger financing needs compared to club deals.

Table of Comparison

| Feature | Syndicated Loan | Club Deal |

|---|---|---|

| Definition | Large loan provided by multiple lenders, led by a lead arranger. | Smaller loan offered by a limited number of banks with equal participation. |

| Number of Lenders | Typically 5+ lenders. | Usually 2-5 lenders. |

| Structure | Complex, often involves formal documentation and underwriting standards. | More informal, less standardized terms. |

| Loan Size | Generally large loans exceeding $100 million. | Moderate loan amounts, usually under $100 million. |

| Flexibility | Less flexible due to many parties and strict governing agreements. | More flexible with fewer participants. |

| Cost | Higher arrangement and legal fees. | Lower fees because of fewer lenders. |

| Borrower Control | Less control due to multiple lenders and lead arranger influence. | More borrower influence from fewer lenders. |

| Use Case | Major corporate financing, infrastructure, and large projects. | Mid-sized financing needs among smaller groups of banks. |

Understanding Syndicated Loans: Key Features

Syndicated loans involve multiple lenders jointly providing funds to a single borrower, spreading risk and increasing loan amounts beyond individual lender capacity. Key features include a lead bank or arranger managing the loan process, standardized terms across participants, and shared collateral or security interests. Syndicated loans typically support large-scale financing needs such as infrastructure projects, acquisitions, or corporate expansions.

What is a Club Deal? Definition and Basics

A club deal is a type of syndicated loan where a small group of banks or financial institutions jointly provide financing to a borrower, sharing the risk and administration equally. Unlike larger syndicated loans involving many lenders, club deals typically involve fewer participants, making negotiations and decision-making more streamlined. This financing structure is commonly used for medium-sized transactions requiring close lender cooperation and coordination.

Structural Differences: Syndicated Loans vs Club Deals

Syndicated loans involve multiple lenders organized by one or more lead arrangers who structure and distribute the loan to a broad group of investors, offering a standardized and highly regulated financing solution. Club deals feature a smaller, more cohesive group of lenders collaborating closely with the borrower, often with fewer formalities and greater flexibility in loan structuring and amendment processes. The structural distinction lies in the syndication process scale and formality, where syndicated loans emphasize widespread distribution and uniform terms, while club deals prioritize partnership and tailored agreements among a limited lending group.

Participants and Roles: Banks and Financial Institutions

Syndicated loans typically involve a larger group of banks and financial institutions, with a lead arranger coordinating the loan structure and distribution of funds among participants. Club deals feature a smaller, more exclusive group of banks working collaboratively, sharing underwriting duties and loan management responsibilities more equally. Both structures allocate roles such as lead bank, agent bank, and participant banks to manage credit risk and administrative tasks efficiently.

Process Overview: How Syndicated Loans and Club Deals are Arranged

Syndicated loans are arranged through a lead bank or arranger who structures the loan and invites multiple lenders to participate, enabling risk distribution and larger funding amounts. Club deals involve a smaller group of banks or financial institutions, often with equal risk and decision-making responsibilities, making the negotiation process more collaborative and streamlined. Both processes require extensive due diligence, with syndicated loans typically involving more complex documentation due to the larger pool of lenders.

Risk Sharing and Allocation in Both Structures

Syndicated loans distribute credit risk among multiple lenders, enhancing risk diversification and reducing individual exposure through lead arrangers who structure and allocate portions of the loan. Club deals involve a smaller group of lenders collaboratively agreeing on terms, which often results in more balanced risk sharing but less liquidity compared to syndicated loans. Both structures optimize risk allocation by spreading default potential across participants, with syndicated loans favoring broader market involvement and club deals emphasizing closer lender cooperation.

Documentation and Legal Considerations

Syndicated loans involve extensive documentation detailing each lender's rights and responsibilities, often requiring standardized agreements to facilitate wide participation and regulatory compliance. Club deals feature simpler, more flexible legal documents negotiated among a limited group of lenders, allowing for tailored terms and quicker execution. Both structures demand thorough legal scrutiny to ensure clear allocation of risks, repayment terms, and adherence to applicable financial regulations.

Typical Borrower Profiles and Use Cases

Syndicated loans are typically utilized by large corporations or governments requiring substantial financing for major projects or acquisitions, benefiting from diversified lender risk and larger credit capacity. Club deals involve a smaller group of banks collaborating to provide medium-sized loans, often favored by mid-sized companies seeking flexible terms and closer lender relationships. Both structures suit varying borrower profiles, with syndicated loans ideal for high-value, complex financing and club deals for more modest, relationship-driven lending needs.

Cost Implications: Fees, Rates, and Expenses Compared

Syndicated loans generally entail higher fees and administrative costs due to the involvement of multiple lenders and complex coordination, making them more expensive than club deals. Club deals usually feature lower interest rates and reduced expenses since a smaller group of familiar lenders shares risk and simplifies negotiation processes. Borrowers opting for syndicated loans should expect increased underwriting fees, arrangement fees, and facility fees compared to the more cost-efficient, limited-fee structure of club deals.

Choosing Between a Syndicated Loan and a Club Deal

Choosing between a syndicated loan and a club deal depends on the borrower's financing needs, loan size, and complexity. Syndicated loans involve multiple lenders sharing the risk, suitable for large-scale financing requiring significant capital, while club deals typically consist of a smaller group of banks offering flexible terms and faster execution. Evaluating the cost, lender relationships, and negotiation power is crucial to determine the best option for optimal funding and risk distribution.

Important Terms

Lead Arranger

A Lead Arranger in syndicated loans coordinates multiple lenders to structure and distribute large-scale financing, whereas in club deals, the Lead Arranger manages a smaller, pre-selected group of lenders with more equal negotiation power.

Participant Lender

Participant lenders in syndicated loans collectively assume shared credit risk, whereas in club deals, a smaller group of lenders collaboratively manages the loan with more direct involvement and tailored agreements.

Underwriting Commitment

Underwriting commitment in syndicated loans involves a lead bank guaranteeing the entire loan amount, while in club deals, participating banks share underwriting responsibility without full commitment guarantees.

Mandated Lead Arranger (MLA)

The Mandated Lead Arranger (MLA) coordinates the syndication process in syndicated loans, structuring and distributing the loan among multiple lenders, whereas in club deals, the MLA facilitates a smaller group of lenders sharing equal risk and decision-making without extensive syndication.

Pro Rata Share

Pro Rata Share in syndicated loans refers to each lender's proportionate participation based on their committed capital, whereas in club deals, it often involves equal or negotiated shares among a smaller group of lenders.

Loan Syndication

Loan syndication involves multiple lenders jointly providing a syndicated loan, which differs from a club deal by having a larger, more diverse group of lenders and a more formalized structure.

Club Facility

A club facility typically involves a smaller group of lenders collaborating on a syndicated loan, offering more flexible terms and closer borrower-lender relationships compared to broader syndicated loans involving numerous participants.

Agency Fee

Agency fees in syndicated loans typically cover administrative and coordination services for multiple lenders, whereas club deals often feature lower or shared agency fees due to a smaller, more closely connected group of lenders.

Information Memorandum (IM)

An Information Memorandum (IM) in Syndicated Loans provides comprehensive details on the borrower and transaction to attract multiple lenders, while in a Club Deal it offers tailored information to a select group of pre-identified banks for shared loan participation.

Primary Allocation

Primary allocation in syndicated loans determines the distribution of loan portions among lenders, with syndicated loans typically involving a larger number of investors and club deals consisting of a smaller, pre-selected group of lenders sharing credit risk.

Syndicated Loan vs Club Deal Infographic

moneydif.com

moneydif.com