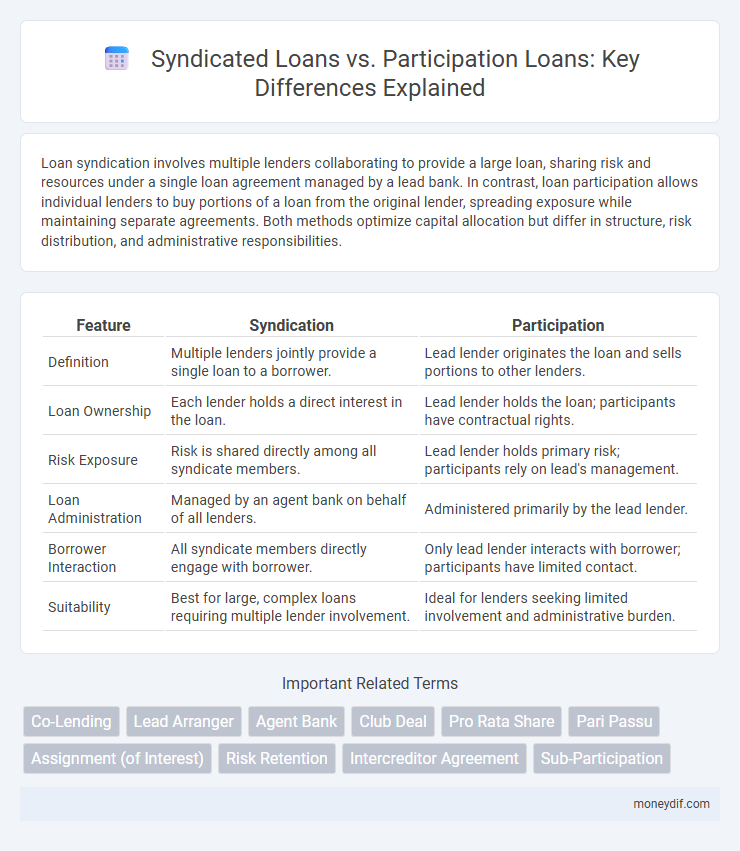

Loan syndication involves multiple lenders collaborating to provide a large loan, sharing risk and resources under a single loan agreement managed by a lead bank. In contrast, loan participation allows individual lenders to buy portions of a loan from the original lender, spreading exposure while maintaining separate agreements. Both methods optimize capital allocation but differ in structure, risk distribution, and administrative responsibilities.

Table of Comparison

| Feature | Syndication | Participation |

|---|---|---|

| Definition | Multiple lenders jointly provide a single loan to a borrower. | Lead lender originates the loan and sells portions to other lenders. |

| Loan Ownership | Each lender holds a direct interest in the loan. | Lead lender holds the loan; participants have contractual rights. |

| Risk Exposure | Risk is shared directly among all syndicate members. | Lead lender holds primary risk; participants rely on lead's management. |

| Loan Administration | Managed by an agent bank on behalf of all lenders. | Administered primarily by the lead lender. |

| Borrower Interaction | All syndicate members directly engage with borrower. | Only lead lender interacts with borrower; participants have limited contact. |

| Suitability | Best for large, complex loans requiring multiple lender involvement. | Ideal for lenders seeking limited involvement and administrative burden. |

Understanding Loan Syndication: Key Features

Loan syndication involves multiple lenders pooling resources to provide a large loan to a single borrower, distributing the risk and enhancing lending capacity. Key features include a lead arranger who structures the deal, standardized loan documentation, and an agreed interest rate and repayment schedule among participants. This collaborative approach enables more efficient capital allocation and risk management compared to loan participation, where a single lender sells portions of the loan without active involvement in administration.

What is Loan Participation? An Overview

Loan participation involves multiple lenders sharing a single loan agreement, where one lender, the lead bank, originates and services the loan while other participants contribute portions of the loan amount. This arrangement allows financial institutions to diversify credit risk and increase lending capacity without assuming the entire exposure. Unlike syndication, loan participation typically lacks direct contractual relationships between participants and the borrower, relying instead on the lead lender's management.

Core Differences: Syndication vs Participation

Syndication involves a group of lenders jointly providing a large loan to a single borrower, with each lender directly liable for their portion, while participation features a lead lender originating the loan and selling portions to participants without transferring borrower liability. Syndicated loans typically have shared documentation and direct relationships between each lender and the borrower, whereas participations involve the lead lender maintaining the borrower relationship and handling loan servicing. The core difference lies in risk and control allocation: syndication distributes borrower credit risk evenly among lenders, whereas participation concentrates credit risk with the lead lender, with participants relying on it for payment flow.

Structure and Process of Loan Syndication

Loan syndication involves a structured process where a lead arranger coordinates multiple lenders to provide a large loan, distributing risk and capital. This structure includes a formal agreement with shared terms, a lead bank managing administration, and simultaneous funding by all syndicate members. Loan participation, by contrast, typically features a single lender extending a loan and selling portions of the loan to other institutions without direct involvement in administration.

Structure and Process of Loan Participation

Loan participation involves multiple lenders sharing portions of a single loan made by a lead bank, where the lead bank originates, structures, and manages the loan, while participants purchase interests without direct interaction with the borrower. The lead bank retains the primary relationship with the borrower, handles servicing, and ensures covenant compliance, whereas participants rely on the lead for information and repayment. This structure allows participants to diversify risk and increase lending capacity while maintaining operational simplicity by avoiding involvement in credit administration.

Risk Distribution in Syndication and Participation

Syndication involves multiple lenders jointly providing portions of a loan, enabling shared credit risk and diversified exposure across the syndicate members. Participation allows a lead lender to issue the loan while transferring portions of the credit risk to participants, although the lead retains primary responsibility for the borrower relationship. Risk distribution in syndication is more transparent and structured, as each lender has a direct contractual agreement with the borrower, whereas participation relies on internal agreements among lenders, creating varying degrees of risk and control.

Roles and Responsibilities of Lenders

In loan syndication, the lead lender arranges the financing, manages negotiations, and coordinates communication while participant lenders provide portions of the loan without direct involvement in administration. Participant lenders in loan participation acquire interests from the lead lender, sharing in repayments and risks but having limited control over borrower interactions. Syndicated loan structures centralize responsibilities with the agent bank, whereas participation loans distribute risk without centralized borrower management.

Legal and Documentation Considerations

Syndication involves a lead bank structuring the deal and drafting a comprehensive loan agreement binding all participants, ensuring uniform legal obligations and streamlined documentation. Participation transactions feature a lead lender entering into a loan agreement with the borrower and separate participation agreements with other lenders, creating distinct legal relationships and potentially increasing documentation complexity. Careful attention to governing law, enforceability, and the allocation of rights and obligations is essential to mitigate risks in both syndication and participation structures.

Pros and Cons: Syndication vs Participation

Syndication offers diversified risk among multiple lenders, enhancing loan capacity for large projects but involves complex coordination and higher administrative costs. Participation loans allow original lenders to retain client relationships while sharing risk, yet participants have limited control and transparency over loan management. Assessing syndication versus participation requires balancing risk distribution, administrative complexity, and control over loan servicing.

Choosing the Right Approach for Your Lending Needs

Syndication involves multiple lenders jointly providing a large loan, distributing risk and capital requirements while maintaining a single agreement with the borrower. Participation allows one lender to originate the loan and then sell portions to other lenders, offering flexibility but with more complex borrower-lender relationships. Selecting the right approach depends on factors like loan size, risk tolerance, relationship management, and regulatory considerations to optimize lending outcomes.

Important Terms

Co-Lending

Co-lending involves multiple lenders jointly providing a loan to a single borrower, distinguishing itself from syndication where each lender holds a direct contractual relationship with the borrower. Participation, by contrast, features a lead lender extending the loan initially and selling portions of it to participants, who do not have a direct relationship with the borrower.

Lead Arranger

A Lead Arranger plays a crucial role in structuring and coordinating syndicated loans by assembling a consortium of lenders and negotiating key terms, enhancing the efficiency of large-scale financing. In contrast, loan participation involves individual lenders purchasing portions of an existing loan without leading the negotiation or structuring process, highlighting the Lead Arranger's pivotal function in syndication.

Agent Bank

Agent bank plays a crucial role in loan syndication by coordinating communication between lenders and borrowers, managing the distribution of funds and repayments, and ensuring compliance with the loan agreement. In contrast, participation involves individual lenders sharing portions of a loan with other financial institutions without direct management, while the agent bank oversees the syndicate's collective interests and administrative duties.

Club Deal

Club Deal structures involve a small group of investors pooling capital to jointly invest in a single asset, offering more control and aligned interests compared to broader syndication models. Syndication distributes investment risk across numerous parties through intermediated participation, while participation agreements allow passive investors to gain exposure without direct involvement in management decisions.

Pro Rata Share

Pro Rata Share defines the proportional ownership interest an investor holds in a syndicated deal, reflecting their specific percentage contribution to the total investment. In syndication, this share directly influences profit distribution and decision-making authority, whereas in participation agreements, the investor's share may only entitle them to cash flow without voting rights or control.

Pari Passu

Pari Passu in syndication ensures all lenders share equal rights and risks across a single loan facility, optimizing borrower terms and minimizing creditor disputes. In contrast, participation involves a lead bank retaining primary exposure while participant banks hold subordinate claims, affecting credit risk distribution and recovery priority.

Assignment (of Interest)

Assignment of interest transfers full ownership of loan rights from the assignor to the assignee, enabling the latter to receive loan repayments and enforce loan terms. Syndication involves multiple lenders jointly funding a large loan while loan participation allows a lender to share in a loan's risks and returns without transferring ownership.

Risk Retention

Risk retention involves the portion of a loan or exposure a lender keeps on their balance sheet to align interests with investors; in syndication, the lead arranger retains a defined risk share while distributing portions to other lenders, whereas in participation, the originating lender transfers both risk and servicing responsibilities, resulting in less direct exposure. Syndication typically supports larger deals with shared risk among multiple banks, whereas participation allows lenders to manage risk more flexibly without direct credit exposure on their books.

Intercreditor Agreement

An Intercreditor Agreement governs the rights and priorities between multiple lenders in syndicated loans, ensuring clear debt servicing order and collateral claims, whereas Participation agreements involve a primary lender selling portions of a loan to participants without altering the underlying borrower-lender contract. Syndication typically entails direct contractual relationships with multiple lenders under a shared credit facility, while Participation creates indirect lender involvement through loan transfers, impacting risk allocation and enforcement rights.

Sub-Participation

Sub-participation involves a lender transferring credit risk to another party without notifying the borrower, differing from syndication where multiple lenders jointly fund a loan with the borrower's knowledge. Syndication allows direct relationships between the borrower and each lender, while sub-participation maintains the original lender as the sole borrower contact, optimizing risk distribution discreetly.

Syndication vs Participation Infographic

moneydif.com

moneydif.com