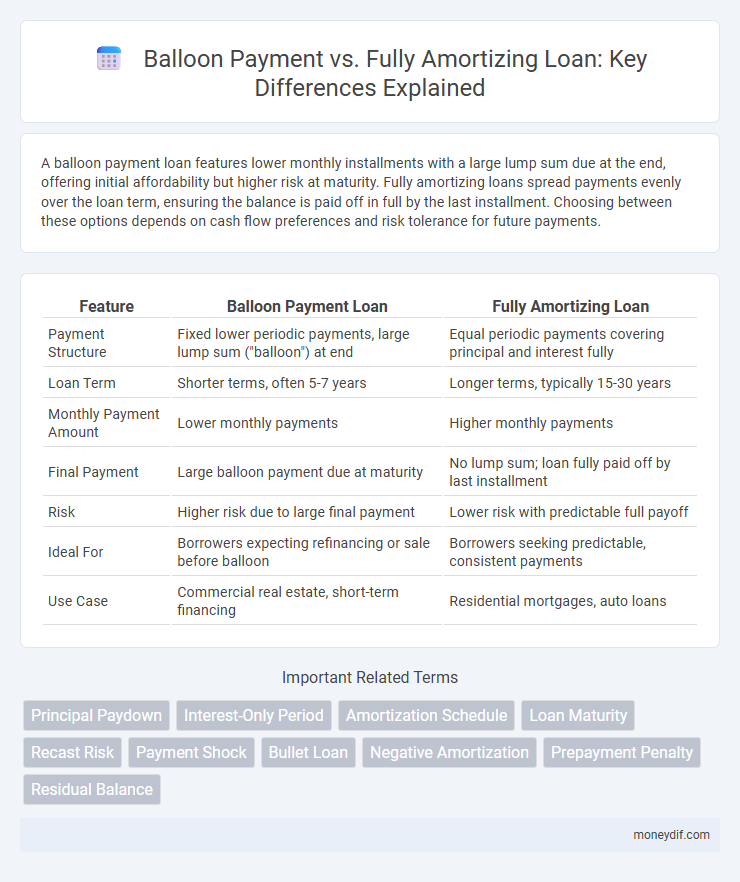

A balloon payment loan features lower monthly installments with a large lump sum due at the end, offering initial affordability but higher risk at maturity. Fully amortizing loans spread payments evenly over the loan term, ensuring the balance is paid off in full by the last installment. Choosing between these options depends on cash flow preferences and risk tolerance for future payments.

Table of Comparison

| Feature | Balloon Payment Loan | Fully Amortizing Loan |

|---|---|---|

| Payment Structure | Fixed lower periodic payments, large lump sum ("balloon") at end | Equal periodic payments covering principal and interest fully |

| Loan Term | Shorter terms, often 5-7 years | Longer terms, typically 15-30 years |

| Monthly Payment Amount | Lower monthly payments | Higher monthly payments |

| Final Payment | Large balloon payment due at maturity | No lump sum; loan fully paid off by last installment |

| Risk | Higher risk due to large final payment | Lower risk with predictable full payoff |

| Ideal For | Borrowers expecting refinancing or sale before balloon | Borrowers seeking predictable, consistent payments |

| Use Case | Commercial real estate, short-term financing | Residential mortgages, auto loans |

Understanding Balloon Payments in Loans

A balloon payment in loans refers to a large, lump-sum payment due at the end of the loan term, significantly larger than the regular monthly installments. Unlike fully amortizing loans where payments gradually repay both principal and interest over time, balloon loans have lower monthly payments followed by a substantial final payment. Understanding balloon payments is crucial for borrowers to plan for refinancing or ensuring they have sufficient funds to cover this final obligation.

What Is a Fully Amortizing Loan?

A fully amortizing loan is a type of loan where the borrower makes regular payments that cover both principal and interest, resulting in the loan being completely paid off by the end of the term. Each payment reduces the principal balance, ensuring no remaining balance or lump sum payment is due at maturity. This contrasts with a balloon payment loan, which requires a large final payment after smaller periodic payments.

Key Differences: Balloon vs Fully Amortizing Loans

Balloon loans require a large lump-sum payment at the end of the term, while fully amortizing loans have equal payments that cover both principal and interest, resulting in full repayment by maturity. Balloon payments often lead to refinancing risks due to the significant final payment, whereas fully amortizing loans provide predictable monthly payments and reduce default risk. The key difference lies in cash flow structure: balloon loans offer lower initial payments but higher end-term costs, contrasting with the steady repayment schedule of fully amortizing loans.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower initial monthly payments compared to fully amortizing loans, making them attractive for borrowers seeking short-term cash flow flexibility. The major drawback is the large lump-sum payment due at the end of the loan term, which can pose refinancing risks or financial strain if the borrower is unprepared. Balloon loans are ideal for borrowers expecting increased income or planning to sell or refinance before the balloon payment is due.

Pros and Cons of Fully Amortizing Loans

Fully amortizing loans provide consistent monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the term, which offers predictable budgeting and reduces the risk of large final payments. However, these loans typically have higher monthly payments compared to balloon payment loans, potentially limiting cash flow flexibility for borrowers. Fully amortizing loans are ideal for those seeking financial stability and long-term debt elimination without the surprise burden of a lump-sum payment.

How Repayment Schedules Differ

Balloon payment loans feature a repayment schedule with lower monthly payments and a large lump-sum payment due at the end of the term, contrasting with fully amortizing loans that require equal monthly payments covering both principal and interest until the balance is zero. This structure in balloon loans reduces monthly financial burden but introduces higher risk at maturity due to the sizable final payment. Fully amortizing schedules provide predictability and gradual debt reduction, making them preferable for borrowers seeking stable, long-term repayment plans.

Impact on Monthly Payments and Cash Flow

Balloon payment loans feature lower monthly payments during the term but require a large lump-sum payment at maturity, significantly impacting cash flow at that point. Fully amortizing loans spread principal and interest evenly over the loan term, resulting in higher monthly payments but no large final payment, providing predictable cash flow. Borrowers seeking short-term cash flow relief may prefer balloon loans, while those desiring steady monthly expenses and full loan payoff by term-end benefit from fully amortizing loans.

Risks Associated with Balloon Payment Loans

Balloon payment loans carry significant risks due to the large lump sum required at the end of the loan term, which can lead to financial strain or refinancing challenges if the borrower lacks sufficient funds. Unlike fully amortizing loans that spread principal and interest payments evenly over the loan period, balloon loans expose borrowers to the risk of default or forced asset liquidation when the balloon payment becomes due. Market fluctuations and tightening credit conditions further increase the uncertainty and potential difficulty in managing balloon payment obligations.

Choosing the Right Loan Structure for Your Needs

Balloon payment loans offer lower initial monthly payments but require a large lump-sum payment at the end of the term, ideal for borrowers expecting a future influx of cash. Fully amortizing loans spread payments evenly over the loan period, ensuring the balance is paid off by the end, providing predictable budgeting and reduced financial risk. Selecting the right loan structure depends on your cash flow stability, future income expectations, and tolerance for payment fluctuations throughout the loan term.

Frequently Asked Questions: Balloon vs Amortizing Loans

Balloon loans require a large lump-sum payment at the end of the term, whereas fully amortizing loans spread payments evenly to cover both principal and interest by maturity. Borrowers often ask how balloon payments affect monthly affordability, with balloon loans typically offering lower initial payments but higher risk due to the final payment amount. Fully amortizing loans provide predictable monthly payments, making them easier to budget for without a substantial payment due at the end.

Important Terms

Principal Paydown

Principal paydown refers to the gradual reduction of the loan's outstanding principal balance through scheduled payments, which is a key characteristic of fully amortizing loans where each payment covers both interest and principal. In contrast, balloon payments involve minimal principal paydown during the loan term, resulting in a large lump-sum payment due at maturity to cover the remaining principal balance.

Interest-Only Period

The interest-only period allows borrowers to pay only interest for a set time, resulting in lower initial payments but a large balloon payment at the end of the term. In contrast, fully amortizing loans require equal payments of principal and interest throughout the loan term, eliminating the risk of a balloon payment by fully repaying the loan balance by maturity.

Amortization Schedule

An amortization schedule outlines each loan payment's principal and interest portions over time, highlighting differences between fully amortizing loans, which pay off the entire balance by maturity, and balloon payment loans, where a large lump sum remains due at the end. Balloon payment loans feature smaller periodic payments but require managing a significant final payment, while fully amortizing loans evenly distribute payments, reducing risk of large outstanding balances.

Loan Maturity

Loan maturity defines the end date when the borrower must repay the loan, with a balloon payment involving a large lump sum due at maturity after smaller periodic payments, whereas a fully amortizing loan requires equal installments covering both principal and interest, eliminating any remaining balance at maturity. Balloon payment loans often have shorter maturities and lower monthly payments, while fully amortizing loans provide predictable payments with no large final payment, significantly affecting borrower cash flow and loan risk management.

Recast Risk

Recast risk arises when a balloon payment is not refinanced or paid off at maturity, causing borrowers to face a large lump-sum payment that can strain cash flow compared to fully amortizing loans, where payments are spread evenly over the loan term. Lenders and borrowers must evaluate recast risk carefully to manage potential refinancing challenges and avoid financial stress from sudden payment increases.

Payment Shock

Payment shock occurs when a borrower faces a sudden increase in monthly payments, often triggered by a balloon payment due at the end of a loan term, unlike fully amortizing loans where payments remain consistent throughout. Balloon payments create a lump-sum balance that can strain finances, while fully amortizing loans gradually pay down principal and interest, minimizing payment volatility.

Bullet Loan

A Bullet Loan requires a single lump sum payment of principal at maturity, making it distinct from Fully Amortizing Loans that spread principal and interest payments over the loan term. Balloon Payments occur in partially amortizing loans where smaller periodic payments are made, but a large remaining principal balance is due at the end, differing from both Bullet Loans and fully amortizing structures.

Negative Amortization

Negative amortization occurs when loan payments are insufficient to cover the interest, causing the principal balance to increase, commonly seen in loans with balloon payments where a large sum is due at maturity. Fully amortizing loans avoid negative amortization by structuring payments to cover both interest and principal evenly, ensuring the loan is paid off by the end of the term.

Prepayment Penalty

Prepayment penalties often apply in loan agreements with balloon payments, where the borrower faces fees for early payoff before the lump sum is due, contrasting with fully amortizing loans that gradually reduce principal and typically lack such penalties. Balloon payment loans carry higher prepayment risk for lenders, incentivizing penalties to protect anticipated interest income not spread evenly over time as in fully amortized loans.

Residual Balance

Residual balance refers to the outstanding loan amount remaining after scheduled payments, often associated with balloon payments where the borrower must pay the large final sum. In contrast, fully amortizing loans gradually reduce the principal through equal payments, resulting in a zero residual balance at maturity.

Balloon Payment vs Fully Amortizing Infographic

moneydif.com

moneydif.com