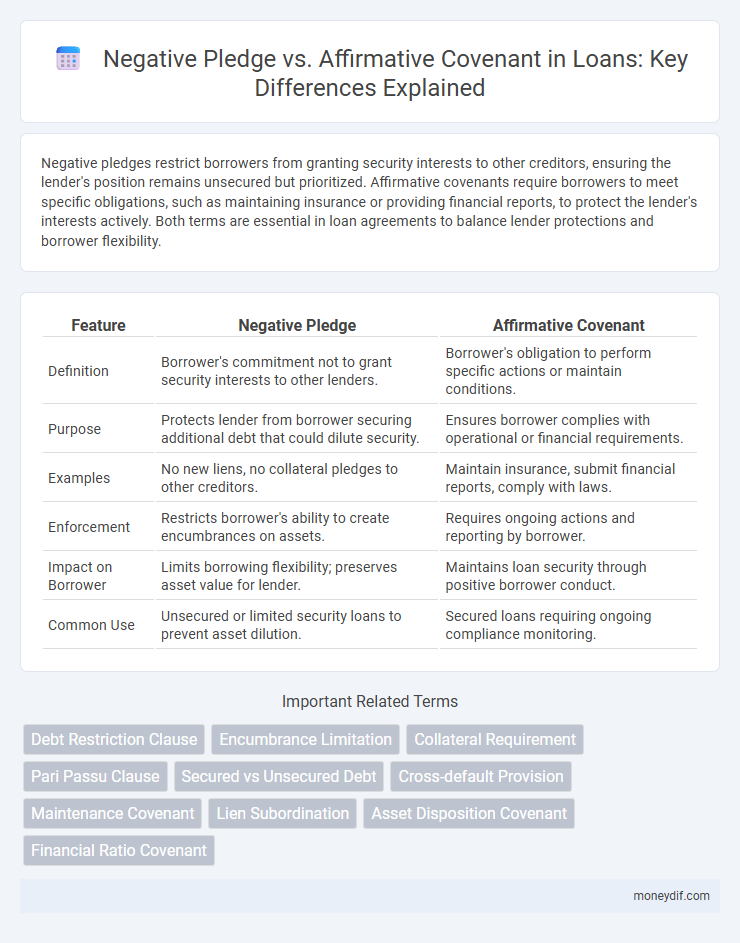

Negative pledges restrict borrowers from granting security interests to other creditors, ensuring the lender's position remains unsecured but prioritized. Affirmative covenants require borrowers to meet specific obligations, such as maintaining insurance or providing financial reports, to protect the lender's interests actively. Both terms are essential in loan agreements to balance lender protections and borrower flexibility.

Table of Comparison

| Feature | Negative Pledge | Affirmative Covenant |

|---|---|---|

| Definition | Borrower's commitment not to grant security interests to other lenders. | Borrower's obligation to perform specific actions or maintain conditions. |

| Purpose | Protects lender from borrower securing additional debt that could dilute security. | Ensures borrower complies with operational or financial requirements. |

| Examples | No new liens, no collateral pledges to other creditors. | Maintain insurance, submit financial reports, comply with laws. |

| Enforcement | Restricts borrower's ability to create encumbrances on assets. | Requires ongoing actions and reporting by borrower. |

| Impact on Borrower | Limits borrowing flexibility; preserves asset value for lender. | Maintains loan security through positive borrower conduct. |

| Common Use | Unsecured or limited security loans to prevent asset dilution. | Secured loans requiring ongoing compliance monitoring. |

Understanding Negative Pledge in Loan Agreements

Negative pledge clauses in loan agreements prohibit the borrower from creating security interests over specified assets to protect lenders' priority claims without outright restricting all future financing options. This provision ensures that the borrower does not pledge collateral to other creditors that could subordinate the existing lender's rights, maintaining the lender's unsecured claim status. Understanding the scope and limitations of negative pledges is essential for borrowers and lenders to balance credit flexibility with adequate risk protection.

Defining Affirmative Covenant: Key Features

An affirmative covenant in a loan agreement requires the borrower to actively maintain specific obligations, such as timely financial reporting and maintaining insurance coverage. These covenants ensure proactive compliance and safeguard the lender's interests by mandating actions that support the stability and transparency of the borrower's financial status. Unlike negative pledges that restrict certain borrower activities, affirmative covenants compel ongoing operational responsibilities to mitigate risk.

Negative Pledge vs Affirmative Covenant: Core Differences

Negative pledge restricts a borrower from creating additional liens on assets, ensuring lenders maintain priority without requiring active obligations. Affirmative covenant mandates the borrower to perform specific actions such as maintaining insurance or submitting financial reports, actively safeguarding lender interests. The core difference lies in negative pledges limiting borrower actions passively, while affirmative covenants impose proactive duties.

Legal Implications for Borrowers

Negative pledge clauses restrict borrowers from creating security interests that could subordinate the lender's claim, protecting lender priority but limiting the borrower's ability to leverage assets. Affirmative covenants require borrowers to take specific actions, such as maintaining insurance or providing financial reports, imposing ongoing operational obligations to ensure loan compliance. Legal implications for borrowers include potential default risks and reduced financial flexibility under negative pledges, while affirmative covenants demand strict adherence to stipulated duties, with breaches possibly triggering loan acceleration or penalties.

Impact on Lender Security and Risk

Negative pledges restrict the borrower from granting security interests to other creditors, preserving the lender's priority and reducing the risk of asset encumbrance. Affirmative covenants require the borrower to take specific actions, such as maintaining insurance or financial ratios, which proactively protect the lender's interests and reduce credit risk. While negative pledges limit competition for collateral, affirmative covenants enhance ongoing risk management through borrower compliance obligations.

Common Examples in Loan Contracts

Negative pledges in loan contracts commonly restrict borrowers from granting security interests over assets, preventing collateralization that could disadvantage lenders. Affirmative covenants typically require borrowers to maintain financial ratios, provide regular financial statements, and ensure compliance with laws. Both clauses are designed to protect lender interests but function differently: negative pledges limit borrower actions, while affirmative covenants impose positive obligations.

Enforcement Mechanisms for Covenants

Enforcement mechanisms for negative pledges primarily involve preventing the borrower from granting security interests that could jeopardize the lender's priority, with remedies including injunctions and acceleration clauses if breaches occur. Affirmative covenants require the borrower to take specific actions, such as maintaining insurance or providing regular financial reports, with enforcement relying on monitoring compliance and triggering events like defaults or penalties upon non-fulfillment. Lenders commonly negotiate both types of covenants to secure their interests, using contractual terms specifying enforcement procedures and consequences to mitigate credit risks.

Negotiating Loan Terms: Borrower Strategies

Borrowers emphasize negotiating loan terms by carefully balancing negative pledge clauses, which restrict asset sales to protect lenders, against affirmative covenants that require specific borrower actions like maintaining financial ratios. Strong borrower strategies include proposing flexible negative pledge terms to preserve asset management freedom while ensuring affirmative covenants are realistic and aligned with business operations. Effective negotiation reduces risk of defaults and enhances loan affordability by tailoring covenants to the borrower's cash flow and growth projections.

Risks of Covenant Breach and Remedies

Negative pledge clauses limit the borrower from creating additional liens, reducing the risk of creditor priority disputes, while affirmative covenants require specific actions such as maintaining financial ratios, directly impacting the borrower's operational conduct. Breaching a negative pledge can lead to accelerated loan repayment demands to protect lender interests, whereas violating affirmative covenants often results in penalties, increased monitoring, or restructuring of loan terms. Remedies for covenant breaches typically include waiver negotiations, enforcement of default provisions, or litigation to secure lender claims and preserve creditworthiness.

Best Practices for Structuring Loan Covenants

Best practices for structuring loan covenants involve clearly distinguishing between negative pledges and affirmative covenants to protect lender interests while maintaining borrower flexibility. Negative pledges prevent borrowers from encumbering assets without lender consent, ensuring priority security, whereas affirmative covenants require borrowers to meet specific financial metrics and reporting obligations for ongoing creditworthiness monitoring. Crafting tailored covenants based on borrower risk profiles and industry norms optimizes risk management and facilitates transparent communication throughout the loan lifecycle.

Important Terms

Debt Restriction Clause

The Debt Restriction Clause limits additional borrowing by imposing a Negative Pledge preventing collateral grants, while an Affirmative Covenant requires specific actions to maintain financial health and compliance.

Encumbrance Limitation

Encumbrance limitation restricts asset liens to maintain borrower solvency, where negative pledges prohibit additional liens on specified assets and affirmative covenants require specific actions to preserve asset value and prevent encumbrances.

Collateral Requirement

Negative pledge restricts a borrower from granting security interests to others, reducing collateral requirements, while affirmative covenants may mandate specific collateral provisions to protect lender interests.

Pari Passu Clause

The Pari Passu clause ensures equal ranking of debt obligations, preventing negative pledges from subordinating debt while affirmative covenants impose specific performance obligations on the borrower.

Secured vs Unsecured Debt

Secured debt involves affirmative covenants that ensure asset collateralization, while unsecured debt often relies on negative pledge clauses to prevent the borrower from pledging assets to other creditors.

Cross-default Provision

A cross-default provision triggers a default if a borrower defaults on any related debt, while a negative pledge restricts asset liens to protect creditors, and an affirmative covenant requires the borrower to take specific actions to maintain compliance.

Maintenance Covenant

A Maintenance Covenant requires the borrower to uphold specific financial ratios or operational conditions, contrasting with a Negative Pledge that restricts collateral grants, while an Affirmative Covenant mandates proactive actions such as asset upkeep or insurance maintenance.

Lien Subordination

Lien subordination strategically prioritizes creditor claims by ranking lienholder rights below those secured by affirmative covenants, contrasting with negative pledge clauses that restrict liens without establishing priority.

Asset Disposition Covenant

An Asset Disposition Covenant restricts the sale or transfer of key assets as a Negative Pledge to prevent value erosion, while an Affirmative Covenant requires maintaining or disposing of assets under specific conditions to protect creditor interests.

Financial Ratio Covenant

A Financial Ratio Covenant restricts borrower actions by requiring specific financial metrics, while a Negative Pledge prevents asset liens and an Affirmative Covenant mandates proactive borrower obligations.

Negative Pledge vs Affirmative Covenant Infographic

moneydif.com

moneydif.com