Callable loans allow the lender to demand full repayment before the scheduled maturity date, offering flexibility but potentially higher risk for the borrower. Bullet loans require the borrower to pay the entire principal amount in one lump sum at the end of the term, simplifying repayment but concentrating payment risk at maturity. Understanding the differences between callable and bullet loans helps borrowers and lenders manage cash flow and risk effectively.

Table of Comparison

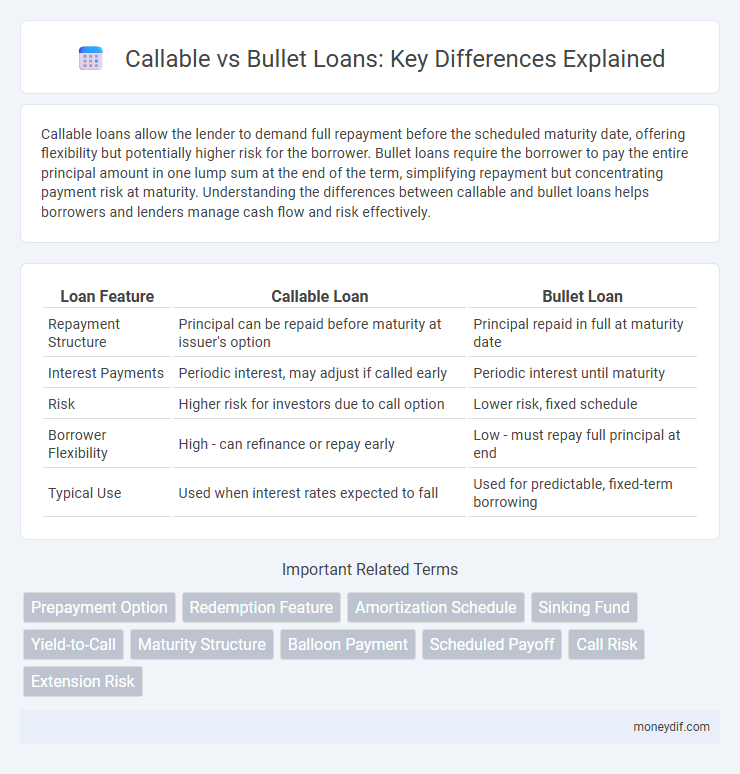

| Loan Feature | Callable Loan | Bullet Loan |

|---|---|---|

| Repayment Structure | Principal can be repaid before maturity at issuer's option | Principal repaid in full at maturity date |

| Interest Payments | Periodic interest, may adjust if called early | Periodic interest until maturity |

| Risk | Higher risk for investors due to call option | Lower risk, fixed schedule |

| Borrower Flexibility | High - can refinance or repay early | Low - must repay full principal at end |

| Typical Use | Used when interest rates expected to fall | Used for predictable, fixed-term borrowing |

Definition of Callable and Bullet Loans

Callable loans allow the lender to demand full repayment before the maturity date, providing flexibility in managing credit risk and interest-rate fluctuations. Bullet loans require the borrower to repay the entire principal amount in a single lump sum at the loan's maturity, minimizing interim payments and simplifying cash flow management. Understanding the distinction between callable and bullet loans is essential for borrowers and lenders to assess repayment schedules and financial risk effectively.

Key Differences Between Callable and Bullet Loans

Callable loans allow borrowers to repay the loan before the maturity date without penalties, offering flexibility but often higher interest rates. Bullet loans require a single lump-sum payment of principal at maturity, with interest typically paid periodically, resulting in lower regular payments but a large final obligation. The key difference lies in repayment structure, risk allocation, and cost, where callable loans transfer prepayment risk to the lender, while bullet loans concentrate repayment risk at maturity.

Advantages of Callable Loans

Callable loans offer borrowers enhanced flexibility by allowing early repayment without penalties, enabling management of debt according to changing financial conditions. These loans can reduce interest costs if the borrower calls the loan when market rates decline, benefiting from potential refinancing opportunities. Lenders may also perceive callable loans as lower risk, given the borrower's option to repay early, which can result in more favorable terms.

Advantages of Bullet Loans

Bullet loans offer borrowers the advantage of lower periodic payments since the principal is repaid in a lump sum at maturity, improving short-term cash flow management. These loans typically have simpler amortization schedules and fewer complications compared to callable loans, which may be subject to early repayment risk by lenders. Bullet loans are ideal for borrowers expecting significant future cash inflows or refinancing opportunities at loan maturity, providing financial flexibility.

Risks Associated with Callable Loans

Callable loans carry the risk of unpredictability in repayment schedules, as lenders can demand early repayment, potentially disrupting borrowers' financial planning. This interest rate risk may lead to refinancing challenges or increased costs if rates rise unexpectedly. In contrast, bullet loans feature a fixed maturity date with a lump sum repayment, reducing the uncertainty but concentrating the repayment risk at one point in time.

Risks Associated with Bullet Loans

Bullet loans carry significant risks, including the obligation to repay the entire principal at maturity, which can lead to cash flow challenges or refinancing risks if the borrower cannot secure new financing. The absence of periodic principal payments increases the risk of default, especially if market conditions deteriorate or the borrower's financial situation weakens. Investors face heightened credit risk and potential volatility, as bullet loans lack intermediate repayments that could mitigate losses during economic downturns.

Suitable Borrowers for Callable vs Bullet Loans

Callable loans are suitable for borrowers expecting fluctuating cash flow or potential refinancing opportunities, allowing them to repay early without penalties. Bullet loans fit borrowers with a lump sum repayment plan, typically those anticipating a large cash inflow at maturity, such as from asset sales or investment returns. Choosing between callable and bullet loans depends on the borrower's financial flexibility and repayment strategy.

Callable vs Bullet Loan Repayment Structures

Callable loan repayment structures allow lenders to demand early repayment before the maturity date, providing flexibility to manage interest rate risks or capitalize on favorable market conditions. Bullet loan repayment structures involve a single lump-sum payment of the principal at maturity, with periodic interest payments made throughout the loan term, minimizing interim cash outflows for the borrower. Callable loans typically carry higher interest rates due to the embedded option, while bullet loans often suit borrowers seeking predictable payment schedules and lower refinancing risk.

Impact on Interest Rates: Callable vs Bullet

Callable loans typically carry higher interest rates compared to bullet loans due to the issuer's option to repay early, which increases uncertainty and risk for lenders. Bullet loans offer fixed interest rates until maturity, providing predictable cash flows and generally lower rates since the repayment schedule is certain. Lenders price callable loans with a premium to compensate for potential reinvestment risk when loans are called before maturity.

Which is Better: Callable or Bullet Loans?

Callable loans offer lenders the flexibility to demand early repayment, often resulting in higher interest rates to compensate for this risk. Bullet loans require the borrower to pay the entire principal at maturity, typically featuring lower interest rates but increased repayment pressure at the end of the term. Borrowers seeking predictability and lower periodic payments may prefer bullet loans, while those valuing flexibility might consider callable loans despite their potential cost premium.

Important Terms

Prepayment Option

The prepayment option allows borrowers to repay a loan before its maturity, typically associated with callable bonds that can be redeemed by the issuer prior to the agreed date, offering flexibility but often at a premium. In contrast, bullet bonds have no prepayment option, requiring full principal repayment at maturity, which provides predictability but less issuer flexibility.

Redemption Feature

The redemption feature in callable bonds allows issuers to repay the principal before maturity, providing flexibility to refinance at lower interest rates, whereas bullet bonds lack this option, requiring full repayment only at maturity. Callable bonds typically offer higher yields to compensate investors for call risk, while bullet bonds carry lower yields due to their fixed maturity date and reduced reinvestment risk.

Amortization Schedule

An amortization schedule for callable bonds includes potential early repayment dates, impacting the principal and interest payments timeline compared to a bullet bond, which repays the entire principal at maturity without interim reductions. Callable bonds often feature fluctuating cash flows reflected in the amortization schedule, while bullet bonds maintain consistent interest payments until a lump-sum principal repayment.

Sinking Fund

A sinking fund is a strategic reserve used by issuers to gradually repay callable bonds before maturity, reducing credit risk and potentially lowering interest costs compared to bullet bonds, which require full repayment at maturity without interim principal reductions. Callable bonds with sinking funds offer investors partial liquidity and issuer flexibility, while bullet bonds expose investors to higher duration and reinvestment risk.

Yield-to-Call

Yield-to-Call measures the return on a callable bond assuming it is redeemed by the issuer before maturity, typically at the call date, contrasting with bullet bonds which do not have call provisions and therefore yield-to-maturity calculations remain applicable. Callable bonds present reinvestment risk and potential price volatility due to the issuer's option to redeem early, whereas bullet bonds provide predictable cash flows and no call risk, impacting investor yield expectations.

Maturity Structure

Maturity structure in callable bonds includes options for issuers to redeem the debt before the final maturity date, providing flexibility and potentially higher yields due to call risk premiums, while bullet bonds have fixed maturity dates with no early redemption options, offering predictable cash flows and lower reinvestment risk. The choice between callable and bullet maturity structures significantly impacts interest rate risk, refinancing strategies, and investor return profiles within fixed-income portfolios.

Balloon Payment

Balloon payment refers to a large, lump-sum payment due at the end of a loan term, often seen in callable loans where issuers can redeem the debt before maturity, contrasting with bullet loans that require a single, full repayment without early redemption options. Callable loans provide flexibility to issuers to refinance or repay early, while bullet loans focus on a fixed maturity payment, making balloon payments critical in managing refinancing risk.

Scheduled Payoff

Scheduled payoff refers to the predetermined timeline for repaying a debt instrument, typically seen in bullet structures where the principal is paid at maturity. Callable bonds, however, allow the issuer to repay the debt before the scheduled payoff date, providing flexibility but potentially affecting yield and investment duration.

Call Risk

Call risk refers to the potential for a bond issuer to redeem a callable bond before its maturity date, typically when interest rates decline, causing investors to lose out on future interest payments. In contrast, bullet bonds have no call provisions, providing investors with predictable cash flows and protection from call risk throughout the bond's term.

Extension Risk

Extension risk occurs when callable bonds are not redeemed by the issuer as expected, causing investors to hold the bond longer than anticipated, exposing them to potential interest rate declines. Bullet bonds, lacking call features, eliminate extension risk but trade off flexibility for issuers, making callable bonds more sensitive to changes in interest rates and refinancing behavior.

Callable vs Bullet Infographic

moneydif.com

moneydif.com