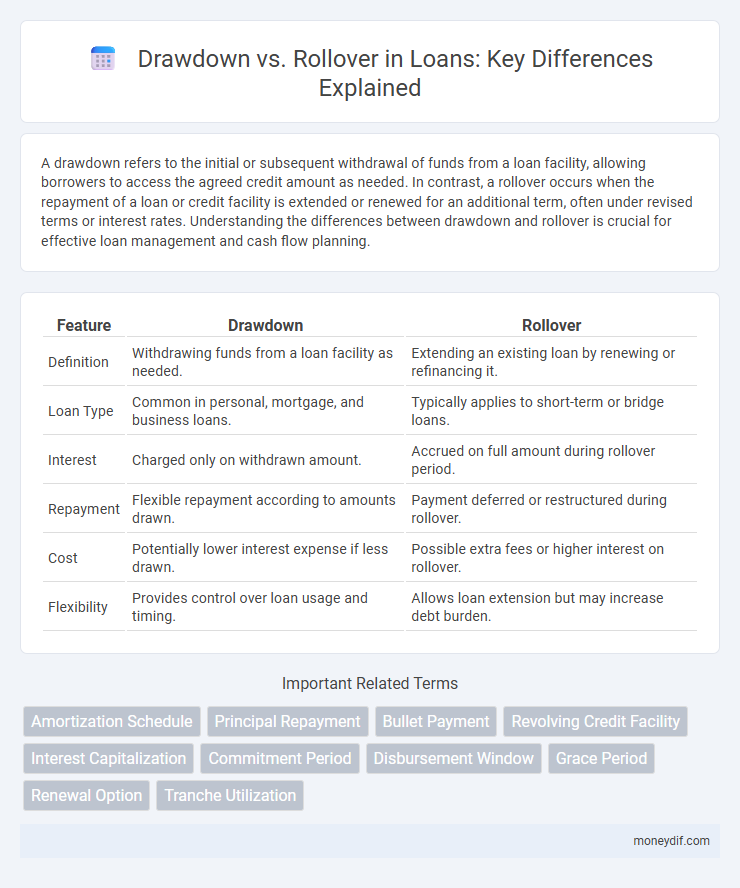

A drawdown refers to the initial or subsequent withdrawal of funds from a loan facility, allowing borrowers to access the agreed credit amount as needed. In contrast, a rollover occurs when the repayment of a loan or credit facility is extended or renewed for an additional term, often under revised terms or interest rates. Understanding the differences between drawdown and rollover is crucial for effective loan management and cash flow planning.

Table of Comparison

| Feature | Drawdown | Rollover |

|---|---|---|

| Definition | Withdrawing funds from a loan facility as needed. | Extending an existing loan by renewing or refinancing it. |

| Loan Type | Common in personal, mortgage, and business loans. | Typically applies to short-term or bridge loans. |

| Interest | Charged only on withdrawn amount. | Accrued on full amount during rollover period. |

| Repayment | Flexible repayment according to amounts drawn. | Payment deferred or restructured during rollover. |

| Cost | Potentially lower interest expense if less drawn. | Possible extra fees or higher interest on rollover. |

| Flexibility | Provides control over loan usage and timing. | Allows loan extension but may increase debt burden. |

Understanding Loan Drawdown: Definition and Process

Loan drawdown refers to the process where a borrower withdraws funds from an approved loan facility, initiating the disbursement of the loan amount. This typically occurs after all lending conditions are met and the loan agreement is executed, allowing the borrower to access the funds for the intended purpose. Understanding the drawdown process is crucial as it affects the timing of interest accrual and repayment schedules linked to the loan agreement.

What is Loan Rollover? Key Features Explained

Loan rollover refers to extending the loan tenure by paying off the current loan installment and renewing it for a new term, effectively postponing the repayment deadline. Key features include additional interest charges based on the extended period, potential processing fees, and the risk of increasing overall debt burden if not managed carefully. This option provides short-term relief for borrowers facing liquidity issues but requires careful consideration of total repayment costs.

Drawdown vs Rollover: Core Differences

Drawdown refers to the initial disbursement of funds from a loan, allowing borrowers to access a portion or the entire approved amount based on their needs. Rollover involves extending or renewing a loan term, often transferring the outstanding balance into a new loan agreement with revised repayment conditions. Key differences include drawdown marking the first withdrawal of funds, while rollover pertains to prolonging loan maturity or refinancing existing debt.

When to Choose Drawdown Over Rollover

Choose a loan drawdown when immediate access to funds is required for specific projects or urgent business needs, as it allows borrowers to withdraw the full approved amount at once. Opt for drawdown to avoid accumulating multiple renewals and potentially higher interest costs associated with rollovers. This method is ideal when the borrower expects predictable repayment capacity without needing to extend the loan term repeatedly.

Financial Implications: Costs and Benefits

Drawdown involves accessing funds directly from a loan, leading to immediate interest accrual on the withdrawn amount, which impacts cash flow and borrowing costs. Rollover extends the loan maturity by refinancing the principal, often incurring additional fees and potential interest rate changes, affecting overall loan expenses. Evaluating the financial implications between drawdown and rollover is crucial for optimizing loan costs and maintaining liquidity management.

Impact on Interest Rates: Drawdown versus Rollover

Drawdown impacts interest rates by setting the rate at the moment funds are accessed, often locking in current market conditions and potentially resulting in lower costs if rates are favorable. Rollover involves renewing or extending the loan term, where interest rates are subject to prevailing market fluctuations, potentially increasing borrowing expenses. Understanding the distinction between drawdown timing and rollover frequency is crucial for managing interest rate risk in loan agreements.

Flexibility and Repayment Structures Compared

Drawdown offers borrowers the flexibility to access funds in tranches, aligning disbursement with project milestones or cash flow needs, which often results in tailored repayment schedules based on the amount utilized. Rollover allows the extension or renewal of the loan term without repaying the principal immediately, providing borrowers with the option to manage short-term liquidity pressures through repeated extensions. While drawdown structures emphasize staggered borrowing and amortized repayments, rollovers focus on prolonging debt maturity, impacting overall interest costs and cash flow planning.

Common Use Cases for Drawdown and Rollover Loans

Drawdown loans are commonly used in construction financing, allowing borrowers to access funds incrementally as project milestones are reached, optimizing cash flow management. Rollover loans are frequently utilized in short-term commercial financing, enabling borrowers to extend the loan maturity by refinancing the principal, providing flexibility during transitional periods. Both drawdown and rollover loans offer tailored solutions for businesses managing phased expenses or temporary funding needs.

Risks Associated with Drawdown and Rollover Options

Drawdown risks include liquidity issues and potential interest rate fluctuations that can increase borrowing costs when funds are disbursed. Rollover risks involve exposure to refinancing uncertainties, higher interest rates, and the possibility of stricter loan terms upon renewal. Borrowers must carefully assess market conditions and their financial stability before choosing between drawdown and rollover options to mitigate these risks.

How to Decide: Factors Influencing the Best Choice

Deciding between a loan drawdown and rollover hinges on interest rates, loan terms, and cash flow needs. Opt for drawdown when immediate capital utilization and predictable repayment schedules are priorities, while rollover suits borrowers seeking flexibility amid uncertain financial conditions. Assess credit score stability, market trends, and potential future borrowing costs to choose the most cost-effective and strategic option.

Important Terms

Amortization Schedule

An amortization schedule details each loan payment, dividing principal and interest over time to show decreasing balance. Drawdown refers to withdrawing funds from a loan facility, while rollover involves extending or renewing the loan term, impacting the amortization timeline and repayment amounts.

Principal Repayment

Principal repayment involves the scheduled return of borrowed capital, impacting cash flow during both drawdown and rollover phases of a loan. During drawdown, principal repayments are minimized or deferred to optimize liquidity, whereas rollover typically initiates structured principal repayments to refinance or amortize the outstanding debt.

Bullet Payment

Bullet payment refers to the full repayment of a loan's principal amount at the end of the loan term, contrasting with drawdown and rollover methods that involve partial disbursements or extending loan maturity respectively. In financing, drawdown allows borrowers to access funds in stages, while rollover extends the repayment period by refinancing existing debt, avoiding lump-sum settlement typical of bullet payments.

Revolving Credit Facility

A revolving credit facility allows borrowers to draw down funds up to a set limit, repay, and redraw as needed, providing flexibility in managing short-term liquidity. Drawdown refers to the initial or subsequent borrowing from the facility, while rollover involves extending or renewing the credit agreement or specific tranches without repaying the principal.

Interest Capitalization

Interest capitalization involves adding accrued interest to the principal balance during drawdown periods, increasing the loan amount over time. In contrast, rollover limits capitalization by renewing the loan term without adding unpaid interest to the principal, preserving the original loan size.

Commitment Period

The commitment period in private equity specifies the timeframe during which investors must fulfill capital calls for drawdowns, ensuring funds are available for investments. Unused committed capital after the drawdown window often undergoes rollover, extending the investment timeline and allowing deferred deployment without additional capital calls.

Disbursement Window

The disbursement window defines the specific period during which a borrower can access funds from an approved credit facility, crucial for managing drawdown timing and rollover decisions. Effective management of this window ensures that drawdowns occur within set limits while rollovers extend the loan term without triggering additional disbursement events, optimizing cash flow and loan utilization.

Grace Period

The grace period in financial terms defines the timeframe after a drawdown during which a borrower can delay repayments without penalties, impacting rollover decisions where debts are extended rather than paid off immediately. Understanding the grace period is crucial for managing cash flow between drawdown events and optimal rollover strategies to avoid default.

Renewal Option

The renewal option allows borrowers to extend the loan term by either drawing down additional funds through a drawdown mechanism or by renewing the existing loan via a rollover, each impacting cash flow and interest accrual differently. Selecting drawdown increases the principal balance with new funds, while rollover maintains the current loan amount but resets the repayment schedule and associated fees.

Tranche Utilization

Tranche utilization measures the proportion of a loan tranche that is actively drawn down compared to the total available amount, highlighting liquidity management between drawdown and rollover strategies. Efficient balance between drawdown allows immediate access to funds, while rollover extends existing tranches, optimizing capital costs and maintaining credit availability.

Drawdown vs Rollover Infographic

moneydif.com

moneydif.com