Negative amortization occurs when loan payments are insufficient to cover the interest due, causing the unpaid interest to be added to the principal balance, increasing the total amount owed. Positive amortization means each payment exceeds the interest, reducing the principal balance over time and lowering the debt. Understanding the difference can help borrowers manage loan costs and avoid unexpected increases in debt.

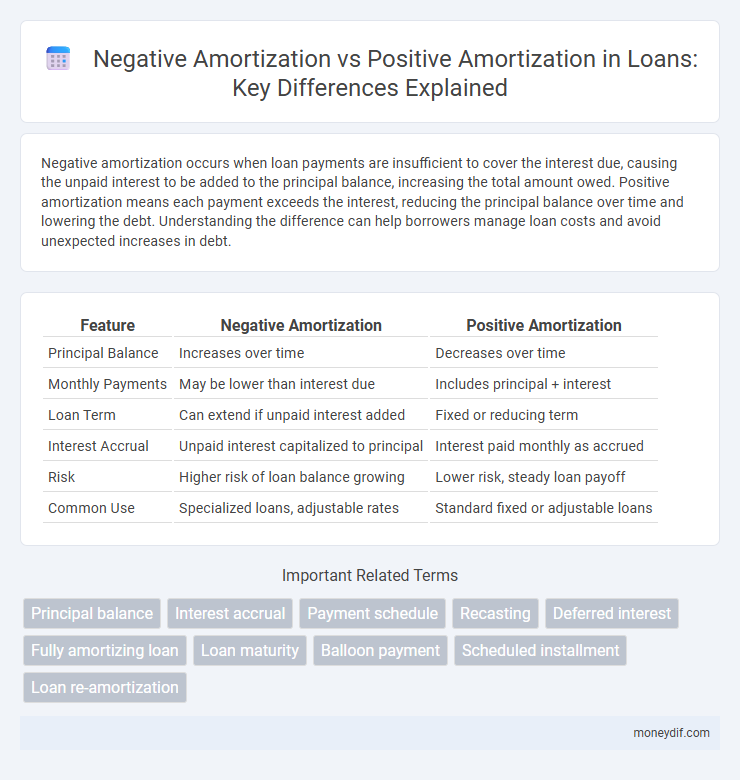

Table of Comparison

| Feature | Negative Amortization | Positive Amortization |

|---|---|---|

| Principal Balance | Increases over time | Decreases over time |

| Monthly Payments | May be lower than interest due | Includes principal + interest |

| Loan Term | Can extend if unpaid interest added | Fixed or reducing term |

| Interest Accrual | Unpaid interest capitalized to principal | Interest paid monthly as accrued |

| Risk | Higher risk of loan balance growing | Lower risk, steady loan payoff |

| Common Use | Specialized loans, adjustable rates | Standard fixed or adjustable loans |

Understanding Amortization: Definitions and Concepts

Negative amortization occurs when loan payments are insufficient to cover the interest, causing the outstanding principal balance to increase over time. Positive amortization involves payments that exceed the interest due, gradually reducing the principal balance until the loan is fully paid off. Understanding these concepts is crucial for borrowers to manage loan repayment strategies and avoid escalating debt.

What is Positive Amortization?

Positive amortization occurs when monthly loan payments are sufficient to cover the interest accrued, allowing the principal balance to decrease over time. This repayment method ensures borrowers gradually build equity in assets like homes or vehicles while reducing overall debt. Unlike negative amortization, positive amortization lowers the loan balance, minimizing interest costs and shortening the loan term.

What is Negative Amortization?

Negative amortization occurs when loan payments are insufficient to cover the interest due, causing unpaid interest to be added to the principal balance. This results in the loan balance increasing over time, contrary to positive amortization where payments exceed interest and reduce the principal. Negative amortization typically arises in adjustable-rate mortgages or certain student loans with deferred interest options.

Key Differences Between Positive and Negative Amortization

Positive amortization occurs when monthly loan payments exceed the interest due, gradually reducing the principal balance over time. Negative amortization happens when payments are lower than the interest owed, causing the unpaid interest to be added to the principal, increasing the loan balance. Key differences include the impact on the principal amount, with positive amortization lowering it steadily, while negative amortization results in growing debt and potentially higher future payments.

How Negative Amortization Loans Work

Negative amortization loans occur when monthly payments are insufficient to cover the interest accrued, causing the unpaid interest to be added to the principal balance. This results in the loan balance increasing over time, even as payments are made, which significantly impacts the total amount owed. Borrowers should carefully evaluate loan terms to understand the potential for escalating debt under negative amortization compared to the gradual reduction of principal in positive amortization loans.

Financial Impact of Positive Amortization Loans

Positive amortization loans steadily reduce the principal balance through regular payments, leading to decreasing interest expenses over the loan term and enhancing borrower equity. This financial impact fosters predictable budgeting and lowers overall loan costs compared to negative amortization alternatives. Consistent principal reduction mitigates the risk of loan balance increases, promoting long-term financial stability and creditworthiness.

Risks Associated with Negative Amortization

Negative amortization loans pose significant financial risks due to unpaid interest being added to the principal balance, which can lead to rapidly increasing debt and higher monthly payments over time. Borrowers may face difficulty refinancing or selling the property if the loan balance surpasses the home's market value, increasing the risk of default and foreclosure. In contrast, positive amortization ensures the loan principal decreases steadily, reducing overall financial exposure and promoting long-term equity growth.

Benefits of Positive Amortization in Loan Management

Positive amortization ensures that each loan payment covers both interest and principal, steadily reducing the outstanding balance and ultimately minimizing total interest costs over the loan term. This approach enhances financial stability by preventing loan balances from increasing, which can occur with negative amortization. Positive amortization provides clearer paths to full loan repayment, making budgeting and long-term financial planning more predictable and manageable for borrowers.

Choosing the Right Amortization Type for Your Loan

Choosing the right amortization type for your loan depends on your financial goals and cash flow flexibility. Negative amortization loans allow lower initial payments but increase the loan balance over time, which may suit borrowers expecting higher future income or refinancing options. Positive amortization ensures steady principal reduction and predictable payments, offering long-term financial stability and reduced overall interest costs.

Frequently Asked Questions About Loan Amortization

Negative amortization occurs when the loan payments are less than the interest accrued, causing the loan balance to increase over time, while positive amortization means the payments cover both interest and principal, gradually reducing the loan balance. Borrowers often ask how negative amortization affects overall loan costs and when it might be advantageous despite rising debt. Understanding the differences helps borrowers choose appropriate loan terms and avoid unexpected increases in principal due to unpaid interest.

Important Terms

Principal balance

Principal balance increases during negative amortization as payments are insufficient to cover interest, causing unpaid interest to be added to the loan's outstanding amount. Positive amortization reduces the principal balance over time by ensuring payments exceed interest, thereby gradually lowering the loan's overall debt.

Interest accrual

Interest accrual in negative amortization occurs when unpaid interest is added to the principal balance, increasing the loan amount over time, whereas in positive amortization, payments exceed the interest accrued, gradually reducing the principal. Negative amortization loans often result in higher total debt, while positive amortization ensures steady principal repayment and decreasing loan balance.

Payment schedule

Payment schedules with negative amortization allow loan balances to increase as payments fail to cover full interest, contrasting with positive amortization schedules where payments reduce principal over time, ensuring loan balance decreases. Negative amortization often occurs in graduated or income-based payment plans, while positive amortization is standard in fixed or adjustable-rate mortgages.

Recasting

Recasting adjusts the loan amortization schedule by recalculating payments based on the current loan balance, which can shift a loan from negative amortization--where unpaid interest is added to the principal--to positive amortization, ensuring principal is paid down over time. This process helps borrowers avoid balloon payments and better manage cash flow by aligning monthly installments with the loan's true balance and term.

Deferred interest

Deferred interest occurs when unpaid interest is added to the loan principal, causing negative amortization, where the loan balance increases over time instead of decreasing. In contrast, positive amortization happens when payments cover both interest and principal, gradually reducing the loan balance and preventing interest deferral.

Fully amortizing loan

A fully amortizing loan requires equal periodic payments covering both principal and interest, ensuring the loan balance reaches zero by maturity, contrasting with negative amortization loans where payments are insufficient to cover interest, causing the principal to increase. Positive amortization loans, similar to fully amortizing loans, reduce the principal balance over time, but may have varying payment amounts that exceed interest.

Loan maturity

Loan maturity impacts the amortization schedule by determining whether negative or positive amortization occurs; with longer maturities, payments may initially cover less principal resulting in negative amortization, while shorter maturities typically ensure positive amortization as payments exceed accrued interest. Negative amortization increases the loan balance over time until maturity, contrasting with positive amortization which steadily reduces principal and interest owed.

Balloon payment

Balloon payment involves a large lump sum due at the end of a loan term, often resulting from negative amortization where monthly payments are insufficient to cover interest, causing loan balance growth. In contrast, positive amortization ensures each payment exceeds the interest, gradually reducing the principal balance and minimizing or eliminating the balloon payment size.

Scheduled installment

Scheduled installments with positive amortization gradually reduce the loan principal by covering interest and principal payments, ensuring the loan balance decreases over time. In contrast, scheduled installments linked to negative amortization result in unpaid interest being added to the principal, causing the outstanding loan balance to increase despite regular payments.

Loan re-amortization

Loan re-amortization adjusts the payment schedule to reflect changes in outstanding principal, effectively converting negative amortization--where loan balances increase due to unpaid interest--into positive amortization, which gradually reduces the principal. This process ensures borrowers can realign payments with current loan terms, preventing balance growth and promoting more manageable repayment.

negative amortization vs positive amortization Infographic

moneydif.com

moneydif.com