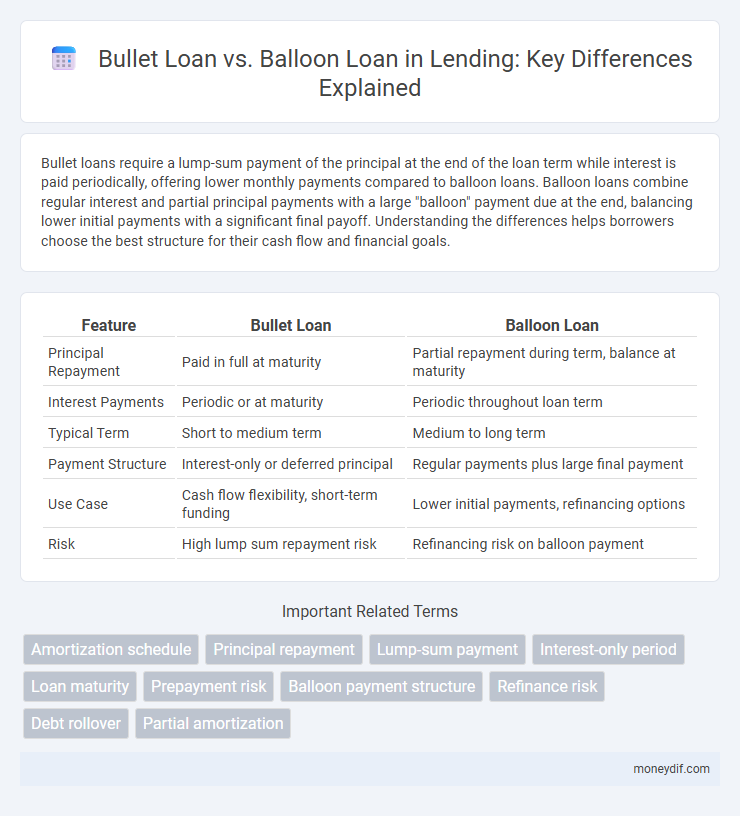

Bullet loans require a lump-sum payment of the principal at the end of the loan term while interest is paid periodically, offering lower monthly payments compared to balloon loans. Balloon loans combine regular interest and partial principal payments with a large "balloon" payment due at the end, balancing lower initial payments with a significant final payoff. Understanding the differences helps borrowers choose the best structure for their cash flow and financial goals.

Table of Comparison

| Feature | Bullet Loan | Balloon Loan |

|---|---|---|

| Principal Repayment | Paid in full at maturity | Partial repayment during term, balance at maturity |

| Interest Payments | Periodic or at maturity | Periodic throughout loan term |

| Typical Term | Short to medium term | Medium to long term |

| Payment Structure | Interest-only or deferred principal | Regular payments plus large final payment |

| Use Case | Cash flow flexibility, short-term funding | Lower initial payments, refinancing options |

| Risk | High lump sum repayment risk | Refinancing risk on balloon payment |

Introduction to Bullet Loans and Balloon Loans

Bullet loans require the borrower to pay only interest during the loan term, with the entire principal due as a lump sum at maturity, making them suitable for borrowers expecting a large future cash inflow. Balloon loans involve regular payments that cover both interest and a portion of the principal, but feature a large final payment, or balloon payment, to settle the remaining balance, often used in real estate financing. Understanding the payment structures and risk profiles of bullet versus balloon loans is essential for selecting the optimal financing strategy.

Key Differences Between Bullet Loans and Balloon Loans

Bullet loans require repayment of the entire principal at the end of the term, while balloon loans involve smaller periodic payments with a large final payment. Bullet loans typically have interest-only payments during the term, whereas balloon loans combine principal and interest payments before the large balloon payment. Understanding amortization schedules and repayment timing is crucial for choosing between bullet and balloon loan structures.

How Bullet Loans Work

Bullet loans require borrowers to pay only interest throughout the loan term, with the entire principal due as a lump sum at maturity. This structure allows for lower monthly payments, making it suitable for short-term financing or projects expecting future cash flow. The key risk involves managing the large principal repayment at the end, often necessitating refinancing or a substantial cash reserve.

How Balloon Loans Operate

Balloon loans require borrowers to make regular, typically lower monthly payments for a set period, followed by a large lump-sum payment, or "balloon payment," at the end of the term. This structure reduces initial monthly installments but demands borrowers to have a plan for the substantial final payoff, often involving refinancing or selling assets. Balloon loans are common in commercial real estate and short-term financing where cash flow management and flexibility are prioritized.

Pros and Cons of Bullet Loans

Bullet loans offer the advantage of lower monthly payments since borrowers pay only interest during the loan term, improving short-term cash flow and financial flexibility. However, the lump-sum principal repayment at maturity presents a significant risk, especially if the borrower lacks a clear refinancing strategy or sufficient funds. The simplicity of bullet loans suits investors or businesses expecting future liquidity, but they may face substantial financial strain due to the large end-term payment.

Advantages and Disadvantages of Balloon Loans

Balloon loans offer lower initial monthly payments compared to traditional loans, making them attractive for borrowers expecting increased future income or planning to refinance before maturity. The primary disadvantage is the large lump sum balloon payment due at the end of the term, which can pose a significant financial risk if the borrower is unprepared or unable to refinance. Balloon loans provide flexibility but require disciplined financial planning to manage the eventual payoff.

Eligibility Criteria for Bullet and Balloon Loans

Eligibility criteria for bullet loans typically require borrowers to demonstrate strong credit scores, a stable income source, and sufficient collateral, as the entire principal is due at the end of the loan term. Balloon loan eligibility often involves stricter scrutiny of debt-to-income ratios and proof of the borrower's ability to refinance or repay a large lump sum payment at maturity. Both loan types generally necessitate a detailed financial history and may require higher creditworthiness compared to traditional amortized loans due to the risk of a substantial end-term payment.

Interest Rates: Bullet Loan vs Balloon Loan

Bullet loans typically feature higher interest rates since the entire principal is repaid at maturity, increasing lender risk. Balloon loans often have lower initial interest rates because borrowers make smaller periodic payments, with a large lump sum due at the end. Understanding the interest rate differences between bullet and balloon loans helps borrowers assess affordability and long-term financial impact.

Best Use Cases for Bullet and Balloon Loans

Bullet loans suit short-term financing needs with a focus on minimizing monthly payments, ideal for businesses expecting a large cash inflow at loan maturity. Balloon loans work well for borrowers planning to refinance or sell an asset before the balloon payment, commonly used in real estate and auto financing. Both loan types offer flexibility but require careful planning to manage large end-term payments effectively.

Choosing the Right Loan: Bullet vs Balloon

Choosing the right loan between bullet and balloon options depends on your repayment capacity and cash flow needs. Bullet loans require full principal repayment at maturity with interest paid periodically, ideal for borrowers expecting a lump sum in the future. Balloon loans combine smaller periodic payments with a large final payment, offering lower initial installments but requiring careful planning for the substantial end payment.

Important Terms

Amortization schedule

An amortization schedule for a bullet loan shows interest-only payments throughout the term with a single principal payment at maturity, whereas a balloon loan amortizes partial principal payments but requires a large final lump sum remaining balance. Bullet loans typically have no principal reduction during the term, while balloon loans feature periodic principal amortization followed by a substantial balloon payment.

Principal repayment

Principal repayment in a bullet loan involves a single lump sum payment of the entire loan amount at maturity, contrasting with a balloon loan where periodic interest payments are made, followed by a large principal payment at the end. Bullet loans minimize regular cash outflows during the term, while balloon loans require smaller periodic payments but still culminate in a significant final principal repayment.

Lump-sum payment

Lump-sum payment in a bullet loan involves repaying the entire principal amount at the end of the loan term, with interest paid periodically or at maturity. In contrast, a balloon loan requires smaller periodic payments throughout the loan term and a large lump-sum balloon payment at the end, combining elements of amortization and deferred principal repayment.

Interest-only period

An interest-only period in a bullet loan involves paying only interest payments without reducing the principal balance until maturity, when the full loan principal is repaid in a lump sum, whereas a balloon loan combines regular principal and interest payments with a large residual principal payment at the end of the term. Both loan types feature deferred principal repayment, but bullet loans focus on interest-only payments during the term, while balloon loans reduce principal partially before the final balloon payment.

Loan maturity

Loan maturity determines the repayment timeline, with bullet loans requiring full principal repayment at the end of the term, unlike balloon loans which combine periodic interest payments with a large lump-sum principal payment at maturity. Bullet loans typically suit short-term financing needs, whereas balloon loans offer lower periodic payments but carry significant refinancing risk due to the sizable final payment.

Prepayment risk

Prepayment risk is higher in balloon loans than bullet loans due to the irregular, large principal payment at maturity, which borrowers may refinance or repay early, impacting lender cash flow. Bullet loans have a fixed principal repayment at the end, reducing uncertainty but still exposing lenders to refinancing risks if prepayment occurs before maturity.

Balloon payment structure

Balloon payment structure involves a large, lump-sum payment due at the end of a loan term, distinguishing bullet loans that require a single repayment of principal only, from balloon loans which combine regular amortized payments with a substantial final payment. Balloon loans reduce monthly installments by amortizing part of the principal, while bullet loans maintain interest-only payments until the full principal is paid in a single lump sum.

Refinance risk

Refinance risk increases significantly with bullet loans due to their single lump-sum principal repayment at maturity, requiring full refinancing to repay the entire amount. Balloon loans, with periodic principal repayments and a reduced final payment, typically lower refinance risk by decreasing the outstanding balance needing refinancing at term-end.

Debt rollover

Debt rollover involves refinancing existing debt to extend the payment period, often used with bullet and balloon loans characterized by large lump-sum payments at maturity. Bullet loans require a single principal payment at the end of the term, while balloon loans combine periodic interest payments with a sizable final principal payment, influencing rollover strategies and refinancing risks.

Partial amortization

Partial amortization involves a loan structure where scheduled payments cover principal and interest but do not fully repay the loan by maturity, resulting in a remaining balance due as a lump sum. Bullet loans require a full principal repayment at maturity without interim principal payments, whereas balloon loans combine partial amortization with a sizable final payment, making the key distinction the timing and size of the remaining balance.

bullet loan vs balloon loan Infographic

moneydif.com

moneydif.com