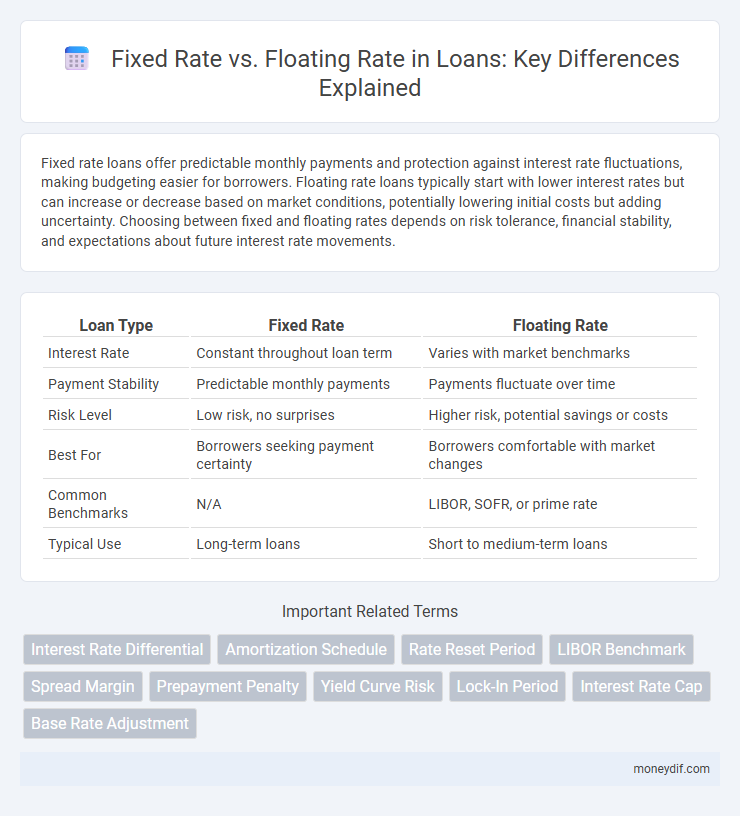

Fixed rate loans offer predictable monthly payments and protection against interest rate fluctuations, making budgeting easier for borrowers. Floating rate loans typically start with lower interest rates but can increase or decrease based on market conditions, potentially lowering initial costs but adding uncertainty. Choosing between fixed and floating rates depends on risk tolerance, financial stability, and expectations about future interest rate movements.

Table of Comparison

| Loan Type | Fixed Rate | Floating Rate |

|---|---|---|

| Interest Rate | Constant throughout loan term | Varies with market benchmarks |

| Payment Stability | Predictable monthly payments | Payments fluctuate over time |

| Risk Level | Low risk, no surprises | Higher risk, potential savings or costs |

| Best For | Borrowers seeking payment certainty | Borrowers comfortable with market changes |

| Common Benchmarks | N/A | LIBOR, SOFR, or prime rate |

| Typical Use | Long-term loans | Short to medium-term loans |

Understanding Fixed Rate and Floating Rate Loans

Fixed rate loans maintain a consistent interest rate throughout the loan term, providing predictable monthly payments and budgeting stability. Floating rate loans, also known as variable rate loans, have interest rates that fluctuate based on benchmark indices like LIBOR or the Prime Rate, potentially lowering or increasing monthly payments over time. Borrowers must assess market conditions and personal financial stability when choosing between fixed rate loans and floating rate loans to optimize cost and risk management.

Key Differences Between Fixed and Floating Rates

Fixed-rate loans have interest rates that remain constant throughout the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Floating-rate loans, also known as variable-rate loans, have interest rates that adjust periodically based on benchmark rates like LIBOR or SOFR, which can lead to lower initial rates but increased payment variability. Key differences include payment stability, interest cost predictability, and sensitivity to economic conditions, making fixed rates ideal for risk-averse borrowers and floating rates suitable for those expecting interest rates to decline.

Pros and Cons of Fixed Rate Loans

Fixed rate loans offer predictable monthly payments and protect borrowers from interest rate fluctuations, providing financial stability over the loan term. However, they often come with higher initial interest rates compared to floating rate loans, which can result in increased overall borrowing costs if market rates remain low. Borrowers seeking certainty and long-term budgeting benefits typically prefer fixed rate loans despite the potential for paying more upfront.

Advantages and Disadvantages of Floating Rate Loans

Floating rate loans offer the advantage of benefiting from lower initial interest rates that adjust with market conditions, potentially reducing borrowing costs during periods of declining rates. However, the main disadvantage lies in the uncertainty and risk of increasing interest payments when benchmark rates rise, leading to higher monthly installments and overall loan costs. Borrowers with fluctuating income may find floating rate loans less predictable, impacting financial planning and long-term budget stability.

Interest Rate Trends: Impact on Loan Choice

Fixed rate loans provide predictable monthly payments by locking in the interest rate, which benefits borrowers when interest rates are rising or expected to increase. Floating rate loans offer lower initial rates tied to benchmark indices like the LIBOR or SOFR, resulting in cost savings when interest rates decline or remain stable. Understanding current market trends and economic forecasts is essential for choosing between fixed and floating rate loans to optimize overall borrowing costs.

Suitability: Who Should Choose Fixed Rate Loans?

Fixed rate loans are ideal for borrowers seeking predictable monthly payments and protection against interest rate fluctuations, making them suitable for individuals with a stable income or long-term financial plans. Homebuyers or borrowers prioritizing budget stability benefit from the fixed interest rate, which remains constant throughout the loan term. Conversely, those averse to risk and preferring financial certainty should consider fixed rate options over floating rates that may increase payments over time.

Suitability: Who Should Choose Floating Rate Loans?

Floating rate loans are best suited for borrowers anticipating a decrease in interest rates or those with flexible budgets to absorb rate fluctuations. Businesses with variable cash flows or individuals planning short-term borrowing may benefit from lower initial rates and potential savings. Borrowers seeking interest rate predictability and long-term stability should consider alternatives, as floating rates expose them to potential rate hikes.

Impact on EMI and Loan Repayment Strategies

Fixed rate loans offer stable EMIs by maintaining consistent interest throughout the tenure, enabling precise budgeting and predictable repayment schedules. Floating rate loans cause EMI fluctuations due to interest rate changes, which can increase repayment costs during rate hikes but may decrease payments if rates fall. Borrowers seeking financial stability often prefer fixed rates, while those aiming to capitalize on potential interest rate drops adopt floating rates to optimize loan repayment strategies.

Risks and Rewards: Managing Rate Fluctuations

Fixed rate loans provide predictability in monthly payments, shielding borrowers from interest rate volatility and safeguarding budgets against market fluctuations. Floating rate loans often start with lower interest rates, offering potential savings when market rates decline, but they expose borrowers to increased payment risk if rates rise. Effective management of rate fluctuations involves assessing risk tolerance and financial stability to choose between consistent fixed costs or variable payments linked to market conditions.

How to Decide: Fixed vs Floating Rate Loans

Choosing between fixed and floating rate loans depends on the borrower's risk tolerance and market interest rate trends. Fixed rate loans provide predictable monthly payments, ideal for budgeting and protection against rising rates, while floating rate loans usually start with lower interest but expose borrowers to potential increases tied to benchmark indices like LIBOR or SOFR. Assessing current economic forecasts, projected interest rate volatility, and personal financial stability helps in deciding the optimal loan type for minimizing costs and managing financial risk.

Important Terms

Interest Rate Differential

Interest Rate Differential plays a crucial role in deciding between fixed rate and floating rate loans, as it reflects the gap between interest rates of two different debt types or currencies. A higher interest rate differential often makes fixed rates more attractive during periods of rising rates, while lower or narrowing differentials tend to favor floating rates due to their potential for cost savings.

Amortization Schedule

An amortization schedule outlines fixed monthly payments for a loan, where fixed-rate loans maintain consistent interest rates, ensuring predictable principal and interest portions over time. In contrast, floating-rate loans adjust interest rates periodically based on benchmark indexes, causing fluctuations in the amortization schedule's payment amounts and interest allocation.

Rate Reset Period

The Rate Reset Period defines the interval at which a floating interest rate is recalculated, contrasting with a fixed rate that remains constant throughout the loan term. Understanding the Frequency of rate resets is crucial for managing interest rate risk and cash flow predictability in fixed versus floating rate loans.

LIBOR Benchmark

LIBOR (London Interbank Offered Rate) serves as a key benchmark for floating interest rates, influencing the pricing of loans and financial contracts by reflecting bank borrowing costs. Fixed rate loans offer stability by locking in interest payments, whereas floating rate loans tied to LIBOR fluctuate with market conditions, providing potential cost savings or increased risk depending on rate movements.

Spread Margin

Spread margin represents the difference in interest rates between fixed-rate loans and floating-rate loans, reflecting the lender's risk premium and market conditions. It influences borrowing costs by adjusting the baseline rate, where a wider spread margin typically indicates higher risk or lower credit quality in fixed-rate lending compared to floating-rate benchmarks like LIBOR or SOFR.

Prepayment Penalty

Prepayment penalties are commonly associated with fixed-rate loans, as lenders charge fees to compensate for lost interest when borrowers pay off the loan early, whereas floating-rate loans typically have fewer or no prepayment penalties due to their variable interest structure. Borrowers choosing between fixed and floating rates should consider prepayment penalties as they can significantly impact the overall cost and flexibility of loan repayment.

Yield Curve Risk

Yield curve risk arises from fluctuations in interest rates affecting the relative value of fixed-rate and floating-rate debt instruments; fixed-rate securities are more sensitive to changes in the yield curve, leading to potential capital losses when rates rise. Floating-rate instruments adjust coupon payments based on benchmark rates, mitigating yield curve risk but exposing investors to variability in cash flows linked to short-term interest rate movements.

Lock-In Period

Lock-in periods in fixed-rate loans restrict borrowers from refinancing or prepaying without penalties, providing predictable interest costs, while floating-rate loans typically lack such restrictions but expose borrowers to interest rate volatility. Understanding the lock-in duration is crucial when comparing the long-term cost implications of fixed versus floating interest rate options.

Interest Rate Cap

An Interest Rate Cap limits the maximum interest payable on a floating rate loan, providing protection against rising rates while allowing some benefit if rates fall. Fixed rate loans offer stable, predictable payments but lack the flexibility of floating rates combined with interest rate caps to manage risk exposure.

Base Rate Adjustment

Base rate adjustment impacts loan repayments by altering the benchmark interest rate underlying fixed and floating rate loans, where floating rates fluctuate with market changes and fixed rates remain constant for a set period. Variations in the base rate typically cause immediate changes in floating rate loan costs, while fixed rate loans may adjust only upon renewal or rate reset periods.

Fixed rate vs Floating rate Infographic

moneydif.com

moneydif.com