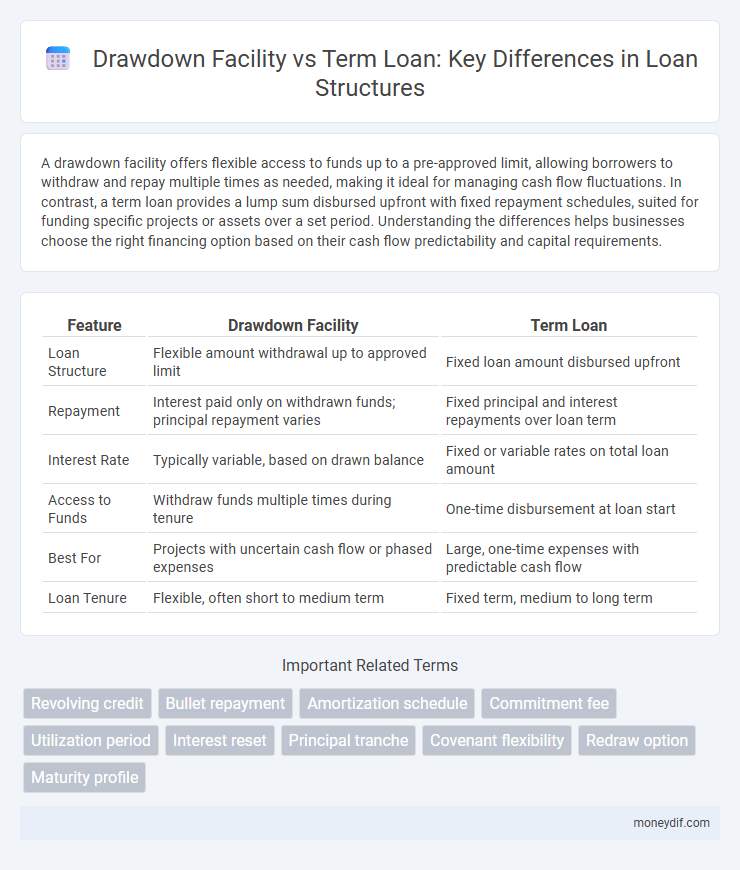

A drawdown facility offers flexible access to funds up to a pre-approved limit, allowing borrowers to withdraw and repay multiple times as needed, making it ideal for managing cash flow fluctuations. In contrast, a term loan provides a lump sum disbursed upfront with fixed repayment schedules, suited for funding specific projects or assets over a set period. Understanding the differences helps businesses choose the right financing option based on their cash flow predictability and capital requirements.

Table of Comparison

| Feature | Drawdown Facility | Term Loan |

|---|---|---|

| Loan Structure | Flexible amount withdrawal up to approved limit | Fixed loan amount disbursed upfront |

| Repayment | Interest paid only on withdrawn funds; principal repayment varies | Fixed principal and interest repayments over loan term |

| Interest Rate | Typically variable, based on drawn balance | Fixed or variable rates on total loan amount |

| Access to Funds | Withdraw funds multiple times during tenure | One-time disbursement at loan start |

| Best For | Projects with uncertain cash flow or phased expenses | Large, one-time expenses with predictable cash flow |

| Loan Tenure | Flexible, often short to medium term | Fixed term, medium to long term |

Drawdown Facility vs Term Loan: Key Differences

A drawdown facility allows borrowers to access funds multiple times up to a pre-approved limit, providing flexibility for ongoing capital needs, whereas a term loan disburses a lump sum upfront with a fixed repayment schedule. Drawdown facilities often come with variable interest rates and are ideal for projects with unpredictable cash flow requirements, while term loans typically feature fixed rates and set maturities suitable for one-time financing. Understanding these distinctions helps businesses choose the appropriate financing structure for working capital or long-term investments.

Understanding Drawdown Facilities in Lending

A drawdown facility in lending allows borrowers to access funds up to an agreed limit in multiple installments instead of receiving the full amount at once, offering greater flexibility for cash flow management. Unlike term loans, which are disbursed as a lump sum with fixed repayment schedules, drawdown facilities enable funds to be drawn as needed, minimizing unused interest costs. This feature makes drawdown facilities ideal for businesses with fluctuating capital requirements or ongoing project expenses.

What is a Term Loan?

A term loan is a specific type of loan that provides a fixed amount of capital to be repaid over a predetermined period with regular installments, typically used for purchasing assets or business expansion. Unlike a drawdown facility, which allows borrowers to access funds flexibly and on-demand up to a credit limit, a term loan involves a lump sum disbursement at the start of the loan term. Term loans often have fixed or variable interest rates and structured repayment schedules that help businesses plan cash flow with predictable monthly obligations.

Flexibility: Drawdown Facility Compared to Term Loan

A drawdown facility offers greater flexibility by allowing borrowers to access funds as needed up to a predetermined limit, unlike a term loan that provides a lump sum disbursed upfront. This flexible structure helps manage cash flow more efficiently and reduces interest expenses by borrowing only what is required. Term loans, while offering fixed repayment schedules and stability, lack the adaptive borrowing and repayment options inherent in drawdown facilities.

Interest Rates: How Drawdown Facility and Term Loan Differ

Drawdown facilities often feature variable interest rates that fluctuate with market benchmarks, offering borrowers flexibility to borrow and repay within a specified limit, which can lead to potentially lower interest costs if used strategically. Term loans usually come with fixed or preset interest rates, providing predictable repayment amounts over a set period but less flexibility in accessing funds. Borrowers must evaluate the interest rate structure relative to their cash flow needs, as drawdown facilities can minimize interest expenses during non-utilization periods, while term loans impose consistent interest charges throughout the loan term.

Repayment Structures: Drawdown Facility vs Term Loan

Drawdown facilities offer flexible repayment structures where borrowers can access funds in multiple installments and repay according to usage, often benefiting cash flow management. Term loans require fixed repayment schedules with predetermined installments over a set period, ensuring predictable cash outflows. Choosing between these depends on the borrower's need for flexibility versus consistency in repayment planning.

Suitable Scenarios for Drawdown Facility and Term Loan

Drawdown facilities are ideal for businesses requiring flexible access to funds over time, such as managing cash flow fluctuations or financing ongoing projects with uncertain costs. Term loans suit borrowers needing a lump sum for fixed investments like purchasing equipment or real estate, where predictable repayment schedules align with stable income streams. Selecting between a drawdown facility and a term loan depends on the borrower's specific financial needs, repayment capacity, and project timelines.

Risks Associated with Drawdown Facility and Term Loan

Drawdown facilities carry risks such as fluctuating interest costs due to variable draw amounts and timing, which can complicate cash flow management and increase financial uncertainty. Term loans pose risks including fixed repayment schedules that may strain borrower liquidity if unexpected expenses arise or income decreases. Both financing options demand careful assessment of repayment capacity and market conditions to mitigate default and refinancing risks.

Application Process: Drawdown Facility vs Term Loan

The application process for a drawdown facility typically involves submitting flexible documentation that allows borrowers to access funds in multiple installments over time. Term loans require a more rigid application with detailed financial statements and a fixed repayment schedule established upfront. Lenders evaluating drawdown facilities focus on ongoing creditworthiness, while term loan approvals emphasize the borrower's ability to repay a lump sum within a set timeframe.

Choosing the Right Loan Type for Your Needs

A drawdown facility offers flexible access to funds as needed, making it ideal for businesses with variable cash flow requirements, whereas a term loan provides a lump sum upfront with fixed repayment schedules suited for long-term investments. Choosing the right loan type depends on cash flow predictability, project duration, and repayment capacity. Evaluating these factors ensures optimal financing aligned with business growth and risk management goals.

Important Terms

Revolving credit

Revolving credit offers flexible borrowing up to a set limit with the ability to draw down and repay funds multiple times, while a drawdown facility allows borrowers to access agreed amounts at specific intervals during the loan term. Term loans provide a fixed lump sum with scheduled repayments over a predetermined period, contrasting with the revolving credit's ongoing availability and revolving balance.

Bullet repayment

Bullet repayment in a drawdown facility typically involves repaying the principal amount in one lump sum at maturity, allowing flexibility in interim cash flow management. In contrast, term loans generally require scheduled amortization payments over the loan period, reducing principal gradually and potentially lowering interest expense.

Amortization schedule

An amortization schedule for a drawdown facility outlines periodic repayments based on the amounts drawn, allowing flexible access to funds with interest calculated only on utilized amounts, unlike a term loan which requires fixed repayments based on the full principal from inception. This distinction affects cash flow management, as drawdown facilities provide liquidity tailored to project phases while term loans have predetermined amortization regardless of fund usage.

Commitment fee

A commitment fee is charged on the undrawn portion of a drawdown facility, compensating the lender for keeping funds available, whereas in a term loan, the entire principal is disbursed upfront, typically eliminating the need for such a fee. This fee structure incentivizes efficient use of credit lines while ensuring lender compensation for reserved capital in revolving credit arrangements.

Utilization period

Utilization period in a drawdown facility refers to the timeframe during which the borrower can access funds multiple times up to the approved limit, unlike a term loan where the entire principal is disbursed upfront. This flexibility allows for better cash flow management and tailored financing needs, whereas term loans typically have a fixed disbursement and repayment schedule.

Interest reset

Interest reset impacts the cost structure of a drawdown facility by periodically adjusting interest rates based on prevailing market indices, enhancing flexibility compared to fixed-rate term loans. Term loans typically feature fixed interest rates over the loan tenure, providing predictable repayments but less adaptability to fluctuating interest market conditions.

Principal tranche

The Principal tranche in a Drawdown facility allows borrowers to access funds in multiple disbursements, offering flexibility compared to a Term loan, which provides a lump-sum amount upfront. This structure enhances cash flow management by aligning borrowings closely with project milestones or capital needs.

Covenant flexibility

Covenant flexibility in drawdown facilities typically allows borrowers to access funds in multiple tranches, facilitating better cash flow management and staged repayments compared to term loans, which usually have fixed disbursement and stricter covenant compliance intervals. This flexibility often results in less restrictive financial covenants and enables adjustments based on borrowing base or utilization levels, enhancing operational adaptability.

Redraw option

The Redraw option allows borrowers to access additional funds from repayments made on a Drawdown facility, providing flexibility and potential savings on interest compared to a Term loan, which offers a fixed loan amount disbursed upfront without the ability to withdraw extra payments. This feature is especially advantageous for managing cash flow and reducing overall borrowing costs by only paying interest on the utilized portion of the loan.

Maturity profile

The maturity profile of a Drawdown facility typically offers greater flexibility with staggered disbursements and repayment schedules, aligning with project cash flow needs, whereas a Term loan features a fixed maturity date with lump-sum disbursement and structured amortization. This difference impacts liquidity management and interest cost optimization in corporate financing decisions.

Drawdown facility vs Term loan Infographic

moneydif.com

moneydif.com