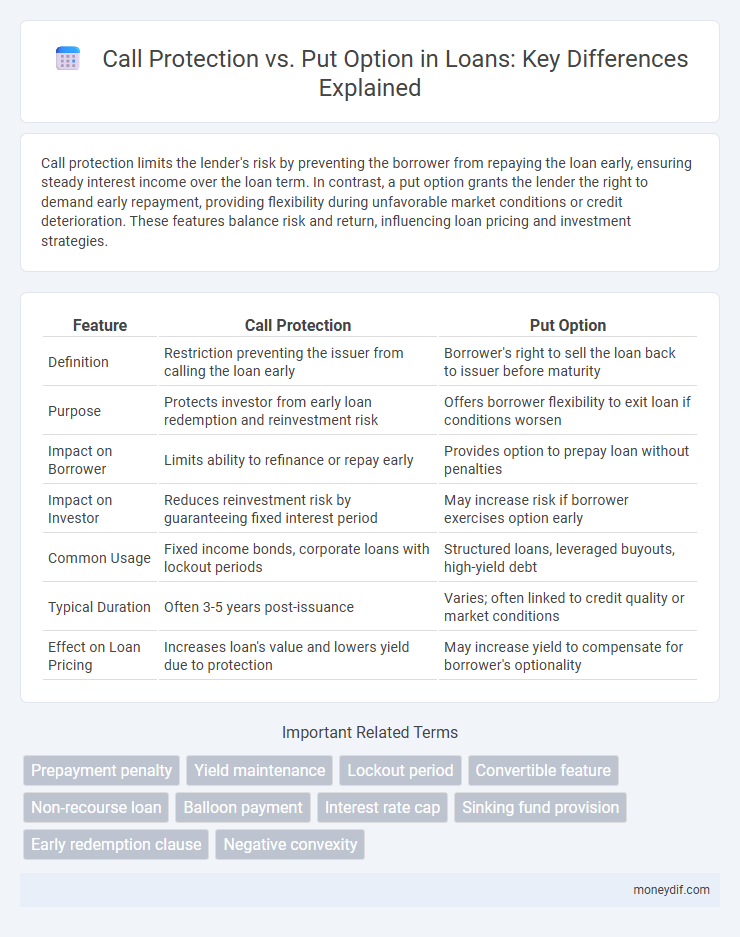

Call protection limits the lender's risk by preventing the borrower from repaying the loan early, ensuring steady interest income over the loan term. In contrast, a put option grants the lender the right to demand early repayment, providing flexibility during unfavorable market conditions or credit deterioration. These features balance risk and return, influencing loan pricing and investment strategies.

Table of Comparison

| Feature | Call Protection | Put Option |

|---|---|---|

| Definition | Restriction preventing the issuer from calling the loan early | Borrower's right to sell the loan back to issuer before maturity |

| Purpose | Protects investor from early loan redemption and reinvestment risk | Offers borrower flexibility to exit loan if conditions worsen |

| Impact on Borrower | Limits ability to refinance or repay early | Provides option to prepay loan without penalties |

| Impact on Investor | Reduces reinvestment risk by guaranteeing fixed interest period | May increase risk if borrower exercises option early |

| Common Usage | Fixed income bonds, corporate loans with lockout periods | Structured loans, leveraged buyouts, high-yield debt |

| Typical Duration | Often 3-5 years post-issuance | Varies; often linked to credit quality or market conditions |

| Effect on Loan Pricing | Increases loan's value and lowers yield due to protection | May increase yield to compensate for borrower's optionality |

Understanding Call Protection in Loan Agreements

Call protection in loan agreements refers to a clause that restricts the borrower's ability to prepay the loan before a specified period, ensuring lenders receive interest payments for a minimum duration. This feature safeguards investors against early repayment risk, stabilizing expected cash flows and enhancing the loan's marketability. Unlike put options, which allow lenders to demand early repayment under certain conditions, call protection limits borrower-initiated prepayments, providing predictable income streams for lenders.

What is a Put Option in Lending?

A put option in lending is a contractual right that allows the lender to sell the loan back to the borrower or issuer at a predetermined price before maturity. This provision offers investors downside protection by enabling them to exit the loan under unfavorable market conditions or credit deterioration. Put options are often included in structured finance and private loan agreements to mitigate credit risk and improve liquidity for lenders.

Key Differences: Call Protection vs Put Option

Call protection restricts the borrower from repaying the loan early without penalty, ensuring lenders receive scheduled interest payments. Put options grant investors the right to sell the loan back to the issuer before maturity, offering protection against interest rate increases or credit deterioration. Key differences include borrower restrictions under call protection versus investor rights under put options, impacting loan flexibility and risk management.

Importance of Call Protection for Borrowers and Lenders

Call protection is crucial for borrowers because it prevents lenders from redeeming loans prematurely, ensuring stable interest expenses and predictable cash flow management. For lenders, call protection provides a safeguard against reinvestment risk by guaranteeing a fixed return period before any early repayment can occur. This balance fosters confidence and financial stability in loan agreements, benefiting both parties involved.

How Put Options Safeguard Loan Investments

Put options offer loan investors a critical safeguard by providing the right to sell the underlying loan asset at a predetermined price, thereby limiting potential losses in volatile markets. This mechanism enhances credit risk management by enabling investors to exit underperforming loans before default or deterioration in value occur. Compared to call protection, which restricts issuer prepayment, put options actively empower investors to protect their investment against adverse market movements and credit events.

Scenarios for Using Call Protection in Loans

Call protection in loans prevents borrowers from refinancing or repaying the loan early without penalties, especially in a declining interest rate environment. It is typically used in fixed-rate loans to secure predictable cash flows for lenders and protect their investment returns. This feature is crucial when interest rates are expected to drop, as it discourages borrowers from exercising repayment options prematurely, ensuring loan stability.

When to Consider a Put Option in Loan Structuring

Consider a put option in loan structuring when borrowers seek the flexibility to prepay debt without penalty, especially in volatile interest rate environments or during refinancing opportunities. Put options provide lenders with the right to demand early repayment, mitigating credit risk and enhancing loan security in uncertain markets. This mechanism aligns borrower incentives with lender protection, making it essential in high-yield or structured finance transactions.

Impact of Call Protection on Loan Pricing and Terms

Call protection in loan agreements limits the borrower's ability to repay the loan early without penalty, directly influencing loan pricing by reducing prepayment risk for lenders. Loans with extended call protection typically feature lower interest rates due to the guaranteed interest income over the lockout period, improving predictability of cash flows. This mechanism impacts loan terms by embedding callable features that balance borrower flexibility against lender risk, shaping the competitive landscape of debt financing.

Risks and Benefits of Put Options in Loan Contracts

Put options in loan contracts provide borrowers with the right to repay the loan early without penalty, reducing exposure to rising interest rates and improving liquidity. This feature mitigates refinancing risk by allowing early loan termination if market conditions become unfavorable. However, lenders face reinvestment risk and potential loss of expected interest income, balancing borrower flexibility against lender income stability.

Choosing Between Call Protection and Put Option for Optimal Loan Security

Call protection ensures borrowers cannot prepay a loan without penalty during a specified period, safeguarding lenders against early repayment risk. Put options grant lenders the right to demand early repayment or sell the loan back at a predetermined price, providing a safety net in declining credit environments. Selecting between call protection and put options depends on balancing borrower flexibility with lender security and market volatility projections.

Important Terms

Prepayment penalty

Prepayment penalties serve as a form of call protection by discouraging borrowers from repaying debt early, thus safeguarding lenders' expected interest income; in contrast, a put option grants the borrower the right to prepay or sell the security back to the issuer without penalty, enhancing borrower flexibility but reducing lender protection. The interplay between prepayment penalties and put options directly impacts the valuation and risk profile of fixed-income securities by influencing prepayment risk and cash flow predictability.

Yield maintenance

Yield maintenance ensures bondholders receive a predetermined return by requiring the issuer to compensate for lost interest if the bond is called early, providing call protection that limits issuer's ability to refinance at lower rates. Unlike call protection, a put option grants bondholders the right to sell the bond back to the issuer before maturity, reducing interest rate risk and enhancing liquidity.

Lockout period

The lockout period restricts early exercise of call options, enhancing call protection by preventing premature option assignment, while put options generally do not have a lockout period, allowing holders flexibility to sell underlying assets before expiration. This mechanism ensures that call option holders retain the benefit of potential upside price movements without the risk of early call assignment.

Convertible feature

The convertible feature in bonds allows holders to convert debt into equity, combining call protection to shield investors from issuer-initiated redemption with embedded put options that grant the right to sell the bond back to the issuer under specified conditions. This dual mechanism enhances investor flexibility by mitigating interest rate risk through call protection while providing downside security via the put option in fluctuating market environments.

Non-recourse loan

Non-recourse loans limit the lender's recovery to the collateral's value, emphasizing the importance of call protection provisions that prevent early loan repayment and safeguard anticipated interest income. Put options in this context provide borrowers a contractual right to prepay or refinance under specified conditions, which can reduce call protection benefits by allowing repayment flexibility.

Balloon payment

A balloon payment is a large, lump-sum payment due at the end of a loan term, often utilized in mortgage or bond financing to reduce initial periodic payments. In call protection, balloon payments limit the issuer's ability to refinance early, while put options give investors the right to sell the bond back before maturity, mitigating interest rate risk and enhancing liquidity.

Interest rate cap

An interest rate cap serves as a call protection by limiting the maximum interest rate a borrower must pay, effectively acting as a ceiling that prevents rates from rising above a specified level. In contrast, a put option grants the holder the right to sell an asset at a predetermined price, offering downside protection but does not directly limit interest rate exposure like an interest rate cap.

Sinking fund provision

A sinking fund provision reduces borrower default risk by mandating periodic bond repayments, offering call protection by limiting issuer's ability to redeem bonds early; conversely, a put option grants investors the right to sell bonds back before maturity, enhancing investor control but reducing issuer flexibility. Both mechanisms impact bond valuation and yield by altering cash flow certainty and redemption risk.

Early redemption clause

The early redemption clause allows issuers to repay bonds before maturity, providing call protection to investors by limiting the issuer's ability to call the bond prematurely. In contrast, a put option grants bondholders the right to sell the bond back to the issuer at a predetermined price before maturity, serving as a safeguard against interest rate declines and credit deterioration.

Negative convexity

Negative convexity occurs when bond prices increase at a diminishing rate as yields decline, often due to embedded call options limiting upside price appreciation, whereas put options provide investors with downside protection by allowing bondholders to sell the bond back to the issuer, enhancing price stability and offsetting negative convexity effects. Call protection periods reduce negative convexity by preventing early calls, maintaining more predictable bond price behavior compared to non-callable bonds without such protections.

call protection vs put option Infographic

moneydif.com

moneydif.com