LIBOR-based rates have historically been the benchmark for many loans, reflecting the average interest rate at which major banks lend to one another, but concerns over manipulation and decreased liquidity led to a global shift toward SOFR-based rates. SOFR, derived from actual overnight Treasury repurchase agreements, offers greater transparency and reduced credit risk, making it a more reliable alternative for pricing loans. Borrowers and lenders are adapting to SOFR's overnight nature and compounding conventions, requiring adjustments in loan agreements and risk management strategies.

Table of Comparison

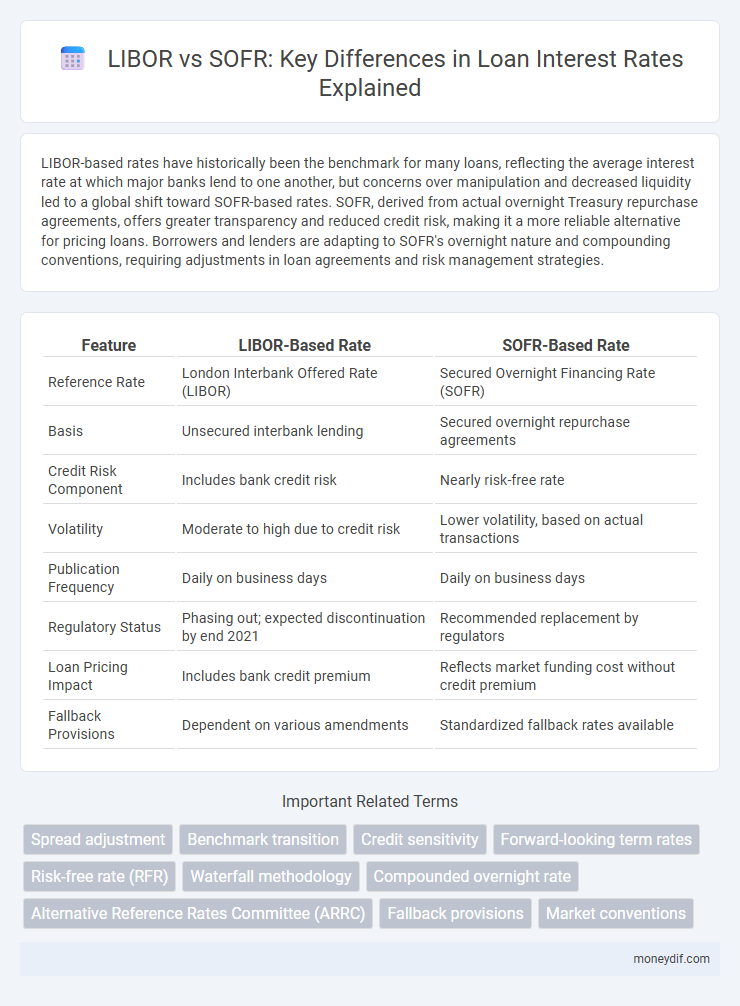

| Feature | LIBOR-Based Rate | SOFR-Based Rate |

|---|---|---|

| Reference Rate | London Interbank Offered Rate (LIBOR) | Secured Overnight Financing Rate (SOFR) |

| Basis | Unsecured interbank lending | Secured overnight repurchase agreements |

| Credit Risk Component | Includes bank credit risk | Nearly risk-free rate |

| Volatility | Moderate to high due to credit risk | Lower volatility, based on actual transactions |

| Publication Frequency | Daily on business days | Daily on business days |

| Regulatory Status | Phasing out; expected discontinuation by end 2021 | Recommended replacement by regulators |

| Loan Pricing Impact | Includes bank credit premium | Reflects market funding cost without credit premium |

| Fallback Provisions | Dependent on various amendments | Standardized fallback rates available |

Introduction to LIBOR and SOFR in Loan Markets

LIBOR, or the London Interbank Offered Rate, has historically served as the primary benchmark interest rate in global loan markets, reflecting the average rate at which major banks lend to each other. SOFR, the Secured Overnight Financing Rate, has emerged as a robust alternative based on actual transactions in the U.S. Treasury repurchase market, providing a more transparent and credit-risk-free reference rate. Transitioning loan agreements from LIBOR to SOFR involves adjusting contract language and interest calculations to accommodate differences in rate tenor, credit risk, and market liquidity.

Key Differences Between LIBOR-Based and SOFR-Based Loans

LIBOR-based loans reference the London Interbank Offered Rate, which reflects estimated bank borrowing costs but has faced credibility issues leading to its phase-out. SOFR-based loans use the Secured Overnight Financing Rate, a risk-free rate grounded in actual overnight repurchase agreement transactions, offering greater transparency and reliability. Key differences include LIBOR's reliance on expert judgment versus SOFR's market transactions, and LIBOR's term structure compared to SOFR's overnight focus, affecting loan pricing and risk management approaches.

Transition Timeline: From LIBOR to SOFR

The transition timeline from LIBOR to SOFR has accelerated since the Financial Conduct Authority announced LIBOR cessation dates, with most USD LIBOR settings expected to be discontinued by mid-2023. Market participants are actively migrating to SOFR-based rates, which are secured overnight financing rates offering greater transparency and reduced manipulation risk compared to LIBOR. Loan agreements now increasingly incorporate fallback language referencing SOFR to ensure continuity post-LIBOR phase-out.

Impact on Borrowers: LIBOR vs SOFR

Borrowers face different interest rate risks with LIBOR-based loans compared to SOFR-based loans due to their underlying reference rates. LIBOR includes a credit risk component, often resulting in higher borrowing costs during market stress, whereas SOFR is a nearly risk-free rate reflecting overnight Treasury repurchase agreements, typically leading to lower base rates but increased rate volatility. Transitioning to SOFR-based loans may affect borrower cash flow forecasting and debt servicing due to its frequent fluctuations and absence of term structure compared to LIBOR.

Impact on Lenders: LIBOR vs SOFR

LIBOR-based loan rates have traditionally provided lenders with predictable interest margins tied to global interbank lending, while SOFR-based rates reflect overnight secured funding costs, resulting in typically lower base rates but increased volatility. The transition to SOFR impacts lenders' risk management strategies, as SOFR's reliance on actual transaction data enhances transparency but requires adjustments in credit spreads and loan pricing models. Lenders must adapt to SOFR's near risk-free benchmark, which may compress profit margins compared to LIBOR, necessitating new hedging instruments and contract terms to maintain loan profitability.

Rate Calculation Methods: LIBOR-Based vs SOFR-Based Loans

LIBOR-based loans calculate interest rates using the London Interbank Offered Rate, reflecting the average rate at which banks lend to each other, while SOFR-based loans use the Secured Overnight Financing Rate derived from repurchase agreement transactions backed by U.S. Treasury securities. LIBOR incorporates credit risk and term premiums, resulting in rates that can vary based on market liquidity and credit conditions, whereas SOFR is a nearly risk-free overnight rate offering greater transparency and stability but lacks a built-in term structure. The transition from LIBOR to SOFR necessitates adjustments in loan agreements, including different methodologies for spread adjustments, compounding periods, and fallback provisions to ensure accurate and fair rate calculations.

Risk and Volatility: Comparing LIBOR and SOFR

SOFR-based rates exhibit lower risk and reduced volatility compared to LIBOR-based rates due to SOFR's transaction-based nature and daily reset frequency. LIBOR's reliance on estimated rates from panel banks introduces credit risk and vulnerability to manipulation, increasing potential volatility. Consequently, SOFR provides greater transparency and stability for loan pricing in volatile markets.

Documentation and Loan Agreement Changes

LIBOR-based rate loan agreements require provisions for fallback language due to discontinuation risks, necessitating amendments specifying alternative reference rates like SOFR. SOFR-based rate documentation demands precise definitions and adjustment spread mechanisms to address differences in credit risk and term structure compared to LIBOR. Loan agreements must incorporate detailed transition clauses, ensuring seamless rate substitution and mitigating legal uncertainties during the LIBOR-to-SOFR transition.

Market Adoption and Regulatory Guidance

LIBOR-based rates have historically dominated loan markets but face phase-out due to regulatory mandates promoting transition to SOFR-based rates, which better reflect actual transactions in overnight repurchase markets. Market adoption of SOFR has accelerated with regulatory agencies such as the Federal Reserve and the SEC endorsing SOFR as the preferred benchmark, enhancing transparency and reducing manipulation risks. Lenders and borrowers are increasingly favoring SOFR-linked loans, supported by widespread industry agreements and fallback language to minimize transition disruptions.

Future Outlook for SOFR-Based Lending

SOFR-based lending is expected to dominate the loan market as it offers greater transparency and resilience compared to LIBOR, which is being phased out due to benchmark manipulation concerns. Financial institutions and regulators are accelerating the transition to SOFR, promoting its adoption through standardized lending products and enhanced market liquidity. Future loan agreements increasingly incorporate SOFR with robust fallback provisions, ensuring stability and predictability in interest rate determination post-LIBOR era.

Important Terms

Spread adjustment

Spread adjustment compensates for credit and term differences when transitioning from LIBOR-based rates to SOFR-based rates to ensure fair valuation.

Benchmark transition

Benchmark transition from LIBOR-based rates to SOFR-based rates enhances financial market stability by using a transaction-based, risk-free reference rate replacing the unsecured interbank lending rate.

Credit sensitivity

Credit sensitivity in interest rates reflects the differential risk premiums between LIBOR-based rates, influenced by bank credit risk, and SOFR-based rates, which are secured overnight funding rates with minimal credit risk exposure.

Forward-looking term rates

Forward-looking term rates based on SOFR provide a credit-risk-free alternative to LIBOR-based rates by offering transparent, market-driven benchmarks for interest rate derivatives and loans.

Risk-free rate (RFR)

The risk-free rate (RFR) associated with SOFR-based rates offers a more accurate reflection of borrowing costs compared to LIBOR-based rates, which include credit risk premiums and have been phased out due to manipulation concerns.

Waterfall methodology

The Waterfall methodology systematically allocates cash flows under LIBOR-based rates and SOFR-based rates to prioritize payments while managing transition risks between the two benchmark interest rates.

Compounded overnight rate

The compounded overnight rate for SOFR-based loans provides a more accurate reflection of actual borrowing costs compared to the LIBOR-based rate, which relies on estimated interbank lending rates and carries higher credit risk.

Alternative Reference Rates Committee (ARRC)

The Alternative Reference Rates Committee (ARRC) promotes the transition from LIBOR-based rates to SOFR-based rates to enhance financial benchmark reliability and reduce systemic risk.

Fallback provisions

Fallback provisions for financial contracts originally referencing LIBOR-based rates specify the transition mechanisms to SOFR-based rates to mitigate discontinuation risks following LIBOR cessation. These provisions outline adjusted spread adjustments, calculation methods, and effective dates to ensure contract continuity and market stability during the shift from LIBOR to the Secured Overnight Financing Rate (SOFR).

Market conventions

Market conventions for LIBOR-based rates typically include term structures and credit risk premiums, whereas SOFR-based rates emphasize overnight secured funding costs with compounded averages and simpler fallback provisions.

LIBOR-based Rate vs SOFR-based Rate Infographic

moneydif.com

moneydif.com