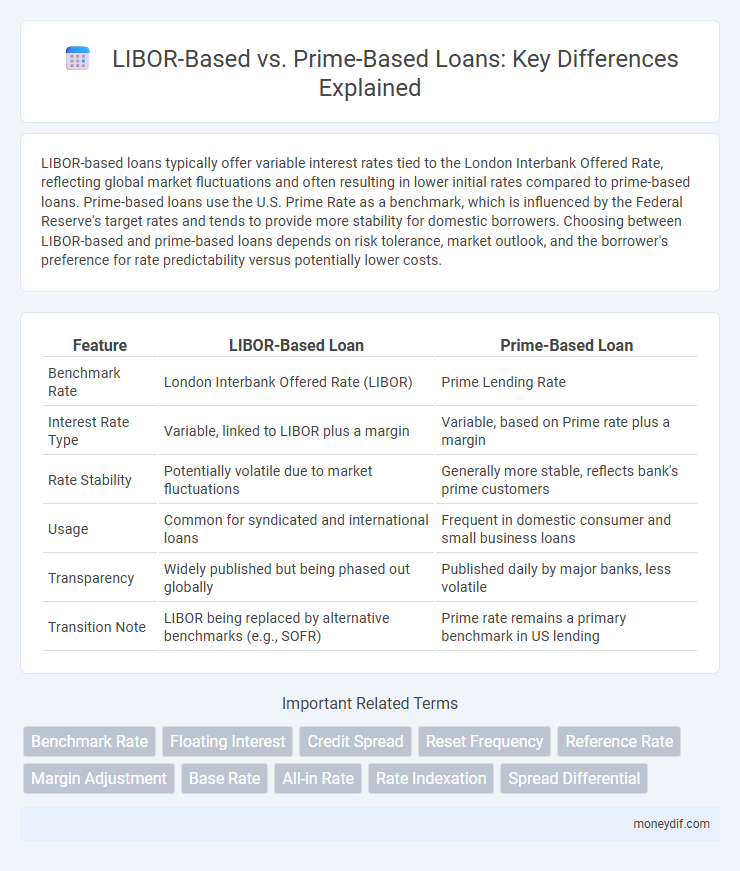

LIBOR-based loans typically offer variable interest rates tied to the London Interbank Offered Rate, reflecting global market fluctuations and often resulting in lower initial rates compared to prime-based loans. Prime-based loans use the U.S. Prime Rate as a benchmark, which is influenced by the Federal Reserve's target rates and tends to provide more stability for domestic borrowers. Choosing between LIBOR-based and prime-based loans depends on risk tolerance, market outlook, and the borrower's preference for rate predictability versus potentially lower costs.

Table of Comparison

| Feature | LIBOR-Based Loan | Prime-Based Loan |

|---|---|---|

| Benchmark Rate | London Interbank Offered Rate (LIBOR) | Prime Lending Rate |

| Interest Rate Type | Variable, linked to LIBOR plus a margin | Variable, based on Prime rate plus a margin |

| Rate Stability | Potentially volatile due to market fluctuations | Generally more stable, reflects bank's prime customers |

| Usage | Common for syndicated and international loans | Frequent in domestic consumer and small business loans |

| Transparency | Widely published but being phased out globally | Published daily by major banks, less volatile |

| Transition Note | LIBOR being replaced by alternative benchmarks (e.g., SOFR) | Prime rate remains a primary benchmark in US lending |

Introduction to LIBOR-Based and Prime-Based Loans

LIBOR-based loans are tied to the London Interbank Offered Rate, reflecting global interbank lending costs and often used in multinational financings. Prime-based loans reference the U.S. Prime Rate, which is the benchmark interest rate commercial banks charge their most creditworthy customers, mainly prevalent in domestic lending. Understanding the differences in interest rate benchmarks is essential for evaluating loan pricing, risk exposure, and market sensitivity.

Understanding LIBOR: A Global Benchmark

LIBOR, the London Interbank Offered Rate, serves as a global benchmark for short-term interest rates, reflecting the average rate at which major banks lend to one another. LIBOR-based loans are often preferred in international lending due to their widespread acceptance and sensitivity to global market conditions. In contrast, Prime-based loans typically reference a domestic benchmark rate set by banks for their most creditworthy customers, making LIBOR more suitable for cross-border financial agreements requiring a standardized global interest measure.

What Is a Prime Rate?

The prime rate is the interest rate that commercial banks charge their most creditworthy customers, typically large corporations, and serves as a benchmark for various loan products including home equity lines of credit and small business loans. Unlike LIBOR, which is based on interbank lending rates and is being phased out, the prime rate is influenced by the federal funds rate set by the Federal Reserve, making it a key indicator of U.S. monetary policy. Borrowers often see prime-based loans with rates tied directly to the prime rate plus a margin, providing a more stable and transparent cost of borrowing compared to LIBOR-based loans.

Key Differences Between LIBOR and Prime Rates

LIBOR-based loans use the London Interbank Offered Rate, reflecting the average interest rates at which major global banks lend to each other, making them sensitive to international financial markets. Prime-based loans hinge on the U.S. Prime Rate, which is set by banks based on the federal funds rate and serves as a benchmark for consumer and small business loans. LIBOR rates can vary daily and cover multiple currencies and maturities, while the Prime Rate is typically adjusted quarterly and primarily influences U.S. dollar loans.

Pros and Cons of LIBOR-Based Loans

LIBOR-based loans offer variable interest rates that closely reflect global financial market conditions, providing borrowers potential savings when rates decline; however, their volatility can lead to unpredictable payment amounts, increasing financial risk. These loans benefit borrowers seeking flexibility and alignment with international benchmarks but may face challenges due to LIBOR's phase-out and transition to alternative reference rates like SOFR. Understanding the impact of LIBOR reform is crucial to assess the long-term stability and comparability of loan terms.

Advantages and Disadvantages of Prime-Based Loans

Prime-based loans offer the advantage of stable and predictable interest rates tied to the prime rate, which is typically less volatile than LIBOR, providing borrowers with more consistent repayment amounts. These loans often come with simpler rate adjustments and are widely accessible, making them suitable for businesses seeking straightforward financing options. However, prime-based loans can result in higher overall costs when the prime rate is elevated, and they may not reflect international market conditions as accurately as LIBOR-based loans, limiting their competitiveness for global borrowers.

Interest Rate Fluctuations and Their Impact

LIBOR-based loans experience more frequent and pronounced interest rate fluctuations due to their direct linkage to the London Interbank Offered Rate, leading to variable borrowing costs that reflect global financial market volatility. Prime-based loans typically offer more stable and predictable interest rates tied to the U.S. Prime Rate, which often adjusts less frequently, providing borrowers with a clearer cost outlook. The choice between LIBOR-based and Prime-based loans significantly impacts interest expense predictability and risk management strategies for both individual and commercial borrowers.

Borrower Profiles: Who Benefits from Each Type?

LIBOR-based loans typically benefit large corporate borrowers with access to sophisticated financial markets, as these loans often feature lower initial rates tied to international benchmark rates. Prime-based loans are more suited for small to medium-sized businesses and individual borrowers who prefer stability linked to the U.S. Prime Rate, often reflecting local economic conditions. Borrowers seeking predictability and transparency tend to favor prime-based loans, while those aiming for potentially lower costs and international market alignment lean toward LIBOR-based loans.

Transitioning from LIBOR: The Rise of Alternative Benchmarks

The global financial market is transitioning from LIBOR to alternative benchmarks such as SOFR, SONIA, and Ameribor to address LIBOR's phase-out and regulatory concerns. Prime-based loans, relying on the prime rate set by banks, offer more stability but may lack the global transparency provided by new risk-free rates. These alternative benchmarks enhance loan pricing accuracy and reduce systemic risk by reflecting actual transaction data rather than estimated rates.

Choosing the Right Index for Your Loan

Selecting the right index for your loan significantly impacts your interest rate and overall payment structure. LIBOR-based loans often provide lower initial rates but can exhibit greater volatility due to global financial market fluctuations. Conversely, Prime-based loans tend to offer more stability tied to the domestic banking environment, influencing predictable budgeting for borrowers.

Important Terms

Benchmark Rate

Benchmark rates such as LIBOR-based and Prime-based rates serve as critical reference points for setting interest rates on various financial products, with LIBOR reflecting the average rate at which major global banks lend to each other, while the Prime rate is typically based on the U.S. Federal Reserve's benchmark and represents the interest rate banks charge their most creditworthy customers. The transition from LIBOR to alternative benchmarks like SOFR highlights regulatory efforts to enhance transparency and reliability in global financial markets, contrasting with Prime rates that remain influenced largely by domestic monetary policy.

Floating Interest

Floating interest rates linked to LIBOR typically adjust based on the London Interbank Offered Rate, reflecting interbank lending costs and often used in international finance, while prime-based floating rates reference the prime rate set by banks, impacting consumer and commercial loans more directly. LIBOR-based rates generally offer more variability aligned with global financial markets, whereas prime-based rates tend to track domestic economic conditions and central bank policies.

Credit Spread

Credit spread reflects the difference in yield between LIBOR-based and Prime-based loans, highlighting variations in perceived credit risk and market liquidity; LIBOR-based spreads typically track interbank lending risks while Prime-based spreads are influenced by consumer credit profiles and bank lending policies. Understanding these spreads is essential for accurately pricing loans and managing interest rate risk in corporate and consumer finance markets.

Reset Frequency

Reset frequency determines how often the interest rate on a loan or financial instrument adjusts, impacting the effective interest cost tied to LIBOR-based versus Prime-based benchmarks. LIBOR-based rates typically reset every 1, 3, or 6 months, reflecting short-term market conditions, while Prime-based rates often reset more infrequently, usually monthly or quarterly, influencing borrower payment variability and risk exposure.

Reference Rate

Reference rates such as LIBOR-based rates and Prime-based rates differ primarily in their underlying benchmarks and market usage, with LIBOR reflecting unsecured interbank lending rates and Prime representing the interest rate banks charge their most creditworthy customers. Financial instruments tied to LIBOR often exhibit more sensitivity to global credit conditions, while Prime-based rates are influenced predominantly by domestic monetary policies and bank funding costs.

Margin Adjustment

Margin adjustment in lending agreements reflects the difference in credit risk and market conditions between LIBOR-based and prime-based rate settings, impacting the spread added to the benchmark rate. LIBOR-based margins often compensate for the transition risk and liquidity premiums, while prime-based margins typically align with the lender's credit policy and retail lending standards.

Base Rate

Base rate serves as a benchmark interest rate determining loan pricing, with LIBOR-based rates reflecting borrowing costs in the interbank market while Prime-based rates are tied to the prime lending rate set by banks for their most creditworthy customers. LIBOR-based lending often adjusts daily or monthly reflecting global market conditions, whereas Prime-based lending generally adjusts less frequently and is influenced more by domestic monetary policy.

All-in Rate

All-in Rate refers to the total cost of borrowing, combining the interest rate and all associated fees, with LIBOR-based loans typically reflecting international benchmark rates influenced by interbank lending costs, while Prime-based loans are tied to the U.S. Prime Rate set by individual banks and more sensitive to domestic monetary policy. Comparing LIBOR-based versus Prime-based all-in rates requires assessing credit risk spreads, currency exposure, and market volatility, as LIBOR rates often incorporate global financial conditions whereas Prime rates mainly reflect national economic trends.

Rate Indexation

Rate indexation for financial products linked to LIBOR often involves using the London Interbank Offered Rate as a benchmark, reflecting average interbank lending costs, whereas Prime-based rate indexation hinges on the Prime Rate, which is the interest rate banks charge their most creditworthy customers. LIBOR-based indexation is typically more sensitive to short-term funding market fluctuations and is widely used in global derivatives and loans, while Prime-based indexation tends to be more stable and commonly applied in consumer and small business loans within the United States.

Spread Differential

Spread differential between LIBOR-based and Prime-based loans often reflects varying credit risk perceptions and market liquidity conditions, with LIBOR spreads generally lower due to its basis on interbank lending rates, while Prime spreads include a higher borrower-specific premium. These differences impact borrowing costs, influencing corporate financing decisions and interest rate risk management in varying economic environments.

LIBOR-based vs Prime-based Infographic

moneydif.com

moneydif.com