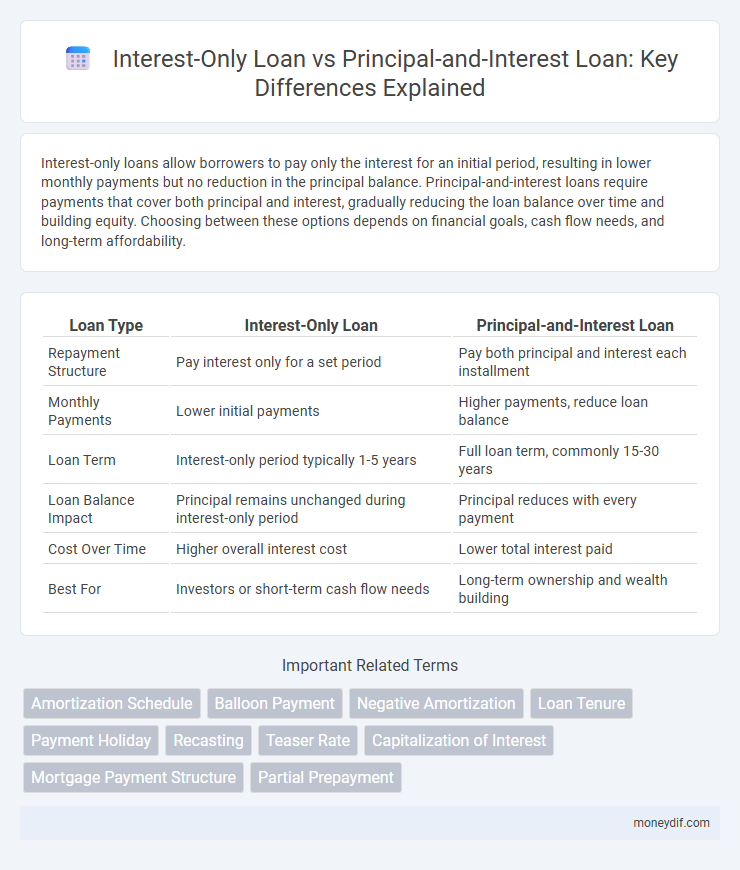

Interest-only loans allow borrowers to pay only the interest for an initial period, resulting in lower monthly payments but no reduction in the principal balance. Principal-and-interest loans require payments that cover both principal and interest, gradually reducing the loan balance over time and building equity. Choosing between these options depends on financial goals, cash flow needs, and long-term affordability.

Table of Comparison

| Loan Type | Interest-Only Loan | Principal-and-Interest Loan |

|---|---|---|

| Repayment Structure | Pay interest only for a set period | Pay both principal and interest each installment |

| Monthly Payments | Lower initial payments | Higher payments, reduce loan balance |

| Loan Term | Interest-only period typically 1-5 years | Full loan term, commonly 15-30 years |

| Loan Balance Impact | Principal remains unchanged during interest-only period | Principal reduces with every payment |

| Cost Over Time | Higher overall interest cost | Lower total interest paid |

| Best For | Investors or short-term cash flow needs | Long-term ownership and wealth building |

Understanding Interest-Only Loans

Interest-only loans require borrowers to pay only the interest portion for a set period, typically 5 to 10 years, resulting in lower initial monthly payments. These loans do not reduce the principal balance during the interest-only period, leading to higher payments once principal repayments begin. Understanding this structure is crucial for managing cash flow and planning long-term financial obligations effectively.

What Is a Principal-and-Interest Loan?

A principal-and-interest loan requires borrowers to make monthly repayments that cover both the loan principal and the accrued interest, steadily reducing the outstanding balance over time. This loan structure ensures that by the end of the term, the entire loan amount is fully repaid, making it a common choice for home mortgages. Principal-and-interest loans typically result in higher monthly payments compared to interest-only loans but save money on interest in the long run.

Key Differences Between Interest-Only and Principal-and-Interest Loans

Interest-only loans require borrowers to pay only the interest portion of the loan for a set period, resulting in lower initial monthly payments but no reduction in the loan principal. Principal-and-interest loans involve payments that cover both the interest and a portion of the principal, gradually decreasing the outstanding loan balance over time. The key difference lies in repayment structure: interest-only loans offer short-term cash flow relief, while principal-and-interest loans build equity and reduce debt steadily.

Pros and Cons of Interest-Only Loans

Interest-only loans offer lower initial monthly payments by requiring borrowers to pay only the interest for a set period, which can improve cash flow and provide financial flexibility especially for short-term financial goals or fluctuating income. However, the principal remains unchanged during the interest-only period, leading to higher payments once principal-and-interest repayments begin, and the total interest paid over the loan term may be significantly higher compared to principal-and-interest loans. Borrowers face the risk of negative equity if property values decline since the loan balance does not decrease during the interest-only phase.

Pros and Cons of Principal-and-Interest Loans

Principal-and-interest loans require repayments on both the loan amount and accumulated interest, steadily reducing the debt over time and building home equity. This structure offers predictability and eventual ownership, but monthly payments are higher compared to interest-only loans, impacting cash flow flexibility. Borrowers benefit from clear financial discipline, though they may face challenges managing larger payments during economic fluctuations or income variability.

Interest Rate Impact: Comparing Both Loan Types

Interest-only loans typically offer lower initial interest rates compared to principal-and-interest loans, which can reduce monthly payments during the interest-only period. However, principal-and-interest loans build equity faster as payments include both interest and principal, resulting in higher cumulative interest costs overall but quicker loan payoff. Understanding the long-term interest rate impact is crucial, as interest-only loans may lead to higher total interest paid over the loan term if interest rates rise or if the principal remains unpaid during the interest-only period.

Repayment Flexibility and Financial Planning

Interest-only loans offer greater repayment flexibility by allowing borrowers to pay only the interest for a set period, easing short-term cash flow management. Principal-and-interest loans require consistent payments that cover both repayment and interest, promoting steady equity building and long-term financial planning. Choosing between these loan types impacts budget stability and the ability to adapt repayment strategies based on financial goals and market conditions.

Suitability: Which Loan Type Fits Your Needs?

Interest-only loans suit borrowers seeking lower initial payments and greater cash flow flexibility, ideal for investors or those with irregular income. Principal-and-interest loans provide steady repayment and faster equity build-up, fitting homeowners aiming for long-term stability and full loan repayment. Evaluating financial goals, income stability, and repayment capacity helps determine the best loan type tailored to individual needs.

Long-Term Costs and Equity Building

Interest-only loans often have lower initial monthly payments but result in higher long-term costs due to interest accruing without reducing the principal. Principal-and-interest loans build equity over time by gradually paying down the loan balance, reducing overall interest paid and increasing homeownership value. Borrowers seeking to minimize total interest expense and increase property equity typically benefit more from principal-and-interest repayment structures.

How to Choose Between Interest-Only and Principal-and-Interest Loans

Choosing between interest-only and principal-and-interest loans depends on your financial goals and cash flow needs. Interest-only loans offer lower initial repayments, making them suitable for investors seeking short-term cash flow benefits, while principal-and-interest loans are ideal for borrowers wanting to build equity and reduce debt over time. Evaluating your repayment capacity, investment horizon, and long-term financial plans is crucial in determining the appropriate loan type.

Important Terms

Amortization Schedule

An amortization schedule for an interest-only loan shows only periodic interest payments with principal repaid at term end, while a principal-and-interest loan schedule gradually reduces both principal and interest over the loan term.

Balloon Payment

A balloon payment in an interest-only loan requires a large lump sum at the end of the term, unlike principal-and-interest loans where payments gradually reduce both principal and interest over time.

Negative Amortization

Negative amortization occurs when interest-only loan payments fail to cover accrued interest, causing the loan balance to increase, unlike principal-and-interest loans where regular payments reduce the loan principal over time.

Loan Tenure

Interest-only loans typically have shorter loan tenures compared to principal-and-interest loans because borrowers pay only the interest initially, delaying principal repayment and affecting total loan duration.

Payment Holiday

A payment holiday allows borrowers with interest-only loans to temporarily pause principal repayments while principal-and-interest loan borrowers may only defer interest payments, impacting overall loan amortization and interest costs.

Recasting

Recasting an interest-only loan reduces monthly payments by recalculating amortization based on a lump-sum principal payment, whereas principal-and-interest loans automatically adjust payments over the loan term without requiring recasting.

Teaser Rate

Teaser rates on interest-only loans initially offer lower monthly payments compared to principal-and-interest loans, but often lead to higher overall costs when principal repayment begins.

Capitalization of Interest

Capitalization of interest increases the loan balance in interest-only loans by adding unpaid interest to the principal, whereas principal-and-interest loans require regular payments that reduce both principal and accrued interest, preventing interest capitalization.

Mortgage Payment Structure

Interest-only loans require payments solely on the loan interest initially, resulting in lower monthly costs but no principal reduction, while principal-and-interest loans involve payments that cover both interest and principal, gradually reducing the loan balance.

Partial Prepayment

Partial prepayment on an interest-only loan reduces future interest costs without lowering the principal balance, while on a principal-and-interest loan it directly decreases the outstanding principal and interest payable.

Interest-only Loan vs Principal-and-Interest Loan Infographic

moneydif.com

moneydif.com