Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, relying solely on the borrower's creditworthiness, typically leading to higher interest rates and stricter approval criteria. Understanding the differences between secured and unsecured loans helps borrowers choose the best option based on their financial situation and risk tolerance.

Table of Comparison

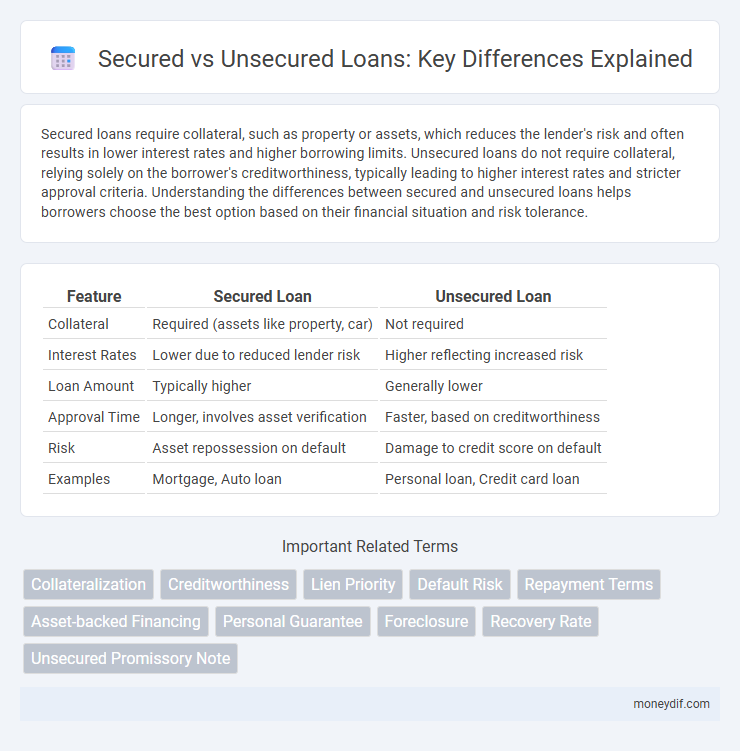

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral | Required (assets like property, car) | Not required |

| Interest Rates | Lower due to reduced lender risk | Higher reflecting increased risk |

| Loan Amount | Typically higher | Generally lower |

| Approval Time | Longer, involves asset verification | Faster, based on creditworthiness |

| Risk | Asset repossession on default | Damage to credit score on default |

| Examples | Mortgage, Auto loan | Personal loan, Credit card loan |

Understanding Secured and Unsecured Loans

Secured loans require collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, making them riskier for lenders, which leads to higher interest rates and stricter credit requirements. Understanding the distinction between secured and unsecured loans helps borrowers choose the best option based on their financial situation, credit score, and repayment ability.

Key Differences Between Secured and Unsecured Loans

Secured loans require collateral such as property or assets, reducing the lender's risk and often resulting in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, relying solely on the borrower's creditworthiness, which typically leads to higher interest rates and stricter approval criteria. The key difference lies in risk management: secured loans offer protection to lenders through asset claims, whereas unsecured loans depend on borrower credit evaluation.

Pros and Cons of Secured Loans

Secured loans require collateral, which reduces the lender's risk and often results in lower interest rates and higher borrowing limits for the borrower. However, the primary risk involves potential loss of the collateral asset, such as a home or vehicle, if the borrower defaults on the loan. Borrowers with secured loans typically benefit from easier approval and longer repayment terms, but face increased financial exposure due to asset forfeiture possibilities.

Pros and Cons of Unsecured Loans

Unsecured loans offer the advantage of not requiring collateral, reducing the risk of asset loss for borrowers and providing quicker approval times compared to secured loans. However, these loans typically come with higher interest rates and stricter credit requirements, reflecting the increased risk for lenders. The absence of collateral means missed payments can significantly impact credit scores, making repayment discipline crucial for maintaining financial health.

Eligibility Requirements for Each Loan Type

Secured loans require borrowers to provide collateral such as property or vehicles, making eligibility contingent on asset ownership and creditworthiness; lenders assess the value of the collateral to mitigate risk. Unsecured loans do not require collateral but typically demand higher credit scores and stable income to qualify, reflecting the increased risk to lenders. Both loan types mandate verification of employment, income documents, and credit history, though secured loans may have more flexible eligibility criteria due to the security offered.

Interest Rates: Secured vs Unsecured Loans

Secured loans generally offer lower interest rates because they are backed by collateral, reducing the lender's risk. Unsecured loans have higher interest rates to compensate for the increased risk since they rely solely on the borrower's creditworthiness. Interest rates on secured loans can range from 3% to 8%, while unsecured loans often start around 6% and can exceed 20% depending on credit scores and loan terms.

Impact on Credit Score

Secured loans, backed by collateral like property or savings, typically have a lower risk of default and can positively impact credit scores when payments are made on time. Unsecured loans, lacking collateral, often carry higher interest rates and missed payments can lead to a more significant negative effect on credit scores due to increased lender risk. Timely repayment of either loan type is critical for maintaining or improving credit health and reflects well in credit reports used by credit scoring models.

Common Examples of Secured and Unsecured Loans

Common examples of secured loans include mortgages, auto loans, and home equity lines of credit, where the borrower pledges assets like property or vehicles as collateral. Unsecured loans consist of credit cards, personal loans, and student loans, which rely on the borrower's creditworthiness without requiring any asset backing. Secured loans typically offer lower interest rates due to reduced lender risk, whereas unsecured loans generally come with higher rates reflecting the increased credit risk.

Choosing the Right Loan for Your Needs

Secured loans require collateral, such as property or a vehicle, which reduces lender risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, making them ideal for borrowers lacking assets but typically come with higher interest rates and stricter credit requirements. Assess your financial situation, collateral availability, and repayment ability to choose the loan type that best aligns with your needs.

Frequently Asked Questions About Secured and Unsecured Loans

Secured loans require collateral such as property or assets, which reduces lender risk and often results in lower interest rates and higher borrowing limits. Unsecured loans do not require collateral, making approval more stringent and interest rates typically higher due to increased lender risk. Common FAQs include differences in eligibility criteria, repayment terms, interest rates, and consequences of default for both secured and unsecured loans.

Important Terms

Collateralization

Collateralization in secured loans reduces lender risk by using assets as security, unlike unsecured loans which rely solely on borrower creditworthiness.

Creditworthiness

Creditworthiness significantly impacts the approval chances and interest rates of secured loans, which require collateral, compared to unsecured loans that rely solely on the borrower's credit history and income.

Lien Priority

A secured loan holds lien priority over unsecured loans because it is backed by collateral, ensuring the lender's claim is satisfied first in case of borrower default.

Default Risk

Default risk is lower for secured loans because collateral reduces lender losses, whereas unsecured loans carry higher default risk due to lack of asset backing.

Repayment Terms

Secured loans typically offer lower interest rates and longer repayment terms due to collateral requirements, while unsecured loans have higher interest rates and shorter repayment periods reflecting increased lender risk.

Asset-backed Financing

Asset-backed financing offers lower interest rates and reduced risk through collateralized secured loans, whereas unsecured loans lack collateral, resulting in higher interest rates and increased lender risk.

Personal Guarantee

A personal guarantee in a secured loan serves as an additional layer of security, allowing the lender to recover funds from the borrower's personal assets if the collateral fails to cover the debt; in contrast, unsecured loans rely solely on the borrower's creditworthiness without collateral, making personal guarantees often a critical factor in loan approval and risk mitigation. Lenders typically require stronger personal guarantees for unsecured loans due to the heightened risk, whereas secured loans primarily depend on the value of the pledged asset.

Foreclosure

Foreclosure occurs when a borrower defaults on a secured loan, allowing the lender to seize the collateral, unlike unsecured loans which lack collateral and do not involve foreclosure.

Recovery Rate

Recovery rate on secured loans typically exceeds 70%, significantly higher than the 20-40% recovery rate observed for unsecured loans due to collateral backing.

Unsecured Promissory Note

An unsecured promissory note is a legally binding financial instrument used in unsecured loans, which do not require collateral unlike secured loans that rely on secured assets to mitigate lender risk.

Secured Loan vs Unsecured Loan Infographic

moneydif.com

moneydif.com