Drawdown in loans refers to the act of the borrower accessing the approved funds, typically in stages or amounts as needed, while disbursement is the actual release of funds from the lender to the borrower or a third party. Drawdown often involves the borrower's request and approval for a specific amount within the loan limit, whereas disbursement is the lender's execution of payment following that request. Understanding the distinction between drawdown and disbursement helps manage cash flow and loan utilization efficiently.

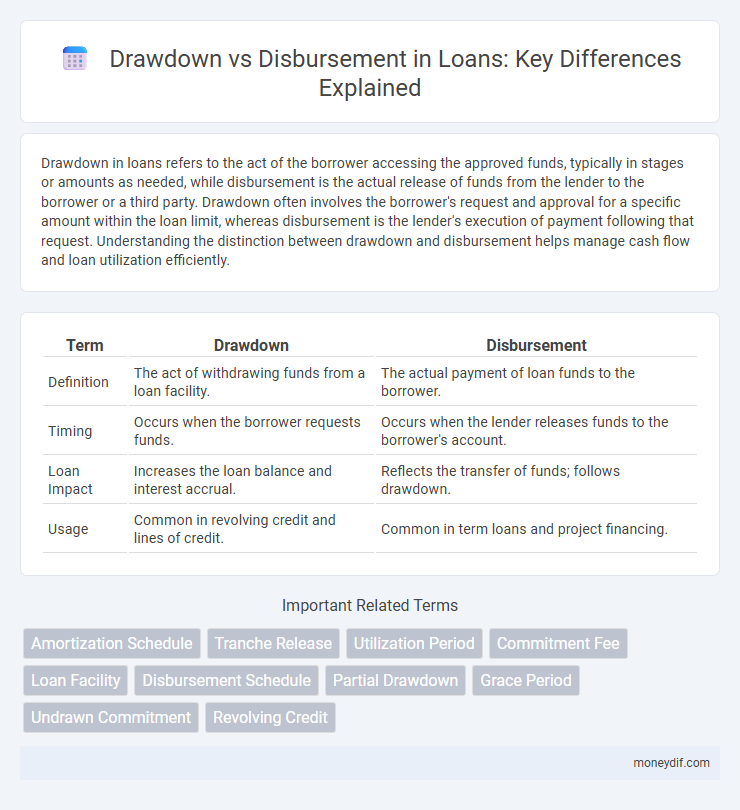

Table of Comparison

| Term | Drawdown | Disbursement |

|---|---|---|

| Definition | The act of withdrawing funds from a loan facility. | The actual payment of loan funds to the borrower. |

| Timing | Occurs when the borrower requests funds. | Occurs when the lender releases funds to the borrower's account. |

| Loan Impact | Increases the loan balance and interest accrual. | Reflects the transfer of funds; follows drawdown. |

| Usage | Common in revolving credit and lines of credit. | Common in term loans and project financing. |

Understanding Loan Drawdown and Disbursement

Loan drawdown refers to the process where a borrower accesses funds from an approved credit facility, often in stages based on project needs or agreed timelines. Disbursement, on the other hand, is the actual transfer of these funds to the borrower's account or directly to vendors or contractors. Understanding the distinction between drawdown and disbursement is crucial for effective cash flow management and compliance with loan terms.

Drawdown vs Disbursement: Key Definitions

Drawdown refers to the process where a borrower requests and withdraws funds from an approved loan facility, often in stages according to need. Disbursement is the actual release and transfer of those loan funds from the lender to the borrower's account. Understanding the distinction between drawdown as the borrower's action and disbursement as the lender's execution is crucial for effective loan management and repayment scheduling.

How Drawdown Works in Loans

Drawdown in loans refers to the process of accessing funds from an approved credit facility or loan amount, allowing borrowers to withdraw money as needed rather than receiving the full loan sum upfront. This method enables flexible cash flow management, where interest is typically charged only on the amount drawn instead of the total loan limit. Drawdowns are common in revolving credit lines, construction loans, and business lines of credit, facilitating staged funding aligned with project milestones or operating expenses.

The Disbursement Process Explained

The disbursement process involves the actual release of loan funds to the borrower following approval and all necessary documentation. Drawdown refers to the borrower's action of withdrawing funds from the approved loan facility in one or multiple installments. Understanding the disbursement schedule and conditions is critical for managing loan utilization and repayment effectively.

Main Differences Between Drawdown and Disbursement

Drawdown refers to the process whereby a borrower accesses funds from an approved loan facility, typically in stages or as needed, while disbursement is the actual transfer of those funds to the borrower's account. The main difference lies in timing and control: drawdown is the request or authorization to use the loan amount, whereas disbursement is the execution of fund release by the lender. Understanding this distinction is crucial for managing cash flow and ensuring compliance with loan terms.

Impact on Borrowers: Drawdown vs Disbursement

Drawdown allows borrowers to access funds gradually as needed, reducing interest costs and improving cash flow management during the loan term. Disbursement involves the full or partial release of the loan amount upfront, which can increase immediate financial flexibility but may lead to higher initial interest expenses. Understanding the timing and method of fund release helps borrowers optimize loan utilization and manage repayment obligations effectively.

Loan Repayment Implications: Drawdown vs Disbursement

Drawdown refers to the specific amount a borrower withdraws from an approved loan facility, directly impacting the interest calculation by starting the repayment period on the drawn funds. Disbursement is the actual transfer of loan funds to the borrower's account, which triggers the formal repayment schedule and associated contractual obligations. Understanding the timing and amount of drawdown versus disbursement is crucial for accurate loan repayment planning and interest cost management.

Drawdown and Disbursement in Different Loan Types

Drawdown refers to the process where a borrower accesses the approved loan amount either partially or fully, often seen in revolving credit facilities and construction loans with multiple disbursements aligned to project milestones. Disbursement generally indicates the initial release of funds in standard term loans, where the entire loan amount is transferred in a lump sum at closing. Different loan types dictate specific drawdown and disbursement schedules; for instance, revolving loans allow multiple drawdowns up to the credit limit, while installment loans typically involve a single disbursement.

Common Mistakes: Drawdown vs Disbursement in Loans

Confusing drawdown with disbursement often leads to delayed loan access and mismanagement of funds. Drawdown refers to the borrower's formal request to access a portion of the approved loan amount, while disbursement is the actual transfer of funds to the borrower's account. Mistaking these terms can result in missed payment deadlines and inaccurate financial reporting in loan agreements.

Choosing the Right Option: Drawdown or Disbursement

Selecting the right option between drawdown and disbursement depends on the loan structure and cash flow needs. Drawdown allows borrowers to access funds in tranches, optimizing interest payments by borrowing only what is needed at each stage. Disbursement involves receiving the full loan amount upfront, suitable for projects requiring immediate large capital outlays or when minimizing administrative steps is a priority.

Important Terms

Amortization Schedule

An amortization schedule details repayment of a loan's principal and interest, with drawdown representing the actual loan amount accessed by the borrower, while disbursement refers to the lender's distribution of funds.

Tranche Release

Tranche release refers to the phased allocation of loan funds based on project milestones or specific conditions, directly impacting the drawdown schedule and overall disbursement timeline. Effective management of tranche release ensures precise coordination between loan drawdowns by the borrower and actual disbursements to project components, optimizing cash flow and minimizing financial risk.

Utilization Period

The utilization period measures the time frame during which funds are actively drawn down compared to the total disbursed amount, reflecting the efficiency of capital deployment.

Commitment Fee

Commitment fee is charged on the undrawn portion of a loan facility, differentiating it from disbursement fees which apply only upon actual loan drawdown.

Loan Facility

Loan facility drawdown refers to the borrower's formal request and approval to access funds up to the agreed credit limit, while disbursement is the actual transfer of those funds into the borrower's account.

Disbursement Schedule

The disbursement schedule details the timeline and amounts of funds released, distinguishing between initial drawdowns and subsequent disbursements to ensure accurate financial management and compliance.

Partial Drawdown

Partial drawdown refers to the incremental withdrawal of funds from a loan or credit facility, allowing borrowers to access capital as needed rather than receiving the full disbursement amount upfront, which helps optimize cash flow management and interest expenses.

Grace Period

The grace period refers to the time interval after a loan disbursement during which the borrower is not required to make principal repayments despite the drawdown amount being fully available.

Undrawn Commitment

Undrawn commitment refers to the portion of a loan or credit facility approved but not yet utilized, contrasting with drawdown as the actual amount borrowers access and disbursement as the lender's transfer of funds to the borrower.

Revolving Credit

Revolving credit allows borrowers to repeatedly draw down funds up to a credit limit, with drawdown referring to the actual amount withdrawn during a transaction. Disbursement, on the other hand, typically describes the initial or scheduled release of funds from the lender to the borrower, often seen in structured loans rather than revolving credit facilities.

Drawdown vs Disbursement Infographic

moneydif.com

moneydif.com