Mezzanine financing offers higher returns due to its subordinate position compared to senior debt, which has priority in repayment and lower interest rates. While senior debt provides secured loans with lower risk, mezzanine financing is often unsecured and used to fill the gap between equity and senior loans. Companies use mezzanine financing to leverage growth without diluting ownership, accepting higher interest costs in exchange for flexible terms.

Table of Comparison

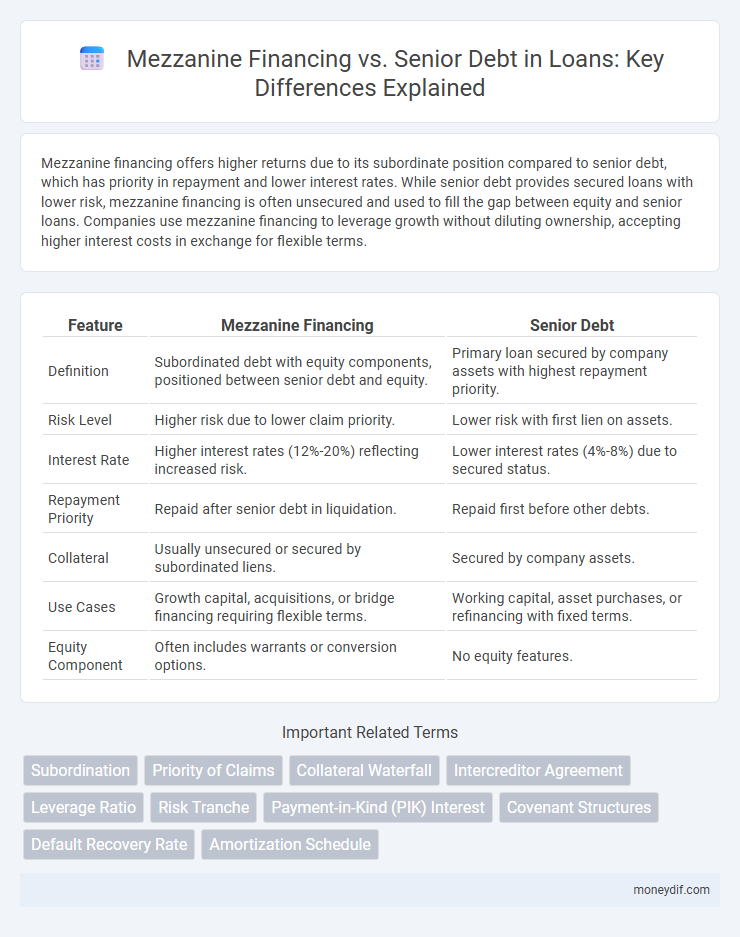

| Feature | Mezzanine Financing | Senior Debt |

|---|---|---|

| Definition | Subordinated debt with equity components, positioned between senior debt and equity. | Primary loan secured by company assets with highest repayment priority. |

| Risk Level | Higher risk due to lower claim priority. | Lower risk with first lien on assets. |

| Interest Rate | Higher interest rates (12%-20%) reflecting increased risk. | Lower interest rates (4%-8%) due to secured status. |

| Repayment Priority | Repaid after senior debt in liquidation. | Repaid first before other debts. |

| Collateral | Usually unsecured or secured by subordinated liens. | Secured by company assets. |

| Use Cases | Growth capital, acquisitions, or bridge financing requiring flexible terms. | Working capital, asset purchases, or refinancing with fixed terms. |

| Equity Component | Often includes warrants or conversion options. | No equity features. |

Introduction to Mezzanine Financing and Senior Debt

Mezzanine financing is a hybrid form of capital that sits between senior debt and equity in the capital structure, typically offering higher returns due to increased risk. Senior debt is secured by collateral and has the highest priority in repayment during default, making it lower risk but with lower interest rates. Understanding the distinctions in risk, repayment priority, and cost is crucial for businesses seeking flexible capital solutions.

Key Differences Between Mezzanine Financing and Senior Debt

Mezzanine financing is a hybrid of debt and equity, characterized by higher interest rates and subordinate claim on assets compared to senior debt, which holds priority in repayment and lower risk. Senior debt typically requires collateral and has stricter covenants, while mezzanine financing often comes unsecured and includes equity warrants or conversion options to compensate for increased risk. The key differences lie in their position in the capital structure, risk profiles, cost of capital, and influence on ownership dilution.

Structure and Features of Senior Debt

Senior debt represents a primary loan secured by company assets, carrying the highest repayment priority in bankruptcy. It typically features lower interest rates due to reduced lender risk and includes strict covenants to protect creditors' interests. The structured repayment schedule ensures predictable cash flow management, often limiting the borrower's additional debt capacity.

Overview of Mezzanine Financing Structure

Mezzanine financing is a hybrid of debt and equity, positioned between senior debt and equity in the capital stack, typically carrying higher interest rates due to increased risk. This structure often includes subordinated debt paired with equity warrants or options, enabling lenders to convert debt into equity stakes in the company. It provides borrowers with flexible capital for growth or acquisitions without immediate dilution of ownership, though it ranks behind senior debt in repayment priority during default.

Risk Profiles: Mezzanine vs Senior Debt

Mezzanine financing carries higher risk than senior debt due to its subordinate position in the capital structure and lack of collateral, resulting in higher interest rates and potential equity participation. Senior debt has priority claim on assets and cash flows in the event of default, making it less risky for lenders but offering lower returns. The differing risk profiles influence lender protections, with senior debt often secured by firm assets, while mezzanine financing relies on the borrower's growth potential and cash flow stability.

Cost of Capital Comparison

Mezzanine financing typically carries a higher cost of capital compared to senior debt due to its subordinated position and increased risk for lenders, often resulting in interest rates ranging from 12% to 20%. Senior debt usually offers lower interest rates, commonly between 4% and 8%, due to its priority claim on assets and lower risk profile. This cost differential reflects the risk-return tradeoff investors require when choosing between mezzanine financing and senior secured loans in corporate capital structures.

Security and Collateral Requirements

Mezzanine financing typically involves unsecured or subordinated debt, offering limited security compared to senior debt, which is secured by specific collateral such as property or equipment. Senior debt holders have priority claims on assets in case of default, reducing their risk, while mezzanine lenders accept higher risk for higher returns due to lower collateral protection. Collateral requirements for senior debt are stringent and clearly defined, often including liens on physical assets, whereas mezzanine financing relies more on the borrower's equity or warrants.

Use Cases: When to Choose Mezzanine or Senior Debt

Mezzanine financing is ideal for companies seeking growth capital without diluting ownership, often used during expansions or acquisitions when senior debt limits are reached. Senior debt suits businesses with stable cash flows needing lower-cost capital and prioritizing repayment security. Choosing between mezzanine financing and senior debt depends on risk tolerance, capital structure flexibility, and the company's stage of development.

Impact on Company Ownership and Control

Mezzanine financing often involves issuing equity warrants or convertible debt, which can dilute existing ownership and reduce control for current shareholders. Senior debt typically does not affect company ownership, as it is secured and must be repaid before equity holders receive returns, preserving original ownership structures. Choosing mezzanine financing impacts control by potentially allowing lenders equity stakes, while senior debt maintains current ownership but increases financial obligations.

Final Considerations: Choosing the Right Financing Option

Mezzanine financing offers higher flexibility and potential equity participation, suitable for companies seeking growth without immediate dilution of ownership, whereas senior debt provides lower cost and priority repayment, ideal for stable businesses with predictable cash flow. The choice depends on the borrower's risk tolerance, capital structure, and long-term financial strategy, balancing cost of capital against control and repayment obligations. Careful assessment of cash flow stability, interest rates, and lender covenants ensures optimal alignment with corporate objectives and capital needs.

Important Terms

Subordination

Subordination in mezzanine financing refers to its lower priority claim on assets and cash flows compared to senior debt, resulting in higher risk and typically higher interest rates. This ranking affects recovery prospects during default, with senior debt holders paid first and mezzanine lenders absorbing losses only after senior obligations are satisfied.

Priority of Claims

In mezzanine financing, priority of claims ranks below senior debt, meaning senior lenders receive repayment first in the event of default or liquidation. This subordinate position results in higher interest rates for mezzanine debt due to increased risk exposure compared to senior secured loans.

Collateral Waterfall

Collateral waterfall structures prioritize senior debt repayment before mezzanine financing claims, ensuring senior creditors receive principal and interest first in default scenarios. Mezzanine financing, positioned subordinately, absorbs losses after senior debts are satisfied, reflecting higher risk and correspondingly higher yield requirements.

Intercreditor Agreement

An Intercreditor Agreement defines the priority, rights, and obligations between mezzanine financing and senior debt holders, typically granting senior lenders precedence in repayment and collateral claims. This contractual framework mitigates conflicts by outlining enforcement procedures, payment subordination, and inter-lender communications to protect senior debt interests while accommodating mezzanine financing risk profiles.

Leverage Ratio

Leverage ratio, calculated as total debt divided by equity, typically increases with mezzanine financing due to its subordinated position and higher risk compared to senior debt, which is prioritized in repayment and often carries lower interest rates. Mezzanine financing bridges the gap between senior debt and equity, allowing companies to optimize capital structure without excessively diluting ownership, but it results in a higher overall leverage ratio and cost of capital.

Risk Tranche

Risk tranches in mezzanine financing hold higher risk compared to senior debt due to their subordinated repayment priority and higher interest rates, often linked to equity kickers or warrants that compensate for the increased default risk. Senior debt offers lower yields but greater security from collateral and priority claims, making it less risky in the capital structure hierarchy.

Payment-in-Kind (PIK) Interest

Payment-in-Kind (PIK) interest is a common feature in mezzanine financing, allowing borrowers to defer cash interest payments by adding accrued interest to the principal balance, which contrasts with senior debt that typically requires regular cash interest payments. Mezzanine financing with PIK interest carries higher risk and cost due to its subordinated position and flexibility in payment structures compared to the lower-risk, cash-interest obligations of senior debt.

Covenant Structures

Covenant structures in mezzanine financing are typically more flexible than those in senior debt, allowing higher leverage ratios and fewer financial maintenance covenants to accommodate the increased risk. Senior debt covenants focus on strict financial performance metrics and priority repayment terms, providing creditors with stronger protections through tighter restrictions on cash flow and collateral usage.

Default Recovery Rate

Default recovery rate in mezzanine financing typically ranges from 30% to 50%, significantly lower than senior debt recovery rates, which can exceed 70% due to its higher claim priority and collateral backing. Mezzanine debt's subordinate position in the capital structure results in increased risk exposure and reduced recovery upon default compared to senior secured loans.

Amortization Schedule

An amortization schedule for mezzanine financing typically involves higher interest rates and longer payment terms compared to senior debt, reflecting the increased risk and subordinate claim on assets. Senior debt amortization schedules prioritize principal repayment with fixed interest rates and shorter maturities, ensuring quicker recovery for lenders ahead of mezzanine investors.

mezzanine financing vs senior debt Infographic

moneydif.com

moneydif.com