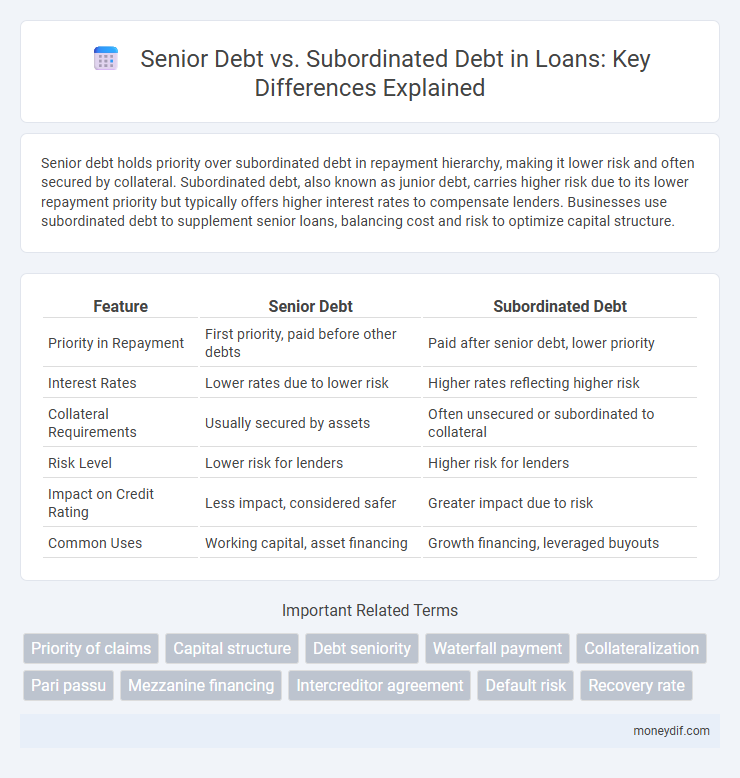

Senior debt holds priority over subordinated debt in repayment hierarchy, making it lower risk and often secured by collateral. Subordinated debt, also known as junior debt, carries higher risk due to its lower repayment priority but typically offers higher interest rates to compensate lenders. Businesses use subordinated debt to supplement senior loans, balancing cost and risk to optimize capital structure.

Table of Comparison

| Feature | Senior Debt | Subordinated Debt |

|---|---|---|

| Priority in Repayment | First priority, paid before other debts | Paid after senior debt, lower priority |

| Interest Rates | Lower rates due to lower risk | Higher rates reflecting higher risk |

| Collateral Requirements | Usually secured by assets | Often unsecured or subordinated to collateral |

| Risk Level | Lower risk for lenders | Higher risk for lenders |

| Impact on Credit Rating | Less impact, considered safer | Greater impact due to risk |

| Common Uses | Working capital, asset financing | Growth financing, leveraged buyouts |

Introduction to Senior and Subordinated Debt

Senior debt holds the highest priority for repayment in the capital structure, typically secured by company assets and carrying lower interest rates due to reduced risk. Subordinated debt ranks below senior debt in repayment hierarchy, often unsecured and bearing higher interest rates to compensate for increased risk exposure. Understanding the distinction between senior and subordinated debt is crucial for lenders and investors assessing risk and recovery prospects in loan agreements.

Key Differences Between Senior and Subordinated Debt

Senior debt holds priority in repayment and is secured by company assets, reducing lender risk and often carrying lower interest rates. Subordinated debt ranks below senior debt in claims and is unsecured or less secured, leading to higher risk but typically offering higher interest rates to compensate. The differing priority levels impact recovery rates during bankruptcy, with senior debt investors recovering funds before subordinated debt holders.

Priority of Claims in Bankruptcy

Senior debt holds the highest priority of claims in bankruptcy, ensuring repayment before any other debt classes, including subordinated debt. Subordinated debt ranks below senior debt, meaning its claims are paid only after all senior obligations have been satisfied, often resulting in higher risk and interest rates. This hierarchy significantly impacts recovery rates, with senior debt typically experiencing higher recovery percentages due to its prioritized legal standing.

Interest Rates: Senior vs Subordinated Debt

Senior debt typically carries lower interest rates due to its higher repayment priority and reduced risk for lenders. Subordinated debt demands higher interest rates to compensate investors for the increased risk and lower claim on assets in the event of default. The interest rate spread between senior and subordinated debt reflects the varying levels of risk and repayment hierarchy associated with each type of loan.

Risk Profiles and Investor Considerations

Senior debt holds priority in the capital structure, offering lower risk to investors due to its secured status and priority in repayment during default. Subordinated debt carries higher risk as it is repaid after senior obligations, often resulting in higher interest rates to compensate investors for increased default risk. Investors weigh the trade-off between risk and return by considering the seniority, recovery rates, and covenants attached to each debt class.

Collateral and Security Features

Senior debt holds priority claims on collateral, often secured by specific assets, ensuring lenders have a first lien in case of default. Subordinated debt lacks direct collateral backing, carrying a lower claim priority and higher risk, typically unsecured or backed by residual assets after senior obligations are met. The distinct security features impact recovery rates, with senior debt offering more protection and lower interest costs compared to subordinated debt.

Legal Rights and Protections

Senior debt holders possess superior legal rights and protections, including priority claims on assets and repayment in the event of borrower default, ensuring lower risk exposure. Subordinated debt ranks below senior debt in the capital structure, with limited legal protections and repayment rights, making it more vulnerable in bankruptcy proceedings. These distinctions directly impact recovery rates and influence lender negotiation leverage during loan restructuring.

Typical Uses in Corporate Financing

Senior debt is commonly used for large-scale corporate financing projects due to its priority claim on assets and lower interest rates, making it ideal for securing stable capital with reduced risk. Subordinated debt typically finances growth initiatives or bridge financing, carrying higher interest rates and greater risk because it ranks below senior debt in repayment priority. Corporations often combine both to optimize capital structure, balancing lower-cost funding from senior debt with flexible, higher-yield subordinated debt to support expansion and operational needs.

Impact on Company Credit Structure

Senior debt holds priority over subordinated debt in a company's credit structure, ensuring senior creditors receive repayment first in case of liquidation, which reduces risk and often results in lower interest rates. Subordinated debt ranks below senior obligations, increasing its risk profile and typically commanding higher interest rates to compensate lenders. The balance between senior and subordinated debt affects a company's credit rating, borrowing capacity, and overall cost of capital.

Pros and Cons of Senior and Subordinated Debt

Senior debt offers lower interest rates and higher repayment priority in bankruptcy, reducing lender risk and attracting conservative investors. Subordinated debt carries higher interest rates to compensate for increased risk, as repayments occur after senior obligations, appealing to investors seeking higher yields. However, senior debt limits financial flexibility due to strict covenants, while subordinated debt allows more operational freedom but increases overall capital costs and risk exposure.

Important Terms

Priority of claims

Senior debt holds priority over subordinated debt in claims on a company's assets and earnings, ensuring senior debt holders are paid first in liquidation or bankruptcy. Subordinated debt is repaid only after senior debt obligations are fully satisfied, reflecting its higher risk and typically higher interest rates.

Capital structure

Senior debt holds priority over subordinated debt in both claims on assets and repayment during liquidation, often securing lower interest rates due to decreased risk exposure. Subordinated debt, positioned lower in the capital structure hierarchy, carries higher interest rates to compensate for increased risk and typically acts as a buffer to protect senior creditors.

Debt seniority

Debt seniority determines the priority of claims on a company's assets, with senior debt having higher repayment priority over subordinated debt in case of liquidation. Senior debt typically carries lower interest rates due to reduced risk, while subordinated debt, being riskier, demands higher yields and is repaid only after senior obligations are fulfilled.

Waterfall payment

Waterfall payment prioritizes senior debt holders by allocating cash flows to them first before subordinated debt holders receive any payment, optimizing risk mitigation for lenders. This structured payment hierarchy ensures senior debt has higher claim priority in asset liquidation, enhancing creditworthiness for senior obligations.

Collateralization

Collateralization secures senior debt with specific assets, reducing lender risk and often resulting in lower interest rates compared to subordinated debt, which lacks collateral and ranks below senior obligations in bankruptcy repayment priority. This higher risk exposure makes subordinated debt more costly, offering investors greater returns in exchange for increased credit risk.

Pari passu

Pari passu refers to the equal ranking of debt instruments in terms of claims on assets or repayment priority, where senior debt holds priority over subordinated debt in case of liquidation. Senior debt is secured or given preference for repayment before subordinated debt, which carries higher risk and typically offers higher interest rates due to its lower claim on the company's assets.

Mezzanine financing

Mezzanine financing combines features of senior debt and subordinated debt by offering higher yields than senior debt due to its subordinate position in the capital structure but ranks above pure equity, providing lenders with a hybrid risk-reward profile. It typically includes warrants or equity kickers as part of the return mechanism, bridging the gap between lower-cost senior loans and higher-risk subordinated loans to fund growth or acquisitions.

Intercreditor agreement

An intercreditor agreement governs the rights and priorities between senior debt holders and subordinated debt holders, ensuring senior creditors maintain priority claims on collateral and repayment before subordinated lenders receive any payments. This agreement typically outlines enforcement procedures, voting rights, and standstill provisions to balance the interests of both creditor classes and mitigate conflicts during borrower defaults or restructurings.

Default risk

Default risk is typically lower for senior debt compared to subordinated debt due to the priority claim senior creditors have on assets and cash flows during bankruptcy proceedings. Subordinated debt carries higher default risk because it is repaid only after senior obligations are fully satisfied, leading to increased potential losses for subordinated lenders.

Recovery rate

Senior debt typically has a higher recovery rate compared to subordinated debt due to its priority claim on a company's assets during bankruptcy or liquidation processes. Recovery rates for senior debt often range between 40% to 80%, while subordinated debt may see recovery rates as low as 10% to 30%, reflecting higher risk and lower seniority in the capital structure.

Senior debt vs Subordinated debt Infographic

moneydif.com

moneydif.com