Amortizing loans require regular payments that cover both principal and interest, gradually reducing the loan balance over time until fully paid off. Interest-only loans mandate payments solely on the interest for a specific period, leaving the principal unchanged and often resulting in a large lump-sum payment later. Choosing between amortizing and interest-only loans depends on cash flow needs, repayment capacity, and long-term financial goals.

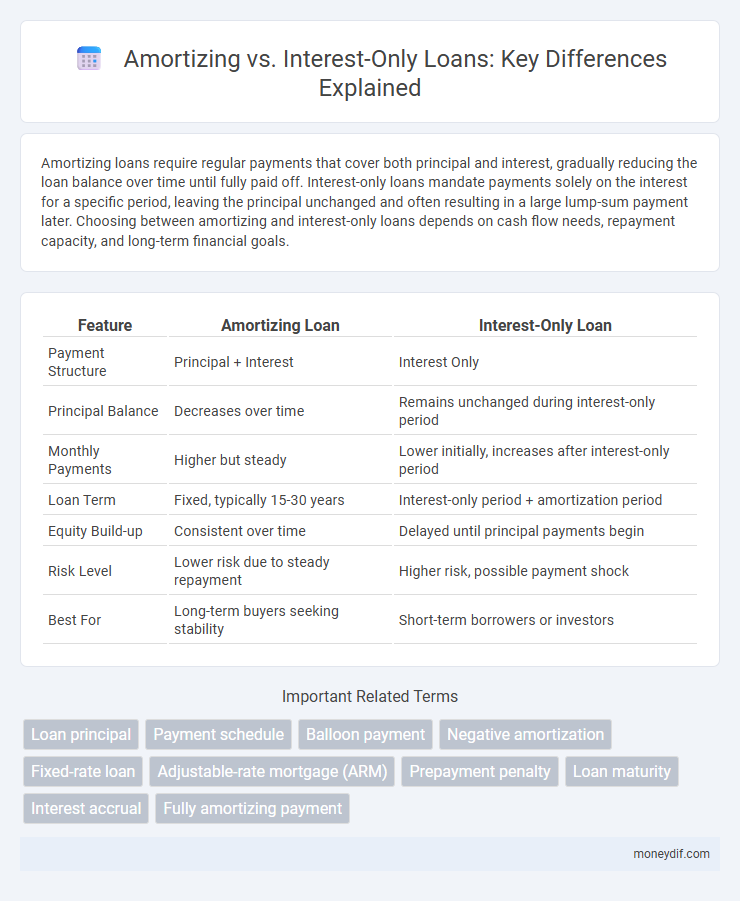

Table of Comparison

| Feature | Amortizing Loan | Interest-Only Loan |

|---|---|---|

| Payment Structure | Principal + Interest | Interest Only |

| Principal Balance | Decreases over time | Remains unchanged during interest-only period |

| Monthly Payments | Higher but steady | Lower initially, increases after interest-only period |

| Loan Term | Fixed, typically 15-30 years | Interest-only period + amortization period |

| Equity Build-up | Consistent over time | Delayed until principal payments begin |

| Risk Level | Lower risk due to steady repayment | Higher risk, possible payment shock |

| Best For | Long-term buyers seeking stability | Short-term borrowers or investors |

Understanding Amortizing Loans

Amortizing loans require regular payments that cover both principal and interest, gradually reducing the loan balance over time until fully paid. This structured repayment schedule provides predictability and helps borrowers build equity steadily. Understanding amortizing loans is crucial for effective financial planning and managing total interest costs.

What Are Interest-Only Loans?

Interest-only loans require borrowers to pay only the interest on the principal balance for a set period, usually 5 to 10 years, before repayments include principal and interest. These loans offer lower initial monthly payments compared to amortizing loans, which combine principal and interest from the start. Borrowers benefit from increased cash flow during the interest-only period but face higher payments later and no principal reduction until the interest-only phase ends.

Key Differences Between Amortizing and Interest-Only Loans

Amortizing loans require regular payments that cover both principal and interest, gradually reducing the loan balance over time until fully paid off. Interest-only loans allow borrowers to pay only the interest for a specified period, resulting in lower initial payments but no reduction in principal during that time. The key difference lies in payment structure and loan balance reduction, impacting total interest paid and loan duration.

Pros and Cons of Amortizing Loans

Amortizing loans provide predictable monthly payments that gradually reduce both principal and interest, offering a clear path to full repayment by the end of the loan term. This structure helps borrowers build equity faster and minimizes the risk of owing a large balance, but monthly payments can be higher compared to interest-only loans. However, the consistent payment schedule promotes financial discipline and stability, making amortizing loans a preferred choice for long-term financial planning.

Advantages and Risks of Interest-Only Loans

Interest-only loans offer the advantage of lower initial monthly payments, enabling borrowers to improve cash flow or invest funds elsewhere during the interest-only period. However, the principal balance remains unchanged, which increases the risk of payment shock once amortization begins, potentially leading to higher monthly payments. These loans also carry the risk of negative amortization if payments do not cover accruing interest, making them suitable primarily for financially disciplined borrowers aware of the repayment schedule.

Impact on Monthly Payments: Amortizing vs Interest-Only

Amortizing loans require monthly payments that cover both principal and interest, resulting in steadily decreasing loan balance and consistent reduction of debt. Interest-only loans have lower initial monthly payments since payments cover only the interest, but principal remains unchanged, causing higher payments later when principal repayments begin. Borrowers choosing amortizing loans benefit from predictable, gradually declining payments, whereas interest-only loans offer short-term payment relief at the cost of larger future financial obligations.

Long-Term Costs: Comparative Analysis

Amortizing loans gradually reduce the principal and interest over the loan term, resulting in higher monthly payments but lower total cost due to decreasing interest accrual. Interest-only loans offer lower initial payments by deferring principal repayment, leading to higher long-term costs as interest accumulates on the full principal for an extended period. Borrowers should consider overall affordability and total interest expense when choosing between amortizing and interest-only loan structures.

Who Should Consider Amortizing Loans?

Borrowers seeking consistent monthly payments that gradually reduce their principal balance should consider amortizing loans. These loans suit individuals aiming for long-term homeownership or those who prefer predictable budgeting over the loan term. Amortizing loans also benefit those who want to build equity steadily while minimizing total interest paid compared to interest-only options.

Ideal Borrowers for Interest-Only Loans

Ideal borrowers for interest-only loans are those seeking lower initial monthly payments and expecting increased cash flow in the future, such as real estate investors or individuals with fluctuating income. These loans suit borrowers planning to sell or refinance before principal payments begin, minimizing initial financial burden while focusing on investment growth or income stabilization. Interest-only loans carry higher long-term risk, making them preferable for financially disciplined individuals with clear exit strategies.

Choosing the Right Loan Structure for Your Needs

Amortizing loans require regular payments that cover both principal and interest, gradually reducing the loan balance over time, making them ideal for borrowers seeking predictable repayment and eventual ownership. Interest-only loans allow lower initial payments by requiring only interest payments for a set period, suitable for those expecting increased future income or planning to refinance. Selecting the right loan structure depends on your cash flow, financial goals, and risk tolerance to ensure manageable payments and long-term affordability.

Important Terms

Loan principal

Loan principal refers to the original amount borrowed that must be repaid, influencing the repayment structure in amortizing versus interest-only loans. In amortizing loans, monthly payments reduce both principal and interest over time, whereas interest-only loans require payments covering only interest for a set term, leaving the principal balance unchanged until the end.

Payment schedule

Payment schedules for amortizing loans involve regular payments that cover both principal and interest, leading to full loan repayment by the end of the term. Interest-only payment schedules require borrowers to pay only interest during the interest-only period, resulting in unchanged principal balance until payments shift to include principal repayment.

Balloon payment

Balloon payments are a lump sum due at the end of a loan term, typically associated with amortizing loans where periodic payments cover principal and interest but leave a large balance outstanding. In contrast, interest-only loans require payments covering only interest throughout the term, making the balloon payment equal to the entire principal balance at maturity.

Negative amortization

Negative amortization occurs when loan payments are insufficient to cover the interest due, causing the principal balance to increase instead of decrease. In contrast, amortizing loans require payments covering both principal and interest, while interest-only loans involve payments only on interest without reducing the principal.

Fixed-rate loan

A fixed-rate loan maintains a constant interest rate over the loan term, providing predictable monthly payments that can be structured as amortizing, where both principal and interest are paid down, or as interest-only, where only interest payments are made initially, delaying principal repayment. Amortizing fixed-rate loans reduce the loan balance with each payment, while interest-only fixed-rate loans keep the principal unchanged until the interest-only period ends, typically leading to larger payments later.

Adjustable-rate mortgage (ARM)

Adjustable-rate mortgages (ARMs) often feature amortizing payments, where each monthly installment gradually reduces the principal balance, contrasting with interest-only ARMs that require payments solely on accrued interest during the initial period. Amortizing ARMs provide predictable equity buildup, while interest-only ARMs offer lower initial payments but can result in payment shock and no principal reduction until the amortization phase begins.

Prepayment penalty

Prepayment penalties often apply to amortizing loans to compensate lenders for lost interest from early payoff, whereas interest-only loans may have stricter or higher penalties due to their reduced initial principal repayment. Understanding the differences in how prepayment penalties affect amortizing versus interest-only mortgage structures is crucial for borrowers aiming to minimize financial costs and optimize loan repayment strategies.

Loan maturity

Loan maturity in amortizing loans involves scheduled principal and interest payments fully repaying the balance by the end of the term, reducing lender risk over time. Interest-only loans maintain the principal balance throughout the maturity period, with borrowers paying only interest until a lump-sum principal repayment is due at maturity.

Interest accrual

Interest accrual in amortizing loans combines principal and interest payments, reducing the outstanding balance over time, while interest-only loans accrue interest without principal repayment, keeping the balance unchanged during the interest-only period. Amortizing loans lead to decreasing interest accrual as the principal diminishes, whereas interest-only loans maintain consistent interest accrual based on the original loan amount.

Fully amortizing payment

Fully amortizing payments gradually reduce both principal and interest, ensuring the loan is completely paid off by the end of its term, unlike interest-only payments that cover only interest for an initial period without decreasing principal. This method benefits borrowers by building equity and avoiding balloon payments, contrasting with interest-only loans that may carry higher risk due to unpaid principal accumulation.

Amortizing vs Interest-only Infographic

moneydif.com

moneydif.com