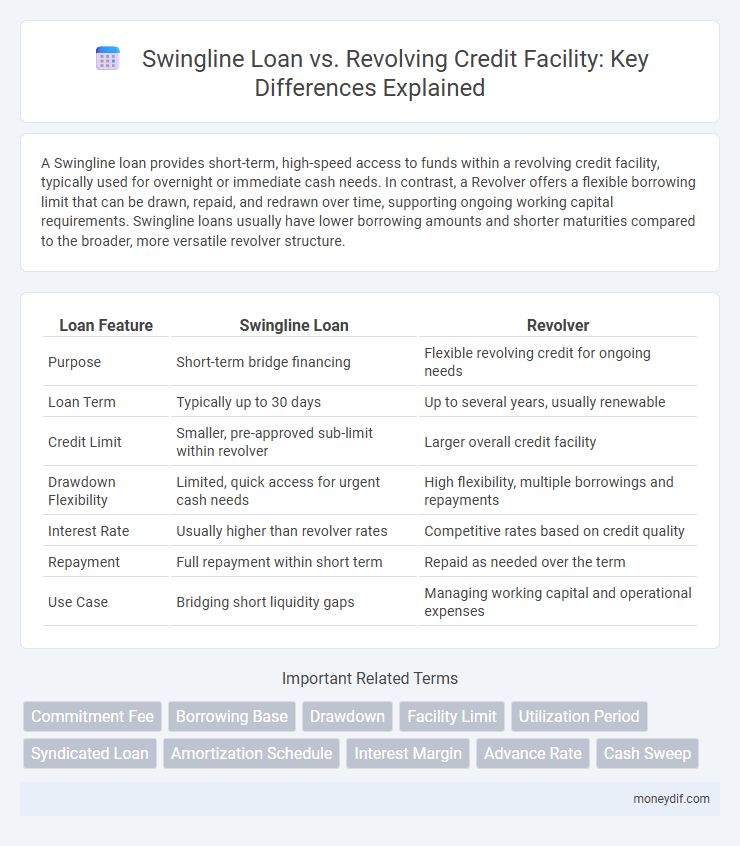

A Swingline loan provides short-term, high-speed access to funds within a revolving credit facility, typically used for overnight or immediate cash needs. In contrast, a Revolver offers a flexible borrowing limit that can be drawn, repaid, and redrawn over time, supporting ongoing working capital requirements. Swingline loans usually have lower borrowing amounts and shorter maturities compared to the broader, more versatile revolver structure.

Table of Comparison

| Loan Feature | Swingline Loan | Revolver |

|---|---|---|

| Purpose | Short-term bridge financing | Flexible revolving credit for ongoing needs |

| Loan Term | Typically up to 30 days | Up to several years, usually renewable |

| Credit Limit | Smaller, pre-approved sub-limit within revolver | Larger overall credit facility |

| Drawdown Flexibility | Limited, quick access for urgent cash needs | High flexibility, multiple borrowings and repayments |

| Interest Rate | Usually higher than revolver rates | Competitive rates based on credit quality |

| Repayment | Full repayment within short term | Repaid as needed over the term |

| Use Case | Bridging short liquidity gaps | Managing working capital and operational expenses |

Introduction to Swingline Loans and Revolvers

Swingline loans offer borrowers quick, short-term access to funds through a sub-facility of a revolving credit agreement, designed for immediate working capital needs and bridging finance. Revolving loans, or revolvers, provide a flexible credit line allowing borrowers to draw, repay, and redraw funds multiple times up to a maximum limit during the loan term, supporting ongoing operational liquidity. Swingline loans typically have shorter tenors and lower borrowing limits compared to revolvers, which serve as the primary long-term revolving credit facility.

Key Differences Between Swingline Loans and Revolving Credit

Swingline loans provide short-term, high-speed financing within a revolving credit agreement, typically with smaller borrowing limits and faster availability compared to standard revolving credit facilities. Revolving credit offers a broader credit line with flexible borrowing and repayment options, allowing multiple draws and repayments over a longer term. Key differences include the speed of access, loan size, and the primary use case: Swingline loans are ideal for immediate cash needs, while revolving credit supports ongoing working capital requirements.

How Swingline Loans Work in Lending

Swingline loans function as short-term, highly flexible credit facilities typically embedded within a revolving credit agreement, allowing borrowers rapid access to funds to cover immediate cash flow needs. These loans are characterized by their quick approval process and minimal documentation requirements compared to standard revolvers, with borrowing limits usually capped at a fraction of the total revolving credit line. Lenders prioritize Swingline loans for operational efficiency, enabling businesses to manage working capital fluctuations without the delays commonly associated with larger credit draws from the revolver.

Understanding the Structure of Revolving Credit Facilities

Revolving credit facilities offer flexible borrowing with an established credit limit that can be used, repaid, and reused repeatedly, unlike Swingline loans which are short-term, high-speed draws within a revolving loan agreement. These facilities typically include a commitment amount, borrowing base, and periodic borrowing availability, allowing companies to manage working capital needs efficiently. Understanding the structure involves recognizing the distinction between the overall revolving credit commitment and the sublimits like Swingline loans or letters of credit, each serving different liquidity and funding purposes.

Advantages of Swingline Loans for Borrowers

Swingline loans provide borrowers with rapid access to short-term liquidity, often approved and funded within hours, making them ideal for urgent cash flow needs. Their flexible repayment terms and minimal borrowing commitments reduce financial strain compared to revolving credit facilities. Swingline loans also feature lower fees and interest rates, enhancing cost efficiency for borrowers needing immediate funds.

Benefits of Revolver Loans for Businesses

Revolver loans provide businesses with flexible access to capital, allowing them to borrow, repay, and re-borrow funds up to a predetermined credit limit as needed. This adaptability supports cash flow management during fluctuating operational cycles, ensuring liquidity without the constraints of a fixed repayment schedule typical of Swingline loans. Many companies leverage revolver loans to finance working capital, handle unexpected expenses, and capitalize on investment opportunities promptly.

Use Cases: When to Choose a Swingline vs. a Revolver

Swingline loans are ideal for short-term liquidity needs and quick access to funds, such as managing daily operational expenses or covering unexpected cash flow gaps. Revolvers suit longer-term financing requirements, providing flexible borrowing up to a set credit limit to support ongoing working capital or seasonal business fluctuations. Choosing a Swingline is optimal for immediate, smaller cash injections, while Revolvers offer scalable funding for sustained financial management.

Risk Factors and Considerations for Each Loan Type

Swingline loans carry higher interest rates and stricter repayment schedules, increasing short-term liquidity risk and default probability for borrowers requiring rapid cash flow. Revolving credit facilities offer flexible borrowing limits and longer draw periods but expose lenders to ongoing credit risk due to potential borrower overextension and market fluctuations. Evaluating cash flow stability, collateral quality, and borrower creditworthiness is essential when choosing between Swingline loans and revolvers to mitigate default and refinancing risks.

Impact on Corporate Liquidity and Cash Flow

Swingline loans provide quick, short-term liquidity with minimal interest costs, enhancing immediate corporate cash flow flexibility for urgent operational needs. Revolving credit facilities offer sustained access to capital, supporting ongoing liquidity management and smoothing cash flow variability over longer periods. The choice between a Swingline and a revolver directly influences working capital optimization and financial agility in corporate treasury functions.

Choosing the Right Loan: Factors for Decision-Making

Choosing the right loan between a Swingline loan and a Revolver depends on liquidity needs and repayment flexibility. Swingline loans offer quick access to short-term funds with higher interest rates and smaller borrowing limits, ideal for immediate cash flow gaps. Revolvers provide larger credit facilities with the ability to borrow, repay, and redraw multiple times, suited for ongoing working capital management.

Important Terms

Commitment Fee

A Commitment Fee is typically charged on the unused portion of a Revolver to compensate lenders for keeping funds available, whereas Swingline loans, as short-term, often overnight borrowings, generally do not incur commitment fees due to their immediate and temporary nature. Understanding the fee structure is essential for efficient liquidity management and cost optimization in corporate financing.

Borrowing Base

The borrowing base determines the maximum amount available for drawing on a revolver, typically based on eligible accounts receivable and inventory, while a Swingline loan provides a short-term, often unsecured, advance within the revolver facility to meet immediate liquidity needs. Revolver advances decrease the borrowing base availability, whereas Swingline loans are usually repaid quickly and may not reduce the borrowing base calculation significantly.

Drawdown

Drawdown on a Swingline loan typically involves short-term, immediate borrowing against a committed credit facility, often used for urgent liquidity needs, whereas drawdown under a Revolver refers to accessing funds up to the total revolving credit limit with more flexible repayment terms and longer availability. Swingline loans generally feature smaller amounts with quick availability and higher interest rates compared to Revolver drawdowns, which are structured for ongoing, cyclical working capital requirements.

Facility Limit

Facility Limit denotes the maximum borrowing capacity set in a credit agreement, distinguishing Swingline loans as short-term, high-priority advances with typically smaller limits compared to the broader, more flexible Revolver facility designed for ongoing working capital needs. Revolver credit lines provide borrowers the ability to draw, repay, and re-borrow up to the agreed Facility Limit, offering substantial liquidity management advantages over the more restrictive Swingline loan terms.

Utilization Period

The utilization period for a Swingline loan is typically short-term, often ranging from one to a few days, designed for immediate, temporary cash needs within a revolving credit facility. In contrast, the revolver portion of a credit line allows longer utilization periods, accommodating more extended financing needs with flexible borrowing and repayment terms.

Syndicated Loan

A Syndicated Loan typically includes a Revolver facility, which allows borrowers to draw, repay, and redraw funds up to a set credit limit during the loan term, whereas a Swingline loan is a short-term, high-cost credit extension within the Revolver designed for urgent, intra-day liquidity needs. Swingline loans usually have lower advance rates and shorter maturities compared to revolving loans, serving as a bridge for immediate funding before longer-term draws from the Revolver facility.

Amortization Schedule

An amortization schedule for a Swingline loan typically involves short-term, rapid repayments with principal and interest calculated on a daily or weekly basis, reflecting its role as a quick-access credit facility under a revolving credit agreement. In contrast, a Revolver amortization schedule allows for more flexible borrowing and repayment patterns, often requiring only interest payments until the final maturity date, which suits longer-term financing needs.

Interest Margin

Interest margin on Swingline loans typically carries a higher rate than Revolver facilities due to their short-term, high-speed access nature, which increases the lender's risk and cost of funds. Revolver loans, designed for longer usage periods and larger credit availability, often offer lower interest margins reflecting their more stable and predictable cash flow profiles.

Advance Rate

The advance rate for a Swingline loan typically ranges from 70% to 85% of eligible receivables, providing rapid, short-term liquidity, whereas the Revolver advance rate usually extends up to 80% of eligible assets including inventory and accounts receivable, supporting broader working capital needs. Swingline loans are designed for quick access with higher risk reflection, while Revolvers offer more flexible borrowing capacity tied to collateral value within established credit limits.

Cash Sweep

Cash sweep provisions in revolving credit facilities often prioritize the repayment of the Swingline loan before reducing the Borrowing Base for Revolver drawings, ensuring that short-term, high-cost Swingline advances are repaid promptly. This mechanism enhances liquidity management by automatically applying excess cash flow towards the outstanding Swingline balance, subsequently lowering the overall revolver utilization and associated interest expenses.

Swingline loan vs Revolver Infographic

moneydif.com

moneydif.com