Mezzanine financing involves subordinated debt with equity components, providing long-term capital often used for business expansion or acquisitions, while bridge loans are short-term, high-interest loans designed to cover immediate cash flow gaps. Mezzanine financing offers more flexible repayment options and potential upside through equity participation, whereas bridge loans require rapid repayment once permanent financing is secured. Understanding the distinct purposes and risks of mezzanine financing versus bridge loans helps businesses optimize their capital structure during transitional phases.

Table of Comparison

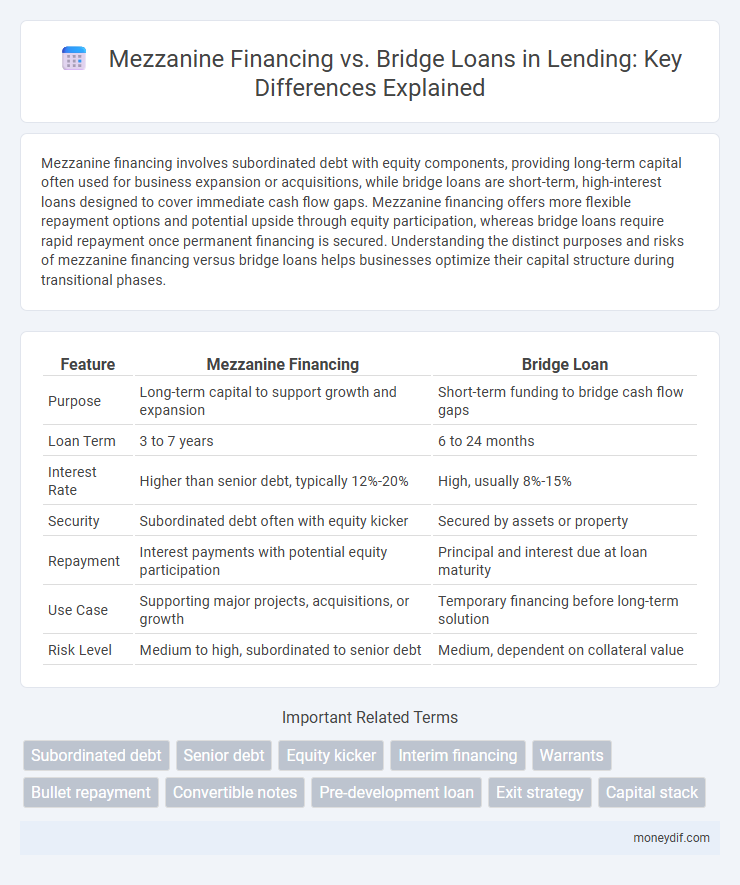

| Feature | Mezzanine Financing | Bridge Loan |

|---|---|---|

| Purpose | Long-term capital to support growth and expansion | Short-term funding to bridge cash flow gaps |

| Loan Term | 3 to 7 years | 6 to 24 months |

| Interest Rate | Higher than senior debt, typically 12%-20% | High, usually 8%-15% |

| Security | Subordinated debt often with equity kicker | Secured by assets or property |

| Repayment | Interest payments with potential equity participation | Principal and interest due at loan maturity |

| Use Case | Supporting major projects, acquisitions, or growth | Temporary financing before long-term solution |

| Risk Level | Medium to high, subordinated to senior debt | Medium, dependent on collateral value |

Understanding Mezzanine Financing

Mezzanine financing is a hybrid form of capital that blends debt and equity, typically used to finance expansion or acquisitions when traditional senior loans are insufficient. It carries higher interest rates than senior debt due to its subordinate position but offers lenders equity participation or warrants as compensation for increased risk. This financing solution bridges the gap between debt and equity, providing businesses with flexible capital without diluting ownership as much as raising pure equity would.

What is a Bridge Loan?

A bridge loan is a short-term financing option designed to provide immediate capital for borrowers awaiting long-term funding or the sale of an asset. Typically used in real estate and business acquisitions, bridge loans offer quick approval and flexible terms but often come with higher interest rates compared to traditional loans. Their primary purpose is to "bridge" the financial gap during transitional periods, making them ideal for urgent liquidity needs.

Key Differences: Mezzanine Financing vs Bridge Loan

Mezzanine financing typically involves subordinated debt or preferred equity, offering higher interest rates and potential equity participation, while bridge loans are short-term, secured loans designed to provide immediate liquidity until permanent financing is secured. Mezzanine financing is often used for business growth or acquisitions with longer terms ranging from 3 to 7 years, whereas bridge loans usually have terms of 6 months to 3 years and serve as temporary capital solutions. Risk levels differ, as mezzanine financing bears higher risk due to its subordinated position, while bridge loans carry lower risk with collateral backing.

Advantages of Mezzanine Financing

Mezzanine financing offers flexible capital solutions by combining debt and equity features, allowing borrowers to access larger funding amounts without immediate dilution of ownership. It provides subordinated debt that typically carries higher interest rates but includes options like warrants, enabling investors to participate in equity upside. This type of financing is advantageous for companies seeking growth capital with less restrictive covenants compared to traditional bank loans or bridge financing.

Pros and Cons of Bridge Loans

Bridge loans offer quick access to capital with minimal documentation, making them ideal for short-term financing needs or real estate transactions. However, bridge loans typically come with higher interest rates and fees compared to traditional loans, increasing the overall cost of borrowing. The short repayment terms and potential for balloon payments pose risks for borrowers if the underlying asset does not sell as anticipated.

When to Choose Mezzanine Financing

Mezzanine financing suits businesses seeking substantial capital without diluting ownership, typically during expansion phases or acquisitions where high growth potential justifies higher interest rates and equity participation. Companies with steady cash flow and strong credit profiles can leverage mezzanine debt to bridge gaps between senior debt and equity financing, supporting long-term strategic goals. This option proves ideal when access to traditional bank loans is limited, yet flexibility and subordinated debt are necessary to fuel growth.

Ideal Scenarios for Bridge Loans

Bridge loans are ideal for borrowers needing quick, short-term financing to bridge the gap between purchase and permanent funding, often used in real estate transactions or business acquisitions. They provide rapid capital to secure an asset before long-term financing is finalized or to cover temporary cash flow shortages. These loans typically feature higher interest rates and shorter terms, favoring situations where speed and flexibility outweigh cost.

Risk Factors: Mezzanine vs Bridge

Mezzanine financing carries higher risk due to its subordinated position in the capital structure, often leading to higher interest rates and potential equity dilution if the borrower defaults. Bridge loans are short-term, typically secured loans with quicker repayment schedules, presenting lower risk for lenders but increased refinancing risk for borrowers. Understanding these risk factors is crucial for borrowers choosing between mezzanine debt's flexible but costly terms and bridge loans' urgency and security.

Typical Terms and Structures

Mezzanine financing typically involves subordinated debt combined with equity instruments, featuring terms that span 5 to 7 years with interest rates ranging from 12% to 20%, often including warrants or options for upside participation. Bridge loans are short-term, usually 6 months to 3 years, secured by collateral with interest rates between 8% and 15%, designed to provide immediate liquidity before long-term financing is secured. Both structures cater to different financing needs, with mezzanine loans offering flexible capital infusion for expansion and bridge loans serving as interim funding to bridge gaps in project or acquisition timelines.

Assessing Which Loan Type Fits Your Project

Mezzanine financing is ideal for projects needing substantial capital with flexible repayment options, often used in growth phases or acquisitions where equity dilution is acceptable. Bridge loans provide short-term funding solutions to cover immediate cash flow gaps or transitional phases, typically with higher interest rates and quicker repayment terms. Assessing your project's timeline, funding amount, risk tolerance, and exit strategy is crucial to determine whether mezzanine financing's hybrid debt-equity structure or the bridge loan's short-term liquidity better aligns with your financial goals.

Important Terms

Subordinated debt

Subordinated debt in mezzanine financing typically carries higher interest rates and warrants than bridge loans, reflecting its increased risk and role as a junior claim behind senior debt. Bridge loans serve as short-term financing solutions with lower risk and priority repayment, often used to quickly bridge liquidity gaps until mezzanine or permanent capital is secured.

Senior debt

Senior debt represents the highest priority debt in a capital structure, typically secured and bearing lower interest rates compared to mezzanine financing, which is subordinated debt or preferred equity with higher risk and returns. Bridge loans serve as short-term financing solutions designed to cover immediate cash flow needs until long-term financing, such as senior debt or mezzanine capital, is secured.

Equity kicker

An equity kicker is a common feature in mezzanine financing, providing lenders with an ownership interest or profit participation in addition to fixed interest, enhancing returns on higher-risk capital. Bridge loans typically lack equity kickers, as they are short-term, interest-only loans designed for quick financing needs without equity upside.

Interim financing

Interim financing bridges temporary cash flow gaps with mezzanine financing offering subordinated debt or equity-like features for growth capital, while bridge loans provide short-term liquidity secured by collateral to quickly finance acquisitions or projects. Mezzanine financing typically carries higher interest rates and longer terms than bridge loans, balancing risk and flexibility in capital structure optimization.

Warrants

Warrants in mezzanine financing serve as equity kickers, giving lenders the right to purchase company shares at a predetermined price, aligning investor returns with company growth and mitigating risk in high-yield debt structures. In contrast, bridge loans rarely include warrants, focusing instead on short-term liquidity needs and typically offering fixed interest rates without equity participation.

Bullet repayment

Bullet repayment in mezzanine financing involves a single lump-sum payment at maturity, often aligning with the longer-term, equity-like nature of this funding, whereas bridge loans typically require a bullet repayment over a short period, serving as temporary financing before securing permanent capital. Mezzanine financing carries higher interest rates and flexible terms compared to bridge loans, which are primarily used for quick capital needs and rely heavily on collateral.

Convertible notes

Convertible notes serve as a hybrid financing instrument combining debt and equity, frequently used in mezzanine financing to provide growth capital with potential equity conversion upon a triggering event, such as a future funding round. Bridge loans, by contrast, are short-term debt solutions designed to provide immediate liquidity, typically repaid quickly or refinanced, without the equity conversion feature inherent in convertible notes.

Pre-development loan

Pre-development loans provide early-stage financing for land acquisition and initial project planning before construction begins, often positioned higher-risk with flexible terms compared to mezzanine financing, which typically occupies a subordinated debt layer with interest rates between senior debt and equity. Bridge loans offer short-term capital to cover immediate funding gaps during transitions or refinancing, usually with higher fees and quicker repayment schedules than mezzanine loans, which are structured to support project completion while maintaining more favorable covenants.

Exit strategy

Exit strategy for mezzanine financing often involves refinancing with long-term debt or equity buyout upon business stabilization, whereas bridge loans typically require quick repayment through an imminent equity raise or asset sale. Mezzanine financing provides subordinated debt with equity kicker, ideal for growth phases, while bridge loans serve as short-term capital solutions to bridge funding gaps before permanent financing is secured.

Capital stack

The capital stack in real estate and corporate finance typically positions mezzanine financing as a subordinate debt layer between senior loans and equity, offering higher returns with increased risk compared to traditional loans. Bridge loans, serving as short-term interim financing, often occupy a senior debt position, providing quick liquidity but generally commanding higher interest rates than permanent financing due to their temporary nature.

Mezzanine financing vs Bridge loan Infographic

moneydif.com

moneydif.com