Cross-default clauses trigger a default on one loan if a borrower defaults on another loan, protecting lenders from increased credit risk across multiple debts. Cross-collateralization involves using the same collateral to secure multiple loans, enhancing lender security by linking assets to several obligations. Understanding these distinct mechanisms helps borrowers and lenders manage risk and prioritize debt obligations effectively.

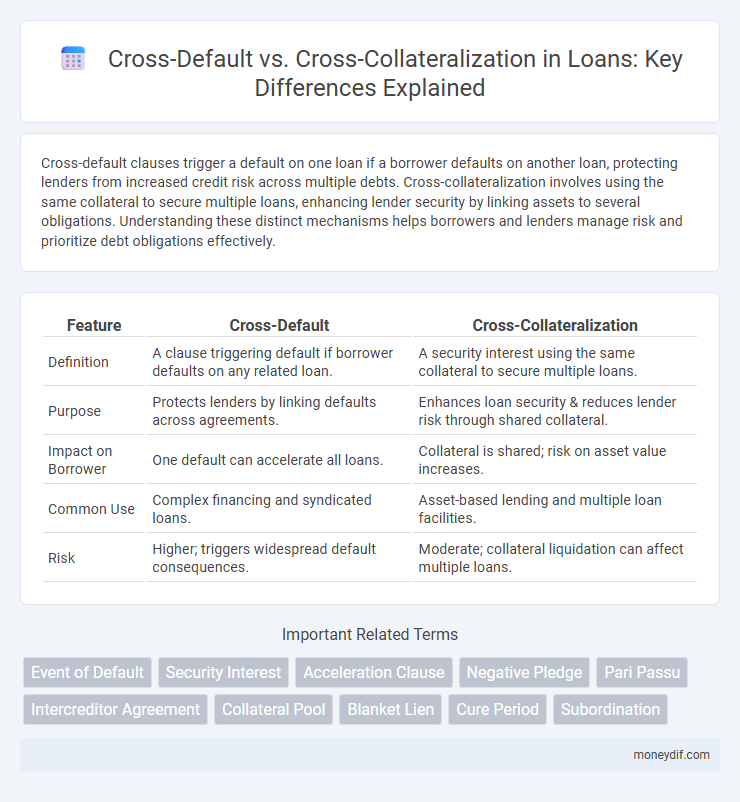

Table of Comparison

| Feature | Cross-Default | Cross-Collateralization |

|---|---|---|

| Definition | A clause triggering default if borrower defaults on any related loan. | A security interest using the same collateral to secure multiple loans. |

| Purpose | Protects lenders by linking defaults across agreements. | Enhances loan security & reduces lender risk through shared collateral. |

| Impact on Borrower | One default can accelerate all loans. | Collateral is shared; risk on asset value increases. |

| Common Use | Complex financing and syndicated loans. | Asset-based lending and multiple loan facilities. |

| Risk | Higher; triggers widespread default consequences. | Moderate; collateral liquidation can affect multiple loans. |

Introduction to Cross-Default and Cross-Collateralization

Cross-default is a loan provision that triggers a default if the borrower defaults on any other loan, protecting lenders from increased risk across multiple agreements. Cross-collateralization involves using the same collateral to secure multiple loans, enhancing lender security by increasing claim over assets. Together, these mechanisms help lenders manage risk by linking obligations and collateral across different financing arrangements.

Defining Cross-Default Provisions

Cross-default provisions trigger a default on a loan when a borrower defaults on another loan or financial obligation, allowing lenders to protect their interests across multiple agreements. These clauses create interconnected liabilities, enhancing lender security by enabling acceleration of debt repayment if any related obligation becomes delinquent. Cross-default is distinct from cross-collateralization, which involves using the same collateral to secure multiple loans rather than linking default events.

Understanding Cross-Collateralization Clauses

Cross-collateralization clauses allow a lender to secure multiple loans using the same collateral, increasing the lender's control over the borrower's assets. These clauses can complicate loan agreements by tying the repayment of one loan to the collateral of another, potentially affecting the borrower's ability to access credit or sell assets independently. Understanding the specific terms of cross-collateralization is essential for both lenders and borrowers to manage risk and ensure clarity in the security interests of multiple debts.

Key Differences Between Cross-Default and Cross-Collateralization

Cross-default triggers a default on one loan when there is a default on another related loan, ensuring lenders' protection against simultaneous loan breaches. Cross-collateralization involves using the same collateral to secure multiple loans, increasing lenders' claim on assets in case of borrower default. The key difference lies in cross-default's focus on default events across loans, while cross-collateralization centers on shared collateral backing multiple debts.

Legal Implications for Borrowers and Lenders

Cross-default clauses legally bind borrowers to default on one loan triggering defaults on related loans, increasing risk exposure for both parties by accelerating repayment obligations. Cross-collateralization involves multiple loans secured by the same asset, complicating priority claims and enforcement rights, potentially limiting borrowers' ability to liquidate collateral without lender consent. Lenders benefit from enhanced security interests and improved recovery prospects, while borrowers face heightened legal complexity and restricted asset flexibility.

Risk Management: Cross-Default vs Cross-Collateralization

Cross-default provisions increase risk exposure by triggering default across multiple loans if one obligation is unmet, amplifying lender protection but heightening borrower vulnerability. Cross-collateralization mitigates risk through securing multiple loans with shared collateral, enhancing asset recovery options but potentially restricting borrower flexibility. Effective risk management requires evaluating the impact of these mechanisms on portfolio stability and borrower creditworthiness.

Practical Examples in Loan Agreements

Cross-default clauses trigger loan repayment obligations if a borrower defaults on any other loan, preventing selective defaults across different credit facilities. Cross-collateralization involves using the same asset as collateral for multiple loans, increasing creditor security but complicating asset recovery in default scenarios. For example, a business with a cross-default clause on its term loan will face immediate repayment demands if it misses payments on a revolving credit line, while cross-collateralization might secure both loans with the same property, limiting the borrower's ability to leverage assets separately.

Benefits and Drawbacks of Each Provision

Cross-default provisions enable lenders to declare a default if a borrower defaults on another loan, providing early warning signals and enhanced protection against cascading failures, but they can increase borrower risk and limit refinancing options. Cross-collateralization pools multiple assets as loan security, improving lender recovery prospects and potentially lowering interest rates, although it risks the borrower's entire collateral base if one loan defaults. While cross-default strengthens credit enforcement, cross-collateralization offers broader asset coverage, each requiring careful consideration of the trade-offs between lender security and borrower flexibility.

Cross-Default and Cross-Collateralization in Syndicated Loans

Cross-default clauses in syndicated loans trigger a default if the borrower defaults on any other loan, protecting lenders by linking multiple credit agreements under one event of default. Cross-collateralization involves securing multiple loans with the same collateral, enhancing recovery potential by pooling assets in a syndicated loan structure. Understanding these mechanisms is crucial for syndicate lenders to manage risk and enforce repayment efficiently.

Best Practices for Structuring Loan Contracts

Loan contracts should clearly delineate cross-default and cross-collateralization clauses to mitigate risk and enhance enforceability. Cross-default provisions trigger default if a borrower defaults on any related obligations, while cross-collateralization secures multiple loans with shared collateral, optimizing asset utilization. Structuring these clauses with precise definitions, carefully calibrated thresholds, and compliance with regulatory standards ensures balanced protection for lenders and borrowers.

Important Terms

Event of Default

Cross-default triggers a default across multiple agreements upon one default event, while cross-collateralization uses shared collateral to secure multiple obligations and mitigate risk.

Security Interest

Cross-default triggers a security interest enforcement when one loan defaults, while cross-collateralization secures multiple loans with the same collateral to mitigate lender risk.

Acceleration Clause

The acceleration clause triggers immediate debt repayment upon a cross-default event, while cross-collateralization uses shared assets as security across multiple loans to mitigate creditor risk.

Negative Pledge

Negative pledge clauses restrict a borrower from pledging assets elsewhere, limiting cross-collateralization risks, while cross-default provisions trigger defaults if obligations under other loans are breached, highlighting distinct but complementary protections in loan agreements.

Pari Passu

Pari passu ensures equal ranking among creditors, differentiating cross-default, which triggers default across agreements, from cross-collateralization, where multiple debts share the same collateral.

Intercreditor Agreement

Intercreditor agreements precisely define the rights and priorities of multiple creditors, clearly distinguishing cross-default provisions that trigger default based on other loan breaches from cross-collateralization clauses that use the same collateral to secure multiple obligations.

Collateral Pool

The Collateral Pool consolidates multiple assets to secure obligations, differentiating from cross-default clauses that trigger default across agreements, while cross-collateralization specifically links collateral across multiple loans to mitigate risk.

Blanket Lien

A blanket lien secures multiple debts with all borrower assets, differing from cross-default, which triggers default across loans upon one default, and cross-collateralization, which uses one collateral for multiple loans.

Cure Period

The Cure Period in a cross-default clause allows a borrower a specified timeframe to remedy a default before it triggers a cross-default event, preventing immediate acceleration of other obligations. In contrast, cross-collateralization involves securing multiple loans with the same collateral, where a breach may lead to the lender seizing assets without a cure period, intertwining default risk with collateral control.

Subordination

Subordination prioritizes debt repayment order, impacting cross-default clauses by triggering default risks across multiple loans and affecting cross-collateralization by determining which secured assets are accessed first.

Cross-default vs Cross-collateralization Infographic

moneydif.com

moneydif.com