Amortization reduces the loan principal through scheduled payments, lowering interest over time and ensuring full repayment by the end of the term. Capitalization, on the other hand, adds unpaid interest to the loan principal, increasing the total amount owed and potentially extending the repayment period. Understanding the differences between amortization and capitalization helps borrowers manage loan costs and avoid unexpected debt growth.

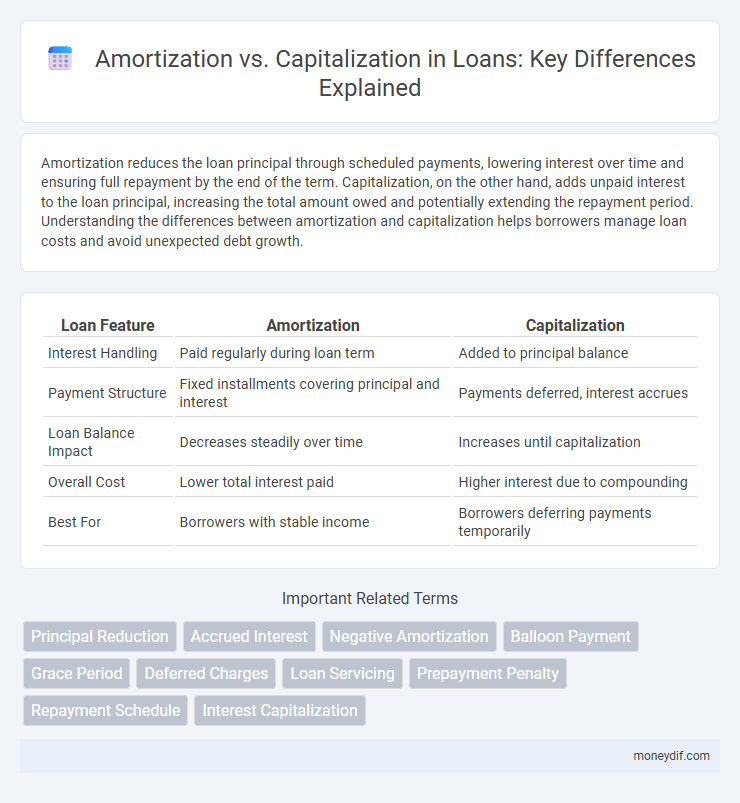

Table of Comparison

| Loan Feature | Amortization | Capitalization |

|---|---|---|

| Interest Handling | Paid regularly during loan term | Added to principal balance |

| Payment Structure | Fixed installments covering principal and interest | Payments deferred, interest accrues |

| Loan Balance Impact | Decreases steadily over time | Increases until capitalization |

| Overall Cost | Lower total interest paid | Higher interest due to compounding |

| Best For | Borrowers with stable income | Borrowers deferring payments temporarily |

Understanding Loan Amortization

Loan amortization involves systematically paying off debt through regular installments that cover both principal and interest, resulting in full repayment by the end of the loan term. Capitalization, in contrast, refers to adding unpaid interest to the outstanding loan principal, increasing the total balance owed. Understanding loan amortization is crucial for borrowers to manage repayment schedules effectively and avoid unexpected increases in debt due to capitalization.

What is Capitalization in Loans?

Capitalization in loans refers to the process where unpaid interest is added to the principal balance, increasing the total loan amount. This often occurs when borrowers defer interest payments, causing the accrued interest to compound and generate higher future interest charges. Understanding capitalization helps borrowers manage long-term repayment costs and evaluate the impact on overall loan expenses.

Key Differences Between Amortization and Capitalization

Amortization refers to the gradual repayment of a loan principal and interest over a set period, reducing the outstanding balance with each payment. Capitalization involves adding unpaid interest or costs to the principal balance, increasing the total loan amount. The key difference lies in amortization lowering the loan balance over time, while capitalization increases the loan principal, often delaying repayment.

How Amortization Impacts Loan Repayment

Amortization breaks down the loan repayment into fixed periodic payments that cover both principal and interest, ensuring the loan is fully paid off by the end of the term. This systematic reduction of the principal balance reduces the total interest cost over time and provides borrowers with predictable payment schedules. In contrast, capitalization adds unpaid interest to the principal balance, increasing the total loan amount and extending the repayment period.

Effects of Capitalization on Loan Balances

Capitalization of interest increases the principal loan balance by adding unpaid interest, resulting in higher overall debt and increased future interest costs. This process delays loan repayment as more funds are required to cover the larger balance during amortization. Understanding capitalization's impact is critical for managing loan costs and minimizing long-term financial burdens.

Amortization vs Capitalization: Pros and Cons

Amortization reduces the loan principal gradually through regular payments, lowering interest costs over time and providing predictable budgeting benefits. Capitalization adds unpaid interest to the loan principal, increasing the total debt but allowing borrowers to delay immediate payment, which can ease short-term financial pressure. Choosing amortization offers financial discipline and cost savings, while capitalization provides temporary relief at the expense of higher long-term repayment amounts.

Real-Life Examples of Amortization and Capitalization

Real-life examples of amortization include monthly mortgage payments where principal and interest are gradually paid down over a fixed term, reducing loan balance systematically. Capitalization often occurs in student loans when unpaid interest is added to the principal balance after deferment or forbearance periods, increasing the overall debt. Understanding the impact of amortization schedules versus capitalization helps borrowers manage loan costs and repayment strategies effectively.

Choosing Between Amortization and Capitalization

Choosing between amortization and capitalization depends on the loan's purpose and cash flow impact; amortization spreads principal and interest repayments over the loan term, ensuring predictable expenses, while capitalization adds unpaid interest to the loan principal, increasing the overall debt but reducing immediate payment burdens. Amortization suits borrowers seeking manageable monthly payments and long-term financial planning, whereas capitalization benefits those needing temporary relief from cash outflows, common in construction loans or projects with delayed revenue. Evaluating loan terms, interest rates, and future income projections is crucial for selecting the financing method that optimizes loan cost and repayment flexibility.

Common Mistakes in Loan Repayment Strategies

Confusing amortization with capitalization often leads to costly loan repayment errors, as amortization spreads payments to reduce principal and interest gradually, while capitalization adds unpaid interest to the principal balance, increasing total debt. Borrowers frequently miscalculate the long-term impact of capitalization, resulting in higher interest accrual and extended loan terms. Understanding the distinction is crucial for developing effective repayment strategies that minimize financial burden and avoid ballooning loan balances.

Frequently Asked Questions on Amortization and Capitalization

Amortization involves spreading loan payments over a set period, reducing the principal and interest gradually to ensure full repayment by the loan term's end. Capitalization refers to adding unpaid interest to the loan principal balance, often seen in student loans or construction loans, increasing the total amount owed. Common FAQs include the impact of capitalization on monthly payments, how amortization schedules change with additional payments, and the differences between fixed and variable interest amortization methods.

Important Terms

Principal Reduction

Principal reduction impacts amortization by decreasing the outstanding loan balance, thereby reducing future interest payments and shortening the amortization schedule. Capitalization, in contrast, involves adding unpaid interest to the principal, increasing the loan balance and extending the amortization period.

Accrued Interest

Accrued interest on a loan can be treated through amortization, where the interest expense is gradually recognized over the loan term, or through capitalization, where the interest cost is added to the asset's carrying value, typically during construction or development periods. Choosing amortization impacts the income statement with periodic interest expenses, while capitalization defers interest recognition by increasing the asset's basis, affecting future depreciation.

Negative Amortization

Negative amortization occurs when loan payments are insufficient to cover the interest, causing the unpaid interest to be added to the principal balance, unlike amortization where payments gradually reduce the loan balance. In accounting, capitalization involves recording costs as assets rather than expenses, which contrasts with amortization that systematically reduces the asset's book value over time.

Balloon Payment

Balloon payment refers to a lump sum payment due at the end of a loan term, often resulting from amortization schedules that do not fully repay principal through periodic payments, contrasting with capitalization where interest may be added to the loan principal, increasing the balance owed. This payment structure affects loan amortization by deferring a significant portion of the principal repayment to the loan's maturity date.

Grace Period

The grace period in amortization allows borrowers to delay principal payments without accruing penalties, optimizing cash flow during the early loan phase. Capitalization during this phase involves adding unpaid interest to the loan principal, increasing the total balance and future interest expense.

Deferred Charges

Deferred charges represent expenses recognized on the balance sheet and amortized over future periods, reflecting their long-term benefit rather than immediate recognition. Capitalization of such costs ensures accurate matching of expenses with revenues, while amortization systematically allocates the deferred charge to profit and loss over its useful life.

Loan Servicing

Loan servicing involves managing amortization schedules that allocate each payment between principal and interest, ensuring predictable loan repayment over time. Capitalization in loan servicing refers to adding unpaid interest to the principal balance, which increases the loan amount and affects future amortization calculations.

Prepayment Penalty

Prepayment penalties often arise in loan agreements where amortization schedules are designed to balance principal and interest payments over time, discouraging early payoff that disrupts expected cash flows. Capitalization of interest during construction loans contrasts with amortization by adding unpaid interest to the loan principal, which can affect the calculation and enforcement of prepayment penalties.

Repayment Schedule

A repayment schedule outlines the timeline and amounts for loan repayments, typically structured through amortization, where each payment gradually reduces principal and interest. Capitalization differs by adding unpaid interest to the principal balance, increasing the loan amount and extending the repayment period.

Interest Capitalization

Interest capitalization involves adding the interest cost of a loan to the value of a long-term asset during its construction or production, thereby increasing the asset's basis rather than expensing the interest immediately. Unlike amortization, which systematically allocates the cost of an intangible asset over its useful life, interest capitalization defers interest expense recognition until the asset is ready for use, impacting both the balance sheet and future amortization calculations.

amortization vs capitalization Infographic

moneydif.com

moneydif.com