A margin call requires the borrower to provide additional collateral to cover a loan's decreased value or risk exposure, while a top-up allows the borrower to increase the loan amount by securing extra funds. Margin calls are triggered by a decline in asset value or loan-to-value ratio, ensuring the lender's protection, whereas top-ups are proactive financial decisions aimed at accessing more credit. Understanding these differences helps borrowers manage their loan obligations and maintain adequate collateral.

Table of Comparison

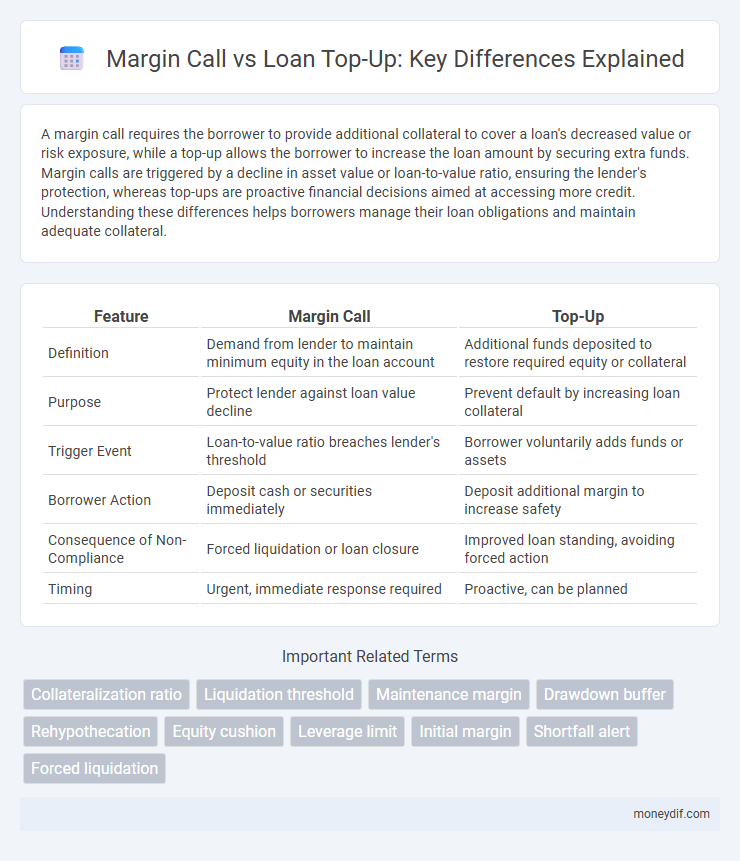

| Feature | Margin Call | Top-Up |

|---|---|---|

| Definition | Demand from lender to maintain minimum equity in the loan account | Additional funds deposited to restore required equity or collateral |

| Purpose | Protect lender against loan value decline | Prevent default by increasing loan collateral |

| Trigger Event | Loan-to-value ratio breaches lender's threshold | Borrower voluntarily adds funds or assets |

| Borrower Action | Deposit cash or securities immediately | Deposit additional margin to increase safety |

| Consequence of Non-Compliance | Forced liquidation or loan closure | Improved loan standing, avoiding forced action |

| Timing | Urgent, immediate response required | Proactive, can be planned |

Understanding Margin Call vs Top-Up in Loans

Margin calls occur when a loan's collateral value falls below a required threshold, prompting the lender to demand additional funds or assets to maintain the loan-to-value ratio. A top-up loan involves borrowing extra funds on an existing loan, increasing the principal amount without necessitating a drop in collateral value. Understanding these distinctions is crucial for managing loan risk and maintaining financial stability in secured lending agreements.

Key Differences Between Margin Call and Top-Up

Margin call requires a borrower to deposit additional collateral to maintain the minimum margin requirement, while a top-up involves adding funds to increase the loan amount or improve credit standing. Margin calls are triggered by a decrease in the value of collateral, whereas top-ups are initiated voluntarily by the borrower for extra liquidity. The key difference lies in margin call being a risk management mechanism imposed by lenders, contrasting with top-ups as borrower-driven financial adjustments.

How Margin Calls Work in Loan Agreements

Margin calls in loan agreements occur when the borrower's collateral value falls below a specified maintenance margin, requiring immediate action to restore the loan-to-value ratio. Lenders typically demand additional funds or assets, known as a top-up, to increase the collateral and secure the loan's credit risk. Failure to meet a margin call can lead to forced liquidation of assets or loan default under the terms of the agreement.

The Process of Loan Top-Ups Explained

Loan top-ups involve applying for additional funds on an existing loan, with approval contingent on the borrower's creditworthiness and repayment history. The process requires the borrower to submit a formal request and updated financial documents, which the lender evaluates to determine the increased loan amount and revised terms. Unlike margin calls that demand immediate collateral replenishment, top-ups extend the loan balance under new conditions, providing borrowers with extra capital without default triggers.

Risk Factors: Margin Call vs Top-Up

Risk factors in margin calls primarily involve sudden market volatility, which can cause the loan-to-value ratio to exceed the agreed threshold, triggering immediate collateral liquidation to cover losses. In contrast, top-up risk factors center around delayed borrower action to increase collateral, potentially leading to forced asset sales or loan default if the additional margin is not provided in time. Both scenarios emphasize liquidity risk and market fluctuations as critical elements impacting loan security and investor exposure.

When Do Lenders Trigger a Margin Call?

Lenders trigger a margin call when the loan-to-value (LTV) ratio exceeds the agreed threshold due to falling asset prices or increased loan balances. This event requires borrowers to either repay part of the loan or provide additional collateral to restore the required equity level. Margin calls protect lenders by mitigating the risk of undercollateralized loans and preventing potential defaults.

Benefits and Drawbacks of Loan Top-Ups

Loan top-ups provide borrowers with quick access to additional funds without undergoing a full loan application, offering flexibility in managing increased expenses or emergencies. Benefits include potentially lower interest rates compared to new loans and simplified approval processes, while drawbacks involve increased total debt and possible extension of the loan tenure, affecting overall repayment costs. Understanding these factors helps borrowers weigh the convenience of immediate funds against long-term financial commitments.

Managing Shortfalls: Margin Call Strategies

Margin call strategies are essential for effectively managing shortfalls in loan collateral, requiring borrowers to promptly increase their account equity to meet lender requirements and avoid forced liquidation. A margin call demands immediate action when asset values fall below the maintenance margin, while a top-up involves voluntarily adding funds to reinforce the loan position before a margin call occurs. Strategic use of margin calls and top-ups ensures loan stability, mitigates risk exposure, and maintains compliance with lending terms.

Margin Requirements vs Top-Up Eligibility

Margin calls occur when the value of collateral falls below the lender's margin requirements, prompting borrowers to provide additional funds to restore the required equity. Top-up eligibility refers to a borrower's capacity to add extra funds voluntarily or as predetermined in the loan agreement to maintain or increase the loan-to-value ratio without triggering a margin call. Understanding the distinction between margin requirements and top-up eligibility is crucial for managing risk and avoiding forced liquidation in margin lending scenarios.

Impact of Margin Calls and Top-Ups on Borrowers

Margin calls require borrowers to deposit additional funds or securities to maintain a minimum equity level, often triggering immediate liquidity pressures and potential forced asset sales. Top-ups, by contrast, involve voluntarily adding funds to improve loan terms or reduce risk exposure, enhancing financial stability and borrowing capacity. Both margin calls and top-ups significantly affect a borrower's cash flow management and long-term creditworthiness.

Important Terms

Collateralization ratio

The collateralization ratio measures the value of collateral relative to the outstanding loan and triggers a margin call when it falls below the maintenance requirement, requiring borrowers to top-up collateral to restore the ratio. Maintaining an adequate collateralization ratio is crucial to avoid forced liquidation and ensure loan security in margin trading or lending platforms.

Liquidation threshold

The liquidation threshold is the critical balance level in a margin account that triggers a margin call when breached, indicating the need for a top-up to restore minimum equity requirements. Maintaining account equity above the liquidation threshold prevents forced asset liquidation and potential losses due to insufficient collateral.

Maintenance margin

Maintenance margin represents the minimum equity balance a trader must maintain in a margin account to avoid a margin call, which occurs when equity falls below this threshold. A top-up is required when a margin call is triggered, compelling the trader to deposit additional funds or securities to restore the account to the maintenance margin level.

Drawdown buffer

A drawdown buffer is a risk management tool that reduces the likelihood of a margin call by providing a predefined cushion before account equity falls below the maintenance margin. This buffer allows investors to avoid immediate top-up requirements by absorbing initial losses, ensuring positions remain open without forced liquidation.

Rehypothecation

Rehypothecation allows brokers to reuse client collateral, impacting margin calls by potentially altering available assets for meeting such calls. A top-up involves clients depositing additional funds or securities to restore margin levels after a margin call, ensuring maintained leverage and compliance.

Equity cushion

Equity cushion refers to the difference between the current value of an investor's account and the required maintenance margin, serving as a buffer against margin calls. A larger equity cushion reduces the likelihood of a margin call, whereas a smaller cushion increases the risk, often necessitating a margin top-up to restore the account balance.

Leverage limit

Leverage limit represents the maximum ratio of borrowed funds to equity allowed in a trading account, directly affecting the risk level and the likelihood of a margin call. When the account equity falls below the required maintenance margin due to unfavorable price movements, a margin call is triggered, requiring a top-up to restore the margin and avoid forced liquidation.

Initial margin

Initial margin is the minimum collateral required to open a position, ensuring sufficient coverage against potential losses, while a margin call occurs when the account equity falls below the maintenance margin threshold, prompting a demand for a top-up to restore the margin balance. Top-up deposits increment the margin to meet the required initial margin level, preventing forced liquidation of positions in volatile markets.

Shortfall alert

A shortfall alert signals that an account's equity has dropped below the required maintenance margin, prompting a margin call for the investor to deposit additional funds. Failure to respond to a margin call with a timely top-up can result in forced liquidation of positions to cover the deficit.

Forced liquidation

Forced liquidation occurs when a trader's margin falls below the maintenance margin requirement due to adverse price movements, triggering an automatic closure of positions to prevent further losses. Margin calls require the trader to top-up their account balance to the initial margin level, avoiding forced liquidation by restoring sufficient equity.

margin call vs top-up Infographic

moneydif.com

moneydif.com