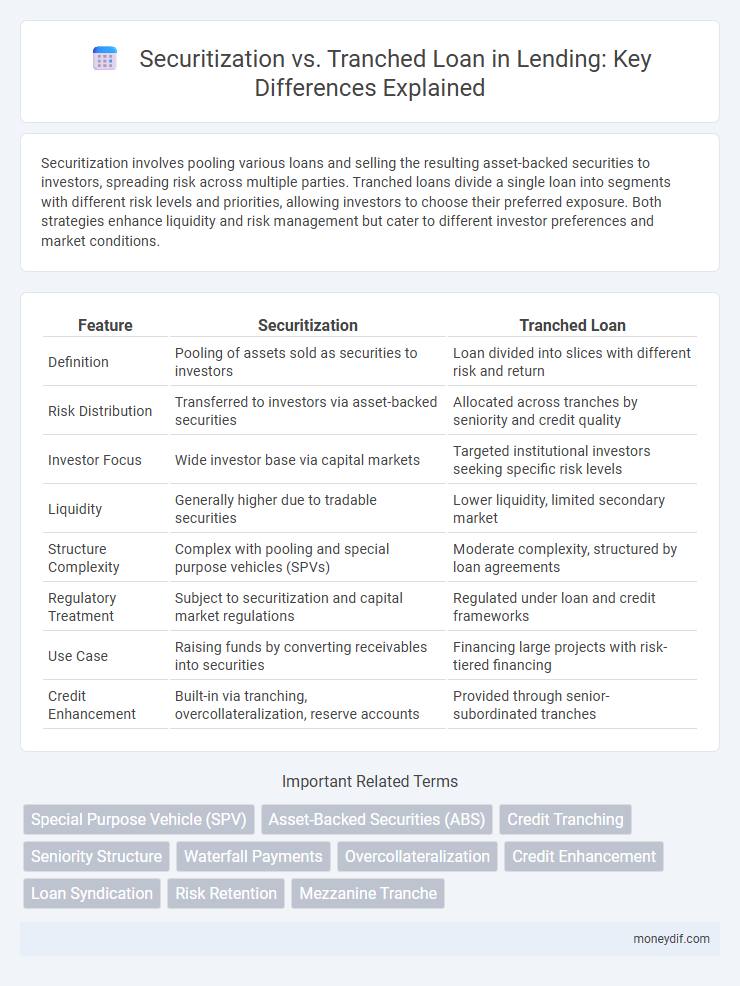

Securitization involves pooling various loans and selling the resulting asset-backed securities to investors, spreading risk across multiple parties. Tranched loans divide a single loan into segments with different risk levels and priorities, allowing investors to choose their preferred exposure. Both strategies enhance liquidity and risk management but cater to different investor preferences and market conditions.

Table of Comparison

| Feature | Securitization | Tranched Loan |

|---|---|---|

| Definition | Pooling of assets sold as securities to investors | Loan divided into slices with different risk and return |

| Risk Distribution | Transferred to investors via asset-backed securities | Allocated across tranches by seniority and credit quality |

| Investor Focus | Wide investor base via capital markets | Targeted institutional investors seeking specific risk levels |

| Liquidity | Generally higher due to tradable securities | Lower liquidity, limited secondary market |

| Structure Complexity | Complex with pooling and special purpose vehicles (SPVs) | Moderate complexity, structured by loan agreements |

| Regulatory Treatment | Subject to securitization and capital market regulations | Regulated under loan and credit frameworks |

| Use Case | Raising funds by converting receivables into securities | Financing large projects with risk-tiered financing |

| Credit Enhancement | Built-in via tranching, overcollateralization, reserve accounts | Provided through senior-subordinated tranches |

Introduction to Securitization and Tranched Loans

Securitization involves pooling various loan assets and issuing new securities backed by these loans, enhancing liquidity and risk distribution. Tranched loans divide a single loan into multiple segments with varying risk and return profiles, allowing investors to select tranches based on their risk appetite. Both securitization and tranched loans optimize capital allocation by tailoring risk exposure to different investor preferences.

Defining Securitization in the Loan Market

Securitization in the loan market involves pooling various types of debt, such as mortgages or corporate loans, and transforming them into tradable securities that investors can buy. This process enhances liquidity by converting illiquid assets into marketable instruments, distributing risk among a broader investor base. Unlike tranched loans, which segment a single loan into different risk layers for investors, securitization aggregates multiple loans, diversifying exposure and enabling efficient capital allocation.

Understanding Tranched Loans: Structure and Purpose

Tranched loans divide a single loan into multiple segments or tranches, each with distinct risk levels, interest rates, and repayment priorities tailored to different investor profiles. This structure offers lenders flexibility in managing credit risk and allows borrowers to access diverse funding sources by appealing to investors with varying risk appetites. Understanding the purpose of tranched loans highlights their role in optimizing capital allocation and enhancing the efficiency of loan syndication in the credit markets.

Key Differences Between Securitization and Tranched Loans

Securitization involves pooling various loans or financial assets and issuing securities backed by these cash flows, transferring credit risk to investors, while tranched loans split a single loan into segments with different risk and return profiles to attract diverse investors. Key differences include the structure of risk distribution--securitization disperses risk across multiple asset classes and investors, whereas tranched loans concentrate risk within varying tranches of the same loan. Furthermore, securitization typically enhances liquidity by creating tradable securities, compared to tranched loans that remain closely tied to original borrower credit quality and less liquid market presence.

Advantages of Securitization for Lenders and Investors

Securitization allows lenders to convert illiquid loans into tradable securities, enhancing liquidity and enabling risk diversification across multiple investors. It provides investors with access to pooled loan assets, offering tailored risk-return profiles through structured tranches that can meet varying investment appetites. Furthermore, securitization reduces credit risk for lenders by transferring loan portfolios off the balance sheet, thereby improving capital efficiency and regulatory compliance.

Benefits and Risks of Tranched Loans

Tranched loans offer benefits such as tailored risk allocation, allowing investors to select tranches that match their risk tolerance and return expectations, enhancing capital efficiency and liquidity. The structured nature of tranched loans provides improved credit enhancement and risk mitigation compared to unsecured loans, facilitating better pricing and broader investor participation. Risks include complexity in valuation, potential misalignment of interests among tranche holders, and increased default correlation within lower-rated tranches, which may lead to higher loss severity under adverse conditions.

Risk Distribution: Securitization vs. Tranched Loan Structures

Securitization distributes risk by pooling diverse loans into asset-backed securities, which are then sliced into tranches with varying credit ratings, allowing investors to select risk levels aligned with their appetite. Tranched loan structures allocate risk within a single loan by dividing it into senior, mezzanine, and junior tranches, each bearing different priority claims and loss exposure. Both methods enhance risk distribution but securitization offers greater diversification through broad asset pools, while tranched loans maintain direct lender involvement and control.

Impact on Loan Liquidity and Capital Efficiency

Securitization enhances loan liquidity by transforming illiquid loans into tradable securities, attracting a broader investor base and improving marketability. Tranched loans segment credit risk into different layers, allowing lenders to optimize capital allocation by prioritizing risk exposure across tranches. This structuring boosts capital efficiency by aligning risk-weighted assets with regulatory requirements, facilitating better risk management and funding flexibility.

Regulatory Considerations for Securitization and Tranched Loans

Regulatory considerations for securitization involve compliance with risk retention rules under frameworks like the Dodd-Frank Act, which mandates sponsors to retain a portion of the credit risk to align interests with investors. Tranched loans, structured into varying risk segments, must adhere to capital adequacy requirements set by regulators such as Basel III, impacting bank capital charges according to loan tranche risk profiles. Understanding these regulatory landscapes is crucial for optimizing capital efficiency and maintaining compliance in structured finance transactions.

Choosing the Right Structure: Factors to Consider

Choosing between securitization and tranched loans depends heavily on risk tolerance, investor appetite, and transaction complexity. Securitization offers diversified risk by pooling assets and issuing multiple classes of securities, appealing to investors seeking stable cash flows and credit enhancement. Tranched loans, divided into senior and subordinated tranches, provide tailored risk-return profiles but require careful assessment of borrower credit quality and structural covenants to optimize capital efficiency and funding cost.

Important Terms

Special Purpose Vehicle (SPV)

Special Purpose Vehicle (SPV) serves as a legally separate entity that isolates financial risk in securitization by acquiring and packaging assets into marketable securities, whereas in tranched loans, the SPV structures debt into different tranches with varying risk and return profiles to attract different types of investors. SPVs enhance risk management and capital efficiency by segregating asset pools and facilitating tailored investment products within both securitization and tranched loan frameworks.

Asset-Backed Securities (ABS)

Asset-Backed Securities (ABS) are financial instruments created through securitization, which pools various cash-flow-generating assets such as auto loans, credit card receivables, or mortgages, and repackages them into marketable securities, offering investors exposure to underlying asset performance. Unlike tranched loans that divide a single loan into slices with varying risk levels primarily for credit risk management, ABS involve a diversified pool of assets structured into tranches that distribute cash flow and risk to investors based on priority of payment and credit enhancement features.

Credit Tranching

Credit tranching in securitization involves dividing pooled assets into segments with varying risk and return profiles to attract diverse investors, whereas tranched loans segment a single loan into slices with different credit risks to optimize capital structure and risk distribution. Securitization offers enhanced liquidity and risk transfer by converting assets into tradable securities, while tranched loans primarily focus on internal risk allocation among lenders.

Seniority Structure

Seniority structure in securitization prioritizes repayment by allocating cash flows to senior tranches before subordinated ones, enhancing creditworthiness and investor confidence; similarly, tranched loans segment risk by seniority levels, where senior tranches have priority claims on collateral and lower interest rates compared to junior tranches. This hierarchy reduces default risk exposure for senior investors, aligning with market practices in asset-backed securities and leveraged financing.

Waterfall Payments

Waterfall payments prioritize the sequential distribution of cash flows, ensuring senior securitized debt holders receive principal and interest before subordinated tranches, which contrasts with tranched loans where repayment depends on specific tranche terms but often allows for more flexible cash flow allocation. In securitization, this strict hierarchical payment structure reduces risk for senior investors, whereas tranched loans incorporate varying risk and return profiles within a single credit facility.

Overcollateralization

Overcollateralization in securitization involves pledging assets exceeding the issued securities' value to provide credit enhancement and reduce investor risk. Tranched loans segment credit risk into different tranches with varying priorities and losses absorbed sequentially, whereas overcollateralization directly increases collateral value to secure repayment.

Credit Enhancement

Credit enhancement improves the creditworthiness of securitized assets by reducing the risk of default through mechanisms such as overcollateralization, subordination, and reserve funds. In comparison, tranched loans divide the loan into segments with varying risk levels, allowing investors to select exposure according to risk appetite, but typically offer less structural credit enhancement than securitization.

Loan Syndication

Loan syndication involves multiple lenders pooling resources to provide a large loan, whereas securitization transforms loan assets into marketable securities sold to investors. Tranche structuring in syndicated loans segments risk and return profiles among lenders, while securitization tranches are typically sold in capital markets, offering different liquidity and risk distribution.

Risk Retention

Risk retention in securitization requires originators to hold a minimum of 5% of the credit risk, aligning their interests with investors and mitigating moral hazard. In contrast, tranched loans distribute credit risk among different tranches, with senior tranches bearing less risk and junior tranches absorbing more losses, often without a mandatory retention obligation by the loan originator.

Mezzanine Tranche

The mezzanine tranche in securitization represents a middle layer of risk and return, subordinate to the senior tranche but senior to the equity tranche, typically absorbing losses after the senior tranche is protected, thus enhancing credit enhancement for investors. In contrast, a tranched loan segments exposure within a single loan agreement, distributing risk and returns among lenders without creating separate securities, often used in structured finance to tailor risk profiles.

securitization vs tranched loan Infographic

moneydif.com

moneydif.com