Prepayment penalties and yield maintenance clauses protect lenders from lost interest when a borrower repays a loan early, but they function differently. A prepayment penalty is a fixed fee charged for early repayment, while yield maintenance compensates the lender for the present value of the lost interest by adjusting the payment amount. Choosing between these options depends on the loan terms and the borrower's financial strategy for minimizing costs.

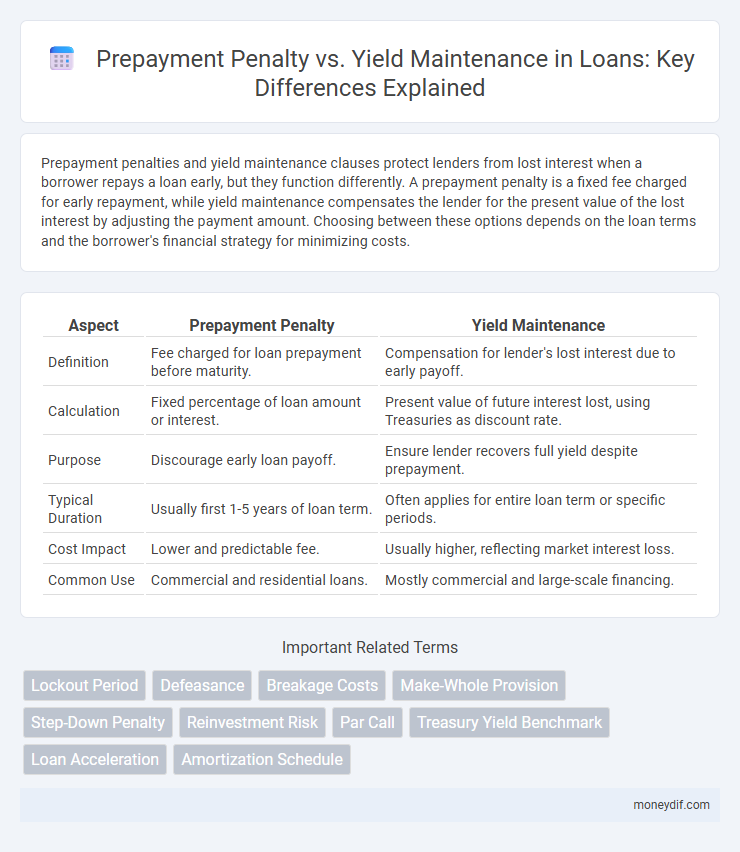

Table of Comparison

| Aspect | Prepayment Penalty | Yield Maintenance |

|---|---|---|

| Definition | Fee charged for loan prepayment before maturity. | Compensation for lender's lost interest due to early payoff. |

| Calculation | Fixed percentage of loan amount or interest. | Present value of future interest lost, using Treasuries as discount rate. |

| Purpose | Discourage early loan payoff. | Ensure lender recovers full yield despite prepayment. |

| Typical Duration | Usually first 1-5 years of loan term. | Often applies for entire loan term or specific periods. |

| Cost Impact | Lower and predictable fee. | Usually higher, reflecting market interest loss. |

| Common Use | Commercial and residential loans. | Mostly commercial and large-scale financing. |

Understanding Prepayment Penalty and Yield Maintenance

Prepayment penalty and yield maintenance are two key mechanisms lenders use to protect projected revenue from early loan payoff. A prepayment penalty imposes a fixed fee based on the outstanding loan balance when the borrower repays early, while yield maintenance compensates the lender for lost interest by calculating a payment equal to the present value of the remaining scheduled interest payments. Understanding the financial impact of each is crucial for borrowers seeking flexibility and lenders aiming to mitigate risk.

Key Differences Between Prepayment Penalty and Yield Maintenance

Prepayment penalty imposes a fixed fee or percentage charge when a borrower repays a loan early, designed to compensate lenders for the lost interest, while yield maintenance ensures the lender receives the full economic benefit by calculating the present value of remaining payments discounted at a comparable Treasury rate. Key differences include the calculation method, with prepayment penalties being simpler and often fixed, whereas yield maintenance involves a more complex formula tied to market interest rates. Yield maintenance typically results in higher costs for borrowers but provides greater revenue protection for lenders compared to standard prepayment penalties.

How Prepayment Penalties Work

Prepayment penalties are fees charged to borrowers who pay off their loans before the scheduled maturity date, designed to compensate lenders for lost interest income. These penalties are typically calculated as a percentage of the outstanding loan balance or a specified number of months' interest. By deterring early repayment, prepayment penalties protect the lender's expected yield but can increase the borrower's overall loan cost if they refinance or pay off the loan ahead of time.

How Yield Maintenance Functions in Loan Agreements

Yield maintenance functions in loan agreements by requiring borrowers to compensate lenders for the interest income lost if the loan is paid off early. This is calculated based on the present value of remaining scheduled payments, discounted at a comparable Treasury rate, ensuring lenders receive the full contracted yield. The mechanism protects lenders from reinvestment risk while allowing borrowers the option to prepay under defined financial terms.

Pros and Cons of Prepayment Penalty Clauses

Prepayment penalty clauses protect lenders by compensating for lost interest when borrowers repay loans early, ensuring predictable returns and reducing reinvestment risk. Borrowers face potential drawbacks such as reduced financial flexibility and higher overall loan costs due to fees imposed on early repayment. While these penalties secure lender income, they may deter borrowers from refinancing or accelerating loan payoff, limiting borrower advantage.

Yield Maintenance: Advantages and Drawbacks

Yield maintenance offers lenders a financial safeguard by compensating for interest lost when a borrower prepays a loan early, ensuring predictable returns. This mechanism benefits borrowers by potentially avoiding severe penalties tied to fluctuating market rates, although it can still result in substantial prepayment costs. The primary drawback includes its complexity in calculation and the possibility that high yield maintenance fees discourage early refinancing or loan payoff.

Impact on Borrowers: Prepayment Penalty vs Yield Maintenance

Prepayment penalties impose a fixed fee on borrowers who repay loans early, often limiting refinancing options and increasing overall borrowing costs. Yield maintenance ensures lenders receive the present value of lost interest, typically resulting in higher penalties that preserve lender returns but significantly raise the cost for borrowers aiming to exit loans early. Borrowers face greater financial uncertainty and reduced flexibility under yield maintenance compared to standard prepayment penalties, influencing their strategic decisions on loan management.

Lender Perspectives on Prepayment Protections

Lenders prioritize yield maintenance to secure the full economic benefit of a loan by compensating for lost interest income when borrowers prepay early, aligning with the expected return over the loan's term. Prepayment penalties provide a simpler, fixed-fee approach that deters early repayment but may inadequately offset financial losses in declining interest rate environments. Yield maintenance clauses are favored in commercial real estate lending for their precision in protecting lender yield against prepayment risk, enhancing financial stability in volatile markets.

Calculating Prepayment Penalties and Yield Maintenance Fees

Calculating prepayment penalties involves determining a fixed percentage of the outstanding loan balance or the interest lost by the lender during a specified period. Yield maintenance fees are calculated based on the present value of the remaining loan payments discounted at the Treasury yield rate, ensuring the lender recovers the interest income as if the loan was held to maturity. Both methods require detailed financial modeling and an understanding of loan terms to accurately quantify the cost to the borrower upon early repayment.

Choosing the Right Option: Prepayment Penalty or Yield Maintenance

Choosing between a prepayment penalty and yield maintenance hinges on the loan's remaining term and the lender's risk tolerance. Prepayment penalties offer a fixed fee structure, providing predictable costs for early repayment, while yield maintenance calculates a compensation amount based on the present value of lost interest, often resulting in higher fees. Borrowers should analyze the financial impact of each option in relation to current interest rates and their likelihood of refinancing to optimize cost savings and minimize penalty exposure.

Important Terms

Lockout Period

The lockout period restricts prepayments during which prepayment penalties, either as a fixed fee or yield maintenance calculated to preserve the lender's expected return, are enforced to protect loan yields.

Defeasance

Defeasance replaces a mortgage with government securities to avoid prepayment penalties associated with yield maintenance agreements while allowing loan payoff flexibility.

Breakage Costs

Breakage costs in loan agreements typically arise when prepayment penalties are applied as a fixed percentage of the outstanding balance, whereas yield maintenance compensates lenders by calculating the present value of lost interest income over the remaining loan term.

Make-Whole Provision

Make-whole provisions ensure lenders receive full economic compensation by calculating prepayment penalties based on the present value of scheduled payments, which aligns with yield maintenance strategies to protect the lender's expected yield.

Step-Down Penalty

Step-down penalties reduce over time in prepayment agreements, offering a less stringent alternative to yield maintenance prepayment penalties that aim to preserve the lender's expected interest income.

Reinvestment Risk

Prepayment penalties like yield maintenance reduce reinvestment risk by compensating lenders for lost interest, whereas standard prepayment penalties may provide less protection against fluctuations in reinvestment yields.

Par Call

Par Call allows borrowers to repay a loan without prepayment penalties, whereas yield maintenance compensates lenders for lost interest by imposing a fee equating to the difference between the loan's interest rate and current market yields.

Treasury Yield Benchmark

Treasury yield benchmarks influence prepayment penalties and yield maintenance strategies by determining the present value of future loan cash flows and ensuring lenders are compensated for interest lost due to early loan repayment.

Loan Acceleration

Loan acceleration clauses often interact with prepayment penalty structures such as yield maintenance, which compensates lenders for interest lost by requiring borrowers to pay a penalty that matches the present value of remaining payments.

Amortization Schedule

An amortization schedule detailing loan repayments highlights that prepayment penalties typically impose a fixed fee, whereas yield maintenance ensures the lender recovers the present value of lost interest, optimizing financial outcomes for both parties.

Prepayment Penalty vs Yield Maintenance Infographic

moneydif.com

moneydif.com