Recourse loans hold borrowers personally liable for the debt, allowing lenders to pursue assets beyond the collateral in case of default. Non-recourse loans limit the lender's recovery to the collateral only, protecting the borrower's other assets from claims. Understanding the distinction between recourse and non-recourse loans is crucial for managing financial risk and loan strategy.

Table of Comparison

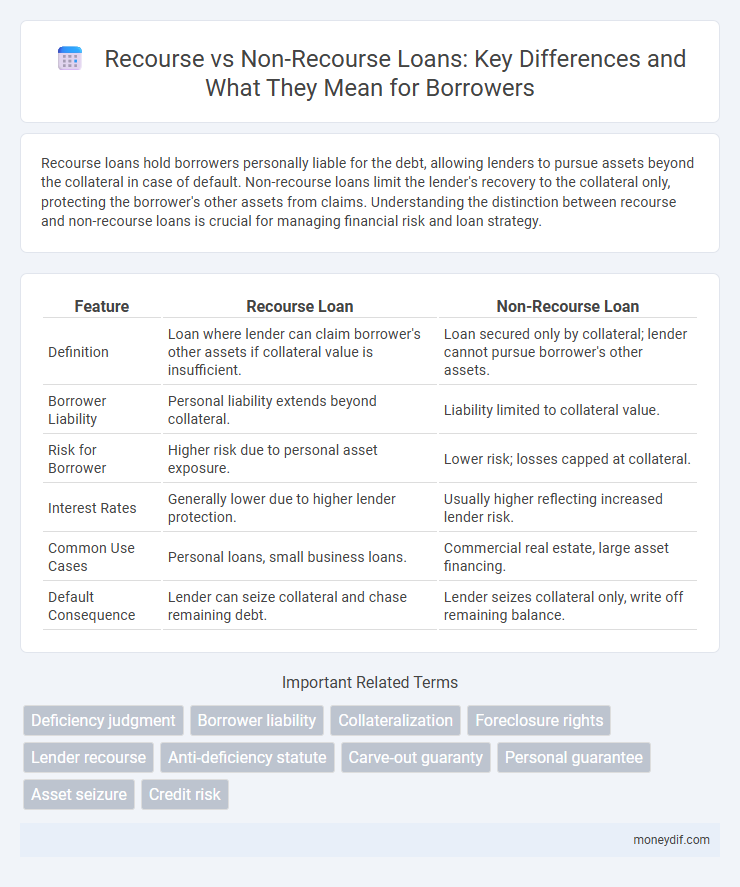

| Feature | Recourse Loan | Non-Recourse Loan |

|---|---|---|

| Definition | Loan where lender can claim borrower's other assets if collateral value is insufficient. | Loan secured only by collateral; lender cannot pursue borrower's other assets. |

| Borrower Liability | Personal liability extends beyond collateral. | Liability limited to collateral value. |

| Risk for Borrower | Higher risk due to personal asset exposure. | Lower risk; losses capped at collateral. |

| Interest Rates | Generally lower due to higher lender protection. | Usually higher reflecting increased lender risk. |

| Common Use Cases | Personal loans, small business loans. | Commercial real estate, large asset financing. |

| Default Consequence | Lender can seize collateral and chase remaining debt. | Lender seizes collateral only, write off remaining balance. |

Understanding Recourse vs Non-Recourse Loans

Recourse loans allow lenders to claim the borrower's personal assets if the loan collateral does not cover the outstanding debt, increasing the lender's security. Non-recourse loans limit the lender's recovery to the collateral only, protecting the borrower's other assets from seizure. Understanding the distinction between recourse and non-recourse loans is crucial for evaluating risk exposure and financial responsibility in loan agreements.

Key Differences Between Recourse and Non-Recourse Loans

Recourse loans hold the borrower personally liable, allowing lenders to pursue other assets beyond the collateral if the loan defaults, whereas non-recourse loans limit the lender's claim strictly to the collateral. The risk profile differs significantly, with recourse loans posing higher personal financial risk to the borrower but often offering lower interest rates due to reduced lender risk. Non-recourse loans are common in real estate finance and are preferred by borrowers seeking to protect personal assets, though they typically carry higher interest costs or stricter qualification criteria.

How Recourse Loans Work

Recourse loans require the borrower to personally guarantee the debt, meaning lenders can pursue the borrower's other assets if the collateral's value does not cover the outstanding loan balance. In these loans, the lender has the legal right to seize the property and seek deficiency judgments to recover any remaining balance after foreclosure. This structure typically results in lower interest rates due to reduced lender risk compared to non-recourse loans, which limit recovery to the collateral alone.

How Non-Recourse Loans Work

Non-recourse loans limit the lender's recovery to the collateral specified, typically the property or asset purchased with the loan. Borrowers are not personally liable beyond the collateral, meaning if the borrower defaults, the lender can seize the asset but cannot pursue the borrower's other assets or income. This structure is common in commercial real estate financing, reducing borrower risk but often resulting in higher interest rates or stricter loan conditions.

Advantages of Recourse Loans

Recourse loans provide lenders the advantage of pursuing the borrower's personal assets beyond the collateral in case of default, reducing lending risk and enabling potentially lower interest rates. Borrowers may gain access to larger loan amounts and more favorable terms due to the enhanced security afforded to lenders. This increased accountability encourages responsible borrowing and timely repayments, benefiting both parties in the loan agreement.

Benefits of Non-Recourse Loans

Non-recourse loans limit the borrower's liability to the collateral, safeguarding personal assets in case of default. These loans reduce financial risk, making them attractive for real estate investors and businesses seeking asset protection. Lenders rely solely on the asset's value for repayment, promoting more predictable risk management.

Risks Associated with Recourse Loans

Recourse loans expose borrowers to greater financial risk because lenders can pursue personal assets beyond the collateral if the loan defaults, increasing potential losses. This risk includes wage garnishment, bank account levies, or legal judgments against the borrower's other properties. In contrast, non-recourse loans limit the lender's recovery to the collateral alone, reducing borrower liability and protecting personal assets from claims.

Risks Linked to Non-Recourse Loans

Non-recourse loans limit the lender's recovery to the collateral, placing the full risk of borrower default on the lender without recourse to the borrower's other assets. This increases the lender's exposure to potential losses if the collateral value depreciates below the outstanding loan balance. Borrowers face fewer personal financial risks with non-recourse loans, but limited lender remedies can lead to higher interest rates and stricter collateral requirements.

Which Type of Loan is Best for Borrowers?

Recourse loans require borrowers to personally guarantee repayment, risking personal assets beyond the collateral, while non-recourse loans limit lender claims strictly to the collateral itself. For borrowers prioritizing asset protection and minimizing personal financial risk, non-recourse loans offer significant advantages despite potentially higher interest rates. Evaluating the borrower's risk tolerance and financial situation determines which loan type is most suitable for managing liability exposure effectively.

Recourse vs Non-Recourse Loans: Real-World Examples

Recourse loans allow lenders to pursue a borrower's personal assets beyond the collateral if the loan defaults, commonly seen in business or personal loans where full repayment is required. Non-recourse loans limit the lender's recovery to the collateral itself, often used in real estate financing, ensuring borrowers are not personally liable beyond the property securing the loan. Real-world examples include commercial real estate loans as typical non-recourse loans, whereas most personal and small business loans are recourse-based.

Important Terms

Deficiency judgment

Deficiency judgment determines the borrower's remaining debt balance after a foreclosure sale in recourse loans, whereas non-recourse loans protect borrowers from deficiency judgments by limiting lender recovery to the collateral only.

Borrower liability

Borrower liability in recourse loans holds the borrower personally responsible for the debt beyond the collateral, whereas non-recourse loans limit the lender's claim to the collateral only, protecting the borrower from additional liability.

Collateralization

Collateralization in recourse loans allows lenders to claim borrower assets upon default, whereas non-recourse loans limit lender claims solely to the collateral itself without pursuing the borrower's other assets.

Foreclosure rights

Recourse foreclosure allows lenders to pursue borrowers for deficiencies after sale, while non-recourse foreclosure limits lender recovery to the collateral property only.

Lender recourse

Lender recourse allows lenders to seize a borrower's other assets beyond the collateral if a loan defaults, whereas non-recourse loans limit the lender's recovery strictly to the collateral pledged.

Anti-deficiency statute

Anti-deficiency statutes prohibit lenders from pursuing borrowers for loan balances exceeding collateral value in non-recourse loans, while recourse loans allow deficiency judgments against borrowers.

Carve-out guaranty

Carve-out guaranty creates personal liability for the guarantor in non-recourse loans by allowing lenders to pursue recourse remedies under specific carve-out events.

Personal guarantee

A personal guarantee in loan agreements typically converts a non-recourse loan into a recourse loan by holding the borrower personally liable for repayment beyond the collateral.

Asset seizure

Asset seizure occurs more frequently in recourse loans where lenders have the right to claim borrower assets beyond collateral, unlike non-recourse loans which limit lender claims strictly to the collateral itself.

Credit risk

Recourse credit risk involves the lender having the right to claim the borrower's other assets upon default, while non-recourse credit risk limits the lender's recovery strictly to the collateral securing the loan.

Recourse vs Non-recourse Infographic

moneydif.com

moneydif.com