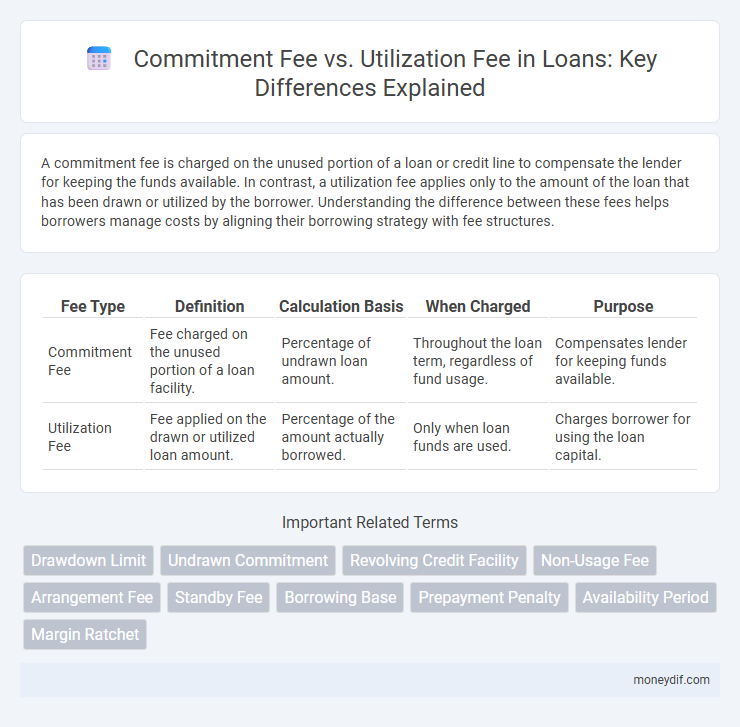

A commitment fee is charged on the unused portion of a loan or credit line to compensate the lender for keeping the funds available. In contrast, a utilization fee applies only to the amount of the loan that has been drawn or utilized by the borrower. Understanding the difference between these fees helps borrowers manage costs by aligning their borrowing strategy with fee structures.

Table of Comparison

| Fee Type | Definition | Calculation Basis | When Charged | Purpose |

|---|---|---|---|---|

| Commitment Fee | Fee charged on the unused portion of a loan facility. | Percentage of undrawn loan amount. | Throughout the loan term, regardless of fund usage. | Compensates lender for keeping funds available. |

| Utilization Fee | Fee applied on the drawn or utilized loan amount. | Percentage of the amount actually borrowed. | Only when loan funds are used. | Charges borrower for using the loan capital. |

Understanding Commitment Fees in Loans

Commitment fees in loans are charges paid by borrowers to lenders for reserving a credit line, regardless of whether the loan funds are utilized. These fees typically range from 0.25% to 0.50% annually on the unused portion of a loan commitment, compensating lenders for the capital set aside. Understanding commitment fees helps borrowers evaluate the true cost of maintaining borrowing capacity alongside utilization fees applied only to drawn amounts.

What is a Utilization Fee?

A utilization fee is a charge applied on the amount of a loan or credit line that a borrower actually uses, rather than the total approved credit. This fee incentivizes efficient borrowing by ensuring costs align with the portion of funds drawn, often calculated as a percentage of the utilized amount over a specific period. Utilization fees differ from commitment fees, which are charged on the unused portion of the loan, reflecting the lender's cost of keeping funds available.

Key Differences Between Commitment Fee and Utilization Fee

Commitment fees are charged on the unused portion of a loan or credit facility, ensuring that funds remain available for the borrower, while utilization fees are assessed only on the amount actually drawn or used. Commitment fees compensate lenders for reserving capital and managing risk, whereas utilization fees reflect the cost of borrowing and encourage efficient use of credit. The key difference lies in timing and basis of calculation: commitment fees apply regardless of usage, whereas utilization fees depend on actual loan utilization.

How Commitment Fees Affect Borrowers

Commitment fees are charged on the unused portion of a loan, ensuring lenders are compensated for keeping funds available, which can increase borrowing costs even if the loan amount is not fully utilized. Borrowers face higher overall expenses because commitment fees accrue regardless of the loan's actual usage, impacting cash flow management and effective interest expense. Understanding how commitment fees affect total loan cost is crucial for borrowers to negotiate favorable terms and optimize financing strategies.

Utilization Fees: Impact on Loan Usage

Utilization fees are charged on the actual amount of the loan that a borrower draws, incentivizing efficient use of the credit facility. These fees directly impact loan usage by encouraging borrowers to utilize only the necessary funds, reducing overall borrowing costs. Lenders often implement utilization fees in revolving credit and syndicated loans to align charges with cash flow needs and risk exposure.

Pros and Cons of Commitment Fees

Commitment fees provide lenders with compensation for holding credit available, ensuring borrowers have guaranteed access to funds without immediate withdrawal, which benefits financial planning and liquidity management. However, borrowers face the downside of paying fees on unused credit, potentially increasing overall loan costs even if the funds remain untouched. Commitment fees create a predictable cost structure but may discourage borrowers from maintaining large unused credit lines due to the recurring expense.

Advantages and Disadvantages of Utilization Fees

Utilization fees, charged only on the borrowed amount actually used, provide borrowers with cost efficiency by avoiding fees on unused credit, promoting optimal fund management. However, the variable nature of these fees can lead to unpredictable expenses, complicating financial planning compared to fixed commitment fees. Borrowers benefit from paying only for utilized funds, but face potentially higher costs during periods of increased borrowing, impacting loan affordability.

Commitment Fee vs Utilization Fee: Which Is More Costly?

Commitment fees are charged on the unused portion of a loan, ensuring the lender is compensated for keeping funds available, while utilization fees apply only to the amount actually borrowed. Typically, utilization fees tend to be more costly because they are calculated as a percentage of the drawn loan amount, directly impacting the borrower's expenses once the loan is utilized. Therefore, the overall cost depends on the loan usage pattern, making utilization fees more expensive when large portions of the loan are accessed.

Best Practices for Managing Loan Fees

Commitment fees are charged on the unused portion of a loan, incentivizing borrowers to efficiently draw down funds while ensuring lenders receive compensation for reserved credit. Utilization fees apply when the borrower exceeds a predetermined borrowing threshold, encouraging prudent loan usage and preventing over-leveraging. Best practices involve clearly defining fee structures in loan agreements, regularly monitoring loan drawdowns, and maintaining transparent communication to optimize cost management and foster stronger lender-borrower relationships.

Frequently Asked Questions About Loan Commitment and Utilization Fees

Loan commitment fees are charges lenders impose for reserving funds for a borrower, regardless of loan usage, typically calculated as a percentage of the unused loan amount. Utilization fees apply only when the borrower draws down on the loan, often based on the outstanding balance during the draw period. Frequently asked questions highlight differences in fee calculation methods, timing of charges, and their impact on overall loan costs for borrowers.

Important Terms

Drawdown Limit

The Drawdown Limit defines the maximum loan amount available, influencing whether a Commitment Fee applies on the undrawn portion or a Utilization Fee applies on the drawn amount.

Undrawn Commitment

Undrawn commitment refers to the portion of a loan or credit facility that remains unused, often incurring a commitment fee while only the utilized amount accrues a utilization fee.

Revolving Credit Facility

The commitment fee on a revolving credit facility is charged on the unused portion of the credit line, while the utilization fee applies only to the amount actually borrowed.

Non-Usage Fee

The Non-Usage Fee is charged on the committed but unused loan amount, contrasting with the Commitment Fee assessed on the total committed credit and the Utilization Fee calculated only on the drawn funds.

Arrangement Fee

The arrangement fee is a one-time charge for setting up a loan agreement, distinct from the commitment fee, which applies to the unused portion of the credit line, and the utilization fee, which is incurred based on the amount of credit actually drawn.

Standby Fee

The standby fee is charged on the undrawn portion of a credit facility while the commitment fee applies to the total committed amount and the utilization fee is assessed only on the actual borrowed funds.

Borrowing Base

The borrowing base determines the maximum loan amount, directly influencing the calculation of commitment fees charged on unused credit and utilization fees applied on drawn funds.

Prepayment Penalty

Prepayment penalties often occur in loan agreements where commitment fees are charged on unused credit lines while utilization fees apply to drawn amounts, impacting overall borrowing costs.

Availability Period

The Availability Period defines the timeframe during which the Commitment Fee is charged for reserved credit capacity, while the Utilization Fee applies only to the actual borrowed amount within that period.

Margin Ratchet

Margin Ratchet adjusts the Commitment Fee and Utilization Fee based on the borrower's leverage or utilization level to incentivize efficient capital use and reduce overall financing costs.

Commitment Fee vs Utilization Fee Infographic

moneydif.com

moneydif.com