Senior debt holds priority over junior debt in repayment hierarchy, making it less risky and often secured by company assets. Junior debt ranks below senior debt, carrying higher risk but offering greater potential returns through higher interest rates. Lenders consider senior debt safer, especially during financial distress, while junior debt serves as a subordinated financing option with increased risk exposure.

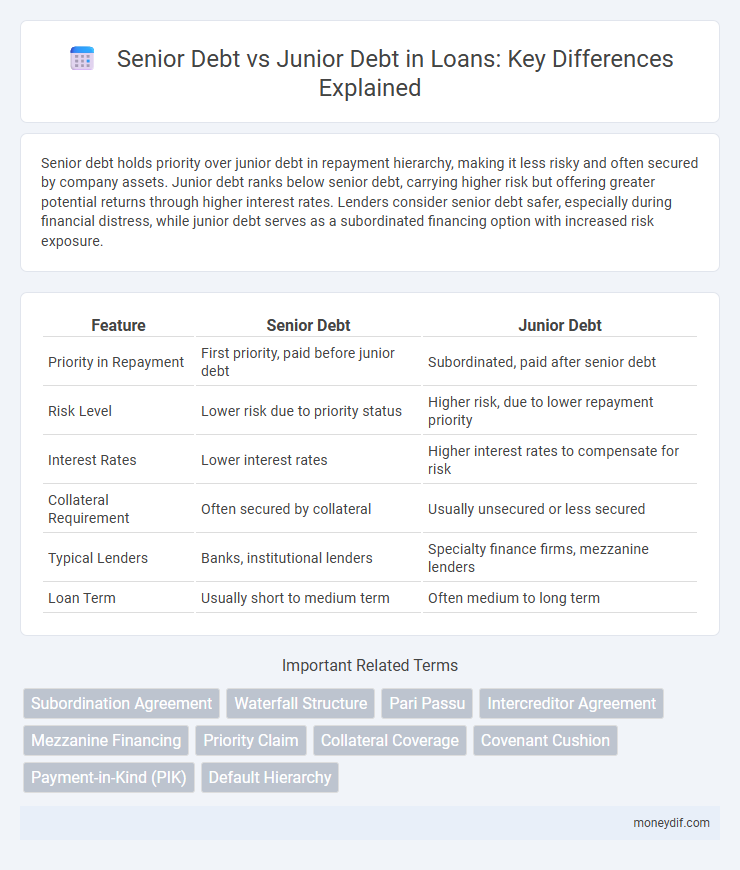

Table of Comparison

| Feature | Senior Debt | Junior Debt |

|---|---|---|

| Priority in Repayment | First priority, paid before junior debt | Subordinated, paid after senior debt |

| Risk Level | Lower risk due to priority status | Higher risk, due to lower repayment priority |

| Interest Rates | Lower interest rates | Higher interest rates to compensate for risk |

| Collateral Requirement | Often secured by collateral | Usually unsecured or less secured |

| Typical Lenders | Banks, institutional lenders | Specialty finance firms, mezzanine lenders |

| Loan Term | Usually short to medium term | Often medium to long term |

Introduction to Senior and Junior Debt

Senior debt holds priority over junior debt in repayment schedules, granting senior lenders first claim on assets during default or bankruptcy. Junior debt, also known as subordinated debt, carries higher risk due to its lower repayment priority but often offers higher interest rates to compensate investors. Understanding the hierarchy between senior and junior debt is crucial for risk assessment and capital structure decisions in corporate financing.

Key Differences Between Senior and Junior Debt

Senior debt holds priority over junior debt in repayment during default, making it a lower-risk investment due to its secured status against company assets. Junior debt, also known as subordinated debt, has a lower repayment priority and typically carries higher interest rates reflecting increased risk. The key differences include senior debt's collateral backing and priority claim versus junior debt's subordinate claim and higher cost of capital.

Priority of Claims in Debt Structures

Senior debt holds the highest priority in debt structures, ensuring repayment before any other creditors during liquidation or bankruptcy. Junior debt, also known as subordinated debt, ranks below senior debt, receiving repayment only after senior obligations are fully settled. This priority of claims directly impacts risk levels, interest rates, and recovery prospects for lenders and investors.

Risk and Return Profiles

Senior debt carries lower risk due to its priority claim on assets during borrower default, resulting in lower interest rates and more secure returns. Junior debt involves higher risk as it is subordinate to senior debt, leading to increased potential returns through elevated interest rates or equity conversion options. Investors balance these risk and return profiles based on their risk tolerance and investment goals in the loan structure.

Security and Collateral Considerations

Senior debt holds priority over junior debt in claims on a borrower's assets, offering greater security through first lien or secured positions on collateral such as real estate, equipment, or receivables. Junior debt is subordinated, often unsecured or backed by less valuable collateral, resulting in higher risk and typically higher interest rates. Lenders of senior debt benefit from stronger legal protections and recovery potential in default scenarios, while junior debt holders face increased exposure due to their lower standing in the capital structure.

Impact on Borrower’s Capital Structure

Senior debt holds priority over junior debt in repayment, significantly influencing a borrower's capital structure by reducing financial risk and enhancing creditworthiness. Junior debt, often subordinated, increases leverage but can dilute overall capital stability and elevate borrowing costs. The choice between senior and junior debt determines the borrower's risk profile, affecting future financing options and capital allocation strategies.

Legal Rights and Remedies for Lenders

Senior debt holders possess superior legal rights and remedies compared to junior debt holders, including priority claims on collateral and repayment in cases of borrower default or bankruptcy. Senior debt agreements typically include covenants granting lenders the right to accelerate repayment and initiate foreclosure or liquidation processes. Junior debt holders face subordinated claims, limiting their ability to recover funds until senior debt obligations are fully satisfied.

Covenants and Restrictions in Loan Agreements

Senior debt agreements impose stricter covenants and tighter restrictions to protect lenders by prioritizing repayment in case of default, often limiting additional borrowing and asset sales. Junior debt carries looser covenants but higher risk, allowing more operational freedom for the borrower while subordinating repayment priority behind senior debt. Loan agreements clearly define these covenant differences to balance risk, borrower flexibility, and lender protection.

Typical Uses for Senior and Junior Debt

Senior debt is commonly used for financing large-scale corporate projects and acquisitions due to its lower risk and priority in repayment, often secured by company assets. Junior debt typically supports growth initiatives and bridge financing where higher risk is acceptable, offering higher interest rates in exchange for subordinate claims. Companies blend senior and junior debt to optimize capital structure by balancing risk, cost, and financing flexibility.

Choosing the Right Debt Structure for Your Needs

Senior debt holds priority in repayment and generally offers lower interest rates due to its secured status, making it ideal for borrowers seeking lower risk financing. Junior debt carries higher risk with subordinated claims but provides greater flexibility and potential for higher returns, suited for businesses needing less restrictive terms. Evaluating your company's cash flow stability and growth prospects will help determine the optimal mix of senior and junior debt to balance cost and financial agility.

Important Terms

Subordination Agreement

A Subordination Agreement legally prioritizes senior debt claims over junior debt, ensuring that senior lenders are repaid first in case of borrower default or liquidation.

Waterfall Structure

Waterfall structure prioritizes senior debt repayment before allocating remaining cash flow to junior debt holders, ensuring senior debt holders have higher claim in bankruptcy or liquidation scenarios.

Pari Passu

Pari Passu ensures that Senior Debt and Junior Debt holders share claims proportionally without priority, affecting debt repayment structures in insolvency.

Intercreditor Agreement

An Intercreditor Agreement establishes the priority, rights, and obligations between Senior Debt holders and Junior Debt holders, ensuring clear repayment hierarchy and enforcement mechanisms during borrower default.

Mezzanine Financing

Mezzanine financing bridges the gap between senior debt and junior debt by offering subordinate, higher-yield debt that ranks below senior loans but above equity in the capital structure.

Priority Claim

A priority claim in bankruptcy ensures senior debt holders are repaid before junior debt holders, reflecting the legal hierarchy of debt obligations.

Collateral Coverage

Collateral coverage ratio measures the extent to which collateral value secures senior debt compared to junior debt, indicating higher protection for senior lenders through prioritized claims on pledged assets.

Covenant Cushion

Covenant Cushion refers to the financial buffer that ensures Senior Debt holders are protected before Junior Debt holders in case of a borrower's default.

Payment-in-Kind (PIK)

Payment-in-Kind (PIK) interest is commonly associated with Junior Debt as it allows borrowers to defer cash payments by increasing the principal, whereas Senior Debt typically requires regular cash interest payments to maintain creditor priority.

Default Hierarchy

Default hierarchy prioritizes senior debt repayment before junior debt during bankruptcy proceedings.

Senior Debt vs Junior Debt Infographic

moneydif.com

moneydif.com