A warehouse line is a short-term funding facility used by lenders to finance mortgage loans before they are sold on the secondary market, while a revolver, or revolving credit facility, provides ongoing access to capital up to a set limit for various business needs. Warehouse lines are typically repaid quickly upon loan sale, whereas revolvers offer flexibility for multiple borrowings and repayments over time. Choosing between a warehouse line and a revolver depends on the lender's cash flow requirements and loan origination volume.

Table of Comparison

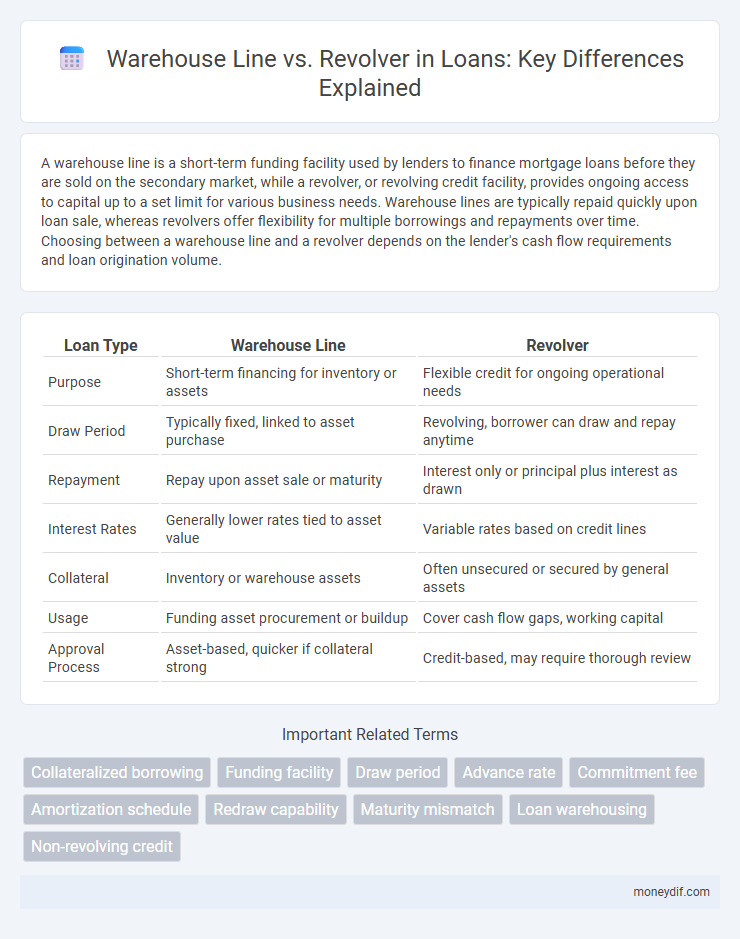

| Loan Type | Warehouse Line | Revolver |

|---|---|---|

| Purpose | Short-term financing for inventory or assets | Flexible credit for ongoing operational needs |

| Draw Period | Typically fixed, linked to asset purchase | Revolving, borrower can draw and repay anytime |

| Repayment | Repay upon asset sale or maturity | Interest only or principal plus interest as drawn |

| Interest Rates | Generally lower rates tied to asset value | Variable rates based on credit lines |

| Collateral | Inventory or warehouse assets | Often unsecured or secured by general assets |

| Usage | Funding asset procurement or buildup | Cover cash flow gaps, working capital |

| Approval Process | Asset-based, quicker if collateral strong | Credit-based, may require thorough review |

Introduction to Warehouse Lines and Revolver Loans

Warehouse lines provide short-term financing that allows lenders to fund multiple loans before selling them to investors, optimizing liquidity and capital efficiency. Revolver loans offer flexible credit access, enabling borrowers to draw, repay, and reuse funds within a set limit, supporting ongoing working capital needs. Both instruments play crucial roles in managing cash flow and funding strategies within financial institutions.

Key Differences Between Warehouse Lines and Revolvers

Warehouse lines and revolvers differ primarily in purpose and structure; warehouse lines are specialized loans used by mortgage lenders to fund multiple loans before selling them, while revolvers are flexible credit lines that businesses utilize for general working capital needs. Warehouse lines typically have short terms and are secured by the loans being warehouse-funded, whereas revolvers often have longer terms and are secured by broader collateral. The interest rates and draw restrictions reflect these differences, with warehouse lines often featuring lower rates due to decreased risk and revolvers offering more flexible borrowing and repayment options.

How Warehouse Lines of Credit Work

Warehouse lines of credit provide short-term financing to lenders, enabling them to fund multiple mortgage loans before selling the loans to permanent investors. These lines allow lenders to draw funds, close loans, and repay the credit as loans are sold, creating a revolving funding cycle specific to mortgage origination. In contrast to traditional revolvers, warehouse lines are tailored for loan inventory management, optimizing liquidity and capital efficiency in mortgage lending operations.

Understanding Revolving Credit Facilities

Revolving credit facilities provide flexible financing that allows businesses to borrow, repay, and borrow again up to a specified credit limit, making them ideal for managing fluctuating cash flow needs. Unlike warehouse lines of credit, which are typically used for short-term funding of loan portfolios before securitization, revolvers function as ongoing credit sources supporting operational expenses and working capital. Understanding the structure and utilization of revolving credit facilities helps companies maintain liquidity while optimizing interest costs and credit availability.

Eligibility Criteria for Warehouse Lines vs Revolver Loans

Warehouse lines require borrowers to demonstrate steady sales pipelines, acceptable credit scores typically above 680, and collateral in the form of inventory or receivables. Revolver loans emphasize liquidity ratios, debt service coverage ratios (DSCR) usually above 1.25, and often require stronger cash flow history and personal guarantees. Eligibility for warehouse lines leans on tangible asset valuation, whereas revolvers prioritize overall financial health and creditworthiness.

Pros and Cons of Warehouse Lines

Warehouse lines offer flexible short-term financing for mortgage lenders, enabling efficient loan origination and funding before long-term sale or securitization. Pros include lower interest rates, quick access to capital, and improved liquidity management; cons involve potential exposure to interest rate fluctuations, strict collateral requirements, and regulatory complexities. Compared to revolvers, warehouse lines are more specialized but may lack versatility for non-mortgage business financing.

Pros and Cons of Revolver Loans

Revolver loans offer flexibility by allowing borrowers to draw, repay, and redraw funds up to a set credit limit, making them ideal for managing short-term cash flow fluctuations. They may have higher interest rates compared to warehouse lines due to the uncertainty and revolving nature of the borrowing, which can increase overall financing costs. However, revolvers provide quick access to capital without the need for repeated loan approvals, supporting ongoing operational needs effectively.

Use Cases: When to Choose Warehouse vs Revolver

Warehouse lines are ideal for lenders needing short-term funding to acquire or aggregate loans before selling them to investors, emphasizing inventory buildup and rapid loan origination. Revolving lines of credit suit businesses requiring ongoing access to funds for operational expenses or variable cash flow needs, providing flexibility with borrowing and repayment cycles. Choosing between a warehouse line and revolver depends on whether the primary goal is loan accumulation and securitization or maintaining liquidity for fluctuating working capital demands.

Cost Structure and Interest Rates Comparison

Warehouse lines typically feature lower interest rates compared to revolvers due to their secured nature and short-term use, minimizing lender risk. Revolvers often carry higher interest rates reflecting their flexibility and unsecured status, leading to increased borrowing costs. The cost structure of warehouse lines usually includes minimal fees and interest calculated only on drawn amounts, whereas revolvers may involve commitment fees plus interest on outstanding balances.

Choosing the Right Loan Type for Your Business Needs

Warehouse lines provide short-term funding for inventory purchases and are ideal for businesses with fluctuating stock levels, while revolvers offer flexible, ongoing credit to manage cash flow and operational expenses. Selecting the right loan depends on your business's cash conversion cycle, inventory turnover, and working capital requirements. Assessing your financial projections and repayment capacity ensures the loan structure aligns with your growth strategy and liquidity needs.

Important Terms

Collateralized borrowing

Collateralized borrowing through a warehouse line offers asset-backed funding secured by inventory or receivables, enabling large-scale inventory financing with typically lower interest rates compared to unsecured options. Revolvers provide flexible, revolving credit lines often used for working capital needs but usually feature higher interest rates and less collateral specificity than warehouse lines.

Funding facility

A funding facility structured as a warehouse line provides short-term capital specifically for aggregating assets before securitization, offering fixed terms and limited draw periods, while a revolver functions as a flexible, revolving credit line enabling ongoing borrowing and repayment up to a set limit. Warehouse lines typically support asset accumulation under loan origination, whereas revolvers accommodate operational liquidity needs with repeated access to funds.

Draw period

The draw period refers to the timeframe during which a borrower can access funds from a revolving credit facility, such as a warehouse line or revolver, to finance inventory or receivables. Warehouse lines typically have draw periods aligned with the funding and sale of loans, while revolvers offer more flexible draw periods for ongoing working capital management.

Advance rate

Advance rate for warehouse lines typically ranges from 70% to 90%, reflecting the loan-to-value ratio based on physical inventory collateral, while revolvers generally have lower advance rates around 50% to 75%, as they rely on broader borrowing bases including accounts receivable and inventory. Warehouse lines optimize short-term liquidity against tangible assets, whereas revolvers provide flexible credit with advance rates adjusted for diverse collateral quality and risk exposure.

Commitment fee

Commitment fees on warehouse lines are typically charged on the unused portion of the credit facility to compensate lenders for reserving capital, contrasting with revolvers where fees are often tied to the entire credit amount or the outstanding balance. Warehouse line commitment fees tend to be lower due to the short-term, secured nature of asset-backed lending, whereas revolver commitment fees reflect the flexible, long-term borrowing risk profile.

Amortization schedule

An amortization schedule for a warehouse line differs from a revolver by outlining fixed principal and interest payments over time, while a revolver features flexible borrowing and repayment up to a credit limit with interest charged only on outstanding balances. Warehouse lines typically support short-term financing for inventory or receivables with structured paydown, whereas revolvers provide ongoing liquidity without a predetermined amortization structure.

Redraw capability

Redraw capability in warehouse lines offers flexible access to funds already repaid, optimizing cash flow management by allowing borrowers to reuse available credit without undergoing a new approval process. Revolvers provide continuous borrowing up to a set limit but typically lack the automatic reuse feature inherent in redraw capabilities, impacting liquidity strategies for businesses.

Maturity mismatch

Maturity mismatch occurs when a warehouse line, typically a short-term financing facility used for rapid asset accumulation, has a shorter maturity than a revolver, which is a longer-term flexible credit line designed for ongoing liquidity management. This mismatch can create refinancing risk because the warehouse line must be repaid or refinanced before the revolver matures, potentially causing cash flow constraints if the warehouse assets do not liquidate as planned.

Loan warehousing

Loan warehousing involves temporary financing structures where the warehouse line serves as a short-term credit facility to accumulate loans before securitization or sale, providing flexibility in loan acquisition. In contrast, a revolver operates as a revolving credit facility allowing borrowers to draw, repay, and redraw funds repeatedly, supporting ongoing liquidity needs rather than loan aggregation.

Non-revolving credit

Non-revolving credit, such as a warehouse line, provides a fixed borrowing limit that cannot be borrowed again once repaid, typically used for short-term financing of inventory or loans before securitization, unlike a revolving credit line or revolver which allows borrowers to repeatedly draw and repay funds up to a maximum limit. Warehouse lines are commonly utilized in mortgage banking for temporary funding, while revolvers offer flexibility for ongoing working capital needs and cash flow management.

warehouse line vs revolver Infographic

moneydif.com

moneydif.com