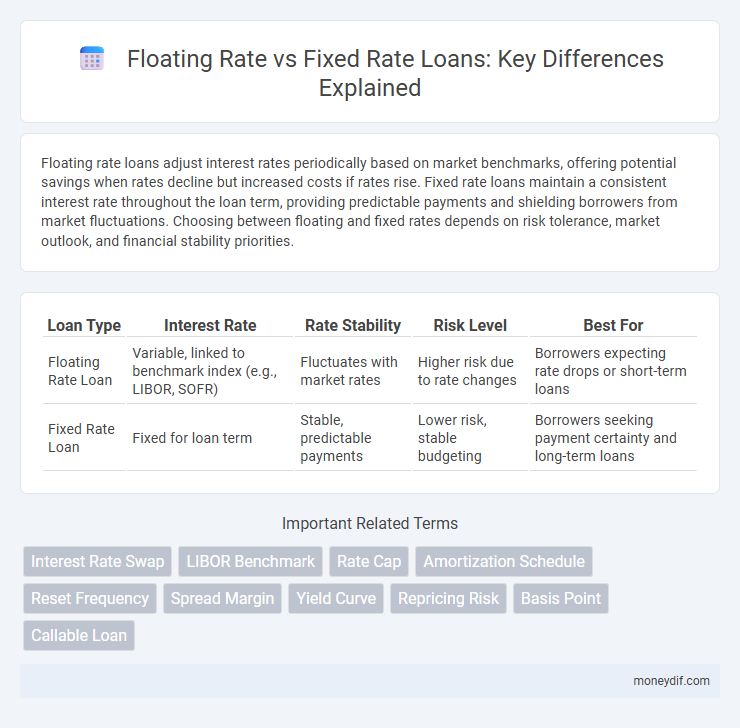

Floating rate loans adjust interest rates periodically based on market benchmarks, offering potential savings when rates decline but increased costs if rates rise. Fixed rate loans maintain a consistent interest rate throughout the loan term, providing predictable payments and shielding borrowers from market fluctuations. Choosing between floating and fixed rates depends on risk tolerance, market outlook, and financial stability priorities.

Table of Comparison

| Loan Type | Interest Rate | Rate Stability | Risk Level | Best For |

|---|---|---|---|---|

| Floating Rate Loan | Variable, linked to benchmark index (e.g., LIBOR, SOFR) | Fluctuates with market rates | Higher risk due to rate changes | Borrowers expecting rate drops or short-term loans |

| Fixed Rate Loan | Fixed for loan term | Stable, predictable payments | Lower risk, stable budgeting | Borrowers seeking payment certainty and long-term loans |

Understanding Floating Rate vs Fixed Rate Loans

Floating rate loans have interest rates that adjust periodically based on benchmark indexes like the LIBOR or SOFR, resulting in variable monthly payments that can increase or decrease with market fluctuations. Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and protection against rising interest rates. Borrowers choose floating rates for potential savings during low-rate periods but prefer fixed rates for stability and budgeting certainty over the life of the loan.

Key Differences Between Floating and Fixed Rate Loans

Floating rate loans feature interest rates that fluctuate based on benchmark rates such as LIBOR or SOFR, causing monthly payments to vary with market conditions. Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments regardless of market changes. Borrowers prioritize floating rates for potential initial savings and market alignment, while fixed rates offer stability and protection against interest rate hikes.

How Floating Rate Loans Work

Floating rate loans feature interest rates that adjust periodically based on a benchmark index such as the LIBOR or SOFR, reflecting current market conditions. Borrowers benefit from lower initial rates but face the risk of increased payments if the reference rate rises over the loan term. These loans typically include a margin added to the benchmark rate, determining the total interest cost paid by the borrower.

How Fixed Rate Loans Work

Fixed rate loans maintain a consistent interest rate throughout the entire loan term, providing borrowers with predictable monthly payments and shielding them from market fluctuations. This stability aids in budgeting and long-term financial planning as the principal and interest amounts remain unchanged. Fixed rate loans often appeal to borrowers who prioritize payment certainty over potential savings from declining rates.

Pros and Cons of Floating Rate Loans

Floating rate loans offer the advantage of lower initial interest rates compared to fixed rate loans, providing potential savings when market rates decline. However, the main drawback is their susceptibility to interest rate volatility, which can lead to unpredictable and potentially higher repayment amounts over time. Borrowers benefit from flexibility but face the risk of increased financial burden if benchmark rates rise significantly.

Pros and Cons of Fixed Rate Loans

Fixed rate loans provide borrowers with predictable monthly payments, protecting them from interest rate fluctuations and facilitating easier budget planning. These loans tend to have higher initial interest rates compared to floating rate loans, potentially resulting in higher overall costs if market rates decline. However, the stability offered by fixed rate loans reduces financial risk and is ideal for long-term borrowing in uncertain economic conditions.

Choosing Between Floating and Fixed Rate: Factors to Consider

Choosing between floating and fixed loan rates depends on interest rate trends, risk tolerance, and financial goals. Floating rates offer potential savings when rates decrease but expose borrowers to higher payments if rates rise. Fixed rates provide payment stability and predictability, ideal for those seeking consistent budgeting without exposure to market fluctuations.

Impact of Market Conditions on Loan Interest Rates

Floating rate loans fluctuate with market interest rates, causing borrower payments to vary based on benchmarks like the LIBOR or SOFR. Fixed rate loans maintain consistent payments regardless of market volatility, providing stability during periods of rising interest rates. During economic uncertainty or inflationary trends, floating rates tend to increase, raising loan costs, while fixed rates protect borrowers from sudden market spikes.

Which Borrowers Should Choose Floating or Fixed Rates?

Borrowers with stable income and risk aversion should opt for fixed-rate loans to ensure consistent monthly payments and protect against interest rate volatility. Floating-rate loans benefit borrowers expecting declining interest rates or seeking lower initial payments, such as businesses with flexible cash flow or short-term financing needs. Understanding market trends and individual financial stability is crucial in choosing between floating and fixed interest rates for optimal loan management.

Long-Term Cost Comparison: Floating Rate vs Fixed Rate Loans

Floating rate loans typically start with lower interest rates but can increase over time, potentially leading to higher long-term costs compared to fixed rate loans. Fixed rate loans offer stability with consistent monthly payments, making them easier to budget for and reducing exposure to interest rate fluctuations. Borrowers should evaluate interest rate trends and their risk tolerance to determine which loan type minimizes total interest paid over the loan term.

Important Terms

Interest Rate Swap

An Interest Rate Swap is a financial derivative where two parties exchange cash flows based on a notional principal, typically swapping a fixed interest rate for a floating interest rate tied to benchmarks like LIBOR or SOFR. This instrument allows participants to hedge interest rate risk or speculate on changes between stable fixed rates and variable floating rates linked to market conditions.

LIBOR Benchmark

The LIBOR benchmark serves as a critical reference rate for floating-rate loans and derivatives, enabling borrowers and investors to price interest payments relative to short-term interbank lending rates. Unlike fixed-rate loans that maintain a constant interest rate throughout the term, LIBOR-based floating rates adjust periodically, reflecting changes in market conditions and liquidity.

Rate Cap

Rate cap is a financial derivative that limits the maximum interest rate payable on a floating rate loan, protecting borrowers from rising rates while allowing them to benefit from lower rates compared to a fixed rate loan. It offers flexibility by capping costs without locking borrowers into potentially higher fixed rates, balancing risk and cost in variable interest rate environments.

Amortization Schedule

An amortization schedule for a floating rate loan displays variable interest payments that adjust periodically based on benchmark rates like LIBOR or SOFR, impacting the principal and interest allocation over time. In contrast, a fixed rate amortization schedule maintains consistent payments throughout the loan term, providing stability and predictability in interest expense and principal reduction.

Reset Frequency

Reset frequency in floating rate instruments determines how often the interest rate adjusts to a reference benchmark, impacting cash flow variability and interest expense predictability compared to fixed rate instruments with stable payments. Higher reset frequencies allow floating rates to reflect market conditions more promptly, increasing interest rate risk compared to fixed rate counterparts with predetermined coupons.

Spread Margin

Spread margin represents the difference between the interest rates of floating rate loans and fixed rate loans, reflecting the risk premium investors demand for rate variability. This margin adjusts dynamically with market conditions, impacting the overall cost of borrowing and hedging strategies in interest rate swaps.

Yield Curve

The yield curve illustrates the relationship between interest rates and different maturities, influencing decisions between floating-rate and fixed-rate debt instruments. Floating-rate loans adjust with changes in short-term interest rates reflected on the yield curve, while fixed-rate debt locks in interest payments based on the curve's long-term rates, impacting risk and return profiles.

Repricing Risk

Repricing risk arises when financial instruments with floating interest rates reset periodically, exposing borrowers or investors to fluctuations in market rates, potentially increasing borrowing costs or reducing investment returns. Fixed-rate instruments mitigate repricing risk by locking in interest rates over the loan or investment term, providing predictability but limiting benefits from falling rates.

Basis Point

A basis point represents 0.01% and is a crucial metric for measuring changes in interest rates, particularly when comparing floating rate loans that adjust periodically to market rates versus fixed rate loans with constant interest over time. Understanding basis point fluctuations helps investors and borrowers assess interest rate risk and potential cost differences between these two types of debt instruments.

Callable Loan

Callable loans provide borrowers with the option to repay the loan before maturity, offering flexibility that is particularly advantageous when interest rates decline from a floating rate benchmark such as LIBOR or SOFR. Fixed-rate callable loans allow borrowers to hedge against rising interest rates while retaining the option to refinance or repay early if floating rates fall, optimizing debt cost management in fluctuating market conditions.

floating rate vs fixed rate Infographic

moneydif.com

moneydif.com