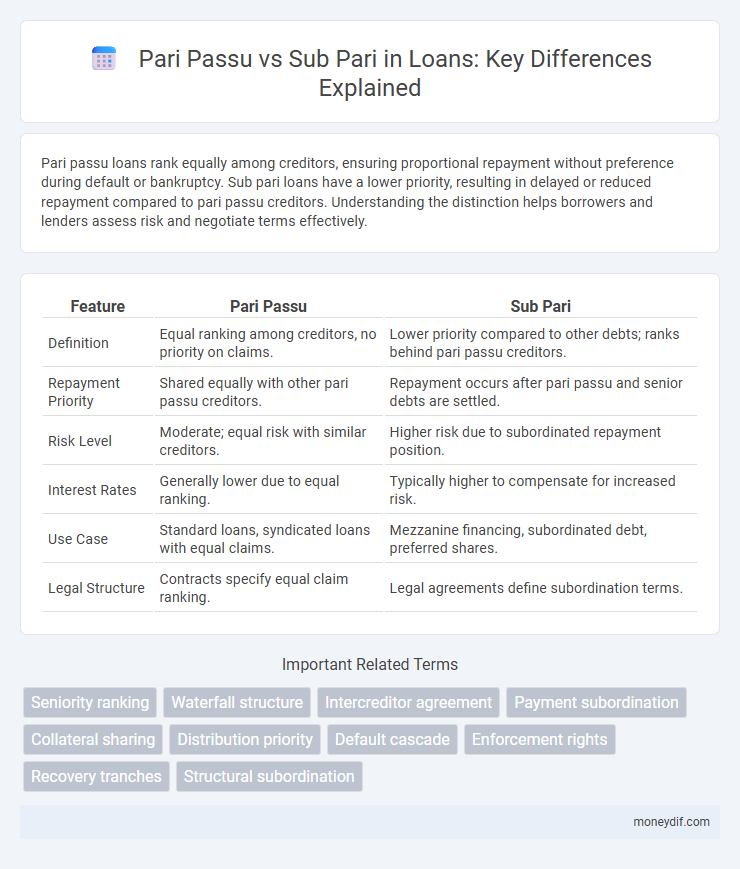

Pari passu loans rank equally among creditors, ensuring proportional repayment without preference during default or bankruptcy. Sub pari loans have a lower priority, resulting in delayed or reduced repayment compared to pari passu creditors. Understanding the distinction helps borrowers and lenders assess risk and negotiate terms effectively.

Table of Comparison

| Feature | Pari Passu | Sub Pari |

|---|---|---|

| Definition | Equal ranking among creditors, no priority on claims. | Lower priority compared to other debts; ranks behind pari passu creditors. |

| Repayment Priority | Shared equally with other pari passu creditors. | Repayment occurs after pari passu and senior debts are settled. |

| Risk Level | Moderate; equal risk with similar creditors. | Higher risk due to subordinated repayment position. |

| Interest Rates | Generally lower due to equal ranking. | Typically higher to compensate for increased risk. |

| Use Case | Standard loans, syndicated loans with equal claims. | Mezzanine financing, subordinated debt, preferred shares. |

| Legal Structure | Contracts specify equal claim ranking. | Legal agreements define subordination terms. |

Understanding Pari Passu: Definition and Principles

Pari passu refers to loans or debt instruments ranked equally in terms of repayment priority, ensuring all creditors share the same level of risk and recovery in case of default. This principle guarantees that no lender receives preferential treatment over others, maintaining fairness and transparency in debt restructuring or insolvency scenarios. Understanding pari passu is crucial for borrowers and investors to evaluate risk exposure and potential payment outcomes in multi-lender agreements.

What is Sub Pari? Key Features Explained

Sub pari refers to a loan or bond issued below its face value, causing the investor to pay less than the nominal amount. Key features include discounted issuance, potential higher yield due to increased risk, and the possibility of capital loss if held to maturity. Sub pari loans typically reflect borrower credit concerns or market conditions impacting repayment certainty.

Core Differences Between Pari Passu and Sub Pari

Pari passu refers to creditors or lenders sharing equal rights to repayment without any priority, ensuring proportional distribution of assets or payments in case of default. Sub pari indicates a subordinate or junior position in the repayment hierarchy, meaning sub pari creditors receive payment only after pari passu or senior creditors have been satisfied. The core difference lies in the ranking of claims: pari passu enforces equal rank, while sub pari reflects a lower priority claim in debt obligations.

Legal Implications in Loan Agreements

Pari passu clauses in loan agreements ensure equal ranking and payment rights among lenders, preventing subordination and reducing the risk of preferential treatment during insolvency or enforcement actions. Sub pari arrangements legally subordinate certain loans to others, impacting recovery priority and influencing creditor negotiations and enforcement strategies. Understanding these distinctions is critical for legal compliance, risk assessment, and structuring effective credit facilities.

Impact on Creditor Rights and Priorities

In loan agreements, pari passu clauses ensure that creditors have equal rights and rankings in repayment, preventing any creditor from receiving preferential treatment. Sub pari status places certain creditors in a lower priority position, reducing their claim on assets in the event of borrower default or insolvency. This hierarchy directly affects creditor recovery prospects and influences the risk assessment and pricing of loans.

Enforcement and Repayment Scenarios

Pari passu loans ensure equal ranking among lenders, allowing proportional enforcement and repayment without priority disputes, which facilitates smooth recovery in default scenarios. Sub pari loans carry lower priority, meaning enforcement actions and repayments happen only after senior creditors are fully satisfied, often leading to delayed or partial recovery. Understanding the distinction impacts risk assessment and enforcement strategies during loan defaults.

Pari Passu vs Sub Pari: Risks for Lenders

Pari passu loans ensure that multiple lenders have equal claim on the borrower's assets, minimizing priority disputes and reducing credit risk. In contrast, sub pari loans rank lower in repayment hierarchy, increasing the likelihood of losses for subordinated lenders if the borrower defaults. Understanding the risk differences between pari passu and sub pari structures is crucial for lenders when assessing exposure and recovery potential in distressed scenarios.

Case Studies: Real-world Applications

Case studies in loan agreements reveal that pari passu clauses ensure equal ranking among creditors, preventing preferential treatment during default, as seen in the 2008 Lehman Brothers bankruptcy. Sub pari arrangements, often used in mezzanine financing, grant junior creditors subordinated claims, illustrated by the Tesla debt restructuring in 2019 where certain loans were ranked below senior secured debt. Analyzing these real-world applications highlights the impact of creditor hierarchy on recovery rates and negotiation leverage in distressed debt scenarios.

Common Misconceptions in Loan Structuring

Many borrowers mistakenly assume that pari passu guarantees equal payment priority, whereas it only ensures equal ranking in repayment order, not equal amounts. Sub pari loans are often misunderstood as inferior in all aspects, while they may still offer competitive interest rates despite lower ranking. Proper loan structuring requires clear differentiation between ranking and payment terms to avoid costly misunderstandings in debt agreements.

Choosing the Right Clause: Factors to Consider

Choosing the right clause between pari passu and sub pari in loan agreements depends on the desired creditor ranking and risk allocation. Pari passu ensures equal ranking among lenders for repayment priority, while sub pari places certain creditors in a subordinate position with lower repayment priority. Key factors include the borrower's credit profile, lender negotiation power, and potential impact on recovery in default scenarios.

Important Terms

Seniority ranking

Seniority ranking determines the priority order in which creditors are paid during bankruptcy or liquidation, with pari passu indicating equal ranking of debts allowing creditors to share payments proportionally, while sub pari status denotes a lower priority, resulting in subordinate creditors receiving payment only after senior debts are fully satisfied. Understanding these distinctions is crucial for investors assessing risk exposure and recovery rates in structured finance and corporate debt instruments.

Waterfall structure

In a waterfall structure, pari passu refers to multiple stakeholders or tranches receiving payments simultaneously and equally according to their share, whereas sub pari indicates a lower priority tier that only receives distributions after higher-priority claims are fully satisfied. This hierarchy ensures that senior investors or creditors have precedence over junior or mezzanine tranches in the allocation of cash flows or liquidation proceeds.

Intercreditor agreement

An intercreditor agreement outlines the rights and priorities of multiple creditors, specifying whether their claims are treated pari passu, meaning equal ranking and shared repayment proportions, or sub pari, where one creditor's claim ranks below another in payment priority. This agreement plays a critical role in defining enforcement actions, repayment order, and security interests in multi-lender financing structures.

Payment subordination

Payment subordination involves ranking debt obligations so that subordinated debts are paid after senior or pari passu debts, impacting lender priority during defaults or liquidation. Pari passu status ensures equal ranking and simultaneous repayment among creditors, while sub pari means lower priority, increasing risk and potentially higher yields for subordinated debt holders.

Collateral sharing

Collateral sharing arrangements determine how secured creditors share asset claims, impacting recovery priorities in insolvency cases. In a pari passu structure, collateral is distributed proportionally among creditors, whereas sub pari status places some creditors behind others, reducing their claim priority on shared collateral.

Distribution priority

Distribution priority determines the order in which claims are paid, with pari passu allowing multiple creditors to share payments equally and simultaneously, while sub pari imposes a subordinate ranking where certain claims receive payment only after others are fully satisfied. This hierarchical payment structure impacts risk assessment, recovery rates, and negotiation terms in insolvency and structured finance scenarios.

Default cascade

Default cascade refers to the sequence in which debt obligations are prioritized and enforced during a borrower's default, impacting the repayment hierarchy among creditors. In pari passu debt ranks equally with other debts of the same class without priority, while sub pari debt is subordinate, receiving repayment only after pari passu debts are satisfied, influencing recovery rates and creditor rights.

Enforcement rights

Enforcement rights under pari passu provisions ensure that creditors receive equal treatment and proportional repayment without preference in insolvency, while sub pari arrangements prioritize certain creditors, granting them superior enforcement rights and higher recovery claims. Understanding these distinctions is crucial for assessing creditor hierarchy and the legal enforceability of claims in debt restructuring and bankruptcy scenarios.

Recovery tranches

Recovery tranches allocate repayment based on priority levels, where pari passu clauses ensure equal treatment of creditors by distributing recoveries proportionally, while sub pari status ranks certain tranches below others, delaying or reducing their recovery in insolvency scenarios. Understanding the distinction between pari passu and sub pari structures is crucial for investors assessing risk and potential returns in distressed debt restructurings.

Structural subordination

Structural subordination occurs when debt issued by a subsidiary ranks below the parent company's direct obligations in the capital structure, creating an inherent credit ranking disadvantage despite equal contractual terms. In a pari passu arrangement, creditors share equal ranking and payment priority, whereas sub pari structuring results in certain creditors receiving payments only after superior claims are satisfied, reflecting the impact of intercompany debt flows on creditor recoveries.

Pari passu vs Sub pari Infographic

moneydif.com

moneydif.com