Bridge loans provide short-term financing to cover immediate cash flow needs during transitional periods, typically secured by the borrower's assets and repaid quickly once permanent financing is arranged. Mezzanine loans combine elements of debt and equity financing, offering higher-risk capital that fills the gap between senior debt and equity, often including warrants or options for lender participation in future upside. Understanding the key differences in risk profile, duration, and collateral requirements helps borrowers choose the optimal financing structure for growth or acquisition projects.

Table of Comparison

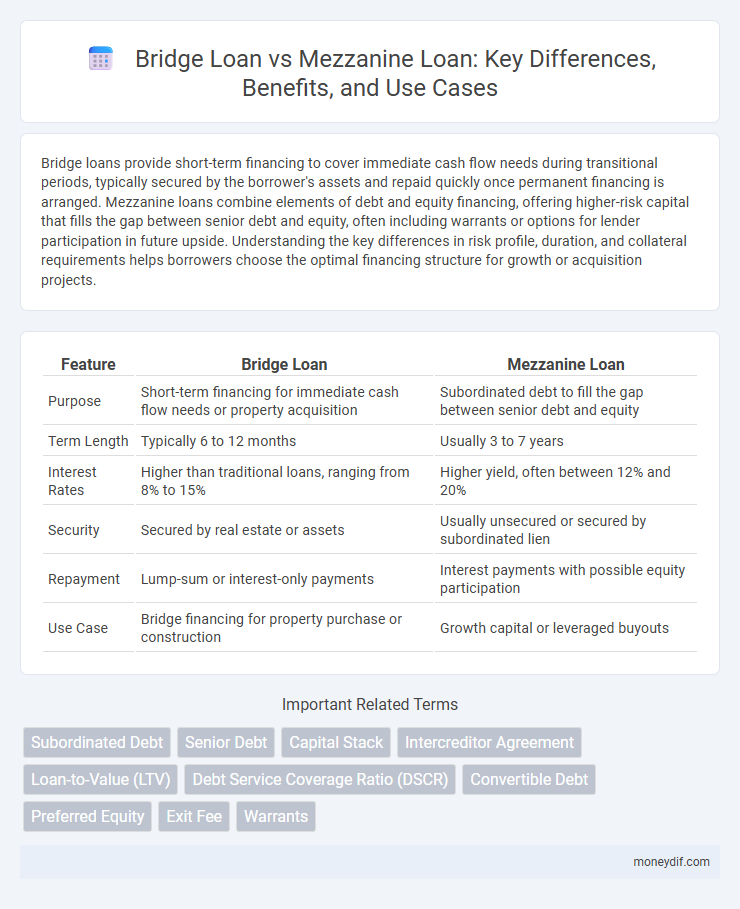

| Feature | Bridge Loan | Mezzanine Loan |

|---|---|---|

| Purpose | Short-term financing for immediate cash flow needs or property acquisition | Subordinated debt to fill the gap between senior debt and equity |

| Term Length | Typically 6 to 12 months | Usually 3 to 7 years |

| Interest Rates | Higher than traditional loans, ranging from 8% to 15% | Higher yield, often between 12% and 20% |

| Security | Secured by real estate or assets | Usually unsecured or secured by subordinated lien |

| Repayment | Lump-sum or interest-only payments | Interest payments with possible equity participation |

| Use Case | Bridge financing for property purchase or construction | Growth capital or leveraged buyouts |

Introduction to Bridge Loans and Mezzanine Loans

Bridge loans provide short-term financing to cover immediate cash flow gaps, often used to secure property while awaiting long-term funding or sale of assets. Mezzanine loans offer subordinated debt with equity conversion options, bridging the gap between senior debt and equity, typically supporting business expansions or acquisitions. Both loan types cater to different risk profiles and funding timelines within the capital structure hierarchy.

Key Differences Between Bridge Loans and Mezzanine Loans

Bridge loans provide short-term, interim financing typically secured by real estate, offering quick access to capital before long-term funding is secured, while mezzanine loans are subordinated debt or preferred equity used to fill the gap between senior debt and equity in a company's capital structure. Bridge loans usually have higher interest rates and shorter terms, ranging from six months to three years, whereas mezzanine loans carry higher risk and returns with terms often spanning three to seven years. The key difference lies in the security and purpose: bridge loans are primarily asset-based with faster approval, whereas mezzanine loans blend debt and equity features, often including warrants or conversion options.

What is a Bridge Loan? Definition and Uses

A bridge loan is a short-term financing option used to provide immediate capital until permanent funding is secured or an existing obligation is removed. Commonly utilized in real estate transactions, bridge loans help buyers purchase new property before selling their current one, ensuring liquidity and continuity. These loans typically have higher interest rates and shorter terms compared to traditional financing, reflecting their role in addressing temporary funding gaps.

What is a Mezzanine Loan? Definition and Applications

A mezzanine loan is a hybrid form of financing that combines features of debt and equity, often used in real estate and corporate acquisitions to fill the gap between senior debt and equity financing. It typically carries higher interest rates and may include warrants or options to convert to equity, providing lenders with potential upside while offering borrowers flexible capital. Mezzanine loans are commonly applied in leveraged buyouts, expansion projects, and bridge financing where quick access to capital is essential without diluting ownership.

Eligibility Criteria for Bridge and Mezzanine Loans

Bridge loans typically require borrowers to have strong credit scores, existing equity in the collateral property, and a clear exit strategy for repayment, often favoring real estate investors seeking short-term financing. Mezzanine loans demand higher eligibility standards, including proven business cash flow, a solid capital structure, and often require personal guarantees or equity participation due to their subordinate position in the capital stack. Both loan types cater to different risk profiles, with bridge loans suited for interim financing and mezzanine loans tailored for growth capital with more stringent financial disclosures.

Pros and Cons: Bridge Loan vs Mezzanine Loan

Bridge loans offer quick financing with lower interest rates and short terms, ideal for immediate cash flow needs, but they carry higher risk due to their short duration and reliance on future funding. Mezzanine loans provide flexible capital with the potential for equity conversion, enabling expansion without immediate dilution of ownership; however, they usually involve higher interest rates and complex agreement terms. Choosing between bridge loans and mezzanine financing depends on the borrower's urgency, risk tolerance, and long-term capital strategy.

Interest Rates and Terms Comparison

Bridge loans typically feature higher interest rates ranging from 8% to 12% due to their short-term nature, usually lasting 6 to 12 months. Mezzanine loans carry interest rates between 12% and 20%, reflecting increased risk and longer terms that can extend up to 5 years. Bridge loans offer faster approval and repayment flexibility, while mezzanine financing includes equity-like features and often requires warrants or an ownership stake.

Risk Factors: Bridge Loans vs Mezzanine Loans

Bridge loans carry higher liquidity risk due to their short-term nature and reliance on quick asset sale or refinancing, making them susceptible to market fluctuations. Mezzanine loans involve increased credit risk because they are subordinated to senior debt, potentially limiting recovery in default scenarios. Both loan types demand careful risk assessment, with bridge loans emphasizing timing risk and mezzanine loans focusing on structural subordination risk.

When to Choose a Bridge Loan or a Mezzanine Loan

Bridge loans are ideal for short-term financing needs such as quickly acquiring a property before securing long-term funding, offering fast approval and flexible terms. Mezzanine loans suit businesses requiring larger capital injections with less dilution of equity, often complementing senior debt during expansion or acquisition phases. Choosing between the two depends on the urgency of funding, loan duration, and the borrower's willingness to balance cost against ownership control.

Conclusion: Which Loan is Right for Your Needs?

Bridge loans provide short-term financing to quickly cover immediate cash flow gaps, ideal for borrowers needing fast access to capital before securing permanent funding. Mezzanine loans combine debt and equity features, suitable for businesses seeking expansion capital without diluting ownership significantly, often used in leveraged buyouts or growth stages. Choosing between a bridge loan and a mezzanine loan depends on your financing timeline, risk tolerance, and long-term business goals, with bridge loans offering speed and flexibility while mezzanine loans offer higher loan amounts with a potential equity kicker.

Important Terms

Subordinated Debt

Subordinated debt in bridge loans typically offers short-term financing with higher interest rates and quicker repayment schedules, whereas mezzanine loans combine debt and equity features, providing longer-term funding with potential equity participation and flexible repayment options.

Senior Debt

Senior debt in bridge loans typically holds priority lien and lower interest rates compared to mezzanine loans, which are subordinate, carry higher risk, and offer higher returns.

Capital Stack

A bridge loan provides short-term financing secured by senior debt in the capital stack, while a mezzanine loan occupies a subordinate position with higher interest rates and potential equity conversion rights.

Intercreditor Agreement

An Intercreditor Agreement clearly defines the priority and rights of lenders in a Bridge Loan versus a Mezzanine Loan to manage repayment hierarchy and protect their respective interests.

Loan-to-Value (LTV)

Bridge loans typically have a higher loan-to-value (LTV) ratio of up to 80% compared to mezzanine loans, which often have lower LTV ratios around 60-70% due to their subordinate financing position.

Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) for bridge loans typically requires a higher threshold than mezzanine loans due to the shorter term and higher risk associated with bridge financing.

Convertible Debt

Convertible debt offers flexible financing by allowing debt to convert into equity, serving as a strategic bridge loan to quickly secure capital before a larger funding round. Compared to mezzanine loans, convertible debt typically carries lower interest rates and dilution risk, making it preferable for startups needing interim funding without immediate high costs or restrictive covenants.

Preferred Equity

Preferred equity offers a flexible capital structure with higher risk tolerance and equity-like returns compared to bridge loans' short-term liquidity and mezzanine loans' subordinated debt position in real estate financing.

Exit Fee

Exit fees on bridge loans typically range from 1% to 3%, often lower than mezzanine loan exit fees, which can reach 3% to 5% due to higher risk and subordinated debt positioning.

Warrants

Warrants in bridge loans provide short-term equity upside potential during financing gaps, while in mezzanine loans, they offer subordinated debt holders equity participation as compensation for higher risk.

Bridge Loan vs Mezzanine Loan Infographic

moneydif.com

moneydif.com