Par value and face value both refer to the nominal worth of a loan or bond as stated on the agreement. The face value is the amount the borrower agrees to repay at maturity, while the par value is often used interchangeably but can differ depending on market conditions or issuance terms. Understanding the distinction is crucial for accurately assessing loan pricing and repayment expectations.

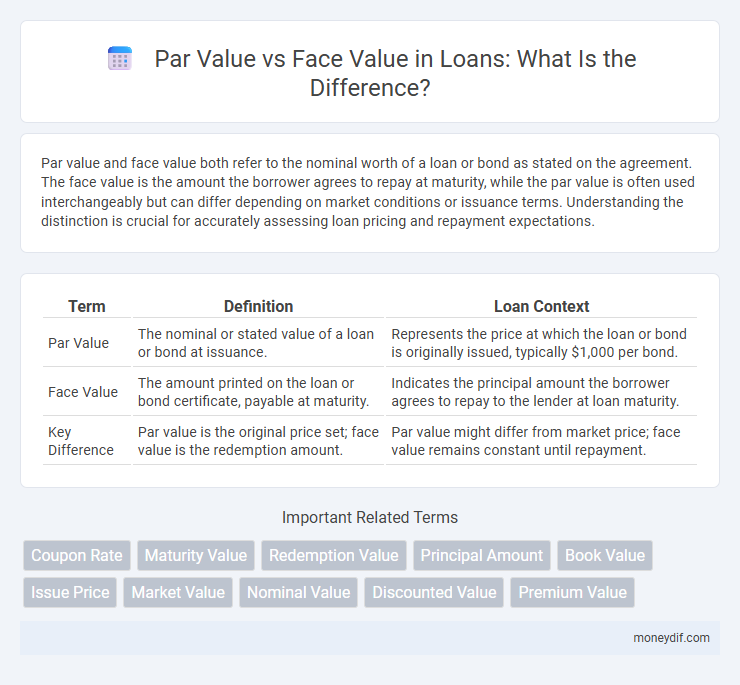

Table of Comparison

| Term | Definition | Loan Context |

|---|---|---|

| Par Value | The nominal or stated value of a loan or bond at issuance. | Represents the price at which the loan or bond is originally issued, typically $1,000 per bond. |

| Face Value | The amount printed on the loan or bond certificate, payable at maturity. | Indicates the principal amount the borrower agrees to repay to the lender at loan maturity. |

| Key Difference | Par value is the original price set; face value is the redemption amount. | Par value might differ from market price; face value remains constant until repayment. |

Introduction to Par Value and Face Value in Loans

Par value and face value in loans represent the principal amount stated on a loan agreement or bond certificate. Par value is the original value at issuance, serving as the baseline for interest calculations and repayment. Face value often equals par value but can differ when loans trade at premiums or discounts in secondary markets.

Defining Par Value in Loan Agreements

Par value in loan agreements refers to the nominal or stated value of a loan or bond, representing the amount the issuer agrees to repay the lender at maturity. It is critical for determining the principal amount on which interest payments are calculated. Unlike market value, par value remains fixed throughout the life of the loan, providing a clear basis for contractual obligations and financial accounting.

Understanding Face Value in Loan Contracts

Face value in loan contracts represents the nominal amount the borrower agrees to repay at maturity, serving as the baseline for interest calculation and payment schedules. Unlike market value, face value remains fixed, providing clarity on principal repayment regardless of market fluctuations. Accurate comprehension of face value ensures borrowers and lenders understand the exact liability, facilitating transparent financial planning and contract enforcement.

Key Differences Between Par Value and Face Value

Par value refers to the nominal value assigned to a loan or bond at issuance, often representing the minimum price investors pay, while face value is the actual amount the issuer promises to repay at maturity. Par value is mainly used for accounting and legal purposes, whereas face value directly impacts interest calculations and repayment obligations. Understanding these key differences is essential for accurately assessing loan valuation and investor returns.

Why Par Value and Face Value Matter to Borrowers

Par value and face value are critical for borrowers because they directly influence loan repayment terms and interest calculations. The face value represents the amount the borrower must repay at maturity, while par value affects the issuance price of the loan or bond. Understanding these values helps borrowers assess the true cost of borrowing and manage cash flow effectively.

Impact of Par Value and Face Value on Loan Repayment

Par value and face value directly influence loan repayment schedules by determining the principal amount borrowers owe and the basis for interest calculations. In loan agreements, face value reflects the nominal amount that appears on loan documents, while par value often represents the bond's value at issuance or redemption, affecting discount or premium amortization. Variations between these values can lead to changes in repayment amounts, impacting the total cost of borrowing and the lender's yield.

Par Value vs Face Value: Implications for Lenders

Par value and face value are critical concepts for lenders assessing loan securities, where par value represents the original issue price of a bond or loan instrument at issuance, often set at $1,000 per bond. Face value, while frequently synonymous with par value, may differ when loans are issued at a premium or discount, impacting the actual repayment amount. Understanding these differences helps lenders evaluate the true value of loan repayments, interest calculations, and potential risks associated with loan securities.

Examples Illustrating Par Value and Face Value in Loans

Par value and face value in loans often represent the same amount but can differ in specific contexts such as bond issuance. For example, a bond with a face value of $1,000 may be sold at a par value of $950 if market conditions favor a discount. In another case, a loan note with a face value of $10,000 might have a par value equal to its principal amount, reflecting no premium or discount on issuance.

Common Misconceptions About Par Value and Face Value

Par value and face value are often mistakenly used interchangeably, but par value refers to the nominal value assigned to a loan or bond at issuance, while face value is the amount the borrower agrees to repay at maturity. A common misconception is assuming par value changes with market fluctuations, when it remains fixed throughout the loan term. Understanding that face value is the actual amount investors or lenders receive at maturity helps clarify loan valuation and repayment expectations.

How to Determine Par Value and Face Value in Loan Documents

Par value in loan documents refers to the nominal amount stated on the loan instrument, representing the principal amount to be repaid. Face value often matches the par value and indicates the loan's stated value at issuance, used for calculating interest and repayment terms. To determine both values, review the loan agreement and note the principal amount specified, which serves as the basis for repayments and financial calculations.

Important Terms

Coupon Rate

Coupon rate is the annual interest rate paid on a bond's face value, which is the amount the issuer agrees to repay at maturity; it is expressed as a percentage of the bond's par value. Par value and face value are often used interchangeably, representing the bond's nominal value, and the coupon rate determines the fixed interest payment based on this amount, regardless of the bond's market price.

Maturity Value

Maturity value represents the total amount payable to the holder of a financial instrument at the end of its term, often differing from the par value, which is the nominal or stated value assigned to the instrument at issuance. Face value, commonly used interchangeably with par value, is the original value indicated on the instrument, whereas maturity value includes the principal plus any accrued interest or returns.

Redemption Value

Redemption value refers to the amount a bondholder receives at maturity, often equal to the bond's face value but can differ if the bond is issued at a premium or discount relative to its par value. The par value represents the bond's nominal worth, serving as a baseline for calculating redemption value, which determines the final payment regardless of market fluctuations.

Principal Amount

The principal amount refers to the original sum of money borrowed or invested, often equated with the par value of a bond, which is its nominal or stated value at issuance. Face value, closely related, indicates the amount printed on a security certificate and represents the principal to be repaid at maturity, though market value may differ from both par and face values.

Book Value

Book value represents a company's net asset value calculated as total assets minus liabilities, and it differs from par value, which is the nominal value assigned to a stock or bond at issuance. Face value specifically refers to the stated value printed on securities such as bonds or coins and may differ from both book value and par value depending on market conditions and accounting practices.

Issue Price

Issue price refers to the amount at which a security is initially sold, which can be above, below, or equal to its par value, the nominal or stated value assigned by the issuer. Face value, often synonymous with par value in bonds, represents the amount paid to the bondholder at maturity, while issue price determines the actual purchase cost at issuance and affects the yield.

Market Value

Market value represents the current price a security trades for in the open market, often fluctuating above or below its par value, which is the nominal amount stated on the certificate. Face value, commonly used interchangeably with par value, serves as the reference point for coupon payments and maturity value but does not reflect the actual market price investors pay.

Nominal Value

Nominal value, often synonymous with par value or face value, represents the initial value assigned to a security or bond by the issuer, serving as the baseline for interest calculations and redemption amounts. Unlike market value, nominal value remains fixed and does not fluctuate with market conditions, providing a consistent measure for accounting and legal purposes.

Discounted Value

Discounted value refers to the present worth of a future cash flow, calculated by subtracting a discount from the par value, which is the nominal or face value of a financial instrument like a bond or stock. While face value represents the stated amount on the certificate, discounted value captures the current market value adjusted for factors such as interest rates and risk, often resulting in a lower valuation than the face or par value.

Premium Value

Premium value occurs when a bond or stock is issued or traded above its par value, reflecting investor expectations of higher returns or market demand. Unlike face value, which is the bond's nominal worth used for interest calculations, premium value indicates a price greater than the original issuance value, often driven by favorable credit ratings or interest rate environments.

par value vs face value Infographic

moneydif.com

moneydif.com